Updated 4/21/25

Chemed Corporation (CHE) brings together two dependable business segments: VITAS Healthcare, a leading hospice care provider, and Roto-Rooter, a well-known name in plumbing and drain services. With a consistent record of revenue growth, disciplined capital allocation, and rising free cash flow, the company has built a reputation for stable operations and strong financials. Its dividend, though modest in yield, is backed by a low payout ratio and steady increases.

Management, led by long-tenured CEO Kevin McNamara, continues to guide Chemed with a clear focus on long-term value. The stock trades at a premium, supported by healthy margins, low debt, and high institutional ownership. Whether through operational strength at VITAS or efforts to stabilize Roto-Rooter, Chemed has maintained reliable performance across various market cycles.

Recent Events

Chemed shares recently dipped to around $563, marking a 3.16% drop on the day and putting the stock roughly 10% below its 52-week high of $623.61. While that might look like a stumble, the broader picture shows a company still trading far above its lows, supported by consistent earnings and revenue growth.

Quarterly revenue grew 9.2% year-over-year, a healthy clip considering the mature nature of its industries. Earnings growth, however, came in at a modest 0.3%, which may have tempered some investor enthusiasm and contributed to recent volatility. Still, with a trailing P/E of 29.25 and a forward P/E closer to 23, the market is clearly still pricing in long-term confidence in Chemed’s performance.

What really sets the company apart is its operational efficiency. Net margins are over 12%, return on equity is a strong 27.12%, and return on assets sits at nearly 14%. Those numbers reflect a business that knows how to convert revenue into real, lasting value.

On the balance sheet side, Chemed keeps it tight. Total debt is just $140 million, which is handily covered by $178 million in cash. That financial flexibility gives the company room to keep investing where needed while maintaining a stable, growing dividend.

Key Dividend Metrics

💰 Forward Dividend Yield: 0.34%

📈 5-Year Average Yield: 0.29%

🔁 Dividend Growth Rate (5-Year CAGR): Solid and consistent

🧱 Payout Ratio: 9.05%

📆 Most Recent Dividend: $2.00 annualized, paid March 14, 2025

🚪 Ex-Dividend Date: February 24, 2025

🪙 Last Dividend Increase: Continues an upward trend

🛡️ Dividend Safety: Fully supported by free cash flow and a strong balance sheet

Dividend Overview

At first glance, Chemed’s dividend might not get your heart racing. A 0.34% yield isn’t going to be the centerpiece of a high-yield portfolio. But there’s something to be said for reliability—and Chemed delivers it in spades.

This is a company that doesn’t chase headlines or overextend itself just to attract attention. It pays what it can comfortably afford, year in and year out. That 9% payout ratio? It’s an investor’s dream. It tells you the dividend is easily covered, even in a soft earnings quarter or an economic downturn.

What really stands out is Chemed’s discipline. Instead of juicing the yield or issuing aggressive buybacks at the expense of financial strength, management has stayed the course with steady, meaningful dividend increases. And they’ve been doing that like clockwork for over a decade.

Dividend Growth and Safety

One of the strongest arguments for owning Chemed isn’t the size of the dividend—it’s the quality of it. The dividend is well protected by the company’s strong free cash flow, which totaled $288 million over the trailing twelve months. Operating cash flow was even higher, topping $417 million.

That gives the company ample room to keep raising the dividend without sacrificing investment in its core businesses or weakening its balance sheet. In fact, with just 12.59% debt to equity and a current ratio of 1.38, Chemed is sitting in a strong position, both financially and operationally.

This kind of setup is ideal for long-term dividend investors. The cash is there. The payout ratio is low. And the company has a demonstrated history of boosting its dividend, even when other firms were pulling back. That consistency is something you can build a portfolio around.

So while the yield might not jump off the page, the reliability and strength behind it absolutely should. Chemed doesn’t need to make noise. It just keeps paying, growing, and delivering—a steady performer in a market that often overvalues flash over fundamentals.

Cash Flow Statement

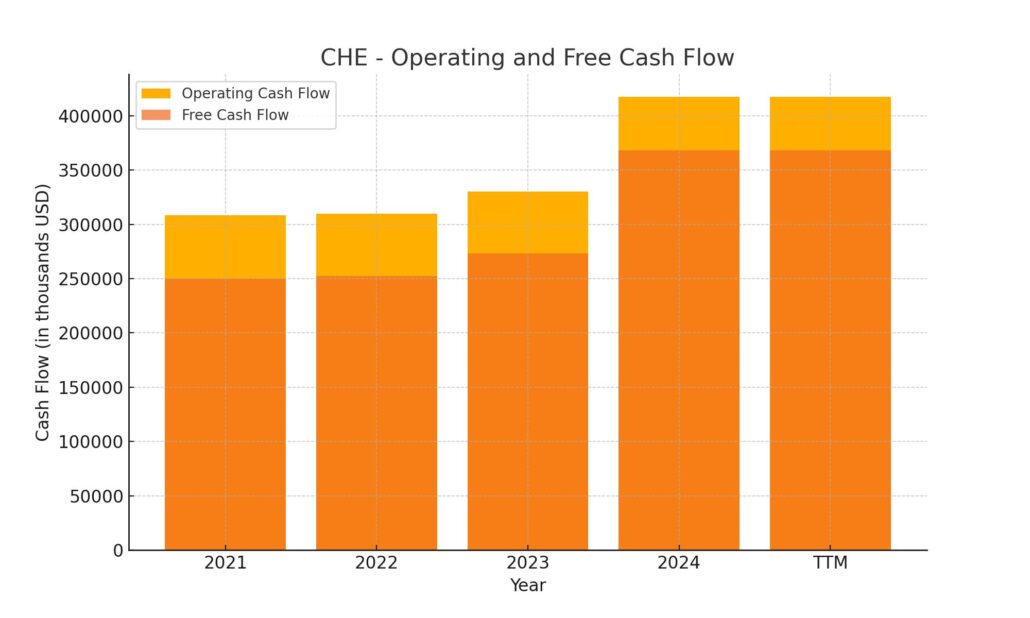

Chemed Corporation generated $417.5 million in operating cash flow over the trailing twelve months, marking a strong improvement from the $330.3 million recorded in the prior year. This consistent upward trend in core cash generation reflects the company’s stable operating base, with both its healthcare and service divisions continuing to deliver reliable results. Capital expenditures remained modest at $49.5 million, leaving Chemed with a healthy free cash flow of nearly $368 million—a clear sign that the business is efficiently converting revenue into usable cash.

On the financing side, outflows were significant at $359.2 million, driven almost entirely by aggressive share repurchases. The company spent over $361 million buying back stock, showing a preference for returning excess cash to shareholders rather than carrying debt or accumulating cash on the balance sheet. No new debt was issued, and no repayments were recorded in the current period, keeping the capital structure stable. Despite the sizable outflow, Chemed still closed the period with $178.4 million in cash, underscoring its ability to balance shareholder returns with liquidity.

Analyst Ratings

Chemed Corporation has recently seen a series of price target updates from analysts, signaling continued confidence in the company’s operations. 📈 Royal Bank of Canada bumped its price target from $633 to $667 in March 2025, highlighting strong performance in Chemed’s VITAS Healthcare segment. That came on the heels of an earlier upward revision in 2024, when RBC raised its target from $604 to $712. The trend suggests analysts see solid traction in Chemed’s underlying business, particularly in its healthcare division.

📊 Oppenheimer also showed optimism, increasing its target from $625 to $650 in early 2024, while reiterating its “Outperform” rating. Analysts there pointed to consistent earnings delivery and steady cash flow generation as key reasons for their confidence. These moves come as Chemed continues to navigate changing macro conditions while keeping its core businesses strong and its financials healthy.

🎯 The current analyst consensus price target for Chemed is $663.67, with a spread ranging from a low of $633 to a high of $708. That puts the stock within striking distance of its potential upside, as viewed by analysts tracking the name. Across the board, the sentiment leans constructive, with expectations centered on stable growth and disciplined execution.

Earning Report Summary

Chemed Corporation wrapped up the fourth quarter of 2024 with a performance that quietly reinforced the strength of its business model. The numbers were solid across the board, with revenue landing around $640 million—a nice jump of over 9% compared to the same time last year. Adjusted earnings per share came in at $6.83, a step up from the previous year and a bit better than expected. It was a quarter that didn’t make big waves but showed clear, steady progress where it matters.

VITAS Healthcare Leads the Way

The clear standout this time around was VITAS Healthcare, Chemed’s hospice care business. It pulled in $411 million for the quarter, up more than 17% year-over-year. That kind of growth doesn’t just happen. It was driven by an increase in the number of patients being cared for each day, along with higher reimbursement rates. VITAS also ran more efficiently this quarter, with better margins that showed the team is keeping a close eye on costs while expanding care.

Roto-Rooter Slows, But Isn’t Out

Not everything was firing on all cylinders. Roto-Rooter, the company’s plumbing and drain division, saw a bit of a step back. Revenue was down nearly 3% from the same quarter last year, mostly due to weaker demand in residential services. Still, Chemed’s leadership didn’t sound alarmed. They acknowledged the softer patch but suggested that things are beginning to even out and that efforts to steady the ship are in place. It’s not panic mode—more like a pause before the next push.

Looking Ahead

Chemed offered up some guidance for 2025 that points to continued momentum. They expect full-year adjusted earnings per share to land somewhere between $24.95 and $25.45, a healthy climb from 2024’s $23.13. A lot of that confidence stems from the continued strength at VITAS, but there’s also hope that Roto-Rooter will regain its footing as the year unfolds.

Leadership had a few candid thoughts to share as well. CEO Kevin McNamara called out Florida as one of the most attractive states for hospice care, thanks to demographics that align perfectly with VITAS’ services. And even with Roto-Rooter’s dip, he seemed encouraged by early signs of improvement.

Chemed’s financials continue to look sharp. There’s no long-term debt weighing things down, and the company is sitting on a comfortable pile of cash. That gives them the flexibility to keep investing in both of their core businesses while also rewarding shareholders through steady dividends and buybacks. All in all, it was a quietly confident quarter from a company that’s used to delivering just that.

Chart Analysis

Price Trend and Moving Averages

CHE has moved through a fairly broad price range over the past year, starting off strong near $620 before falling into a steady decline that bottomed out just above $520 in late summer. The red 50-day moving average dropped below the 200-day moving average during that period, a crossover that often signals weakening momentum. From October onward, there was a noticeable shift in direction. The price began trending upward again, and by March, the 50-day average crossed back above the 200-day line, reflecting renewed buying strength.

The recent pullback in April brings the price close to its 200-day average once again, hinting at a key support zone that investors may be watching closely. It’s also worth noting how price has respected this moving average as support and resistance at different points over the year.

Volume Activity

Volume has remained relatively steady throughout the year, with occasional spikes tied to major price moves. A surge in volume accompanied the rally in March, which suggests conviction behind the upward momentum. Since then, volume has cooled, aligning with the recent sideways-to-downward drift. That slowdown may reflect a pause rather than a shift in sentiment, but it’s something to keep an eye on.

RSI and Momentum

The relative strength index (RSI) spent much of the last six months hovering around the neutral 50 level, with brief forays into the overbought zone in March. The current RSI reads closer to 40, indicating momentum has cooled off without crossing into oversold territory. This suggests the stock isn’t showing extreme weakness but is simply taking a breather after its recent climb.

Overall, CHE has worked through a full cycle in the past year—falling, recovering, and now consolidating. The moving averages have realigned in a more constructive formation, and the RSI isn’t signaling any major overextension. It’s a technical setup that points to potential stability, even if near-term upside looks tempered.

Management Team

Chemed Corporation is led by Kevin J. McNamara, who has been with the company since 1980. He took on the role of President in 1994 and became CEO in 2001. His long-standing leadership has brought steady direction to the business through various market cycles. Over the years, McNamara has emphasized strategic growth, operational efficiency, and shareholder value, steering the company through both expansion and transformation across its dual segments.

The board of directors brings a mix of experience in finance, healthcare, law, and operations. This variety in expertise helps guide the company through both regulatory challenges and industry changes. With a strong emphasis on governance and long-term planning, the team continues to support management in navigating the complexities of both the healthcare and service-based industries. The overall structure of the leadership team reflects a steady hand with a clear focus on risk management and sustainable growth.

Valuation and Stock Performance

Over the last year, Chemed’s stock has seen a wide range, climbing to a high of $623.61 and dipping to a low of $512.12. It’s currently trading in the mid-$580s, which puts it slightly below where it was twelve months ago. While it hasn’t outpaced the broader market recently, the stock has shown resilience. With a beta of just 0.49, its price tends to move less than the broader index, making it more stable in times of market stress.

Valuation-wise, Chemed’s trailing P/E ratio is 29.25, while its forward P/E stands at 23.09. Those figures reflect the market’s expectations for earnings growth and the quality of its earnings stream. The company’s EV/EBITDA ratio of 18.23 suggests investors are still willing to pay a premium for the company’s stable cash flows and consistent operating performance. The price-to-sales ratio is 3.63, and price-to-book stands at 7.60, both of which are elevated but not unreasonable for a company with Chemed’s history of reliable profitability and high returns on equity.

The stock has seen moderate volume, averaging just under 120,000 shares traded daily over the last few months. Institutional ownership remains high, above 97%, reflecting a strong vote of confidence from long-term holders and fund managers.

Risks and Considerations

Chemed operates in two very different industries, and each comes with its own set of risks. On the healthcare side, the VITAS segment is heavily influenced by government reimbursement rates and healthcare policy. Any adjustments to Medicare rules or broader changes in healthcare funding could impact margins. While current trends have been supportive, the political landscape can shift quickly.

On the service side, Roto-Rooter competes in a fragmented market where pricing pressure and local competition can be intense. Any slowdown in residential or commercial spending could weigh on revenue growth. The company also has to manage labor costs and supply constraints, both of which have been unpredictable in recent years.

External economic pressures like inflation and broader labor market tightness are worth monitoring as well. Rising costs for wages, fuel, and materials could eat into margins if not managed carefully. So far, Chemed has shown strong discipline in this area, but continued inflation could test that control.

Finally, the stock itself carries a valuation premium. While the business is strong, any slip in earnings or slowdown in growth could pressure the share price more than a lower-multiple stock.

Final Thoughts

Chemed has steadily carved out a niche by combining healthcare and home services in a way few other companies do. It’s a unique structure that’s provided reliable performance, solid cash flow, and long-term value for shareholders. The management team has been in place for decades and knows how to run a tight ship, whether it’s dealing with hospice regulation or clogged drains.

The company isn’t immune to risks—no stock is—but it has consistently shown it can adapt, reinvest wisely, and return capital to shareholders in a thoughtful manner. With a modest dividend, strong balance sheet, and a business model built on essential services, Chemed continues to quietly deliver in the background while letting its results speak for themselves.