Updated 4/21/25

Cardinal Health (CAH) is a cornerstone in the healthcare distribution space, supplying pharmaceuticals and medical products across the U.S. With a market cap of over $32 billion and more than 30 consecutive years of dividend increases, it’s built a reputation for operational consistency and shareholder discipline. Over the past year, the stock has gained over 30%, driven by earnings growth, rising margins, and strategic execution across its pharmaceutical and medical segments. Backed by a capable management team and strong free cash flow generation, CAH continues to offer stability with upside potential.

Recent Events

Behind the scenes, Cardinal Health has been busy refining its strategy. It’s been investing more heavily in its Pharmaceutical and Medical segments, focusing on simplification and operational efficiency. These changes aren’t about reinventing the wheel—they’re about tuning it to roll smoother and faster.

In its latest quarterly report, CAH posted an 8.7% year-over-year increase in earnings. That kind of progress deserves attention, especially given a slight 3.8% dip in revenue. More profit on less revenue? That tells us the company is getting leaner and more effective, not just coasting.

Investors seem to be noticing. The stock has jumped over 30% in the past year, handily beating broader market indices. And yet, even after this strong run, the stock is trading at a forward P/E just under 15. It’s not a bargain-bin name, but it’s certainly not overpriced considering the fundamentals.

Key Dividend Metrics

💵 Forward Annual Dividend: $2.02 per share

📈 Forward Dividend Yield: 1.50%

📆 Ex-Dividend Date: April 1, 2025

📊 Payout Ratio: 37.57%

📉 5-Year Average Yield: 2.84%

📅 Last Dividend Paid: April 15, 2025

🔁 Dividend Growth Streak: Over 30 years

The numbers may not scream “high-yield,” but there’s substance here—particularly for those who value consistency and discipline over flash.

Dividend Overview

Cardinal Health isn’t trying to be the highest yielder on the block. Instead, it’s the kind of dividend name that quietly builds wealth over time. With a dividend yield of 1.50%, it’s a bit below its historical average, but context matters. The stock has had a strong run—when prices climb, yields naturally compress. That’s not a knock, it’s a side effect of success.

The dividend is well-supported. A payout ratio under 38% means the company isn’t overextending itself. In fact, it’s got room to breathe, even in tougher environments. Cash reserves of around $4 billion offer a solid buffer, and total debt, while sizable at $7.6 billion, remains manageable given the company’s size and cash flow profile.

What stands out most is the mindset behind the payout. This isn’t a company throwing around dividend hikes to juice its stock. It’s one that pays what it can, protects its balance sheet, and raises the dividend when the fundamentals justify it. That’s exactly the kind of steady approach that keeps dividend portfolios on track.

Dividend Growth and Safety

There’s something to be said for a company that quietly delivers dividends year after year. CAH has raised its dividend for more than 30 consecutive years—a stat that puts it in elite company. Through recessions, industry shifts, and margin pressures, it’s kept the dividend flowing.

Growth hasn’t been explosive in recent years, but it’s been consistent. And more importantly, it’s been responsible. CAH maintains a deliberate pace, which feels appropriate for a company operating on razor-thin margins. Its operating margin is just above 1%, and its profit margin under 1%. These aren’t numbers that support flashy dividend hikes, but they do support reliability.

That reliability is also reflected in the company’s beta of just 0.62. This is not a stock that’s going to bounce around with the broader market. For income investors looking for a ballast in their portfolio—something that won’t rock the boat—this low volatility can be incredibly attractive.

From a safety perspective, the dividend looks solid. Earnings are healthy, the balance sheet isn’t overleveraged, and cash flow—though recently light—is typically strong enough to support the current payout. There’s no stretch here, just a sustainable rhythm.

Cardinal Health doesn’t pretend to be something it’s not. It’s not a high-growth disruptor or a flashy yield trap. It’s a mature, stable company that knows what it’s doing and continues to return value to shareholders without drama. And for investors who rely on dividends to fund their goals, that kind of steadiness can be the most valuable trait of all.

Cash Flow Statement

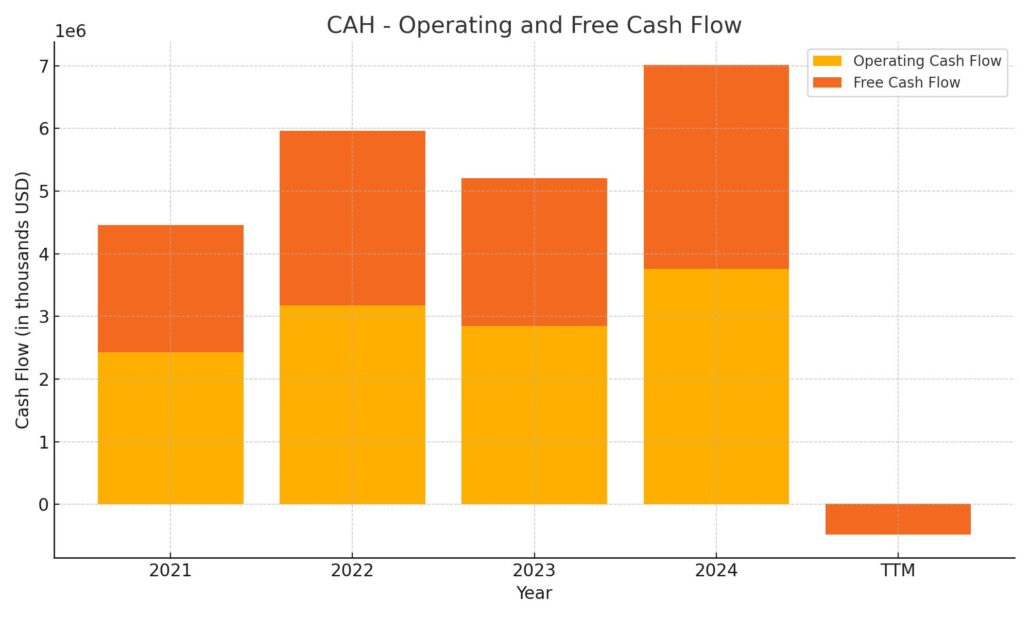

Cardinal Health’s cash flow picture has seen a sharp shift over the trailing twelve months (TTM), with operating cash flow collapsing to just $8 million—an abrupt drop from $3.76 billion the prior year. This dramatic dip appears to be an outlier, likely reflecting one-time shifts in working capital or timing of payments rather than a broader deterioration in the company’s core operations. Historically, Cardinal has posted consistent and healthy operating cash flow north of $2 billion annually. The company has maintained modest capital expenditures, with recent outflows of around $494 million, which keeps capex within a sustainable range given its size.

Investing cash flow turned more negative in the TTM, reaching -$2.75 billion, pointing to stepped-up investments or acquisitions. On the financing side, Cardinal Health reversed course from its prior deleveraging trend by raising $4 billion in new debt, which more than offset repayments. Share buybacks have slowed considerably, with just $390 million spent on repurchases compared to a much more aggressive $2 billion in fiscal 2022. Overall cash on hand declined from $5.13 billion to $3.82 billion, but remains solid. The sudden drop in free cash flow into negative territory raises questions, but should be viewed in the context of the company’s otherwise consistent historical cash generation.

Analyst Ratings

📈 Cardinal Health has recently caught the eye of several analysts, prompting updates to their outlooks and price targets. 🔍 Bank of America nudged its price target higher from $150 to $155 while reaffirming its buy rating. This boost stems from the company’s operational efficiencies and its ability to adapt within a challenging healthcare supply landscape. 🔧 Mizuho also lifted its price target from $142 to $150, citing consistent performance and solid execution in both the Pharmaceutical and Medical segments. 🩺 Meanwhile, Jefferies moved from a hold to a buy rating, setting their target at $150 after reviewing the company’s stronger-than-expected earnings and focus on cost control. 💼

🔮 Across the board, the analyst consensus leans toward a moderate buy, with an average price target hovering around $145.50. This represents a modest upside from current levels, suggesting cautious optimism. 🚀 The sentiment is supported by reliable earnings, a disciplined capital approach, and momentum from streamlining efforts. ⚙️ Many analysts see Cardinal Health’s ability to operate effectively in a low-margin, high-volume space as a strong indicator of future stability. In short, the latest ratings reflect growing confidence in CAH’s steady hand and long-term strategy. 📊

Earnings Report Summary

Cardinal Health closed out its latest quarter with results that show the company is quietly gaining strength. Revenue for the fourth quarter came in at $59.9 billion, which marked a 12% climb compared to the same period last year. What really stood out, though, was how efficiently the business operated—non-GAAP operating earnings jumped to $605 million, up 14%, and earnings per share came in at $1.84, up nearly 30%.

Over the full fiscal year, Cardinal’s revenue reached $226.8 billion, a solid 11% increase. More importantly for shareholders, diluted earnings per share (on a non-GAAP basis) surged 29% to $7.53. The company also turned in strong cash flow numbers, with operating cash flow hitting $3.8 billion and free cash flow slightly higher at $3.9 billion. That kind of cash flexibility gives them options—whether it’s reinvesting in the business or returning value to shareholders.

Strong Segment Performance

The Pharmaceutical and Specialty Solutions segment led the way again. Revenue in that area rose 13% to $55.6 billion, fueled largely by higher sales in brand-name and specialty drugs. Segment profits were up too, increasing 8% to $482 million, thanks in part to solid performance in Cardinal’s generics program. On the medical side, the Global Medical Products and Distribution segment posted a 2% gain in revenue, coming in at $3.1 billion. While the revenue bump was modest, profit really turned a corner—jumping from just $7 million last year to $47 million this quarter, thanks to smart inflation mitigation and better sourcing strategies.

Leadership Tone and Looking Ahead

CEO Jason Hollar sounded confident in the company’s direction. He pointed out the continued strength in pharma, improving margins in the medical segment, and progress on their cost-cutting efforts. It’s clear that leadership is focused on balancing long-term strategic investments with near-term financial discipline.

Cardinal also bumped up its guidance for fiscal 2025, now expecting earnings per share to fall between $7.55 and $7.70. That small adjustment signals that management sees more upside ahead, not just more of the same. The company also plans to step up its share buybacks, adding another $250 million to the program—bringing the total to $750 million. It’s another sign of confidence from leadership, and a shareholder-friendly move to boot.

The company has been steadily executing on its plan, opening new distribution centers and moving deeper into specialty care. These aren’t flashy changes, but they add up to a business that’s more efficient, more resilient, and better positioned to navigate what’s next in the healthcare landscape.

Chart Analysis

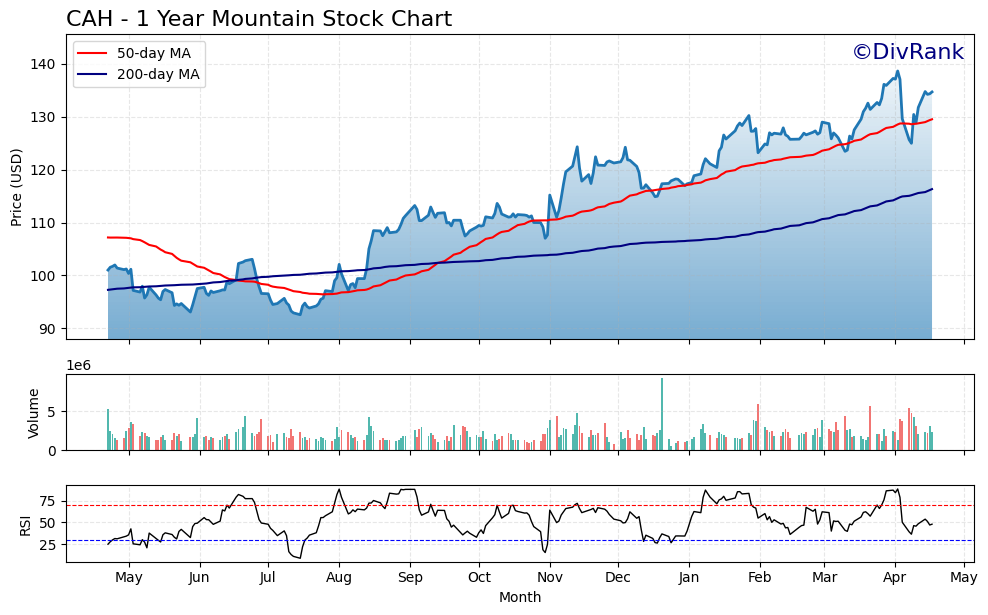

CAH has shown a strong upward trend over the past year, with the price steadily climbing from just below $95 to over $130. The long-term price action reflects a healthy and consistent performance, particularly since August, when the stock began moving above its 50-day and 200-day moving averages with conviction.

Moving Averages

The 50-day moving average (red line) crossed above the 200-day moving average (blue line) around August, forming what many view as a bullish signal. Since then, the 50-day line has acted as a support level, gently guiding the stock higher. The 200-day moving average is steadily rising as well, showing sustained buying interest and momentum over the longer haul. The fact that both moving averages are pointing up adds weight to the broader strength in this name.

Volume Trends

Volume has been relatively steady with a few spikes, especially around key price moves. There’s no unusual selling pressure on down days, which suggests that investors are holding rather than exiting positions. The more pronounced volume surges coincide with breakouts or recoveries after brief pullbacks, showing responsive demand.

RSI Indicator

The Relative Strength Index (RSI) has mostly hovered in the 50 to 70 range throughout the year, indicating a strong but not overly stretched trend. There were a couple of brief overbought signals above 70, most recently in April, but nothing sustained. That suggests demand remains healthy without the kind of overheating that usually brings on aggressive selling.

Overall, CAH appears to be in a well-supported long-term uptrend, with healthy pullbacks and continued momentum on the upside. The technical picture complements the company’s steady fundamentals and recent financial results.

Management Team

Cardinal Health is led by a group of executives with deep experience and a steady hand. At the center of it all is CEO Jason Hollar, who took over the top job in 2022 after serving as the company’s CFO. His background in finance is evident in the company’s focused execution and tight cost discipline. Since stepping into the role, Hollar has been clear about simplifying operations and driving long-term value, and that focus has started to show up in the numbers.

Supporting him is Aaron Alt, the current CFO, who brings strong credentials in managing financial turnarounds and building sustainable growth. Debbie Weitzman heads up the Pharmaceutical and Specialty Solutions segment and is known for her detailed understanding of customer needs and industry dynamics. On the medical side, Steve Mason is driving operational improvements with an emphasis on efficiency and product quality. Together, this leadership team has leaned into modernization while keeping a clear eye on the fundamentals.

Valuation and Stock Performance

Cardinal Health shares have been on a solid run, recently trading around $134.71, brushing up against all-time highs. The stock has outpaced the broader market over the last year, driven by consistent earnings and a clear path forward. Non-GAAP earnings per share jumped 29% in the most recent fiscal year, which gave investors even more reason to stay on board.

From a valuation perspective, the stock doesn’t appear overheated. The forward price-to-earnings ratio is sitting just under 15, suggesting a fair price for a company with reliable cash flow and strong execution. With the business generating nearly $4 billion in free cash flow and modest capital spending, there’s room for ongoing shareholder returns, whether through dividends or buybacks. Analysts have gradually moved their price targets higher, and while the stock isn’t cheap, it’s not priced for perfection either.

Risks and Considerations

Cardinal Health has a solid base, but it’s not without its challenges. Regulatory pressure is one area that continues to cast a shadow, especially given the scrutiny around medical device quality and pharmaceutical distribution. Any misstep here could bring both financial penalties and reputational risk.

Then there are the legal overhangs. The company has already agreed to hundreds of millions in settlements related to opioid litigation. These issues may not be fully behind them yet, and future claims could create headline risk or impact the balance sheet. It’s also worth keeping in mind that public sentiment and legal interpretations around the pharmaceutical supply chain can shift quickly.

Operationally, supply chain disruptions remain a concern. A recent example was the recall of certain surgical gloves due to sterilization issues. Even isolated incidents like these can affect trust and cause ripple effects in a low-margin business like this. On top of that, competition in the distribution and medical supply space remains intense. Keeping costs low while still delivering quality service is a constant balancing act.

Final Thoughts

Cardinal Health has managed to carve out a reliable space in a complicated and competitive industry. The leadership team has proven itself capable of managing through volatility while sticking to a long-term strategy that prioritizes financial health and operational stability.

The business model isn’t flashy, but it’s built on predictable demand and careful execution. While there are risks on the regulatory and legal fronts, the company has shown it can navigate them without losing focus. There’s a quiet confidence in the way this company operates—staying consistent, delivering value, and avoiding the noise. That kind of steadiness often matters more than splashy headlines.