Updated 4/11/25

Based in Tulsa, Oklahoma, BOKF operates with a clear focus on community-driven banking across the Midwest and Southwest. With a market cap hovering around $5.6 billion, this isn’t a behemoth—but that’s part of the appeal. BOKF’s core strength lies in its conservative management style, solid balance sheet, and loyal customer base. It doesn’t overextend, it doesn’t chase trends, and it’s been delivering consistent performance in a space that’s seen more than its fair share of turbulence lately.

For investors building income-generating portfolios, BOKF offers a compelling dividend profile—quiet, sturdy, and backed by fundamentals that actually matter.

Recent Events

This past year has been a story of quiet resilience for BOKF. The share price has cooled off from its 52-week high of $121.58, now trading just under $88, but still managing to stay slightly positive over the past year. That’s no small feat in a volatile market environment that’s been especially rough on regional banks.

Earnings have come in strong. Net income jumped nearly 65% year-over-year in the latest quarter, driven by disciplined cost management and healthy margins. Return on equity is right around 9.8%, while return on assets sits at a conservative 1.05%. Not flashy numbers—but certainly respectable, especially considering BOKF’s risk-averse posture.

It’s also worth noting the liquidity cushion: $6.58 billion in cash versus $4.94 billion in debt. That gives the bank more than enough breathing room to navigate rate changes, loan fluctuations, or any unforeseen stress. And with a book value per share of $86.53, the stock is trading right around its intrinsic value. You’re not paying a premium for quality here.

Key Dividend Metrics

💵 Forward Dividend Yield: 2.53%

📅 Dividend Growth (5-Year Avg): Steady and predictable

🧮 Payout Ratio: 27.27%

🪙 Forward Annual Dividend: $2.28

📆 Most Recent Dividend Date: February 26, 2025

⚠️ Ex-Dividend Date: February 12, 2025

📈 5-Year Average Yield: 2.53%

Dividend Overview

BOKF isn’t going to win any awards for dividend size, but what it does offer is reliability. The forward yield of 2.53% lines up perfectly with its five-year average. That kind of consistency says a lot—it means the yield isn’t the result of some short-term bump in price or a temporary spike in payout. It’s just part of the bank’s steady rhythm.

And it gets better when you look under the hood. The payout ratio is sitting at 27.27%, which is pretty conservative. That means there’s ample room for the dividend to grow even if earnings stay flat. More importantly, it tells you that BOKF isn’t stretching to make its payouts. They’re comfortably funded by a healthy stream of income.

Cash flow is another key piece here. Over the past twelve months, the bank has pulled in $1.43 billion in operating cash flow. That’s a strong backdrop for sustaining—and gradually raising—dividends. Plus, with more cash than debt on the books, there’s very little financial pressure weighing on future distribution plans.

There’s also a quiet confidence built into the ownership structure. Insiders hold over 60% of the shares, which means the people making dividend decisions are deeply invested in the company’s long-term success. That kind of alignment is reassuring for any income-focused investor looking for consistency over flash.

Dividend Growth and Safety

BOKF’s dividend growth won’t knock your socks off—but it’s there. The payout has moved up from $1.68 to $2.28 over the past five years, and the pace has been slow but steady. This is a bank that raises its dividend when it makes sense—not to signal strength, not to chase a higher yield, just to reflect stable growth.

The real story, though, is in the safety of the dividend. With $8.14 in trailing earnings per share and only $2.28 paid out annually, the dividend is well-covered. Even in a tougher earnings environment, BOKF would have plenty of room to maintain its payout. And since the business is already operating with a conservative financial structure, there’s not much risk of a surprise cut.

Another thing to appreciate: no gimmicks. No special dividends, no accelerated payouts, no recent stock splits since way back in 2004. Management doesn’t use the dividend to make statements. They use it to quietly reward long-term shareholders who appreciate predictability.

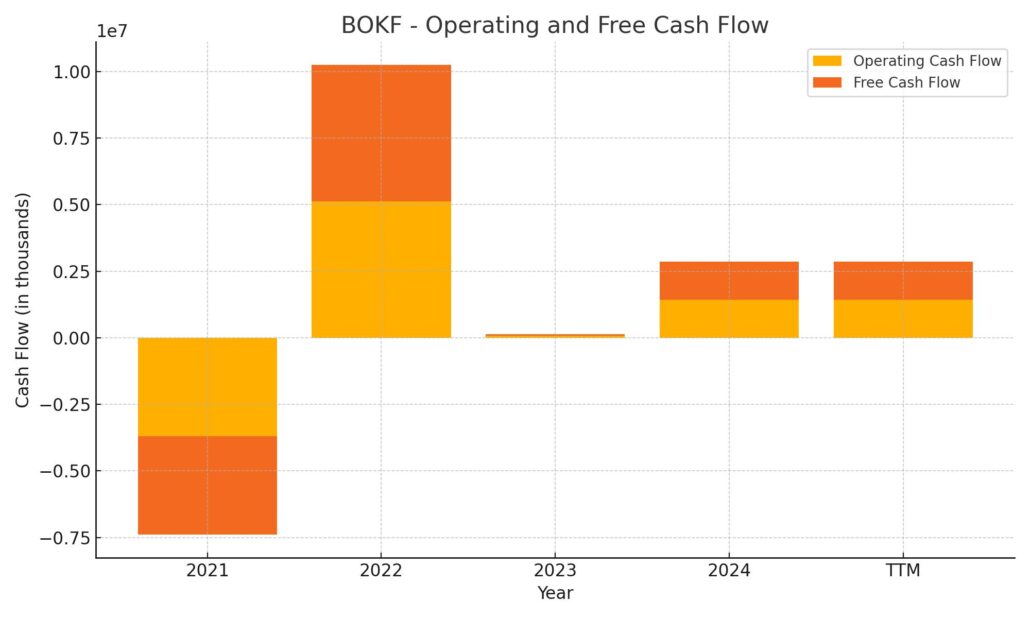

Cash Flow Statement

Over the trailing twelve months, BOK Financial generated $1.43 billion in operating cash flow, a massive improvement from just $66 million the year prior. This shift reflects a normalization after volatile swings in previous years, particularly in 2021 and 2022, when the bank saw extreme movements driven by balance sheet repositioning and macroeconomic shifts. Importantly, this recent figure brings BOKF back to a place of strong internal cash generation—crucial for supporting its dividend and day-to-day operations.

On the investing side, the company posted outflows of $477 million TTM, a much more restrained level than previous years, signaling more disciplined capital deployment. Financing cash flow came in at a negative $867 million, likely reflecting debt repayment and shareholder returns. The company’s ending cash position of $1.43 billion is steady, maintaining a healthy buffer. With interest paid topping $1.42 billion over the same period, it’s clear BOKF is managing a significant cost of capital, but still doing so with solid coverage through operating inflows.

Analyst Ratings

📉 BOK Financial Corporation (BOKF) has recently seen mixed signals from analysts. Wells Fargo lowered its price target from $120 to $100 while holding steady on its Equal Weight rating. The decision was driven by rising uncertainty across the regional banking sector, despite BOKF showing stable earnings and solid credit quality. Interestingly, the analyst also mentioned that the recent drop in BOKF’s stock might actually open up some near-term opportunity, with expectations now sitting at more reasonable levels.

📈 On the flip side, D.A. Davidson took a more optimistic view and upgraded the stock to a Buy, raising their target to $124. The upgrade came on the back of strong fee income and a favorable deposit structure—two areas where BOKF appears to outshine many of its smaller peers. Fee income accounts for around 40% of BOKF’s revenue, much higher than the 20% range typical of other regional banks. Add to that a conservative loan-to-deposit ratio of just 68%, and the bank has meaningful flexibility to manage through different interest rate environments.

📊 Looking at the bigger picture, the current analyst consensus is a Hold, based on ten ratings. The average 12-month price target sits at $117, with individual estimates ranging from $100 to $127. That implies a potential upside of roughly 33% from where the stock trades today.

Earnings Report Summary

BOK Financial wrapped up 2024 on a high note, delivering a fourth quarter that showed off the kind of steady performance long-term investors appreciate. Net income came in at $136.2 million for the quarter, which worked out to $2.12 per diluted share. For the full year, earnings landed at $523.6 million, or $8.14 per share. That’s not just solid—it’s a sign of how well the bank managed through a year with shifting interest rates and plenty of pressure on regional lenders.

Strong Core Banking Results

One of the standout points from the report was how the bank handled its core operations. Net interest income ticked up, with the net interest margin expanding by seven basis points. That’s a good sign that management is staying sharp on the asset and liability side of the balance sheet. On the lending front, commercial and industrial loans grew by more than 8% compared to the previous year, with a big push coming from the Texas market, where loan growth was nearly 10%.

Fee Income Keeps Growing

Beyond traditional banking, BOKF showed strength in fee income, which climbed to just under $207 million for the quarter. That stream now makes up 40% of total revenue—a healthy mix that gives the bank more flexibility regardless of where rates head. Trading fees were a major bright spot, jumping nearly 40%, which helped lift the overall performance.

Credit Quality and Capital Look Solid

Credit quality held up well, with criticized and classified loans still sitting below pre-COVID levels. Net charge-offs were minimal, running at just five basis points annualized, which is a strong indicator of loan performance and risk control. Capital-wise, the bank ended the year with a tangible common equity ratio of 9.2%, giving it plenty of breathing room to invest in talent, expand its footprint, or return capital to shareholders.

Looking Ahead

For 2025, BOKF expects revenue to keep climbing at a mid- to upper single-digit pace. Both net interest income and fee income are projected to drive that growth. And with a steeper yield curve possibly on the horizon, management believes trading-related revenue may begin to shift more toward interest-based income.

All in all, it was a strong close to the year, and the outlook for 2025 is looking just as grounded and growth-focused.

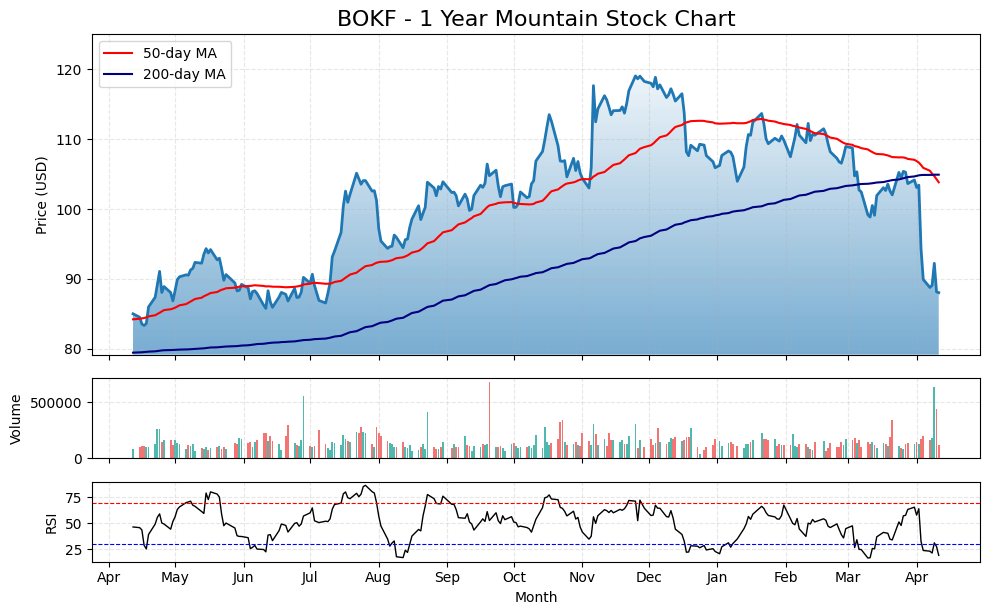

Chart Analysis

BOKF has had quite a journey over the past year, and this chart captures the narrative well—rising momentum in the first half, topping out into the fall, and a clear shift in sentiment heading into the spring.

Price Trend and Moving Averages

For much of the year, the stock was comfortably trading above both the 50-day and 200-day moving averages, reflecting a healthy uptrend that peaked around November. The 50-day moving average, shown in red, was steadily climbing and led the way for months. However, the tone began shifting as we entered the new year. The 50-day started to roll over in February and has now dipped below the 200-day, forming what many consider a bearish crossover. This marks a technical shift in momentum, and as of April, the stock has pulled back sharply, moving from the mid-110s to the high-80s.

Volume and Trading Behavior

Trading volume remained fairly stable through most of the year, with occasional spikes during short-term rallies and dips. What’s worth noting is the recent volume surge coinciding with the sharp price drop. That type of volume confirms conviction behind the selling pressure and likely points to institutions repositioning their exposure. It’s a development that adds weight to the downward move and isn’t just noise.

RSI and Momentum Shift

The Relative Strength Index (RSI) adds another layer to the story. For much of last year, RSI values hovered in the middle to upper range, even entering overbought territory a few times in late summer and early fall—mirroring the price highs. Lately, however, the RSI has been consistently sitting under 30, signaling that the stock is now oversold. While this could suggest a potential short-term bounce, the repeated drops below this level show how firmly momentum has shifted out of favor.

BOKF clearly had a strong run last year, but recent price action and technicals point to a stock that’s been repriced lower and is working through a new base. The decline has broken below major trend supports, and the convergence of lower RSI, falling averages, and spiking volume suggest caution, or at the very least, patience until the chart finds footing again.

Management Team

Boise Cascade’s leadership has built a reputation on stability, not flash. The current CEO, Nate Jorgensen, stepped into the role in 2020 after holding multiple senior positions within the company. His background isn’t just about management experience—it’s rooted in the actual operations of the business. That shows in the way the company navigates cycles. When times are good, they don’t overextend. And when the market tightens, like we’ve seen recently, they don’t panic or cut corners.

What stands out is the team’s commitment to running a disciplined operation. They continue to invest where it makes sense—whether that’s upgrading facilities or maintaining strong distribution channels—but they never lose sight of the balance sheet. Decisions feel measured, not reactive. And it’s this consistency in approach that has kept Boise Cascade not only afloat during tough periods, but quietly thriving in the background. For long-term investors, especially those drawn to dividend-paying companies, this steady leadership style is a major plus.

Valuation and Stock Performance

Right now, Boise Cascade is trading well off its highs. Shares are hovering in the $90s, a far cry from the $155 they reached not too long ago. It’s a sharp drop, no doubt, but one that’s more about macro sentiment than any company-specific problem. The housing market has slowed, and with it, so has investor appetite for names tied to construction and building products.

Even so, the valuation picture looks interesting. The company’s price-to-earnings ratio is under 10, which is low by almost any measure, especially for a profitable business with strong cash flow and minimal debt. Price-to-sales is also down around 0.55, and the enterprise value to EBITDA ratio sits in the mid-single digits. Those numbers suggest Boise Cascade is being priced more for uncertainty than for its underlying fundamentals.

Looking at performance, the chart tells a clear story of decline over the last several months. The 50-day and 200-day moving averages are both trending downward, which doesn’t bode well for momentum traders. But the price has recently bounced off lows, and momentum indicators like RSI are showing some life again. It’s not a turnaround yet, but it could be the start of stabilization.

From a value lens, the market seems to be giving investors a chance to own a well-run, cash-generating company at a significant discount. While near-term headwinds are real, the long-term case looks stronger than the current stock price might suggest.

Risks and Considerations

Every investment comes with risk, and Boise Cascade is no exception. The most obvious challenge is its tie to the housing and construction markets. When interest rates rise and homebuilding slows, companies like BCC feel it pretty quickly. That sensitivity to macro cycles can create big swings in earnings from one year to the next.

Then there’s the commodity factor. Boise Cascade relies on raw materials like lumber, which can be highly volatile. Swings in input costs can hit margins hard, especially when prices move faster than the company can adjust its selling prices. They’ve managed that risk well historically, but it’s always a factor in this kind of business.

Labor is another piece of the puzzle. Skilled labor shortages across manufacturing and distribution aren’t going away anytime soon. Boise Cascade operates a large network of mills and distribution centers, and finding and keeping talent in those operations can put pressure on costs and efficiency.

Competition is also something to keep in mind. The building materials space is filled with both large players and nimble regional outfits. Price pressure is real, and while Boise Cascade has scale on its side, maintaining that edge takes constant attention.

And finally, there’s always the broader sentiment around cyclical stocks. When investors shift toward safer, defensive names, companies like Boise Cascade can get left behind, even if they’re performing well. That disconnect between performance and perception can create opportunities—but it can also test your patience if you’re hoping for a quick rebound.

Final Thoughts

Boise Cascade isn’t a stock that’s going to generate headlines. It’s not pushing into flashy new markets or touting the next big tech breakthrough. What it does offer is something a little harder to find: a business that knows who it is and stays focused on doing things right.

The company has weathered a pullback in housing and construction without losing its footing. It’s still profitable. It’s still generating healthy cash flow. And it’s doing it all while keeping debt low and maintaining a solid cash cushion. The dividend isn’t high, but it’s secure—and there’s room for it to grow.

Right now, the stock is out of favor. But that’s often when the best opportunities appear. Investors with a longer time horizon may find Boise Cascade’s current valuation and financial strength appealing, especially if they value consistency and discipline in management. When the housing cycle turns back around—and history says it eventually will—Boise Cascade is positioned to participate without needing a reinvention.

For dividend investors looking for a name with real assets, real cash flow, and real management discipline, Boise Cascade is the kind of company that doesn’t need to be loud to be valuable.