Updated 4/14/25

Canadian National Railway Company (CNI) operates one of North America’s most extensive rail networks, connecting key industrial and commercial hubs across Canada and the U.S. With a focus on long-term asset investment, operational efficiency, and disciplined capital allocation, the company has built a track record of consistent performance. Over the past year, it has navigated softer freight volumes, modest revenue declines, and rising costs, yet continued to generate strong operating and free cash flow. Under the leadership of CEO Tracy Robinson, CNI remains committed to growing earnings, increasing its dividend, and returning capital through share buybacks. While the stock has pulled back from its highs, valuation levels have become more attractive, and the company’s outlook points toward steady improvement. Supported by nearly three decades of dividend growth and a long-term investment approach, CNI’s structure and strategy remain well aligned with generating reliable shareholder value.

Recent Events

This past year has tested a lot of businesses, and CNI hasn’t been spared. Revenue came in 2.5% lower than the same time last year. Earnings took a bigger hit, dropping over 46%, which turned some heads. But stepping back, that kind of move isn’t unusual in cyclical industries like rail. Freight volumes shift. Economic cycles come and go. The bigger picture here is how CNI managed through it.

Even with the revenue dip, the company still posted a profit margin of just over 26% and kept its operating margin close to 40%. That tells you a lot. They’ve kept costs in check, operations tight, and the core business running smoothly even as volumes softened.

From a stock performance standpoint, it’s been a choppy ride. The share price is down more than 20% over the last year, which puts the current valuation in a more attractive range for income-focused investors. Meanwhile, total debt has crept up above $21 billion, pushing the debt-to-equity ratio past 100%. But with CNI still generating solid cash flow—about $6.7 billion from operations in the last year—the company isn’t in a tight spot. It’s managing its leverage while continuing to invest in the business and return capital to shareholders.

Key Dividend Metrics 🚆

📈 Forward Dividend Yield: 2.49%

💸 Annual Dividend Rate: $2.48

📆 Payout Ratio: 48.22%

📉 5-Year Average Dividend Yield: 1.85%

🔄 Dividend Growth: Around 10% annually over the past five years

💰 Levered Free Cash Flow (TTM): $2.58 billion

📊 Operating Cash Flow (TTM): $6.7 billion

📉 Quarterly Earnings Growth (YoY): -46.2%

These figures paint a picture of a mature, cash-generating business that’s committed to growing its dividend in a way that makes sense long-term.

Dividend Overview

CNI’s dividend isn’t going to win any awards for size, but it scores high on dependability. That 2.49% forward yield might not seem eye-popping at first, but it’s comfortably higher than the stock’s five-year average. The market is valuing CNI a bit more conservatively right now, which has pushed the yield higher—a potential opportunity for income investors who value consistency.

The company isn’t overextending itself to pay that dividend either. With a payout ratio just under 50%, there’s plenty of flexibility. That leaves CNI with breathing room to keep investing in operations, reducing debt, or navigating through economic slowdowns without cutting its dividend.

This kind of conservative approach is exactly what long-term dividend investors want to see. There’s no rush to impress the market with aggressive hikes or risky moves. The dividend is built on solid ground, and it reflects the strength of the underlying business.

Dividend Growth and Safety

One of the most encouraging signs from CNI is how it treats its dividend policy. The company has quietly grown its payout at a strong clip—around 10% annually over the past five years. And it’s done so without compromising its financial health.

That’s the key. Growth is nice, but only when it’s sustainable. CNI has been able to raise its dividend while still generating enough free cash flow to reinvest in the business and handle its financial obligations. In the last 12 months alone, it produced $2.58 billion in levered free cash flow. That provides a strong cushion.

The nature of the business also helps support dividend stability. Railroads are incredibly tough to replicate. The physical infrastructure, regulatory approvals, and sheer scale make them a long-term moat. That translates into reliable cash flow, even in bumpy economic conditions.

CNI doesn’t have the kind of volatility you might see in more speculative stocks. Its beta sits at 0.83, which simply means it tends to move less than the overall market. That’s a welcome trait for anyone who depends on dividend income to stay steady, especially in a portfolio designed for the long run.

There’s also strong institutional backing here—nearly 75% of the float is held by large firms. That adds another layer of confidence. Big investors tend to favor companies that can consistently return capital and ride out economic cycles, and CNI fits that mold perfectly.

At the end of the day, Canadian National Railway delivers exactly what income investors are looking for: a stable, cash-rich business that pays a growing dividend and isn’t trying to be something it’s not. It just stays on track—year after year.

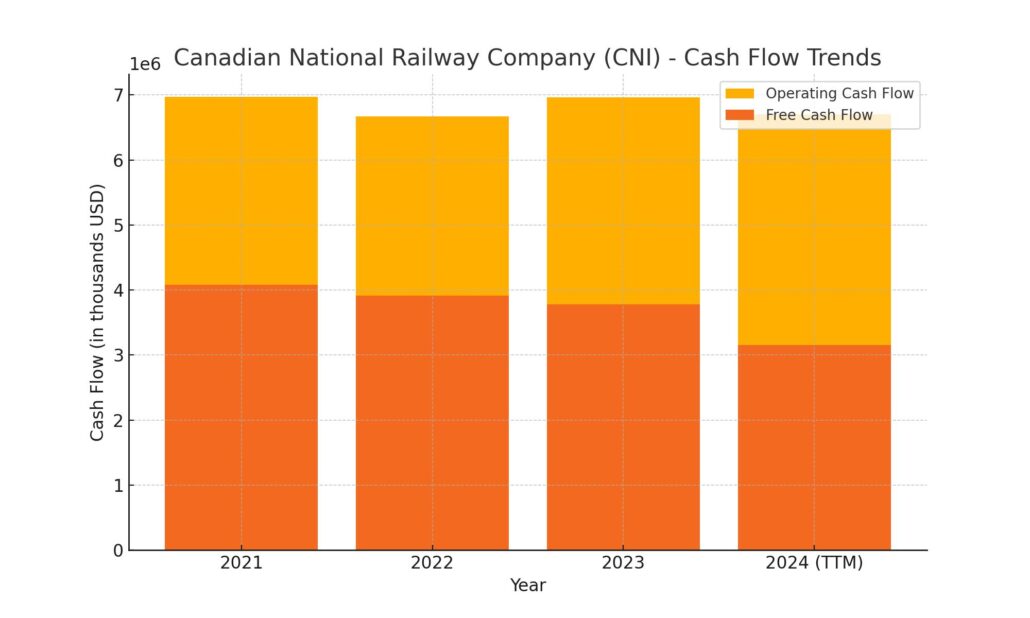

Cash Flow Statement

Canadian National Railway’s cash flow for the trailing 12 months shows a steady, disciplined operation built on consistency. Operating cash flow came in at $6.7 billion, maintaining a level very close to recent years and highlighting the strength of its core business. After capital expenditures of $3.55 billion, free cash flow landed at $3.15 billion. That’s more than enough to support dividends and share repurchases while still investing in infrastructure and operations.

On the financing side, the company issued over $23.7 billion in new debt but also repaid $22.7 billion—indicating active management of its debt load rather than aggressive leveraging. It returned $2.65 billion to shareholders through share buybacks, showing continued commitment to capital return. The end cash position dropped to $401 million, largely due to this mix of high investment spending and capital returns, but nothing in the cash flow trends points to financial strain. The business continues to generate strong, reliable cash flow that underpins both its operational stability and its growing dividend.

Analyst Ratings

📉 Analyst sentiment for Canadian National Railway (CNI) has seen some shifts recently. On February 3, 2025, Loop Capital downgraded the stock from Hold to Sell, pointing to ongoing concerns around freight volumes and broader economic pressures that could weigh on earnings in the near term. While this downgrade raised some eyebrows, it reflects a cautious view on how the company might perform against a backdrop of slower industrial activity.

📊 At the same time, other analysts have taken a more measured stance. Barclays, for example, held steady with an Equal Weight rating but did trim its price target from $112 to $104. The firm noted ongoing uncertainty in key markets and freight trends but still acknowledged CNI’s operational discipline and financial resilience. These kinds of adjustments suggest a wait-and-see approach rather than a full retreat from the name.

📈 Overall, the stock continues to carry a moderately positive tone from the analyst community. The consensus 12-month price target now sits around $121.19, signaling potential upside from its current trading range. While there are clear short-term headwinds, many analysts seem to believe in the longer-term story—one anchored by steady cash flow, efficient operations, and a strong position in the North American rail network.

Earnings Report Summary

A Mixed Quarter to Close Out 2024

Canadian National Railway wrapped up 2024 with results that reflected a bit of everything—some softness in demand, higher costs, but also some promising signals for what lies ahead. In the fourth quarter, revenue came in at just over C$4.3 billion, which was slightly down from the previous year. Operating income dipped by 10%, and earnings per share dropped quite a bit, landing at C$1.82, a decline of about 45% year over year.

One thing that stood out was the operating ratio ticking up to 62.6%. That’s a key measure of efficiency for railroads, and a higher number isn’t ideal—it means expenses are climbing a bit faster than revenue. Still, even with those headwinds, the core operations remained profitable, and the company held onto its long-standing financial discipline.

Steady for the Year, Eyes on 2025

For the full year, revenue edged up slightly to C$17.05 billion, but operating income and earnings per share both saw declines. Earnings fell 18% for the year, and the operating ratio moved up again to 62.9%. These aren’t numbers that jump off the page, but they do show a company that’s navigating a tricky environment without losing its footing.

What gave investors some reassurance was the tone from leadership. CEO Tracy Robinson acknowledged the challenges but also spoke confidently about what’s ahead. The company expects earnings to grow by 10% to 15% in 2025 and is planning to invest around C$3.4 billion into infrastructure and operations to support that goal.

One of the bright spots was the continued focus on returning capital to shareholders. The board approved a 5% increase to the dividend for the first quarter of 2025, marking the 29th consecutive annual increase. That’s a strong signal of confidence, especially in a year that brought more questions than answers.

There’s also a plan to repurchase up to 20 million shares over the next year. Between the dividend hike and buybacks, CNI is clearly leaning into its track record of rewarding long-term investors—even in a slower year.

Looking Ahead

Management laid out a goal of growing adjusted earnings per share in the high single-digit range through 2026. For 2025, they’re projecting volume growth in the low to mid-single digits, with more than half of that growth expected to come from company-driven initiatives rather than broad market conditions. Operational improvements, especially around car velocity and network fluidity, are also high on the list.

So, while 2024 had its rough spots, the message from leadership is clear—they’re looking to get back on track quickly. And with the kind of infrastructure CNI has in place, they’ve got the tools to make that happen.

Chart Analysis

Downward Momentum Over the Past Year

Looking at the 1-year chart for CNI, the overall trend has been undeniably lower. From last spring to early this year, the stock has steadily moved down from the $130 range to briefly touching under $95. The 50-day moving average crossed below the 200-day moving average last summer and has stayed below it ever since, a classic sign that the longer-term trend has shifted bearish. Both moving averages are sloping downward, reinforcing the broader pressure that’s been weighing on the stock.

Price action over the last few months shows a series of lower highs and lower lows. That pattern hasn’t been broken yet, though there’s been a recent bounce off the low 90s which has pushed the price back toward the 100 mark. This could be an early sign of basing, but it’s too early to call it a turnaround just yet.

Volume and RSI Paint a Cautious Picture

Volume has remained relatively stable with some occasional spikes, often aligning with minor price rallies or dips. There’s no standout accumulation phase here, at least not yet. That tells us there’s interest, but not necessarily conviction from larger buyers stepping in with force.

Looking at the RSI on the lower panel, the stock has spent a lot of time in the lower half of the scale, often dipping into or near oversold territory. There have been a few attempts to push above 70, most notably in September and February, but those moves didn’t hold. More recently, RSI has hovered near the midpoint, which typically reflects indecision or consolidation after a downtrend.

Final Observations

CNI has had a rough 12 months, but the recent price bounce combined with a cooling RSI could suggest that the worst of the selling might be behind it. For now, the technical picture is still more cautious than optimistic, and any real shift in sentiment would likely need to be backed by stronger price action breaking above the declining moving averages. Until that happens, the stock is still trying to find its footing after a long slide.

Management Team

The leadership at Canadian National Railway (CNI) brings a steady, experienced hand to the table. At the top is Tracy Robinson, who stepped into the CEO role with a background in both energy and rail—an ideal fit for a business that thrives on operational discipline and strategic logistics. Since taking over, she’s made it clear that efficiency, safety, and long-term growth are top priorities.

What’s noticeable about this team is that they don’t chase short-term trends. Instead, their focus is on long-term asset optimization and maintaining strong financial health. Capital investments have been directed toward infrastructure upgrades, technological improvements, and workforce development. That kind of consistency, paired with a clear direction, has helped the company weather slowdowns without overreacting.

Despite the softer earnings in recent quarters, the message from management has remained calm and confident. They’ve stuck to a long-range growth outlook, made smart capital allocation decisions, and kept their commitments to returning capital to shareholders through dividends and share buybacks. It’s a team that’s navigating through uncertainty without losing sight of the broader strategy.

Valuation and Stock Performance

CNI’s share price has seen a notable pullback over the past year, sliding from above $130 to just under $100. That kind of move isn’t unique in this market environment, but it does open up questions about valuation. With earnings temporarily under pressure, the forward price-to-earnings ratio has dropped to around 17.8, bringing the stock back into a more historically average range.

This change in valuation doesn’t necessarily reflect a broken business—it’s more about recalibrated expectations. Freight volumes have dipped, operating margins have narrowed, and investors have responded accordingly. But the fundamentals remain intact. Free cash flow is still strong, return on equity is north of 20 percent, and the company continues to generate steady operating income.

When you zoom out and look at the long-term trend, CNI has delivered reliable total returns, driven by a mix of share price appreciation and a steadily rising dividend. The stock doesn’t move in sharp bursts—it compounds gradually, and that’s often where long-term value builds. Institutional ownership remains high, a signal that big investors still have confidence in the business and its ability to deliver over time.

Risks and Considerations

CNI operates in a cyclical industry, and that comes with a fair share of risk. Economic slowdowns, industrial production declines, or weaker commodity volumes can all translate directly into reduced rail traffic. That’s a variable the company doesn’t control, but it has to manage through.

Operating costs are another area to watch. Fuel, labor, and maintenance remain significant expenses, and any sharp increases there can eat into margins quickly. While management has done a solid job keeping costs in check, inflationary pressure and wage negotiations can still create surprises.

CNI also carries a meaningful amount of debt—over $21 billion on the books. While current cash flows easily cover interest payments, rising rates make future refinancing more expensive. That could lead to a shift in capital allocation priorities if borrowing costs continue to increase.

Then there’s regulation. Railroads operate under a heavy regulatory framework in both Canada and the U.S., and changes in policy, especially those impacting emissions or cross-border logistics, could introduce new challenges. Add in potential labor disruptions or infrastructure setbacks, and there are several moving parts that need to be monitored closely.

Technology is a longer-term consideration as well. Automation, network optimization, and safety systems are evolving rapidly across the industry. CNI has made progress in this area, but it’s not a one-time spend—it’s an ongoing race to keep operations modern and efficient.

Final Thoughts

CNI doesn’t chase trends or make flashy headlines, and that’s part of what makes it appealing. The business is built around something simple and tangible: moving freight efficiently across a massive rail network. That structure gives the company a durable economic moat, consistent cash generation, and a clear purpose.

The recent pullback in the share price reflects market concerns, but not necessarily business deterioration. Revenues are holding up, margins are still solid, and leadership continues to manage the company with long-term stability in mind. The dividend, which has grown for nearly three decades, is still very much intact and supported by healthy free cash flow.

While short-term results might continue to reflect broader economic pressures, the foundation is strong. The company’s approach to reinvesting in its network, upgrading technology, and returning capital to shareholders suggests it’s playing a long game. That kind of steady, grounded strategy tends to be rewarded in the end.

There are risks to watch, of course—economic swings, cost inflation, and regulatory hurdles can’t be ignored. But for a company with hard assets, a proven model, and a clear focus, CNI remains firmly on track. It’s not about chasing the next big thing—it’s about delivering consistent results, year after year. And that’s a story worth following.