Updated 4/21/25

Capital City Bank Group (CCBG), a regional bank with roots going back to 1895, operates across Florida, Georgia, and Alabama with a focus on disciplined growth and community-based banking. Over the past year, the stock has gained more than 26%, supported by steady earnings, a solid balance sheet, and a conservative payout ratio of just over 28%. Recent quarterly results exceeded expectations, with net income rising to $16.86 million and noninterest income showing healthy growth. CCBG’s management team, led by longtime CEO Bill Smith, has consistently emphasized shareholder value and risk control. The bank’s valuation remains reasonable with a forward P/E around 10, and analyst sentiment leans cautiously optimistic with a consensus price target of $38.33. While interest rate sensitivity and regional exposure present some risk, the company’s strong cash flow, stable dividend, and experienced leadership continue to build investor confidence.

📌 Key Dividend Metrics

💵 Dividend Yield: 2.80%

📈 5-Year Average Yield: 2.39%

💸 Forward Annual Dividend: $0.96 per share

📆 Dividend Date: March 24, 2025

📊 Payout Ratio: 28.21%

🔁 Dividend Growth: Positive trend over last five years

🔍 Beta: 0.38

Recent Events

The past year has been a quietly strong one for CCBG. Shares are up more than 26% over the last twelve months, while the broader S&P 500 has managed a single-digit gain. That kind of performance often gets overlooked with regional banks, but it’s been earned here.

Looking at the company’s latest results through the end of 2024, there’s plenty to like. Net income came in at just under $53 million, and the profit margin remains comfortably high at 22.9%. Return on equity hit 11%, signaling efficient capital usage and a healthy core business. Revenue growth clocked in at 9%, which isn’t eye-popping but is solid and consistent—traits that tend to win over long-term investors.

Valuation-wise, CCBG is trading at just over 10 times forward earnings. That’s a multiple that doesn’t scream expensive, especially for a bank producing mid-double-digit returns on equity. Price-to-book sits a touch above 1.1, keeping things grounded. Book value per share is $29.18, which provides a decent floor beneath the stock that’s now trading in the mid-$30s.

One subtle but reassuring point: nearly 20% of the stock is held by insiders. Another 49% sits with institutions. That’s a decent split, suggesting management has real skin in the game while still attracting enough institutional attention to keep the stock liquid.

Dividend Overview

The dividend yield currently sits at 2.80%, which is both competitive and above the company’s own five-year average. CCBG isn’t stretching itself to reach that figure either—the payout ratio is just over 28%. That leaves plenty of room to reinvest in the business while still rewarding shareholders.

The latest quarterly dividend of $0.24 was paid in March, and if history is any guide, the company will keep that cadence going. One thing to appreciate here is the steady hand. Management hasn’t jumped at raising the dividend in huge increments, but they also haven’t pulled back. Through different market cycles, CCBG has shown it knows how to deliver a dependable payout.

There’s also a long-term shareholder-friendly streak that pops up now and then. The last stock split was back in 2005 (a 5-for-4 split), which is admittedly a while ago—but still shows a track record of thinking about shareholder value over the long haul.

Dividend Growth and Safety

What makes CCBG stand out is how it balances stability with growth. The dividend has been increasing at a slow but steady rate, without any major interruptions. That reliability becomes particularly attractive during times of economic uncertainty or rising interest rates.

The most recent jump from a trailing dividend of $0.88 to a forward rate of $0.96 represents a healthy year-over-year increase of just over 9%. That’s not aggressive growth, but it’s not stagnant either. It signals a confident management team that isn’t chasing yield but is rewarding long-term holders.

On the safety front, this is where the company really shines. CCBG is holding nearly $400 million in cash, which translates to over $23 per share. That’s a substantial cushion given where the stock currently trades. With operating cash flow over $63 million and total debt around $107 million, the balance sheet is in strong shape.

And don’t forget the volatility profile here—CCBG has a beta of just 0.38. For dividend investors, that low correlation to broader market swings adds a layer of calm that’s hard to quantify but easy to appreciate. It’s a name that doesn’t lurch with every economic headline, and that kind of temperament fits nicely in an income portfolio.

Capital City Bank Group doesn’t pretend to be exciting, but for those who value reliable dividends and sound management, it might just offer more peace of mind than plenty of louder names out there.

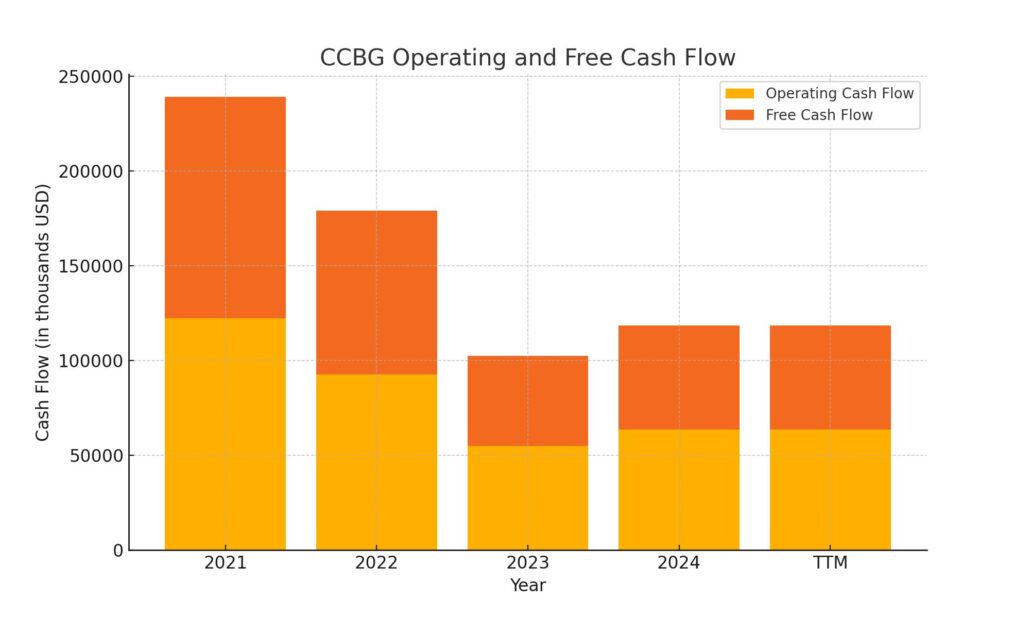

Cash Flow Statement

Capital City Bank Group reported $63.6 million in operating cash flow over the trailing twelve months, reflecting solid internal cash generation. This figure is a notable improvement over the previous year’s $54.8 million and reinforces the company’s consistent ability to produce cash from core banking operations. Free cash flow during the same period stood at $54.9 million, also up from the prior year. These figures suggest a steady, well-managed operation with sufficient cash left over after capital expenditures.

On the investing side, the company generated $68.4 million, a dramatic reversal from past years when large outflows were recorded—particularly in 2021 and 2022. This swing appears to reflect reduced investment outlays or possible asset sales. Financing cash flow was negative at $52.1 million, largely due to returning capital through dividends and share repurchases, and possibly trimming some debt. CCBG ended the period with $391.9 million in cash, down from the post-pandemic highs but still providing a strong liquidity buffer. Overall, the cash flow profile reflects stability and conservative capital management.

Analyst Ratings

📊 Capital City Bank Group (CCBG) has recently seen mixed reactions from analysts, reflecting differing views on how much upside is left after a strong run.

📉 Piper Sandler moved the stock from “Overweight” to “Neutral,” despite bumping up the price target to $34. This signals a view that CCBG has likely hit its short-term valuation ceiling, at least in their eyes, following its recent price appreciation.

📈 On the other hand, Keefe, Bruyette & Woods maintained an “Outperform” rating and increased their target from $43 to $44. That’s a pretty clear indication they see more room for growth, probably driven by stronger-than-expected earnings and a steady operating performance.

🟢 Janney Montgomery Scott also weighed in, upgrading CCBG to “Buy” from “Neutral” and assigning a new target of $37.50. Their rationale likely comes down to the bank’s consistent earnings, healthy capital position, and disciplined expense management.

📌 Across the board, the current consensus rating is “Hold,” with an average 12-month price target of $38.33. That suggests analysts, on balance, expect modest upside from current levels—roughly 11.8%—but aren’t universally bullish. It’s a mixed but overall steady sentiment, in line with the company’s consistent track record.

Earning Report Summary

Capital City Bank Group kicked off 2025 with a solid first quarter, delivering results that came in well ahead of expectations. Net income climbed to $16.86 million, which works out to $0.99 per share. That’s a pretty nice jump from the $12.56 million, or $0.74 per share, they posted a year earlier—and definitely higher than what analysts were predicting.

A Strong Showing on the Interest Side

Net interest income edged up to $41.6 million from $41.2 million the previous quarter and $38.4 million the year before. What’s helping here is a favorable mix of higher yields on investments combined with better control on deposit interest expenses. The net interest margin improved too, landing at 4.22%, which suggests the bank is doing a good job managing its assets and liabilities even with the current rate environment being what it is.

More Than Just Lending

Noninterest income came in at $19.9 million, which marks a 6.1% bump from the last quarter and a 10% increase compared to this time last year. This growth wasn’t driven by one single thing either—it was a combination of stronger performance in mortgage banking and higher fees coming in from their wealth management arm. Those areas are definitely pulling their weight.

On the expense side, the bank saw a 7.4% drop in noninterest expenses, coming down to $38.7 million. That savings came partly from selling off some banking facilities and trimming occupancy costs. Anytime you can see a revenue increase while cutting back on costs, that’s a nice combo for the bottom line.

Lending and Deposits Stay Healthy

Loan balances were up slightly—about $9.2 million from the last quarter—which shows cautious but steady growth. Meanwhile, deposits grew by $111.9 million, helped in part by seasonal inflows from public funds. So the foundation of the business—lending and funding—continues to look solid.

Credit quality is holding up well, too. Net loan charge-offs came in low at nine basis points of average loans, and the allowance for loan losses sits at 1.12%, which provides a decent cushion if things were to get bumpy down the road.

Leadership’s Outlook

The management team seemed pretty upbeat in their comments about the quarter. They pointed to the bank’s ability to stay on track even with rate pressure and economic uncertainty still hanging around. Their focus going forward is on sticking to disciplined growth and continuing to build shareholder value without taking unnecessary risks.

Overall, it was a confident quarter. The results show a business that’s not only stable but still growing in all the right places.

Chart Analysis

Price Trend and Moving Averages

CCBG has spent the past year carving out a fairly consistent uptrend until it began to taper off in recent months. From early summer through mid-winter, the stock gained significant ground, moving from the $26 range to above $36, before entering a sideways-to-downward drift. The red 50-day moving average shows this climb clearly, peaking around February before beginning to slope downward. In contrast, the blue 200-day moving average has been climbing steadily and now sits just under current price levels, offering potential support.

The recent dip in price below the 50-day moving average suggests some short-term weakness, but the stock has bounced back quickly, showing renewed buying interest. The fact that it’s still trading above the 200-day moving average—while not strongly above it—is worth noting as it often signals the broader trend is still intact, even if the momentum has cooled.

Volume and Momentum

Volume has remained relatively light for much of the year with the exception of a few spikes, particularly around July and again in early January. These surges may correspond to earnings announcements or other catalysts, but outside those periods, trading volume has been subdued, which isn’t uncommon for a smaller regional name.

Looking at the RSI at the bottom of the chart, the stock touched oversold levels around early April, dropping below the 30 mark. Since then, it’s recovered and is now sitting near the neutral 50 zone, indicating neither overbought nor oversold conditions at the moment. That recent oversold signal followed by a quick recovery is a positive sign of underlying demand returning after a pullback.

Overall Structure and Behavior

Over the past year, CCBG has shown a pattern of stair-stepping higher with periods of consolidation followed by another leg up. That rhythm was disrupted slightly over the last couple of months, with the stock testing and holding above the 200-day average after dipping below the 50-day line. The most recent candles show a bounce off the lows with noticeable lower wicks—an indication of buyers stepping in to support the price after early selling pressure.

While the immediate upside momentum has softened, the longer-term structure still appears intact. The moving averages haven’t crossed in a bearish manner, and the RSI suggests there may still be room for stabilization or gradual recovery. Patience may be needed here, but the underlying behavior points more toward consolidation than breakdown.

Management Team

Capital City Bank Group is led by Bill Smith, who has been with the company since 1978 and took over as CEO in 1995. His leadership spans decades, during which time he’s steered the bank through different economic environments with a steady hand. That kind of long-term consistency is a rarity in today’s financial world and speaks to the deep institutional knowledge within the executive team.

Working alongside him is Tom Barron, who became President the same year Smith stepped into the CEO role. With experience going back to 1974 within the organization, Barron’s understanding of operations and lending strategy helps shape the bank’s disciplined approach. Rounding out the team is CFO Jep Larkin, who oversees the financials with a close eye on operational efficiency and cost controls. Bill Moor leads the wealth management division, an area that’s quietly grown in importance for the bank over the years. Together, they represent a team that values measured growth, capital preservation, and continuity.

Valuation and Stock Performance

As of mid-April 2025, shares of CCBG closed at $34.30, with pre-market action pushing the price up near $36.34. That puts the stock up roughly 26 percent over the past year, showing that investors are rewarding the company’s strong fundamentals. The 52-week high of $40.86 and low of $25.45 reflect a relatively stable trading range, which is often appealing to those looking for long-term steadiness over short-term volatility.

From a valuation standpoint, the numbers are still reasonable. A trailing price-to-earnings ratio just under 11 suggests the stock isn’t overpriced relative to its earnings power. Meanwhile, a price-to-book ratio of 1.18 means shares are trading only modestly above the book value. That’s often seen as a healthy sign for a bank with reliable cash flows and conservative loan exposure.

Analyst opinions are mixed but generally positive. The average price target across the board sits at $38.33, hinting at some room for further appreciation from current levels. While a few recent upgrades have nudged expectations higher, the overall sentiment appears to reflect confidence in the company’s consistency more than expectations for explosive growth.

Risks and Considerations

No stock is without its risks, and CCBG is no exception. One of the key considerations is geographic concentration. With a footprint that’s primarily based in Florida, Georgia, and Alabama, the company is more exposed to local economic trends than some of its larger peers. A slowdown in any one of these regional markets could directly impact loan demand or credit quality.

Another ongoing factor is interest rate sensitivity. Like most banks, CCBG earns money on the spread between the interest it collects on loans and what it pays on deposits. If rate trends shift rapidly or unpredictably, it could compress margins and affect profitability. The past year has shown some resilience in this area, but it’s always something to watch.

Regulatory oversight remains an evergreen concern in the banking sector. While CCBG has a strong compliance record, any regulatory changes or internal delays can pose challenges. In 2024, the bank received a notice related to a delayed filing, which serves as a reminder that even well-managed institutions are still navigating complex and evolving regulatory environments.

Final Thoughts

Capital City Bank Group continues to show what it looks like when a bank operates with discipline, experience, and long-term thinking. The management team’s longevity and consistency are key strengths, and they’ve been able to produce steady results across both boom times and tougher cycles.

The stock itself reflects that steadiness. It’s not flying under the radar entirely, but it also hasn’t seen the dramatic run-ups or volatility that often come with higher-risk financials. The valuation is reasonable, and analyst expectations remain grounded in reality—supportive but not overheated.

Of course, there are risks to consider, especially with the bank’s regional exposure and dependence on rate dynamics. But with a strong balance sheet, solid earnings momentum, and a management team that knows how to navigate through uncertainty, CCBG makes a case for long-term durability in a sector where that still matters.