Updated 4/21/25

ChoiceOne Financial Services (NASDAQ: COFS) is a Michigan-based community bank offering a full range of traditional banking services, from personal loans and business financing to wealth management. The company has shown consistent performance through measured loan growth, disciplined expense control, and a growing dividend. Over the past year, earnings per share climbed to $3.25, with revenue rising nearly 16% year-over-year.

COFS maintains a conservative payout ratio of 33.5% while offering a forward dividend yield of 4.24%. Management, led by CEO Kelly Potes, continues to focus on local market strength and operational efficiency. The recent merger with Fentura Financial is expected to broaden its reach and improve long-term profitability. Trading at under 8 times earnings, the stock has recently pulled back, offering potential value supported by strong fundamentals and a stable leadership team committed to steady, sustainable growth.

Recent Events

In its most recent quarterly update, COFS reported a solid uptick in both top-line and bottom-line performance. Revenue for the trailing twelve months reached just over $91 million, showing a year-over-year increase of nearly 16%. Net income followed suit, rising to $26.7 million, with earnings per share landing at $3.25—a significant improvement of more than 35% compared to last year’s figure.

That kind of earnings strength hasn’t gone unnoticed. The market cap has surged from around $206 million at the start of 2023 to just shy of $400 million today. Even with that upward momentum, the valuation remains attractive, trading at just over 8x trailing earnings and under 8x forward estimates.

Interestingly, short interest has dropped substantially. Just a month ago, short sellers held over 550,000 shares. That number has since plummeted to around 70,000. This could be a sign that pessimism is fading, and investors are starting to appreciate the fundamentals and income potential COFS brings to the table.

Key Dividend Metrics

💵 Forward Dividend Yield: 4.24%

📈 5-Year Average Yield: 3.73%

📊 Payout Ratio: 33.54%

🧾 Forward Annual Dividend Rate: $1.12

📆 Most Recent Dividend Date: March 31, 2025

🔔 Ex-Dividend Date: March 14, 2025

📉 Trailing Dividend Yield: 4.13%

Dividend Overview

When it comes to dividends, COFS stands out for its balance of yield and safety. With a current forward dividend yield of 4.24%, it offers a premium over the broader market and even many other regional banks. It’s not a case of chasing yield either—the company is backing it with solid earnings and prudent capital management.

At a payout ratio of just 33.54%, the dividend is comfortably covered by profits. That leaves plenty of room for reinvestment, balance sheet strength, and continued growth. It’s a sign that the dividend isn’t just sustainable—it has room to grow.

The annual dividend rate is now up to $1.12 per share, slightly higher than the $1.09 rate from the past year. It’s not a huge leap, but it signals management’s ongoing confidence in the business. That small raise, especially in today’s uncertain rate environment, tells you the team isn’t overextending—they’re being deliberate.

COFS last paid its dividend at the end of March, and the stock went ex-dividend on March 14. These quarterly payments are rhythmically reliable, which is exactly what long-term dividend investors tend to appreciate.

Dividend Growth and Safety

What makes COFS a compelling option for income investors is its strong foundation. The bank’s return on equity sits at 11.72%, while its profit margin is nearly 30%. These numbers suggest an efficient, well-run operation with a knack for turning revenue into real profit.

The cash position is also a strength—$121 million on the books, which equates to about $13.50 per share. That kind of liquidity is more than enough to keep the dividend flowing through leaner periods if necessary. Even with over $212 million in debt, there’s no indication of overreach or financial strain.

The five-year average yield of 3.73% has steadily inched upward to its current 4.24%, showing a quiet but consistent effort to return value to shareholders. Growth has been modest, but consistent. COFS isn’t trying to impress anyone with flashy increases; it’s focused on keeping the dividend flowing quarter after quarter.

One other thing that stands out is the stock’s lower beta—just 0.63. This means COFS tends to be less volatile than the broader market, which is a nice bonus for those using dividend income as part of a retirement strategy or simply looking for more portfolio stability.

Altogether, COFS brings together the kind of attributes income-focused investors value: solid earnings, responsible management, and a dividend that’s built on a strong foundation.

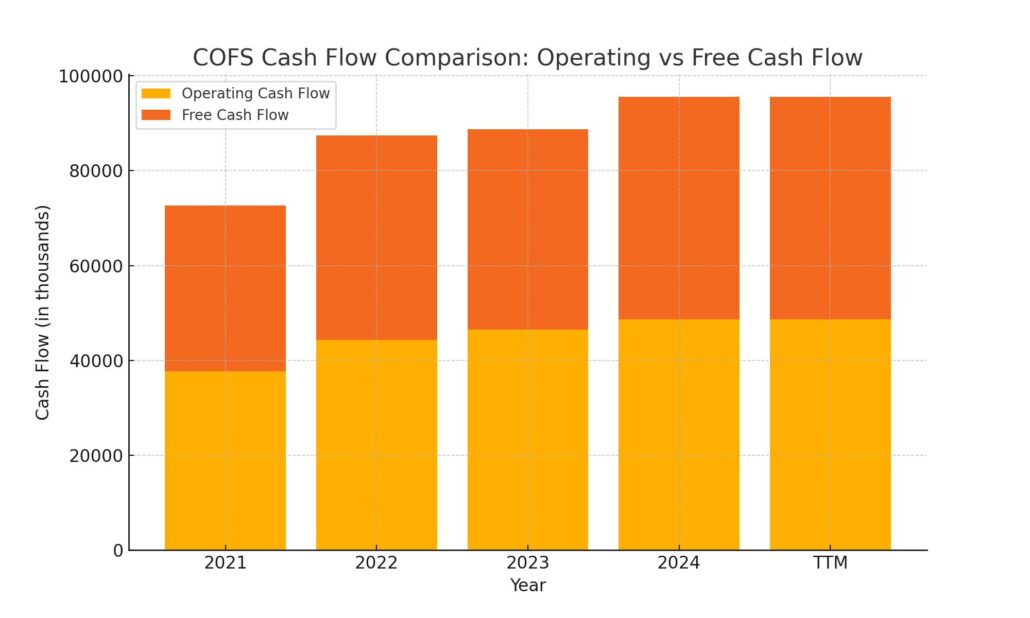

Cash Flow Statement

ChoiceOne Financial Services delivered a stable operating cash flow of $48.6 million over the trailing twelve months, showing consistent year-over-year growth from $37.7 million in 2021. Free cash flow followed a similar upward trend, hitting $46.9 million in the latest period, reflecting strong core earnings and disciplined capital expenditure, which remained modest at just $1.7 million.

Investing activities remained a net outflow at -$97.9 million, in line with previous years where investment demand has been high, although the magnitude was less extreme than the -$521 million seen in 2021. On the financing side, the company raised $315 million in new debt but repaid $340 million, showing active balance sheet management. Financing cash flow still came in positive at $90.6 million, largely driven by tactical funding and liquidity moves. Cash at the end of the period rose to $96.8 million, nearly doubling from 2023, which further reinforces COFS’s ability to sustain its dividend and navigate any short-term financial challenges with confidence.

Analyst Ratings

📈 ChoiceOne Financial Services (COFS) has recently seen a shift in analyst sentiment. Janney Montgomery Scott upgraded the stock from “Neutral” to “Buy” on March 3, 2025. This move reflects growing confidence in the bank’s financial strength, driven by improved earnings and a stable outlook for the year ahead. Another firm, DA Davidson, continues to stand behind the stock with a “Buy” rating as well.

💬 The overall consensus among analysts currently sits at a “Strong Buy.” The average 12-month price target is $38.50, which implies a potential upside of around 45% from the stock’s recent trading level near $26.35. That’s a sizable cushion and suggests analysts see room for the stock to run.

🧾 These upgrades are largely a response to consistent performance across key financial indicators—steady revenue growth, expanding net income, and a healthy dividend payout backed by solid free cash flow. Analysts also appear to be encouraged by the company’s conservative lending strategy and strong local market presence, both of which have helped COFS maintain resilience during volatile periods in the broader banking sector.

💡 For income-oriented investors, this kind of analyst support can be reassuring, especially when paired with the bank’s track record of stable dividends and operational discipline.

Earning Report Summary

ChoiceOne Financial Services closed out 2024 with a strong finish, and there was a lot to like in their latest earnings report. The bank pulled in $26.7 million in net income for the year, up more than 25% compared to the previous year. Earnings per share climbed to $3.25, and if you strip out some one-time merger-related costs, adjusted earnings looked even better at $3.37 per share. That’s the kind of consistent, upward momentum shareholders like to see.

Strong Lending and Interest Income

One of the standout pieces from the quarter was growth in the bank’s loan portfolio. Core loans rose by over $114 million, which comes out to an 8.2% increase year over year. That loan growth helped push net interest income to $74.4 million. As interest rates remained relatively high, the bank also benefited from improved lending margins. Net interest margin rose to 2.98% in the fourth quarter, which is a nice step up from the 2.66% posted the year before.

Deposits were also solid, especially given the competitive environment. Excluding brokered deposits, ChoiceOne saw $79 million in organic deposit growth across the year. That’s a strong signal of customer trust and stability, even though there was a slight seasonal dip in the fourth quarter—something that’s not unusual for community banks like this.

Noninterest Income and Expenses

Noninterest income reached $18 million for the year, helped along by a mix of service fees, income from bank-owned life insurance, and gains from loan sales. It’s a healthy chunk of revenue that adds to the consistency of the business model.

On the expense side, operating costs ticked higher to $58.7 million. A big reason for that was merger-related costs and increased employee benefits, which are to be expected during times of growth and consolidation. Nothing jumped out as unusual or worrying here—it looks like standard integration-related activity.

Comments from Leadership

CEO Kelly Potes shared his optimism during the quarter, highlighting the solid credit performance, core loan growth, and stable deposits. He also spent time discussing the bank’s upcoming merger with Fentura Financial and The State Bank, which is set to close in mid-2025. The combination is expected to expand the bank’s footprint and customer reach, particularly in Michigan, and bring additional scale to their operations.

All in all, the tone from leadership was confident but grounded. They acknowledged the macroeconomic challenges banks are still facing, but the strategy remains steady: conservative lending, maintaining high asset quality, and growing in a disciplined, customer-focused way.

With good momentum behind them and more scale on the horizon, ChoiceOne appears to be positioning itself for a strong 2025.

Chart Analysis

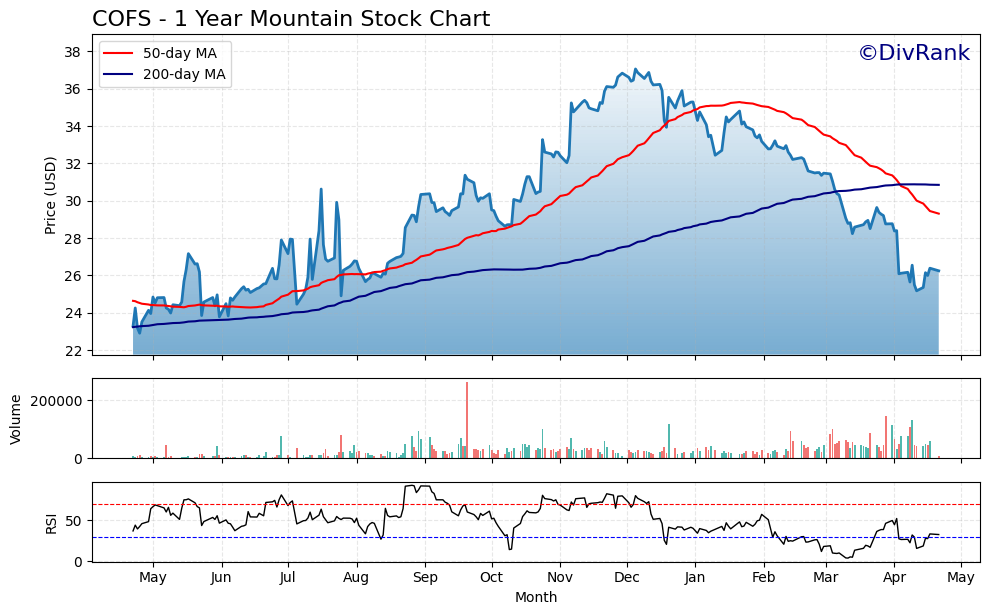

Price Movement and Trends

The chart for COFS over the past year shows a clear story of strength followed by a gradual pullback. From late spring through early winter, the price climbed steadily, peaking just above $36 in December. This run-up was supported by a rising 50-day moving average, which stayed above the 200-day moving average for a good stretch—typically a sign of strong momentum.

That momentum started fading around the beginning of the year. The 50-day moving average began to turn down in January, eventually crossing below the 200-day moving average by April. This crossover is usually interpreted as a bearish signal, and it lines up with the drop in price that took the stock down toward the $24 range. The price has since bounced modestly off those lows but remains under both moving averages, suggesting the trend is still under pressure.

Volume and Market Behavior

Looking at volume, there were a few noticeable spikes—one especially strong around late October—which might suggest institutional activity or news-driven movement. Other than that, volume has stayed relatively muted during the downtrend, which might hint that the decline was more about gradual selling rather than panic-driven exits.

RSI and Momentum Signals

The Relative Strength Index (RSI) has been mostly below the midline since February, falling close to oversold territory a couple of times in March and April. That aligns with the price weakness seen over the same period. Recently, RSI has started turning up, which could mean selling pressure is easing. It hasn’t crossed 50 yet, so momentum hasn’t shifted decisively, but it’s worth keeping an eye on.

Overall Takeaway

The chart reflects a transition phase for COFS. After a strong second half of 2023, the stock has entered a period of consolidation or possible correction. While the current trend is tilted downward, the price seems to have found some footing in the mid-$24 range. If momentum continues to stabilize and volume picks up on the buy side, the setup could shift again in the coming months.

Management Team

ChoiceOne Financial Services is led by a team that understands the balance between local community needs and long-term financial strategy. At the top is Kelly Potes, serving as Chief Executive Officer. He brings a mix of banking and insurance experience, having spent years developing relationships across Michigan’s communities. Potes is known for his steady approach, guiding the company through mergers, growth initiatives, and evolving market conditions with a focus on long-term sustainability.

Supporting him is President Michael Burke Jr., who has built his career in community banking. He’s been instrumental in driving operational improvements and helping align the bank’s day-to-day performance with its broader strategic goals. The CFO, Adom Greenland, plays a key role in financial planning and reporting, especially during periods of acquisition and integration. Bradley Henion, the Chief Lending Officer, oversees lending strategy and risk controls, while Shelly Childers, as Chief Information Officer, manages the digital infrastructure that’s become central to modern banking.

Together, this team has shown a disciplined, measured approach to growth—often prioritizing long-term stability over chasing short-term trends. They’ve led the bank through some pivotal moves, including a major merger that’s now reshaping its future footprint.

Valuation and Stock Performance

COFS is currently trading at a price-to-earnings ratio of just under 8, which puts it in value territory, especially considering its consistent profitability and dividend history. Compared to larger regional banks, this lower valuation could be attractive for investors looking for steady income and capital preservation. Over the past year, the stock has moved between $23 and just over $38, reflecting both strong investor sentiment at its peak and more cautious views as broader market conditions changed.

Even with the price down from its highs, the fundamentals behind the stock remain largely intact. The dividend yield is still north of 4%, supported by a conservative payout ratio, and the bank continues to generate strong free cash flow. The market may be waiting to see how the recent merger with Fentura Financial plays out, but that could also open the door for revaluation if synergies are realized and earnings continue trending higher.

Technical indicators show the stock recently dipped below its 200-day moving average, though relative strength has begun to stabilize. It’s in a holding pattern at the moment, but this could represent an accumulation phase as the market evaluates the next catalyst.

Risks and Considerations

There are always trade-offs in this space, and COFS is no exception. Banks are exposed to interest rate risk, and though net interest margin has been healthy, changes in the rate environment could shift that picture quickly. Likewise, the competitive landscape is intense, with fintech and large national players capturing more attention in both retail and commercial banking. That puts added pressure on smaller, community-focused banks to differentiate through service, personalization, and operational efficiency.

The merger with Fentura is a significant opportunity, but it’s also a risk. Integrating systems, cultures, and customer bases always carries potential friction. Even if the long-term thesis makes sense, the short-term noise could create periods of uneven performance. Additionally, broader economic risks—such as a slowdown in loan demand or rising defaults—could hit smaller banks harder than their larger peers.

It’s also worth noting that, as with any financial institution, cybersecurity remains a constant concern. Data security investments are necessary, and any breaches could not only affect operations but also damage customer trust.

Final Thoughts

ChoiceOne Financial Services offers a unique combination of community banking heritage and forward-thinking execution. The leadership team has proven capable of managing growth without losing sight of the bank’s roots. While risks remain, particularly around regulatory shifts and competitive pressure, the fundamentals here are solid. With a conservative payout ratio, consistent free cash flow, and a growing footprint through recent mergers, COFS is positioning itself for steady, disciplined growth.

The market may not fully reflect the value of those efforts yet, especially given the stock’s recent pullback. But for those focused on quality and resilience, this bank continues to deliver the kind of results that speak louder than the headlines. The long-term story is still unfolding, and the pieces in place suggest it’s one worth watching.