Updated 4/14/25

Camden Property Trust (CPT) is a multifamily REIT focused on owning and managing apartment communities across high-growth markets like Texas, Florida, and the Southeast. With a market cap of $11.74 billion and a forward dividend yield near 3.9%, the company offers investors steady income supported by consistent free cash flow. Despite a year-over-year earnings decline and recent stock pullback, Camden continues to generate strong operational performance, with high occupancy levels and a disciplined development pipeline. The leadership team, led by CEO Ric Campo, has guided the company through changing market cycles while maintaining long-term strategic focus.

Recent Events

Over the past year, the business has faced some pressure. Its market cap has pulled back from a peak of over $13 billion to around $11.7 billion today. That drop tracks closely with a broader slowdown in REIT valuations, especially those with exposure to interest-rate-sensitive assets.

Camden’s earnings have taken a hit too. Net income has fallen sharply, with a dramatic drop in earnings growth year over year—down more than 80%. That kind of decline is worth noting, but it doesn’t tell the full story. Revenue has barely budged, slipping just 0.3%, and core operations are still strong. EBITDA, a key measure of profitability for REITs, came in at $883 million, which speaks to the underlying health of the business.

From a liquidity standpoint, things are tight. The company is working with just over $21 million in cash, and its current ratio is thin. That said, it continues to throw off plenty of free cash flow—$677 million over the trailing twelve months. That’s what really matters when it comes to keeping the dividend safe.

Management continues to walk a careful line, managing a sizable debt load while maintaining steady operations. With $3.49 billion in total debt, Camden isn’t light on leverage, but that’s typical in the REIT space. What sets it apart is the consistency of its cash generation and its steady approach to capital allocation.

Key Dividend Metrics

📬 Forward Dividend Yield: 3.89%

💰 Forward Annual Dividend: $4.20 per share

📆 Next Dividend Date: April 17, 2025

🧮 Payout Ratio: 274.67%

📉 5-Year Average Dividend Yield: 3.22%

📈 Dividend Growth (Trailing vs. Forward): $4.12 → $4.20

⏱️ Ex-Dividend Date: March 31, 2025

Dividend Overview

Camden’s dividend yield currently sits at 3.89%, a touch above its five-year average. That small bump may not seem like much, but it tells you the market is either slightly discounting the stock or giving investors a bit more for sticking around. Either way, income investors are getting a better-than-usual payout from a company that has rarely missed a beat.

The $4.20 annual dividend is a modest increase over the previous year’s $4.12. It’s not a jaw-dropping raise, but it’s a raise all the same—especially in a year where many real estate firms are holding the line or cutting back.

That said, the high payout ratio will catch some attention. At over 270%, it looks steep when you’re just looking at net income. But this is where REITs operate differently. Camden’s dividend isn’t funded out of earnings—it’s funded out of operating cash flow. With nearly $678 million in free cash flow and around 109 million shares outstanding, the company is paying out approximately $456 million in dividends. That’s a comfortable margin, even if it’s not overly generous.

In other words, the dividend still looks well-covered when viewed through the lens that really matters.

Dividend Growth and Safety

Camden has never been known for aggressive dividend growth, but it has been known for consistency. That’s what stands out here. The latest increase, though small, is a clear signal that management is still committed to returning value to shareholders—even when the earnings line is moving in the wrong direction.

The safety of the dividend depends more on the company’s ability to maintain strong cash flow than anything else. And right now, the fundamentals suggest it can. Camden’s operating margins are healthy, its properties are located in resilient rental markets, and tenant demand remains stable. All of this helps support ongoing cash generation.

Still, debt and liquidity are worth watching. The cash on hand is minimal, and the debt level is high. If interest rates stay elevated or capital markets tighten up, refinancing could become more expensive. But that’s a manageable risk for a company that continues to operate with discipline.

Another point in Camden’s favor: institutional ownership sits above 96%. That means most of the float is held by professional managers, pension funds, and long-term investors. These aren’t the types chasing hot trends—they’re the ones looking for stable, income-producing names with low volatility. And Camden fits that profile.

Even with earnings dipping, the company hasn’t wavered on its dividend policy. For dividend-focused investors who care more about stability than speed, that’s a message worth hearing. Camden’s not trying to impress with flash—it’s just paying the bills, and paying investors, quarter after quarter.

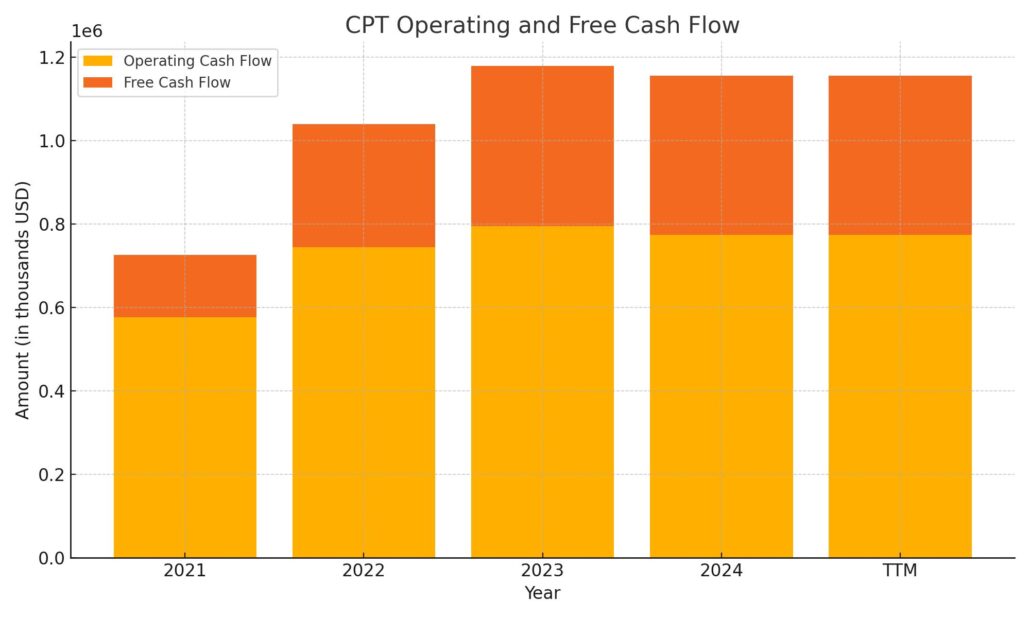

Cash Flow Statement

Camden Property Trust generated $774.9 million in operating cash flow over the trailing twelve months, slightly below the prior year’s figure but still reflecting solid performance at the property level. Free cash flow came in at $381.1 million, maintaining a consistent trend with past years. This steady cash generation has continued to support the company’s dividend, even amid fluctuations in net income.

On the investment side, Camden spent $285.2 million, primarily tied to capital expenditures totaling nearly $394 million. Financing activities saw a significant outflow of $725.5 million, driven by both the repayment of over $1.2 billion in debt and a modest $50 million in stock repurchases. While the company did issue nearly $982 million in new debt, it was offset by larger repayments. Despite these movements, Camden ended the period with $32.2 million in cash—down sharply from prior years but consistent with its cash-efficient operating model.

Analyst Ratings

Camden Property Trust has seen a mixed batch of analyst sentiment in recent weeks. 📈 Citigroup upgraded the stock from Neutral to Buy, raising its price target from $125 to $138. This shift reflects growing confidence in Camden’s resilience and its strategic foothold in high-demand, fast-growing rental markets. Jefferies followed suit, moving its rating from Hold to Buy and increasing the price target from $117 to $139. Their rationale? A stronger-than-expected outlook for multifamily housing demand and improving fundamentals.

📉 On the flip side, JPMorgan pulled back its optimism, downgrading the stock from Neutral to Underweight. They made only a small adjustment to their price target, trimming it from $128 to $127. Their note pointed more toward valuation concerns and broader caution in the REIT space, especially given the impact rising interest rates have had on leveraged real estate names.

📊 As of now, the overall consensus on Camden stands at Hold, with an average 12-month price target hovering around $127.76. That suggests analysts are seeing a modest upside from current levels, but also signals that expectations are being balanced against ongoing macro pressures and the cost of capital environment.

Earning Report Summary

Camden Property Trust wrapped up 2024 with results that show a bit of everything—steady cash flow, a few soft spots, and a forward-looking plan that’s cautious but grounded.

Slower Earnings, But Stable Operations

The headline number might catch your eye: earnings per share came in at $0.37, which is down quite a bit from the $2.03 posted during the same quarter last year. But digging a little deeper, the story isn’t quite so dramatic. Core funds from operations, or Core FFO, landed at $1.73 per share—right in line with expectations and a sign that day-to-day operations are still holding up well.

Revenue from existing properties nudged higher, with same-property NOI growing by just over 1% and revenue inching up nearly as much. Occupancy improved to 95.3%, a good sign that demand remains strong across Camden’s communities. That said, new lease rates were under pressure, falling 4.7%, which points to some softening in rental pricing power.

Development Moves and Market Positioning

Camden continued to invest in its future, completing two development projects—one in Durham and another in Richmond. It also picked up a 352-unit property in Austin for just under $68 million. These aren’t massive swings, but they show that the company is still selectively building out its portfolio in growth markets, even while being mindful of broader economic conditions.

A Realistic Look Ahead

Looking to 2025, Camden’s guidance suggests they’re planning for more of a steady-as-she-goes kind of year. They’ve set EPS expectations between $1.00 and $1.30 and see Core FFO landing somewhere between $6.60 and $6.90 per share. Same-property revenues are expected to grow modestly—up to 2%—but expenses could rise slightly faster, which might keep NOI growth relatively flat.

One thing that stands out is Camden’s conservative balance sheet. They’ve got over $1 billion in liquidity and no major debt coming due until 2026. That gives them some breathing room and flexibility to make strategic decisions without being backed into a corner.

Management’s tone on the call was measured. They acknowledged the headwinds—especially on the leasing side—but emphasized operational discipline and a focus on long-term value creation. No grand pronouncements, just a steady hand at the wheel, which is what you’d expect from a REIT with Camden’s track record.

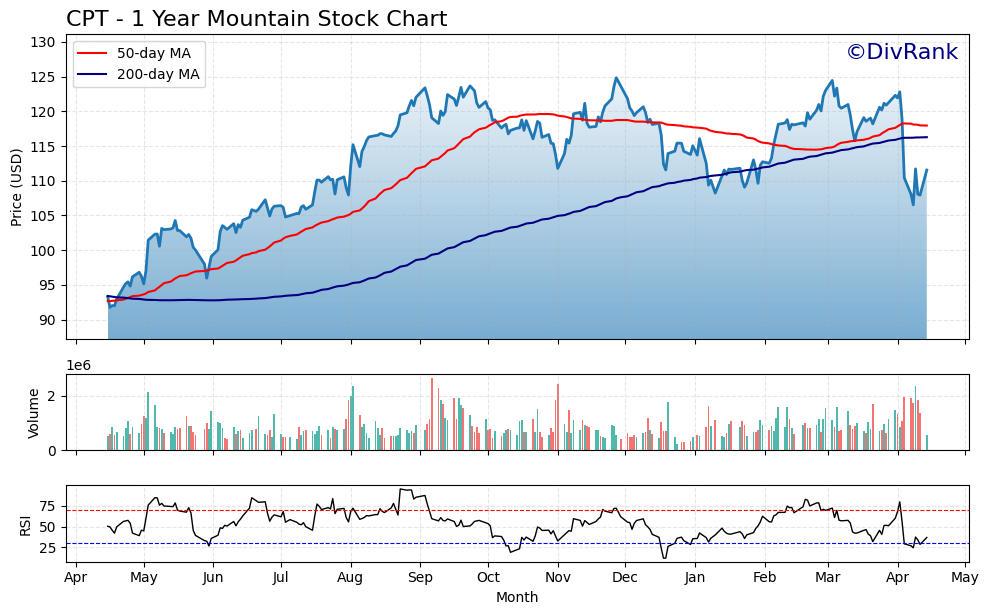

Chart Analysis

Price Trends and Moving Averages

The chart for CPT over the past year shows a clear shift in momentum. The stock enjoyed a steady uptrend from spring through early fall, pushing well above both the 50-day and 200-day moving averages. That consistent climb was supported by gradual gains, with few sharp pullbacks, until mid-October when volatility began to pick up.

From December into early April, the stock began to slip below its 50-day moving average, and by mid-April, it crossed below the 200-day as well—a technical sign of short-term weakness. The 50-day moving average, once comfortably leading above the 200-day, has now flattened and turned slightly downward. This crossover, known to some as a bearish signal, confirms that momentum has cooled off.

Volume Behavior

Looking at the volume section, spikes occurred during major price dips and rebounds. Increased trading activity around these periods typically reflects either institutional repositioning or broader reactions to news or earnings. Recently, volume has picked up again during the drop in April, which often indicates that buyers and sellers are actively reassessing the stock at lower levels.

Relative Strength Index (RSI)

The RSI adds some extra perspective. After hovering in or near overbought territory for much of late summer and into early fall, CPT’s RSI has dipped closer to oversold conditions several times since February. Notably, it hit oversold readings in early April before bouncing slightly—suggesting the stock may be finding some support, at least in the near term.

General Tone

The chart tells a story of strength in the first three quarters, followed by a loss of upward momentum and a return to more cautious trading. While the recent decline may raise eyebrows, the broader trend still reflects a stock that has historically bounced back from weakness. Investors will want to see whether the price can reclaim and hold above the moving averages in the coming weeks, especially with RSI showing signs of potential recovery.

Management Team

Camden Property Trust is led by a leadership group with decades of experience in real estate and a clear long-term vision. At the top is Chairman and CEO Ric Campo, who has been a foundational figure in Camden’s growth since the early 1990s. He’s known for steering the company through multiple market cycles with a steady hand and an emphasis on sustainable operations and shareholder returns.

Alongside him is D. Keith Oden, Executive Vice Chairman and co-founder. While he has transitioned from his prior role as President, he continues to play a key part in strategic planning and governance. Recently, Camden promoted Alex Jessett to President while he continues to serve as Chief Financial Officer. Jessett’s expanded role gives him a broader influence across both finance and operations, keeping Camden tightly aligned in its execution.

Supporting the executive bench are leaders like Laurie A. Baker, Chief Operating Officer, and Michael Gallagher, Chief Accounting Officer. Their collective expertise gives Camden both stability and operational agility, which is particularly important given today’s shifting market dynamics.

Valuation and Stock Performance

Camden’s stock has had its ups and downs over the last year. It reached a high of $127.69 last fall but has since pulled back, most recently closing around the $108 level. That decline—roughly 15% off its peak—has come as interest rate worries and sector-wide volatility made investors a little more cautious across the board.

Despite that pressure, Camden continues to trade on solid underlying fundamentals. The company currently carries a market cap of around $11.74 billion and an enterprise value of $15.21 billion. It’s not cheap on a price-to-earnings basis, with a trailing P/E over 70 and a forward P/E just above 70 as well, but that reflects long-term optimism in Camden’s recurring cash flow model.

The stock’s price-to-book ratio sits at 2.51, while the price-to-sales ratio is 7.59, suggesting that the market still values its income-generating assets at a premium. With a beta of 0.81, CPT also tends to be less volatile than the broader market, which makes it appealing for those who prefer steadier holdings. Analysts currently have a consensus 12-month price target near $128, which suggests room for moderate upside from current levels.

Risks and Considerations

While Camden’s operations are sound, there are a few flags worth keeping in view. The dividend payout ratio stands at 274.67%, which seems high at first glance. However, real estate investment trusts often look expensive on a net income basis because depreciation heavily impacts earnings. Free cash flow tells a more accurate story—and on that front, Camden brings in close to $775 million in operating cash flow, which comfortably supports its dividend outflows.

Interest rates are the biggest external headwind. Rising rates increase financing costs and can depress property values. With $3.49 billion in total debt and a debt-to-equity ratio of about 73%, Camden is leveraged—but not in an unusual way for a REIT. What stands out more is its limited short-term liquidity, shown in a current ratio of 0.11. That doesn’t leave much room for unexpected bumps, so continued access to capital markets is key.

Another consideration is macroeconomic. Real estate demand, especially for apartments, is tied closely to job markets, migration patterns, and consumer confidence. Camden’s focus on fast-growing regions like Texas and the Southeast helps insulate it somewhat, but no real estate firm is fully immune to economic cooling.

Final Thoughts

Camden Property Trust remains a solid name in the apartment REIT space, supported by a thoughtful management team and a strong operational foundation. Its long-term strategy emphasizes steady growth, disciplined capital use, and reliable distributions—all characteristics that point to a well-run, mature real estate platform.

While there are risks—like rising rates and earnings compression—the company’s free cash flow generation and stable property base provide a meaningful buffer. Camden isn’t aiming to wow the market with flashy growth. Instead, it sticks to what it does best: owning quality assets in desirable locations and running them efficiently. That approach, especially in uncertain times, can go a long way.