Updated 4/21/25

Carrier Global Corporation (CARR) is a leader in heating, ventilation, air conditioning, and refrigeration technologies, with a global footprint and a focused strategy on climate and energy solutions. Since its 2020 spin-off, the company has made deliberate moves to streamline its portfolio and invest in high-growth areas like sustainable building systems and smart climate control.

Under CEO David Gitlin, Carrier has expanded its reach through key acquisitions and improved operational efficiency, resulting in strong revenue growth and rising adjusted earnings. With a forward-looking management team, consistent dividend growth, and a business model geared toward global demand for energy-efficient solutions, Carrier continues to carve out a stable position in the industrial sector.

Recent Events

The last year has been eventful for Carrier, and in a good way. Revenues surged by more than 19% year-over-year, reaching $22.5 billion over the trailing twelve months. Earnings per share saw a massive jump too—up over 500%. These numbers don’t just appear out of thin air. They reflect a company firing on most cylinders.

One of the bigger strategic moves was the $12 billion divestiture of its fire and security segment. By streamlining its business to focus squarely on climate solutions, Carrier has sharpened its identity and doubled down on growth areas. Investors seemed to like this leaner version of the company, with the stock posting double-digit gains over the past year.

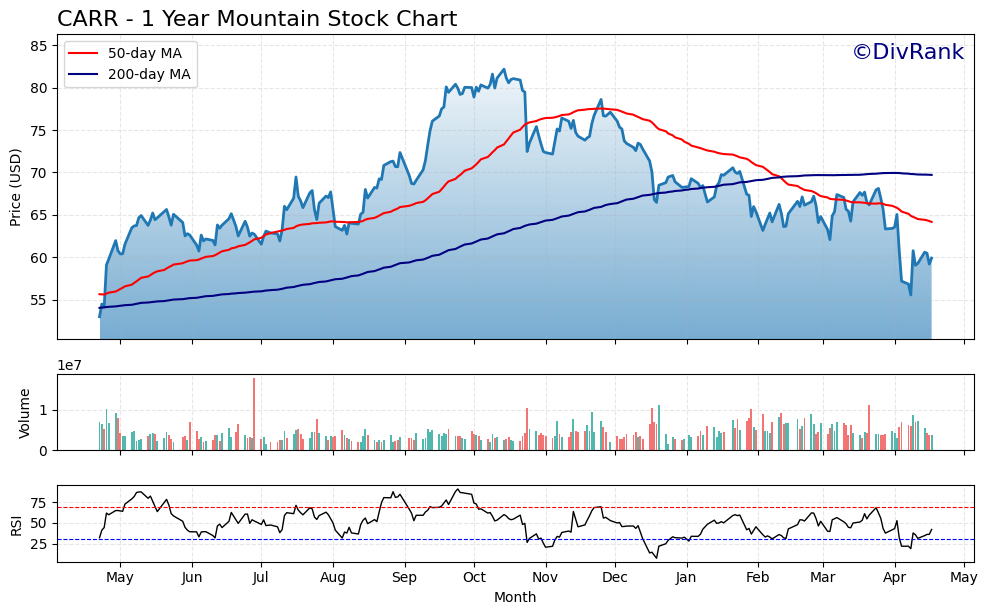

That said, recent price action has been more muted. At around $59.90, shares are trading below both the 50-day and 200-day moving averages. Some digestion of the gains and the business realignment is expected. The valuation is still leaning toward a growth narrative, with a forward P/E near 20.

Key Dividend Metrics

📈 Forward Yield: 1.50%

💰 Annual Dividend (Forward): $0.90

📆 Next Ex-Dividend Date: May 2, 2025

📊 Payout Ratio: 80.74%

📅 Dividend Date: May 22, 2025

🔥 5-Year Average Yield: Not yet established

📉 Dividend Growth: Trending upward

🔒 Dividend Safety (cash flow view): Balanced, with areas to watch

Dividend Overview

Carrier’s dividend yield won’t turn heads at first glance—1.5% isn’t exactly high-octane income. But what it offers is more about long-term dependability than immediate return. The company pays out $0.90 annually per share, and while that’s not a huge amount, it’s a step up from the previous year’s $0.80. A steady rise in payouts, even if modest, shows management’s intent to grow shareholder returns over time.

Now, let’s talk sustainability. The payout ratio based on earnings is sitting high at around 81%. Normally, that would raise a few eyebrows. But a deeper look tells a more nuanced story. Carrier generated over $5.3 billion in levered free cash flow in the last year, which gives the company flexibility to fund dividends even when net earnings are compressed by one-time items or restructuring charges.

That said, the operating cash flow of just $563 million is on the lighter side. It doesn’t spell trouble, but it does mean there’s room for improvement if the company wants to make its dividend foundation even stronger.

Dividend Growth and Safety

Since becoming an independent company, Carrier hasn’t wasted time building a record of annual dividend increases. Sure, the history is short, but it’s been consistent. The recent raise to $0.90 is proof that dividend growth is a part of the playbook, even while the company reinvests in its business and reshapes its portfolio.

Debt is one piece of the safety puzzle worth watching. The company carries just under $13 billion in debt, and the debt-to-equity ratio is sitting at about 89%. That’s manageable in an industrial setting, but it’s not trivial. The positive side? Carrier’s sitting on nearly $4 billion in cash, which helps offset that leverage. They’re not in a tight corner here.

What also stands out is the institutional ownership—almost 87% of the float is held by big money players. That usually means dividends are under a spotlight. Large shareholders tend to push for reliability and accountability when it comes to payouts.

Overall, Carrier is shaping up as a solid player for dividend investors who are in it for the long haul. The yield might be modest today, but the pattern of increases, paired with strong free cash flow and strategic business focus, suggests this is a company with income potential that’s still maturing. If you’re building a dividend portfolio with an eye on growth and staying power, Carrier deserves a serious look.

Cash Flow Statement

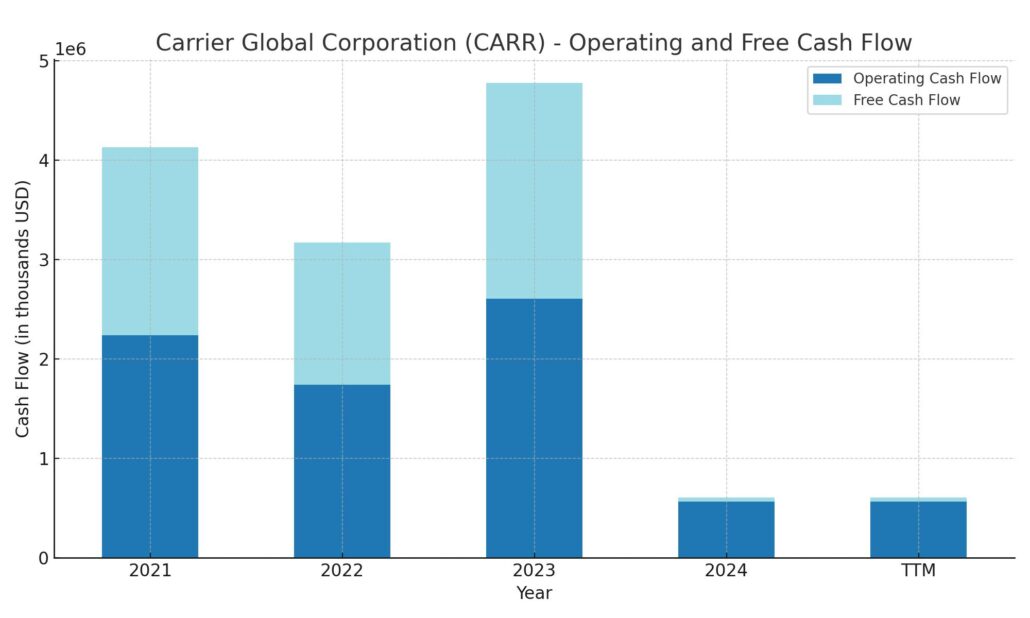

Carrier’s latest trailing twelve-month cash flow statement shows a significant pullback in operating cash generation, coming in at just $563 million. That’s a steep drop from prior years, where operating cash flow routinely topped $2 billion. This decline directly impacts the company’s free cash flow, which fell to just $44 million—well below historical levels. This softness in core cash generation raises some questions about short-term efficiency and timing of working capital.

On the financing side, Carrier was quite active. The company repaid over $5.3 billion in debt, while also issuing about $3.4 billion, indicating ongoing efforts to reshape its capital structure. Share repurchases reached nearly $2 billion, suggesting a shareholder return strategy even amid compressed cash flow. On the investing side, outflows hit $2 billion, partly due to capital spending and other strategic investments. While Carrier still holds nearly $4 billion in cash, it’s a noticeable drop from the $9.8 billion reported at the end of 2023, reflecting how active the company has been in deploying capital this past year.

Analyst Ratings

📊 Carrier Global (CARR) has seen a mix of analyst activity recently, reflecting both confidence in its long-term strategy and some caution around short-term headwinds. The general consensus from Wall Street leans toward a “Moderate Buy,” with an average 12-month price target of $80.13. That marks a potential upside of about 34% from the current share price of around $59.90.

📈 In March, JPMorgan shifted its rating from “Neutral” to “Overweight,” pointing to the company’s sharpened focus on HVAC systems and its potential to drive stronger profit margins in the coming quarters. Wolfe Research followed suit with an upgrade from “Hold” to “Buy,” emphasizing Carrier’s favorable positioning in the global climate solutions space and its clean energy appeal.

🔻 On the flip side, a few firms have nudged their price targets downward while still maintaining positive ratings. Citigroup kept its “Buy” call but lowered its target from $89 to $72, citing some expected volatility in near-term earnings. Barclays also trimmed its target from $87 to $83, even as it maintained an “Overweight” rating, pointing to external macroeconomic pressures as a factor worth watching.

📌 Overall, the mood from analysts remains constructive. While short-term uncertainties persist, Carrier’s long-term fundamentals, focus on sustainability, and strategic business decisions continue to draw support from the analyst community.

Earnings Report Summary

Strong Finish to the Year

Carrier Global closed out 2024 with real momentum. Total sales for the year came in at $22.5 billion, which is a solid 19% increase over the previous year. That kind of top-line growth was supported by both acquisitions—most notably the Viessmann Climate Solutions deal—and a 3% bump in organic sales. On the earnings side, adjusted EPS reached $2.56, up 16% year-over-year. Operationally, things tightened up too. Adjusted operating profit jumped 34%, reflecting improvements in efficiency and the early benefits of integrating Viessmann.

In the final quarter alone, Carrier posted $5.1 billion in revenue, which is also a 19% gain compared to Q4 the year before. The HVAC segment really stood out, especially in the Americas where both commercial and residential markets drove double-digit growth. Adjusted earnings per share came in at $0.54 for the quarter—up 50% from the same time last year. That said, the company did report a GAAP net loss of $48 million, mainly due to a one-time $650 million tax charge tied to internal restructuring.

Leadership Perspective and What’s Ahead

CEO David Gitlin didn’t shy away from calling 2024 a transformative year. With the portfolio reshaped and Viessmann now under the Carrier umbrella, leadership seems confident about the company’s new direction. Gitlin highlighted growth in the commercial HVAC backlog, stronger aftermarket demand, and the company’s leadership position across several core business areas.

Looking to 2025, Carrier is forecasting adjusted EPS in the range of $2.95 to $3.05, which would represent a healthy increase from last year. Free cash flow is expected to land between $2.4 billion and $2.6 billion, and the company is planning to repurchase about $3 billion worth of its own stock. The outlook assumes continued mid-single-digit organic growth and stable performance across its business units.

Overall, Carrier’s leadership is clearly leaning into a strategy built around focus, innovation, and delivering consistent value—not just to customers, but to investors as well.

Chart Analysis

Price Trend and Moving Averages

CARR’s one-year chart paints a story of early strength followed by a steady fade. From spring through late summer, the stock showed consistent upward momentum, climbing from the mid-50s to just above 80 dollars. That peak around November marked the high point, with the 50-day moving average (red line) riding comfortably above the 200-day (blue line). But the tone shifted sharply after that. The 50-day MA has been in a clear downtrend since December and has now crossed below the 200-day—a bearish signal known as a death cross, often a sign that momentum has turned.

From a price standpoint, shares have drifted steadily lower through winter and early spring, dipping near 55 before seeing a slight bounce. Still, with the price below both major moving averages and the shorter-term average declining faster, the trend remains under pressure.

Volume and Activity

Volume has stayed relatively steady across the year, though there were a few noticeable spikes—particularly during the steep drawdowns in April and late January. These surges tend to indicate heavier institutional involvement or larger moves tied to news or earnings. That said, there hasn’t been a sustained volume uptick to suggest accumulation at the lows yet.

Momentum and RSI

The Relative Strength Index (RSI) has been mostly trending sideways but dipped into oversold territory twice—once in January and again more recently in April. The current RSI hovers near 40, suggesting there’s still room to fall before it becomes truly oversold again. What stands out is that despite those two sharp selloffs, buyers have yet to mount any sustained push higher, and momentum remains tepid.

All in all, the chart tells a story of a stock that had a strong run, but sentiment has cooled. The market is in a wait-and-see mode, looking for signs of stabilization or a shift in trend before stepping back in with confidence.

Management Team

Carrier Global is led by Chairman and CEO David Gitlin, who has guided the company since its spin-off from United Technologies in 2020. Gitlin brings decades of leadership experience from his time at UTC Aerospace Systems and Collins Aerospace, and his track record reflects a consistent focus on innovation, operational efficiency, and repositioning Carrier as a climate-focused industrial leader. His tenure has been marked by strategic decisions like the Viessmann Climate Solutions acquisition and divesting non-core assets to sharpen the company’s identity.

Supporting Gitlin is a stable and seasoned executive team. Patrick Goris, the CFO, joined from Rockwell Automation and brings a disciplined financial lens to Carrier’s operations and capital deployment. Ajay Agrawal, Chief Strategy Officer, brings long-term vision to the table, particularly in healthy buildings and energy solutions. Other key leaders span operations, engineering, HR, and global business lines, giving the organization a balanced foundation for scaling growth and managing risk across regions.

Valuation and Stock Performance

Carrier’s stock is currently trading near $59.90, giving the company a market cap of around $51.75 billion. Over the last twelve months, shares have climbed approximately 12 percent, although it’s come with some volatility. The stock touched a high of $83.32 and a low of $53.50 within that window, showing the kind of range that comes with evolving investor expectations and market conditions.

Looking at valuation, the trailing P/E sits near 49, while the forward P/E is just under 20. That gap suggests expectations for significant earnings growth in the year ahead. On a price-to-sales basis, the stock trades at about 2.4 times trailing revenue, which is relatively fair for an industrial with consistent margin improvement and global demand drivers. Analysts have placed the average 12-month price target around $80, which would imply meaningful upside from current levels. Even with a premium valuation, the fundamentals—particularly in recurring revenue and long-term contracts—offer support for where the stock is priced.

Risks and Considerations

While Carrier’s growth narrative is compelling, it doesn’t come without its share of risk. With half of the company’s revenue generated outside the U.S., foreign exchange shifts, geopolitical instability, and international regulation could introduce earnings variability. Whether it’s the euro, yuan, or other regional currencies, global operations always bring that added layer of complexity.

Legal exposure has also been a headline recently. The company is working through a sizable settlement related to historical PFAS liabilities via Kidde-Fenwal. Although these costs are expected to be covered largely through insurance, it’s a reminder of how legacy issues can still weigh on current financials and sentiment. Meanwhile, Carrier’s supply chain—like many in the industrial sector—continues to face pressure. Whether it’s sourcing components or dealing with freight inflation, any disruption has the potential to impact timelines or squeeze margins.

Debt is another angle to watch. The balance sheet is currently managing over $12 billion in debt, and while interest coverage is adequate, it places some responsibility on the company to maintain strong cash flow and preserve flexibility, especially with ambitious share repurchase plans on the table.

Final Thoughts

Carrier is in the middle of a meaningful transformation, and the pieces seem to be falling into place. Management’s strategic decisions are giving the company a clearer identity, and the financial performance is proving that execution is following intent. The HVAC and climate solutions space continues to expand globally, and Carrier’s brand strength and product range put it in a favorable position to grow along with it.

There are, of course, variables that could challenge the story—macroeconomic pressures, liability costs, or operational bumps—but the company has shown an ability to adapt. For investors looking at well-positioned companies with a global footprint and a growing presence in sustainable infrastructure, Carrier is one to keep on the radar. The road ahead may not be without noise, but the foundation looks increasingly solid.