Updated 4/11/25

Broadstone Net Lease specializes in net lease agreements across multiple sectors—including industrial, healthcare, retail, and even casual dining—and it does so with an eye on long-term value and stability. With tenants typically responsible for taxes, insurance, and maintenance, BNL enjoys predictable income streams with fewer headaches on the landlord side. For investors who like their dividends steady and their real estate exposure diversified, BNL sits in an interesting spot.

Recent Events

BNL shares recently closed at $15.07, a modest move from its recent trading range but still noticeably below its 52-week high of $19.15. It’s also a solid bounce off the lows around $13.96, suggesting some stability has returned after broader market pressure weighed on REITs. Despite those headwinds, BNL has shown it can keep the gears turning.

Revenue over the trailing twelve months reached $431.8 million, growing nearly 7% year-over-year. Even more eye-catching is the spike in net income—coming in at $161.28 million, driven by disciplined cost control and strong performance across its real estate holdings. On a per-share basis, earnings came in at $0.86, and quarterly earnings growth year-over-year hit a staggering 307.4%. That’s the kind of swing that turns heads, even in a sector known for slow and steady.

The balance sheet shows a decent buffer too, with $61 million in cash and a current ratio of 2.10, signaling solid short-term financial health. Debt is considerable at $1.92 billion, but that’s to be expected with a REIT of this size. As long as the cash flow stays strong—and with $276 million in operating cash flow and over $222 million in levered free cash flow, it is—there’s room to stay comfortably ahead of obligations.

Key Dividend Metrics 📌

📈 Dividend Yield: 7.17% (Forward)

💰 Dividend Payout Ratio: 134.30%

📆 Next Dividend Date: April 15, 2025

📉 Ex-Dividend Date: March 31, 2025

🧾 Annual Dividend (Forward): $1.16 per share

🕰️ 5-Year Average Dividend Yield: Not available

📊 Trailing Dividend Yield: 7.75%

Dividend Overview

This is where Broadstone Net Lease earns its place in the conversation for income-focused portfolios. With a forward yield of 7.17%, it’s delivering far more than most equities in today’s market. In fact, the trailing yield has been even higher, at 7.75%, reflecting how the stock has held up even while delivering consistent payouts.

BNL issues its dividend quarterly, and the next scheduled payment is just around the corner on April 15. If you’re a long-term investor focused on generating income from real assets, this is the kind of setup that brings peace of mind. The net lease model offers a level of consistency you don’t always find elsewhere in real estate.

Now, let’s talk about the elephant in the room—the payout ratio. At 134.3%, it looks aggressive. But with REITs, traditional earnings-based payout metrics don’t always tell the full story. Because these firms distribute based on funds from operations (FFO), not net income, the headline payout ratio can appear inflated. BNL’s operational cash flow gives it plenty of coverage, even if it looks stretched on the surface.

So while that number might raise some eyebrows for newcomers, seasoned REIT investors know to dig deeper—and what they’ll find here is a solid core of recurring income supporting those dividends.

Dividend Growth and Safety

When it comes to dividend growth, BNL has taken a more conservative route. Increases have happened, but not like clockwork, and certainly not aggressively. Still, for many investors, especially those in or near retirement, consistency can be more valuable than rapid growth. And BNL’s ability to keep the checks coming is what counts most here.

Its tenant base is spread across a range of sectors, with long-term leases in place—many of them structured with built-in rent escalators. That kind of setup builds durability into the revenue stream. It’s not flashy, but it’s effective.

As for the safety of the dividend? It’s a mixed picture, but mostly reassuring. The nearly $2 billion in debt is balanced by solid cash flow and a respectable debt-to-equity ratio near 61%. With $276 million in operating cash flow and over $222 million in levered free cash flow, BNL is doing what it needs to do to keep its dividend pipeline flowing.

It’s also worth noting that institutional investors own a whopping 87% of the stock. That kind of heavy participation usually comes with heightened oversight and a preference for companies that don’t stray far from their financial guardrails. Insider ownership is low, but that’s typical for externally managed REITs.

In this interest rate environment, where cost of capital is climbing and refinancing is becoming more expensive, BNL’s fixed long-term leases and defensive real estate footprint give it room to breathe. It won’t be immune to pressures in the market, but it’s far from fragile.

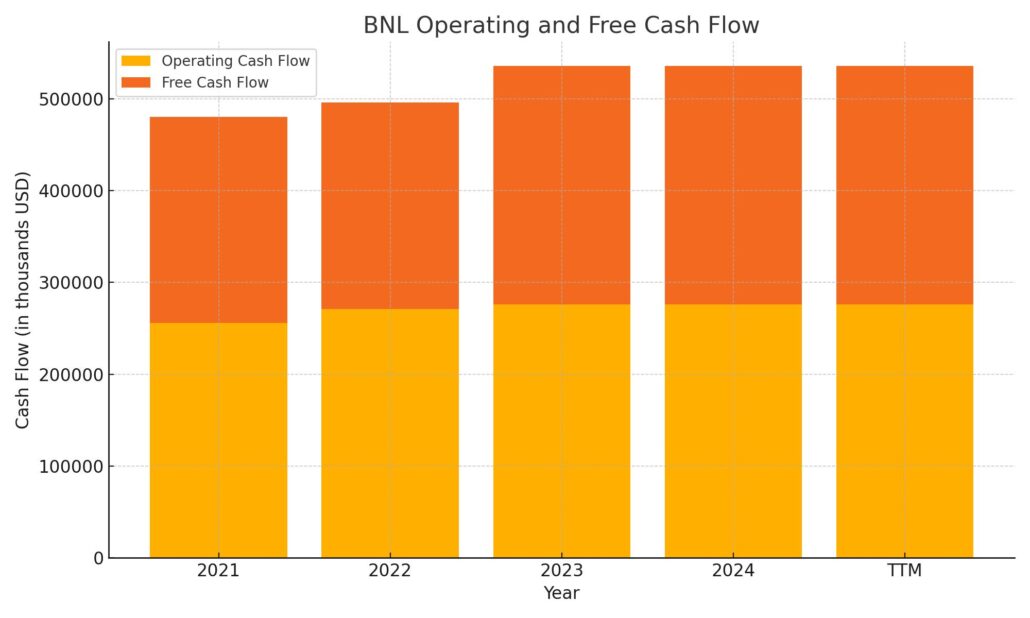

Cash Flow Statement

Broadstone Net Lease’s cash flow picture over the trailing twelve months reflects strong consistency in operational performance. Operating cash flow came in at $276.3 million, maintaining a steady upward trajectory from previous years. This reliability in cash generation underlines the strength of its net lease model, where long-term contracts and tenant obligations create dependable revenue streams. Free cash flow also saw a healthy total of $259.5 million, which positions the company well to support its dividend payments and ongoing capital requirements without overreliance on external funding.

On the investing side, the company recorded a net outflow of approximately $59.7 million, a more modest figure compared to prior years marked by heavy acquisition activity. This suggests a more measured pace of capital deployment recently. Financing cash flow was negative $221.2 million, primarily due to debt repayments and capital returns, though partially offset by $256.5 million in new debt issuance. The net impact brought the ending cash position to just under $16 million, a dip from previous years but still in line with operating needs. Broadstone appears to be balancing its capital structure carefully while ensuring operational cash flow continues to carry the weight of its financial obligations.

Analyst Ratings

📊 Broadstone Net Lease (BNL) has been getting more attention from analysts lately, and the tone is turning cautiously optimistic. The consensus 12-month price target is sitting around $19.30, pointing to a potential upside of over 28% from where shares currently trade at $15.07. Within that range, estimates span from a low of $16.00 to a high of $22.00. That spread shows there’s still some uncertainty in the air, but a fair number of analysts see meaningful room for appreciation.

🟢 On the upgrade front, a few firms have been notably positive. In February, Citizens Capital Markets reiterated their ‘Market Outperform’ stance and maintained a price target of $21.00, citing strength in BNL’s operational performance and confidence in its net lease strategy. JMP Securities followed a similar path, bumping BNL up from ‘Market Perform’ to ‘Market Outperform’ back in December and also backing the $21.00 target. What’s driving this sentiment is the company’s ability to keep cash flowing smoothly even as commercial real estate faces macro pressures.

🟠 Not every voice in the room is bullish though. In April, Wolfe Research took a more neutral tone, downgrading BNL from ‘Outperform’ to ‘Peer Perform.’ Their rationale centered on sensitivity to interest rate movements and the uncertain outlook for certain property sectors. Still, most analyst updates lean supportive overall, with a moderate buy consensus reflecting confidence in the company’s defensive structure and stable income profile.

Earning Report Summary

Steady Growth in AFFO

Broadstone Net Lease ended 2024 on a high note, showing solid financial footing despite a choppy real estate landscape. The company reported Adjusted Funds from Operations (AFFO) of $1.43 per share, which was not only up slightly from the prior year but also landed right at the top of its projected range. That kind of precision says a lot about how well management is executing. It’s not just about hitting numbers—it’s about doing it with consistency, which BNL has clearly prioritized.

Portfolio Strength and Stability

The real backbone of BNL’s success continues to be its tenant base. As of year-end, the portfolio was 99.1% leased, and rent collections were comfortably above 99%. That kind of stability gives the company room to plan, invest, and grow without the usual operational headaches. And speaking of investments, 2024 saw over $400 million poured into new opportunities, with $234 million going toward new acquisitions and another $227 million into build-to-suit projects—those long-term, tailor-made leases that often bring in reliable returns.

Prudent Financial Management

BNL also took steps to clean up and focus its healthcare segment, dialing back exposure to surgical and clinical properties. By the end of the year, those assets made up just 3.2% of the company’s annualized base rent. That’s a strategic shift that shows they’re tightening up the portfolio in ways that should lower risk over time. On the balance sheet side, the company finished with a net debt to EBITDAre ratio of 5.0x and kept plenty of liquidity on hand—$907 million available through its revolving credit facility.

A Confident Look Ahead

Looking to 2025, the company is guiding toward AFFO between $1.45 and $1.49 per share. That range suggests they expect continued growth, albeit modest, and underscores their confidence in the fundamentals. BNL isn’t swinging for the fences—it’s playing a long game built on predictable income and disciplined capital allocation. That’s the kind of tone dividend-focused investors tend to appreciate.

Chart Analysis

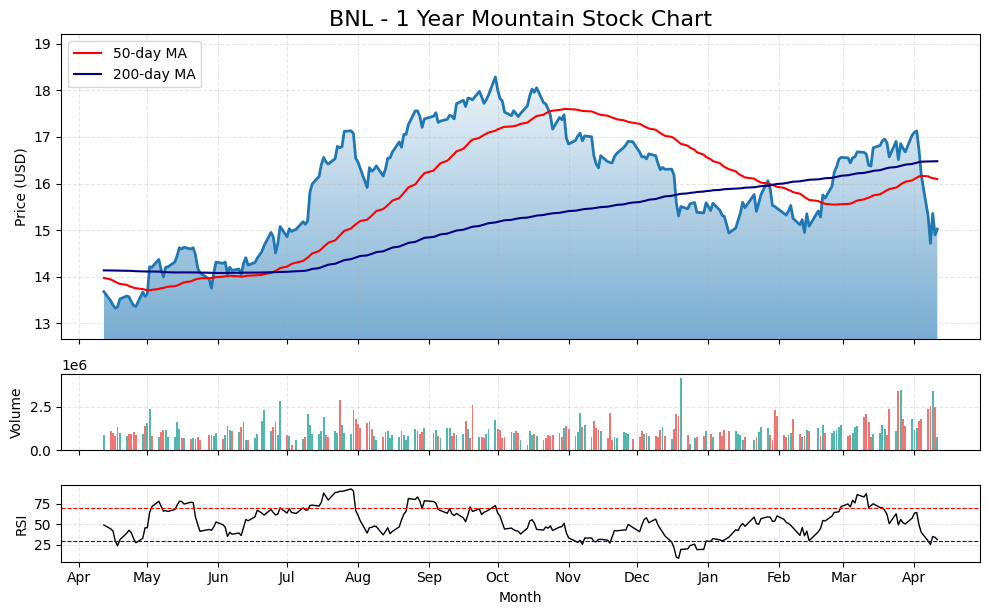

Price Movement and Trend Shifts

BNL has had a story of two very different halves over the past year. The stock climbed steadily from around $13.50 last spring to a peak near $18.50 by late fall, showing a strong upward trend with momentum backing the move. That climb coincided with the 50-day moving average rising sharply above the 200-day, a classic sign of bullish sentiment and investor confidence in the underlying fundamentals.

But by December, things started to turn. The price lost altitude, and the 50-day moving average began to slope downward. More recently, a bearish crossover occurred where the 50-day dropped below the 200-day, a signal that the stock has shifted out of its earlier uptrend. Price action in the last few weeks has confirmed that change, with a sharp pullback taking BNL down from near $17.50 to under $15. There was a brief push higher, but it was quickly rejected, indicating sellers are still in control.

Volume and Relative Strength

Volume patterns show an increase in trading activity during the recent decline, which could mean distribution—holders stepping away rather than just short-term noise. When combined with the moving average crossover and price weakness, it adds weight to the idea that sentiment has shifted at least for now.

Looking at the RSI at the bottom, BNL recently dropped below 30, placing it in oversold territory. That doesn’t guarantee a bounce, but it does suggest that the stock may have been sold off too aggressively in the short term. It’s a spot where some traders look for a potential reversal, although for longer-term investors, it’s more of a flag to watch price behavior closely.

What the Chart Suggests

The stock is currently below both the 50- and 200-day moving averages, and momentum is weak. Until there’s a clear sign of base-building or a push back above key moving averages, the trend remains to the downside. That said, the steep decline may begin to find footing soon, especially if RSI levels start to stabilize and volume tapers off. The next few weeks will be important for setting the tone into the summer.

Management Team

Broadstone Net Lease is guided by a leadership team with deep experience in both real estate and finance. At the top is CEO John Moragne, who officially stepped into the role in 2023 after previously serving as COO and General Counsel. His background brings a legal and strategic perspective, which has helped shape the company’s risk-managed, long-term approach.

Working closely with him is President and COO Ryan Albano, a key figure in Broadstone’s acquisition and operational strategy since 2013. His dual knowledge of finance and real estate supports the company’s disciplined investment philosophy. On the financial side, Kevin Fennell serves as CFO and Treasurer, leveraging his expertise in capital markets and credit risk to maintain a strong balance sheet and liquidity position.

The company’s board has also been reinforced with experienced additions like Richard Imperiale and Joseph Saffire. Their backgrounds in investment management and real estate operations bring added depth and oversight to Broadstone’s long-term direction. Together, the executive and board teams offer a steady hand and a focus on continuity, which matters in a space built on predictability.

Valuation and Stock Performance

BNL’s share price has had its ups and downs over the past year, tracking closely with broader REIT sector volatility. After a strong rally last summer, the stock gave up some ground in the fall and early winter, with more recent action showing signs of stabilization. Still, the company’s fundamentals continue to point in the right direction.

Based on analyst coverage, the average 12-month price target sits near $19.30, suggesting there’s room for the stock to climb from its current level. Some are even calling for a high of $22.00. This range reflects mixed sentiment on the short-term outlook but confidence in Broadstone’s longer-term story. That optimism is fueled by strong occupancy rates, dependable cash flow, and conservative debt levels.

The Relative Strength Index (RSI) shows the stock has recently been in oversold territory, which could mean it’s near a technical floor. When combined with improving analyst sentiment and a high dividend yield, that setup may attract more income-focused investors looking for value in real assets.

Risks and Considerations

Despite its strengths, Broadstone isn’t without risks. Its reliance on long-term lease agreements creates consistent income, but it can also limit flexibility. When inflation is high, built-in rent escalators may not keep up with rising costs, potentially pressuring real income growth.

There’s also tenant concentration to keep an eye on. While the portfolio is diversified across industries, certain sectors like manufacturing or casual dining may be more vulnerable to economic slowdowns. A dip in those areas could impact lease renewals or rent collection.

And like most REITs, interest rates remain a wild card. As borrowing costs rise, refinancing debt or funding new property acquisitions becomes more expensive. While Broadstone has done a good job managing leverage and keeping plenty of liquidity available, sustained rate hikes would still create pressure on margins. Regulatory shifts or changes to REIT tax treatment could also introduce longer-term uncertainties.

Final Thoughts

Broadstone Net Lease offers a straightforward value proposition—steady income, a well-managed portfolio, and a team focused on consistency over flash. The stock has taken some punches from macro conditions, but the fundamentals are still in place. With a healthy dividend, disciplined leadership, and a conservative capital structure, the company remains positioned to weather volatility while continuing to deliver stable results.

It’s not trying to chase growth at all costs. Instead, it’s leaning into what it does well: providing shareholders with durable, long-term income from a diversified base of high-occupancy properties. For investors looking for something dependable in a landscape that’s anything but, Broadstone has built a structure designed to last.