Updated 4/21/25

Carlisle Companies (CSL), a 100-year-old manufacturer based in Arizona, has steadily evolved into a focused leader in building products. Its core operations now revolve around roofing systems, insulation, and weatherproofing technologies—critical components in the non-residential construction space. Backed by consistent free cash flow, low payout ratios, and nearly five decades of dividend growth, CSL has built a strong case for long-term investors.

With an experienced management team, a forward-looking acquisition strategy, and a sharp focus on margin expansion, the company is positioning itself for sustainable performance. Trading around $350 with a forward P/E of 15.75 and a growing dividend yield of over 1%, Carlisle offers a mix of income, stability, and operational discipline.

Recent Events

As 2025 got underway, Carlisle was coming off a mixed year. Its full-year results showed net income of $863 million and a small year-over-year revenue decline of 0.4%. While not thrilling at first glance, that kind of performance during a tougher stretch in construction spending deserves credit. Profitability held up impressively, with operating margins sitting just over 18%. EPS for the year landed at $18.33—solid footing considering the broader backdrop.

It’s not just earnings that make this name attractive. Free cash flow remained strong at over $2.2 billion, and the balance sheet continues to support shareholder-friendly decisions. Carlisle hasn’t let short-term headwinds derail its focus on long-term value creation. That includes staying the course on dividend growth, even when earnings growth slows.

Key Dividend Metrics

📈 Forward Dividend Yield: 1.13%

💸 Annual Dividend Rate: $4.00 per share

📆 Ex-Dividend Date: February 18, 2025

🧾 Payout Ratio: 20.17%

📊 5-Year Average Yield: 1.10%

🏗️ Dividend Growth Streak: 47 years and counting

💼 Free Cash Flow (TTM): $2.27 billion

🏦 Cash on Balance Sheet: $753.5 million

Dividend Overview

Carlisle’s dividend yield might not immediately turn heads, sitting at just over 1%. But that’s not the full story. What’s more important here is the consistency, the discipline, and the room for growth.

With only about 20% of earnings being paid out as dividends, Carlisle leaves itself plenty of cushion. This is a payout strategy rooted in sustainability. They’re not stretching to return capital—they’re doing it comfortably, and in a way that leaves flexibility for tough years or strategic investments.

On top of that, the company’s financial footing is strong. A current ratio of 2.89 means liquidity isn’t a concern, and despite having just over $2 billion in debt, it’s offset by nearly $754 million in cash and strong ongoing cash generation. For investors who prize safety and stability, this setup provides reassurance that the dividend isn’t going anywhere.

Dividend Growth and Safety

Now here’s where Carlisle really starts to shine. This company has increased its dividend for 47 straight years. That’s a record that puts it within striking distance of the elite Dividend Kings club. The latest increase saw the annual payout rise from $3.70 to $4.00 per share—a jump of a little over 8%.

It’s not just that they raise the dividend. It’s how they do it. Carefully. Consistently. Thoughtfully. The 5-year dividend growth rate hovers around 9%, comfortably above inflation and offering real income growth for long-term holders. They aren’t reacting to short-term market swings. They’re executing a clear, long-term plan.

Even in 2024, a year that brought a 20% dip in earnings per share, management still raised the dividend. That kind of decision sends a strong message. It tells you they’re thinking in decades, not quarters.

Dividend safety here isn’t just about the numbers, though the numbers are solid. It’s also about philosophy. Carlisle’s leadership is clearly committed to rewarding shareholders, but they’re doing it without putting the business at risk. That’s a balance that many companies struggle with—and Carlisle seems to manage with quiet confidence.

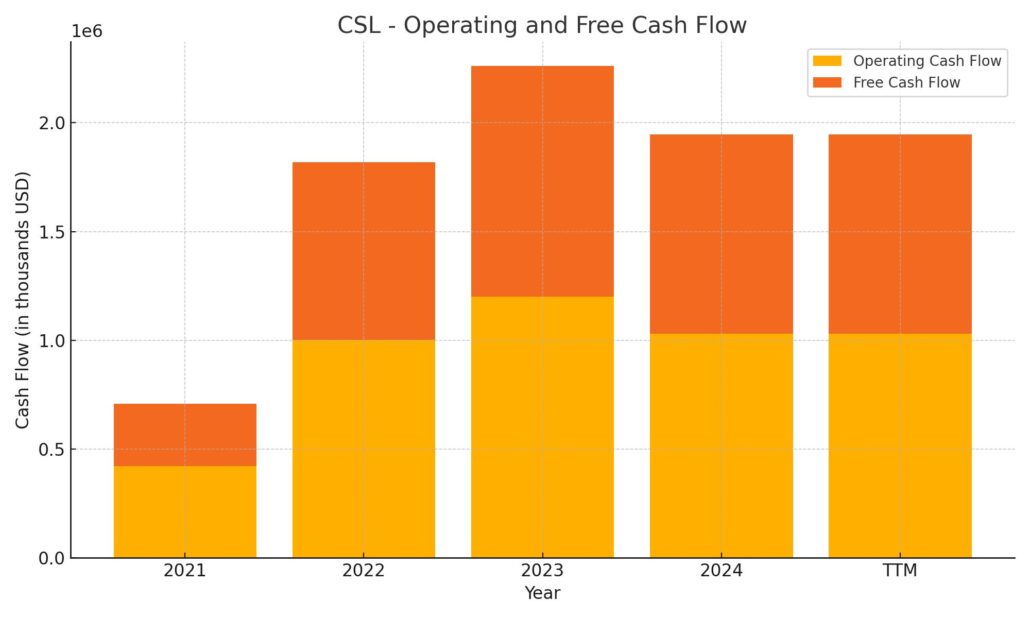

Cash Flow Statement

Carlisle Companies has demonstrated robust cash generation over the trailing 12 months, with operating cash flow reaching $1.03 billion. This steady inflow supports the business’s core operations and lays the groundwork for continued financial flexibility. Capital expenditures came in at $113.3 million, reflecting a disciplined approach to reinvestment, and leaving Carlisle with free cash flow of $917 million—an amount comfortably covering dividends and providing room for other capital allocation moves.

On the investing side, the company reported a net inflow of $1.23 billion, a significant shift from prior years, driven likely by divestitures. Meanwhile, financing cash flow was deeply negative at -$2.11 billion. This included $1.59 billion spent on share repurchases and $422 million in debt repayments, showing a strong return of capital to shareholders. With $753.5 million in cash now on the books, Carlisle is positioned to maintain its dividend, buy back shares, and stay nimble in the face of market shifts.

Analyst Ratings

🟡 Carlisle Companies (CSL) recently caught a bit more attention from analysts. On April 14, 2025, Zelman & Associates upgraded the stock from “Underperform” to “Neutral,” signaling a more balanced perspective on the company’s near-term prospects. While not a glowing endorsement, the shift suggests that earlier concerns—likely tied to macroeconomic headwinds or construction cycle slowdowns—may be easing.

📊 The current analyst consensus gives CSL a moderate buy rating, with an average price target of $476. That marks a potential upside of nearly 35% from where the stock is currently trading. Among the forecasts, the lowest target stands at $460, while the most bullish outlook puts it at $500. These targets reflect confidence in Carlisle’s core business stability, steady cash flows, and disciplined capital returns.

🔍 The upgrade appears to stem from a recognition that Carlisle’s fundamentals remain strong, despite a softer year in earnings. The company’s ability to generate free cash flow, maintain a low payout ratio, and consistently return capital through buybacks and dividends likely played a role in shifting analyst sentiment. With reduced downside risk and signs of resilience in construction markets, analysts are becoming more comfortable with CSL’s setup heading into the rest of 2025.

Earnings Report Summary

A Strong Finish to 2024

Carlisle Companies wrapped up 2024 with what could best be described as a quietly impressive performance. Adjusted earnings per share came in at $20.20 for the year, up a solid 30% from the previous year. Revenue hit the $5 billion mark, which was about a 9% jump year-over-year. Even more telling was the company’s ability to maintain strong profitability, closing the year with an adjusted EBITDA margin of 26.6%.

In the fourth quarter specifically, revenue landed at $1.12 billion, which was just a tick below the prior year—down about 0.4%. Despite that slight dip, earnings remained strong. Adjusted EPS for the quarter rose to $4.47, a 7% increase, which really highlighted Carlisle’s ability to stay steady even in the face of broader headwinds like elevated interest rates and some tough weather conditions that affected project timing.

Segment Highlights and Strategy Shifts

The Carlisle Construction Materials division continued to do the heavy lifting. Revenue in that segment climbed 2.2% in the fourth quarter, thanks to ongoing strength in re-roofing demand. On the flip side, the Weatherproofing Technologies segment saw a 7% decline, largely tied to softness in the residential construction market. That’s not a huge surprise given the broader slowdown in housing-related activity.

Margins for the quarter held at just under 20%, which is still a healthy level, though it reflects some of the cost pressures that many companies are feeling right now.

Behind the scenes, 2024 was a big year in terms of Carlisle’s long-term strategy. The company completed its move into a focused building products business by divesting its Interconnect Technologies segment. At the same time, it added new capabilities with the acquisitions of MTL, Plasti-Fab, and ThermaFoam—each expanding Carlisle’s reach in the building envelope space.

They didn’t just sit on their cash, either. Carlisle returned $1.6 billion to shareholders through buybacks during the year, which underlines how much confidence leadership has in the business and its future.

Leadership’s Outlook for 2025

CEO Chris Koch spoke positively about what lies ahead in 2025. He mentioned expectations for mid-single-digit revenue growth and a slight uptick in margins, about 50 basis points higher than last year. There’s optimism that strong demand for re-roofing projects will continue, and that the recent acquisitions will start to make a more noticeable contribution.

Carlisle seems to be entering the new year with momentum, a cleaner business model, and a clear path toward its Vision 2030 goals. For shareholders and long-term investors, that’s the kind of quiet strength that can be easy to overlook—but often pays off in the long run.

Chart Analysis

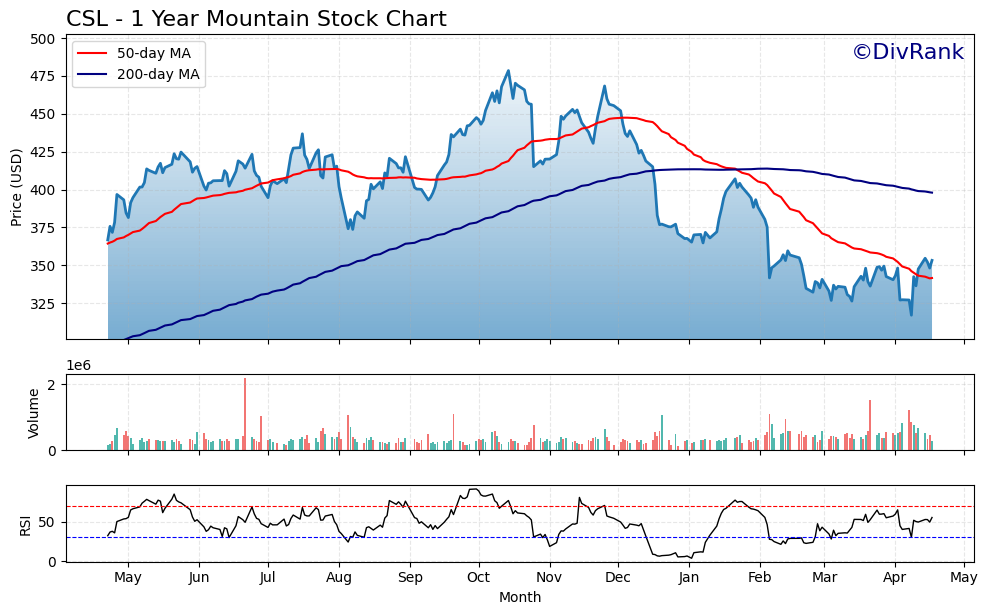

Price Action and Moving Averages

The stock price of CSL has had quite the journey over the past year. It started with a strong uptrend that peaked around late November, where prices briefly touched the $475 mark. From there, the stock began a clear descent, losing ground steadily into the first quarter of this year. What stands out is the breakdown below the 50-day moving average (in red) in early December, followed by a sustained drop beneath the 200-day moving average (in blue) not long after.

Both moving averages have since turned downward, with the 50-day now sitting well below the 200-day—a classic technical signal that the short-term trend remains under pressure. That said, the most recent price action shows CSL trying to carve out a bottom near $325–$340. It has made a couple of attempts to rebound, and while not explosive, the recent lift from late March into April shows buyers gradually stepping back in.

Volume Activity

Looking at the volume, there was a spike during some of the sharpest drawdowns, suggesting capitulation by some investors earlier in the year. Since then, volume has normalized, though a few higher bars in early April coincide with attempts to rally off the lows. This suggests a growing interest at current levels, potentially indicating that the worst of the selling pressure may be behind it for now.

Relative Strength Index (RSI)

The RSI has mostly recovered from deeply oversold territory seen in January. It dipped well below the 30 line during the steepest correction, but it has now worked its way back toward the mid-50s range. This shift is subtle, but it points to improving momentum and a healthier balance between buying and selling pressure. RSI readings just above 50 aren’t euphoric, but they suggest the stock is stabilizing rather than continuing its prior downtrend.

Overall Read

CSL appears to be finding its footing after several months of consistent decline. It hasn’t reclaimed the longer-term trendlines yet, and the chart still carries the memory of a steep fall. However, the flattening RSI, returning volume, and price support around $325–$340 indicate some resilience. The key from here will be whether the price can reclaim the 50-day moving average and eventually push back toward the 200-day line—markers that would strengthen the case for a longer-term turnaround.

Management Team

Carlisle Companies (CSL) is led by Chair, President, and CEO D. Christian Koch, who has been instrumental in shaping the company’s transformation over the past several years. His focus on streamlining operations and narrowing the company’s focus toward high-margin, less cyclical building product businesses has defined his tenure. Under Koch’s leadership, Carlisle has completed key divestitures, added strategic acquisitions, and maintained a disciplined capital allocation strategy that prioritizes shareholder returns.

Supporting Koch is Kevin P. Zdimal, serving as Vice President and Chief Financial Officer. Zdimal brings financial discipline and transparency to the table, keeping the balance sheet in good health while enabling the company to pursue growth initiatives. The executive team is rounded out by experienced leaders like Scott C. Selbach, the General Counsel, and Susan Wallace, the Chief Human Resources Officer. Together, this group has created a focused, performance-driven culture at Carlisle, with a clear vision toward long-term operational and shareholder value.

Valuation and Stock Performance

Carlisle’s stock has seen a fair bit of movement over the past year. As of late April 2025, CSL is trading near $350 per share, which places its market cap just over $15.6 billion. That’s a modest step down from its highs last year when the stock was trading above $475. The drop aligns with the broader cooling across construction-related equities, especially as interest rates have remained elevated and building activity slowed in some sectors.

Still, looking at the valuation today, the picture isn’t gloomy. Carlisle is trading at a forward price-to-earnings ratio of around 15.75. For a company with strong free cash flow, solid margins, and an established dividend growth history, this isn’t stretched. In fact, it might even appear conservative compared to other companies in the building materials space with lower profitability.

Over the longer term, the performance tells a different story. The stock has returned nearly 200% over the past five years, reflecting not only earnings growth but the impact of significant share buybacks and increasing dividends. For investors who’ve held the stock over multiple years, Carlisle has been a rewarding name—quietly compounding in the background.

Risks and Considerations

No stock comes without risk, and Carlisle is no exception. One of the most immediate concerns is the company’s exposure to the construction cycle. A meaningful portion of revenue is tied to non-residential re-roofing and building projects, which can be delayed or canceled when economic conditions tighten. A prolonged slowdown in construction spending, especially commercial or industrial projects, would likely weigh on results.

Another consideration is raw material inflation. Carlisle relies on petroleum-based inputs for many of its products. When commodity prices spike, margins can get squeezed—especially if the company can’t pass those costs through to customers quickly. Supply chain disruptions, while not as severe as in prior years, are always a factor to watch in global manufacturing businesses.

Additionally, regulatory pressures tied to environmental and energy standards continue to evolve. Carlisle has been proactive in sustainability efforts, but ongoing investment will be required to meet both internal and external expectations. There’s also execution risk tied to their acquisition strategy—integrating new businesses while preserving margins can be challenging, particularly in volatile markets.

Final Thoughts

Carlisle Companies has built a reputation for operational discipline, strategic clarity, and a steady approach to rewarding shareholders. Its transformation into a pure-play building products firm has sharpened its focus and streamlined the business model. Leadership is experienced, results-driven, and appears well aligned with long-term shareholders.

While the stock has seen some pressure in the last year, that’s come more from external macro factors than company-specific issues. The fundamentals remain intact. The balance sheet is strong, cash flow is healthy, and the dividend has room to grow. Risks exist, particularly around the construction cycle and input costs, but Carlisle has demonstrated that it can navigate those cycles effectively.

All in, CSL presents a business that understands where it’s going and how to get there—steadily, with patience, and with an eye on long-term results.