Updated 4/11/25

Founded over a century ago, Booz Allen Hamilton has built its reputation on providing top-tier consulting services to the U.S. government—especially in the defense, intelligence, and civil sectors. If it’s complex, strategic, and sensitive, there’s a good chance Booz Allen is involved behind the scenes.

Its business model is simple: long-term contracts, high-level expertise, and deep relationships with federal agencies. That consistency has translated into a reliable stream of income and strong free cash flow, which is exactly the kind of foundation dividend investors like to see. While the stock has pulled back sharply from its highs, the fundamentals remain sturdy.

Let’s take a closer look at what matters most for income-focused investors.

📌 Recent Events

This past year hasn’t been the smoothest for Booz Allen shareholders. The stock is down over 24% from its 52-week high of $190.59, now trading closer to the $108 range. That said, the business performance has told a different story. Revenue grew 13.5% year-over-year, hitting nearly $11.8 billion, and earnings climbed an impressive 28.4%. Clearly, the company is doing something right operationally, even if the market hasn’t quite rewarded it lately.

Booz Allen has been doubling down on innovation, investing heavily in artificial intelligence and advanced analytics to stay competitive in the ever-evolving world of federal contracting. It’s also maintaining its disciplined approach to capital allocation, with steady dividends and no signs of overreach.

Most recently, the company went ex-dividend on February 14, and paid its quarterly dividend on March 4. These aren’t flashy events, but they’re consistent—and that’s exactly what long-term dividend investors want.

🧮 Key Dividend Metrics

💰 Forward Annual Dividend: $2.20 per share

📈 Forward Dividend Yield: 2.01%

🧱 5-Year Average Yield: 1.58%

🛡️ Payout Ratio: 30.45%

📅 Last Dividend Date: March 4, 2025

❌ Ex-Dividend Date: February 14, 2025

These numbers point to a dividend strategy that’s intentional and sustainable. The yield sits just above the company’s long-term average, suggesting the payout is not only reliable but has room to grow.

📤 Dividend Overview

For income-focused investors, Booz Allen fits into that dependable, slightly conservative bucket. A 2.01% yield may not scream excitement, but when it’s backed by consistent earnings and low payout ratios, it starts to look pretty attractive.

The company pays out just over 30% of its earnings in dividends, a level that offers flexibility. That payout ratio is a signal. It says management is confident about future cash flows, but isn’t stretching the business to support the dividend. In other words, you’re getting a healthy check without risking the company’s financial health.

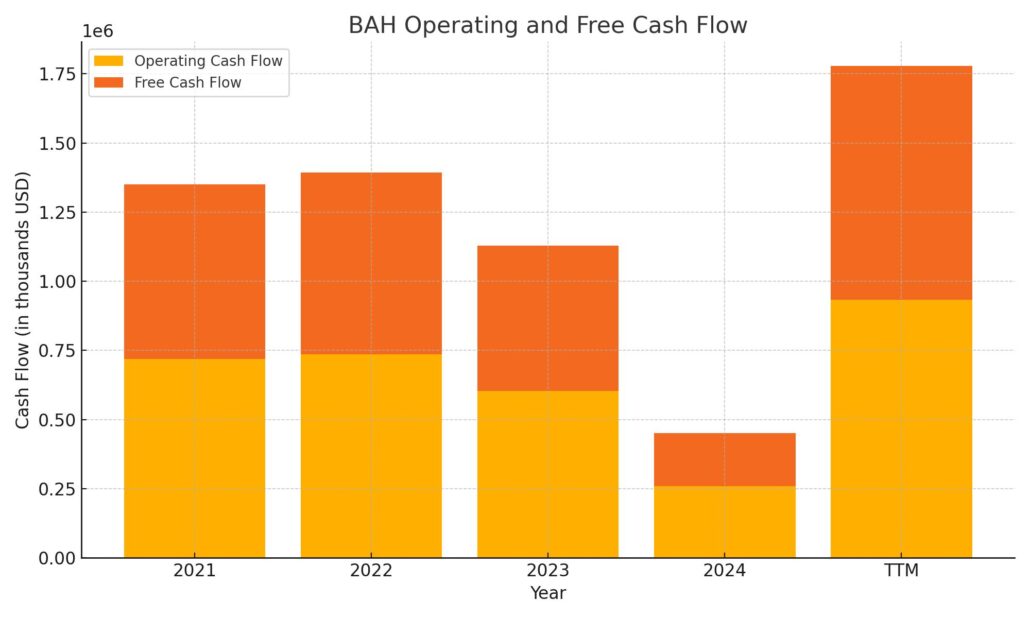

Even more compelling is the free cash flow story. Booz Allen generated over $710 million in levered free cash flow over the past year. That’s a sizable cushion, and one that easily supports ongoing dividend increases. Throw in nearly $934 million in operating cash flow, and it’s easy to see why the board has confidence in its quarterly payouts.

The stock also brings some built-in stability. With a beta of just 0.58, Booz Allen tends to move less than the broader market. For investors trying to build a portfolio that can ride out market turbulence, that’s a big plus.

📊 Dividend Growth and Safety

Booz Allen has shown a quiet but consistent commitment to dividend growth. Over the past several years, the dividend has increased steadily—nothing explosive, but comfortably ahead of inflation. That kind of growth matters, especially when you’re planning for income that needs to last decades.

What really stands out is how the company supports this growth. While Booz Allen does have a fair amount of debt—$3.6 billion to be exact—it also has a well-managed capital structure and a solid cash position. With a current ratio of 1.57, the company has more than enough liquidity to meet its short-term obligations and continue rewarding shareholders.

The debt-to-equity ratio may look high at first glance, but that’s typical for asset-light, service-based companies. Booz Allen’s business model doesn’t require heavy capital expenditures or inventories. Instead, it leverages human capital and long-term contracts, which can produce strong returns on equity—an eye-popping 75.8% in this case.

That kind of profitability and cash generation is what makes the dividend so secure. With earnings per share at $6.70 over the last 12 months and strong growth in both the top and bottom lines, there’s no indication that Booz Allen will need to pull back on shareholder returns anytime soon.

Cash Flow Statement

Booz Allen Hamilton continues to show strong cash-generating capabilities, with trailing 12-month operating cash flow at $933.8 million. That’s a notable improvement from $602.8 million the year prior, and it reflects solid execution across core government consulting operations. Free cash flow followed suit, reaching $844.2 million TTM, giving the company significant financial flexibility to support dividends, buybacks, and reinvestment initiatives. Despite spending $89.6 million on capital expenditures, the business remains highly efficient in turning earnings into real cash.

On the other side of the ledger, Booz Allen used $206.2 million in investing activities, largely directed toward internal growth rather than major acquisitions. Financing outflows totaled $875.9 million over the same period, driven by debt repayments and returns to shareholders. The company’s end cash position now sits at $453.5 million—down from pandemic-era highs but still healthy, especially in the context of consistent cash inflow from operations. Taxes and interest payments have climbed, signaling a growing business footprint, but they remain well within manageable ranges.

Analyst Ratings

📉 Booz Allen Hamilton has recently seen a shift in analyst sentiment, with a notable downgrade coming from Goldman Sachs. The firm moved its rating from Buy to Neutral and adjusted its price target from $150 down to $109. This change wasn’t made lightly. It stemmed from concerns around how much the company is being affected by reductions in government contract spending—especially in areas where Booz Allen had previously been seen as well-insulated, such as artificial intelligence and cybersecurity. According to analysts, these pressures have weighed more heavily than initially expected, prompting a more cautious stance.

📊 Even with the downgrade, broader analyst sentiment remains relatively constructive. The average 12-month price target now sits around $152.33, indicating upside from the current trading levels. There’s a fairly wide range among analysts, with targets stretching from $135 on the low end to $210 on the high. That spread highlights both the optimism about Booz Allen’s long-term positioning and the near-term uncertainty tied to federal spending trends and competitive dynamics. While recent rating changes reflect a more guarded outlook, there’s still recognition of the company’s consistent cash generation and firm grip on long-standing federal relationships.

Earning Report Summary

Booz Allen Hamilton just posted its fiscal third-quarter results, and the numbers tell a pretty upbeat story. The company pulled in $2.92 billion in revenue, which is a solid 13.5% jump from the same time last year. What’s even more impressive is that most of that growth was organic—about 12.6%—which means it’s coming from the core business and not acquisitions. That’s a healthy sign in any industry, but especially in the highly competitive government services space.

Strong Bottom Line Performance

On the earnings front, Booz Allen showed some real momentum. Operating income climbed nearly 18%, landing at $291.3 million. Net income didn’t disappoint either, rising 28.4% to hit $187 million. If you’re looking at it from a per-share angle, diluted EPS came in at $1.45, up from $1.11 a year ago. On an adjusted basis, which strips out one-time items, earnings were $1.55 per share—a nice lift of nearly 10% year-over-year.

Backlog and Dividend Growth

Another highlight: the company’s backlog now sits at $39.4 billion, a 14.8% increase that reflects a steady stream of future projects. That backlog is backed by a book-to-bill ratio of 1.41x, which essentially means Booz Allen is booking more work than it’s delivering—a good position to be in.

On the shareholder front, management gave a little extra love by bumping up the quarterly dividend to $0.55 per share. That’s a four-cent increase, signaling confidence in the cash flow and future earnings.

Focus on Innovation

The company continues to lean heavily into innovation, particularly in areas like artificial intelligence and cybersecurity. These investments are aimed squarely at serving long-standing government clients with evolving digital needs. It’s a forward-thinking approach that’s clearly paying off, both in terms of contract wins and long-term strategy.

All in all, the quarter painted a picture of a company that’s executing well, staying focused on its mission, and rewarding shareholders along the way.

Chart Analysis

Price and Trend Overview

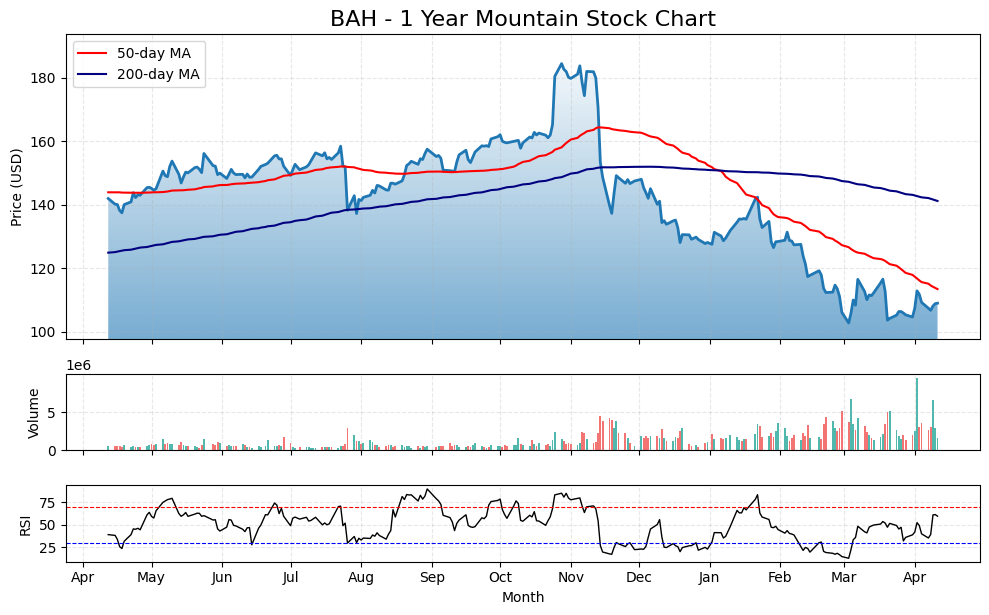

BAH has had a rocky twelve months. Starting from around $140 last spring, it gained ground through the summer and peaked above $190 in late fall. Since then, the story has flipped. The stock has been on a clear downward path, with lower highs and lower lows carving out a persistent decline. Currently, the price is hovering just above the $100 level.

What really stands out is the behavior of the moving averages. The 50-day moving average (red line) crossed below the 200-day moving average (blue line) in early January—a bearish signal often referred to as a death cross. This kind of setup typically confirms a longer-term downtrend, and in this case, it’s held true. The stock has struggled to regain any sustainable momentum since then.

Volume Activity

Volume tells a quieter but interesting story. Spikes in trading activity have been intermittent, with noticeable surges in March and early April. These bursts could suggest moments of accumulation or institutional rebalancing, but there’s no clear trend of sustained buying pressure just yet.

Momentum and RSI

The Relative Strength Index (RSI) at the bottom of the chart shows some recent life. After spending much of the winter in oversold territory, the RSI has pushed back above 50 and is trending upward. This doesn’t mean the trend has reversed, but it could be an early signal that bearish momentum is weakening and the stock is finding some footing.

Taken together, the chart paints a picture of a stock that has been under pressure but may be nearing a stabilization phase. The moving averages are still pointing down, so there’s work to do technically. But for now, it looks like the pace of selling has slowed, and eyes will be on whether it can build a base from here.

Management Team

Booz Allen Hamilton’s leadership team is composed of seasoned professionals with deep roots in consulting, technology, and long-term strategic planning. At the top is Horacio D. Rozanski, who serves as Chairman, Chief Executive Officer, and President. He’s been with the firm since the early ‘90s and has played a major role in shaping the company’s transformation strategies, particularly the tech-focused shift that’s helped define Booz Allen’s recent evolution.

Supporting Rozanski is Kristine Martin Anderson, the Chief Operating Officer. She’s the one ensuring that day-to-day operations stay aligned with the firm’s long-term goals. On the financial side, Matt Calderone serves as the Chief Financial Officer, overseeing capital allocation, financial risk, and growth planning.

The executive lineup also includes Richard Crowe, who leads the Civil Sector, and Andrea Inserra, who was recently promoted to head the Global Defense Sector. Her appointment signals Booz Allen’s push to reinforce its footprint in global defense consulting. Then there’s Shannon Fitzgerald, the Chief Strategy Officer, who’s responsible for keeping the firm focused on long-term positioning and identifying growth opportunities. Together, the leadership team brings a steady hand and a forward-thinking mindset, which continues to steer Booz Allen through a complex and evolving market.

Valuation and Stock Performance

BAH stock has seen its fair share of movement over the past year. As of early April 2025, it’s trading around the $108 mark—down roughly 24 percent from its highs in the past 12 months. That kind of pullback can raise eyebrows, but it also reflects broader market conditions and shifting investor sentiment around government contract-driven businesses.

Looking at valuation, the current price-to-earnings ratio sits near 15.8. That’s right in the zone where many would consider it reasonably valued, especially given the stability of its cash flow. Price-to-sales is just over 1.1, which is modest and suggests the stock isn’t being priced at a premium to revenue. The cash flow multiple is also in a manageable range, around 15.9.

Some analysts have taken a more cautious stance in recent months. One firm moved its rating from Buy to Hold, citing possible headwinds from federal budget tightening. The price target was trimmed slightly to reflect that caution. Even so, the business fundamentals remain steady. Revenue continues to grow, the backlog is healthy, and management is investing smartly in tech and innovation—two key drivers in Booz Allen’s strategy.

Risks and Considerations

A few risks are worth keeping in view. First and foremost is the company’s heavy dependence on U.S. government contracts. That’s been a strength for years, but it also makes the business vulnerable to shifts in federal spending priorities. When Washington tightens the belt, even the most trusted contractors can feel the squeeze.

Competition is another consideration. The field is crowded, and while Booz Allen is a recognized name with a strong track record, there’s no shortage of rivals bidding for the same work. This can put pressure on margins and force firms to differentiate in ways that may require ongoing investment.

Cybersecurity is also a big one—not just as a service Booz Allen offers, but as a core risk it must manage. Given the sensitive nature of its work, any breach or lapse in security could have serious consequences. Protecting data and maintaining strong security practices isn’t optional—it’s essential.

Financially, the company does carry some leverage. While not extreme, its debt levels should be monitored. The firm has been responsible in how it manages its capital, but any uptick in borrowing or tightening of credit conditions could limit flexibility going forward.

Final Thoughts

Booz Allen Hamilton remains a steady, focused player in a complicated and ever-changing environment. The management team is experienced, the business model is proven, and the firm has made meaningful moves into high-priority sectors like digital transformation and national security. While the stock has come down from its highs, the company itself hasn’t lost its footing.

The risks are there—mainly around federal spending and increased competition—but so are the strengths. Backlog is growing, leadership is stable, and the firm’s ability to generate cash gives it room to navigate whatever comes next. For those who understand the nature of the business and the cycles it moves through, Booz Allen continues to offer a compelling story rooted in consistency, innovation, and long-term value creation.