Updated 4/11/25

Black Hills Corporation (NYSE: BKH) might not be the name that lights up financial headlines, but for investors who value consistent income and long-term reliability, it’s a name worth knowing. This utility company has been around since the late 1800s and continues to deliver electricity and natural gas to over a million customers across parts of the Midwest and Mountain West. What stands out about BKH isn’t fast growth or disruptive tech—it’s the dependable nature of its business and its strong commitment to rewarding shareholders.

Serving customers in states like South Dakota, Wyoming, and Nebraska, the company operates in a highly regulated environment. That might sound restrictive, but it’s actually a source of strength for utilities. Regulation provides a level of predictability, which translates to stable cash flows—ideal for supporting a solid dividend over the long haul.

Recent Events

Looking at the latest financial results, Black Hills turned in a fairly steady performance. For the fiscal year ending December 2024, revenue came in at $2.13 billion, reflecting a small year-over-year bump of just under 1%. But the more interesting story is on the profit side. Net income climbed to $273.1 million, helped along by an impressive 23% rise in earnings over the prior year. That kind of growth isn’t typical in the utility sector, and it suggests a well-run operation.

Operating margin stands strong at 26.68%, showing that the company’s managing its costs effectively. Meanwhile, the trailing price-to-earnings ratio is sitting at 14.9, and the forward P/E is slightly lower at 14.04. That’s not screaming “cheap,” but it does suggest that investors aren’t overpaying for steady earnings.

Debt remains a big part of the picture here, with $4.38 billion in total liabilities. That puts the debt-to-equity ratio at a hefty 122.28%. While that might seem high, it’s not unusual for utilities, which rely heavily on borrowing to finance infrastructure investments. The important thing is whether they can service that debt—and with $719 million in operating cash flow over the past year, BKH seems to be managing just fine. Still, with levered free cash flow sitting in negative territory, it’s a figure that’s worth monitoring going forward.

Key Dividend Metrics

📈 Dividend Yield: 4.63% (Forward)

💵 Annual Dividend: $2.70

📅 Ex-Dividend Date: February 18, 2025

📆 Dividend Payment Date: March 1, 2025

🔄 Payout Ratio: 66.5%

📊 5-Year Average Yield: 3.86%

🚀 Dividend Growth Streak: 54 consecutive years

Dividend Overview

Here’s where Black Hills really shines. With a 4.63% forward dividend yield, it offers a payout that’s noticeably above its own historical average. That means investors picking it up at today’s prices are locking in an above-average income stream. More importantly, BKH has been increasing its dividend for 54 straight years. That’s more than just consistency—it’s a clear sign that management prioritizes shareholder returns.

The current annual dividend stands at $2.70, and the payout ratio is at 66.5%. That’s a comfortable level—high enough to suggest management is committed to income, but still leaving enough room to reinvest in the business and navigate any bumps along the way.

What makes BKH’s dividend particularly attractive is how stable the underlying business is. Regulated utilities may not grow fast, but they also don’t shrink fast. Customers need electricity and gas regardless of what the market is doing, and that dependable demand fuels the dividend.

Dividend Growth and Safety

While Black Hills doesn’t deliver jaw-dropping dividend increases, it does offer a reliable track record of steady, moderate growth. Over the past decade, dividend hikes have averaged around 5% annually. Combined with a starting yield that’s already strong, that slow and steady approach can quietly build real returns over time.

Safety-wise, there’s a lot to like. The payout is backed by regulated earnings, and while free cash flow has dipped negative in the most recent period, it appears to be a timing issue related to capital expenditures rather than operational weakness. The company’s strong operating margins and solid cash generation support the ongoing payout.

Another layer of security? The stock’s low beta, sitting at just 0.62. That means it doesn’t swing nearly as much as the broader market, which is a nice cushion for income investors looking to avoid excessive volatility.

Institutional investors seem to agree. Around 87% of the float is held by institutions, a sign that the big players view BKH as a steady hand in uncertain markets.

The last time the company split its stock was back in 1998, and at today’s price near $58, it remains relatively affordable for long-term dividend investors building out their portfolios.

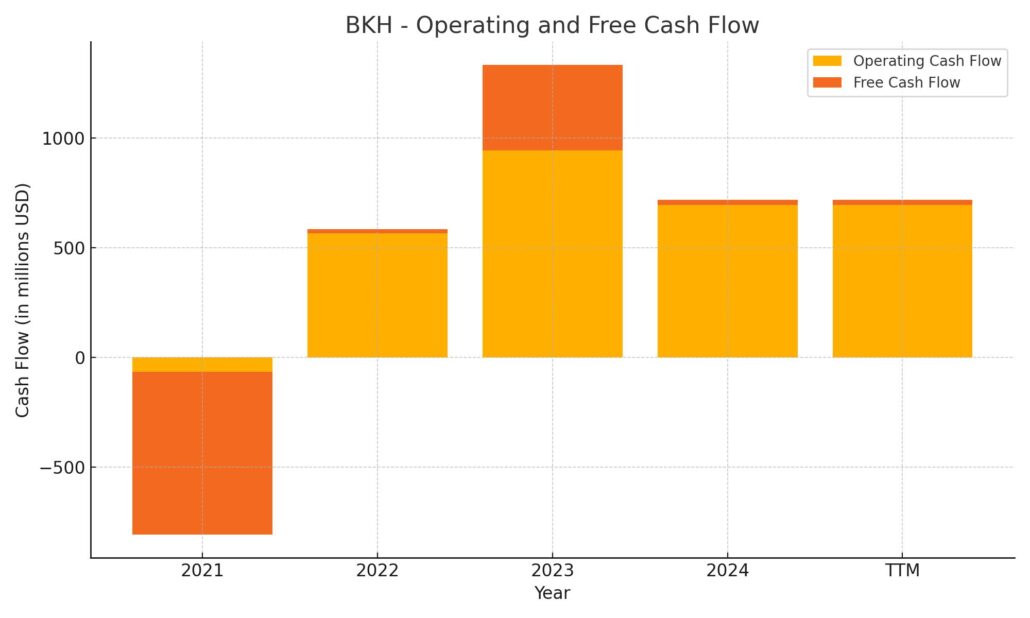

Cash Flow Statement

Black Hills Corporation’s cash flow statement over the trailing twelve months shows strong operational performance, with operating cash flow reaching $719.3 million. This represents a recovery from prior volatility and puts the company on solid footing when it comes to funding its regular business needs. However, the company remains in a negative free cash flow position at -$24.9 million, largely due to hefty capital expenditures of $744.2 million. These investments are typical for a regulated utility and are likely directed at long-term infrastructure upgrades and system improvements.

On the financing side, BKH experienced a modest cash outflow of $42.9 million. While this is much smaller than the $341.7 million outflow in the previous year, it still reflects debt repayments and dividend distributions. The company also raised $181.4 million through capital stock issuance, helping to offset some of its spending. Despite negative free cash flow, the company ended the period with $23.4 million in cash—down from $93 million the year before, but still ahead of its 2021 and 2020 year-end levels. Overall, the cash flow dynamics suggest BKH is managing its capital-intensive model with a focus on long-term asset growth, even if short-term free cash flow remains pressured.

Analyst Ratings

📊 Analyst sentiment for Black Hills Corporation (BKH) is currently leaning neutral, with most maintaining a “Hold” stance. The average 12-month price target is around $62.33, offering a modest upside from where shares are trading today. Targets span from a low of $57.00 to a high of $66.00, signaling a consensus that, while upside exists, it’s likely to be gradual rather than dramatic.

🔄 Scotiabank recently kept its rating at “Sector Perform” while making a slight adjustment to its price target, trimming it from $67 to $66. The tone was neutral, reflecting steady fundamentals with no major surprises expected in the near term.

📈 Wells Fargo maintained its “Equal Weight” view and nudged its target up from $61 to $64. That small bump reflects growing confidence in earnings consistency and rate base growth.

⬆️ In a more notable shift, Mizuho moved its rating from “Underperform” to “Neutral” last November. With that change, they set a target of $53, which while still conservative, marked a step toward a more constructive outlook.

⬇️ On the flip side, Bank of America reiterated its “Underperform” rating and cut its target to $49 from $60. The concern here was focused on regulatory cost pressures and high capital spending, which could weigh on near-term returns.

Overall, the market seems to view BKH as a stable player with dependable cash flow, but without the spark that might prompt more aggressive analyst upgrades. Investors looking for consistency in a regulated environment are still finding value here.

Earning Report Summary

Solid Finish to 2024

Black Hills Corporation wrapped up 2024 on a strong note, delivering earnings per share of $3.91. That’s a nice improvement compared to the prior year, and much of it came down to the company’s ability to put new rates into place, recover costs through riders, and grow its customer base. These factors alone contributed around $0.82 to earnings per share. Even with some headwinds—like unusually mild weather and a few unexpected outages at its power generation facilities—Black Hills still managed to come out ahead.

On the operations side, income rose to $503.1 million from $472.7 million in 2023. Net income available to common shareholders reached $273.1 million, up slightly from $262.2 million the year before. These aren’t explosive numbers, but they reflect steady and disciplined performance, especially in the face of higher insurance expenses and other external pressures.

Capital Spending and Growth Outlook

Over the year, Black Hills put roughly $800 million to work in its infrastructure, including progress on the Ready Wyoming transmission project. That level of investment shows they’re not just playing defense—they’re building for the future. And with demand from data centers continuing to rise, they’re expecting more growth ahead.

In fact, the company bumped up its five-year capital forecast by 10 percent, now expecting to invest about $4.7 billion through 2029. That’s a sizable commitment and points to confidence in both the regulatory environment and customer demand.

A Reliable Dividend Player

Another highlight from the report was the dividend. Management raised the quarterly payout by 4 percent, making this the 55th straight year of dividend increases. That kind of consistency is exactly what income-focused investors tend to appreciate, especially in the utility space where reliability often trumps rapid growth.

Looking to 2025, earnings guidance has been set between $4.00 and $4.20 per share. It’s a projection that suggests the company expects to keep its momentum going, thanks to its rate-regulated utility model and ongoing infrastructure expansion. All in all, Black Hills delivered a report that underscores what it does best—steady, reliable performance with a focus on long-term value.

Chart Analysis

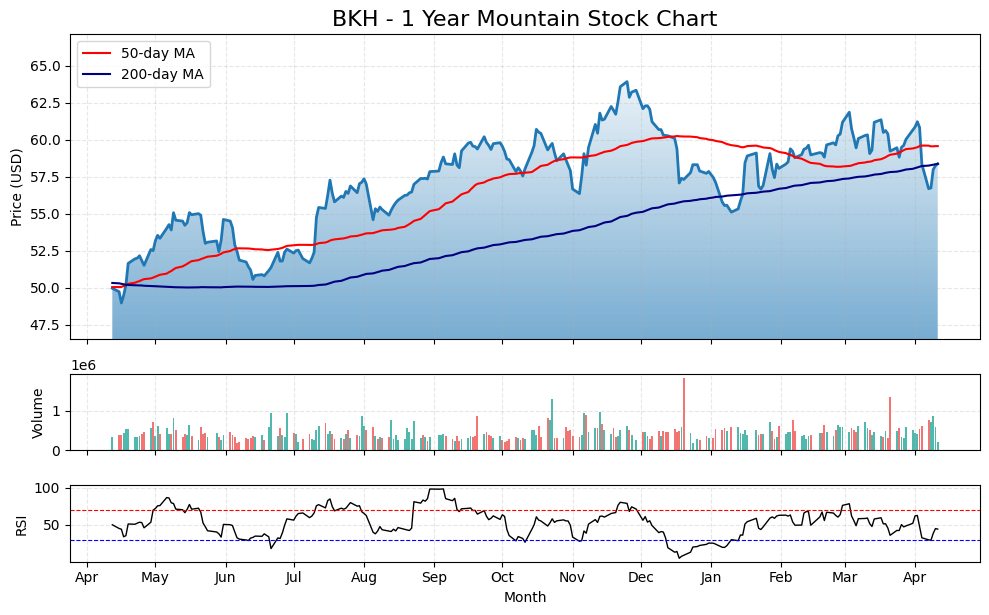

Price Action and Moving Averages

BKH has been in a steady upward trend over the past year, with a few periods of consolidation and pullbacks along the way. The price moved from below $50 last April to recent highs just under $65 before softening a bit in early April. The 50-day moving average, shown in red, has mostly hovered above the 200-day moving average (in blue), which signals ongoing strength. There was a brief moment where the two lines nearly met, but the longer-term trend still favors gradual price appreciation.

The price recently dipped below the 50-day average but stayed above the 200-day line, which can often act as a level of support in a maturing trend. The consistent spacing between the two moving averages shows a relatively smooth climb without erratic volatility.

Volume Behavior

Volume has remained steady throughout the year, with a few spikes, particularly in November and early April. These surges often coincide with price pullbacks or quick recoveries. Overall, there’s no sign of distribution or panic selling, and the volume profile suggests regular accumulation and healthy trading activity. It’s neither too thin nor too speculative.

RSI Indicator

The Relative Strength Index has stayed mostly between the 40 and 70 range, occasionally pushing above 70 but never staying overbought for long. In the early part of the year, RSI flirted with the lower 30s, which hinted at short-term oversold conditions. More recently, the RSI pulled back slightly, leaving room for another potential leg upward without appearing stretched.

General Momentum

What stands out is the consistent upward movement with a handful of natural pauses. There’s no parabolic move here—just a well-behaved trend with pullbacks that seem to get bought up. Even after recent weakness, the structure remains intact. This chart reflects a name that’s being held for a purpose, not chased for quick gains.

Management Team

Best Buy’s leadership is headed by Corie Barry, who stepped into the CEO role in 2019 after spending over 20 years with the company. Her experience spans finance, operations, and strategy, and she’s played a central role in guiding Best Buy through major digital and retail shifts. Before taking on the top job, she served as the company’s CFO and was instrumental in pushing forward its transformation initiatives, including the expansion into health technology and digital services.

Supporting her is Matt Bilunas, the company’s Chief Financial Officer and Executive Vice President of Enterprise Strategy. He’s known for maintaining a conservative financial approach while ensuring the company remains agile in the face of shifting economic conditions. The rest of the executive team includes leaders with deep backgrounds in retail operations, customer experience, and supply chain efficiency, all of which are vital as Best Buy works to stay competitive in a fast-changing retail environment.

Valuation and Stock Performance

As of April 2025, Best Buy’s stock is trading near $59.80, well off its 52-week high of $103.71. The drop of over 40 percent suggests the stock may now be trading below fair value. Analysts currently estimate a consensus price target around $91.28, pointing to a potential upside of over 50 percent from the current level if sentiment and performance stabilize.

Looking at valuation metrics, the trailing price-to-earnings ratio sits at 13.96, while the forward P/E is even more attractive at 9.56. That tells us the market is pricing in modest earnings growth or possibly bracing for further earnings pressure. The price-to-sales ratio is just 0.31, and the price-to-book ratio stands at 4.50, both of which are relatively low for a well-known, profitable brand in the retail space.

Even with recent price weakness, Best Buy has managed to hold strong on profitability metrics. Return on equity is a solid 31.63%, and return on assets comes in at 7.29%. These numbers highlight that the company continues to generate value for shareholders and use capital effectively. On top of that, the 6.29% dividend yield offers ongoing income, which adds a layer of support for the stock, particularly during periods of market volatility.

Risks and Considerations

There are clear risks to consider going forward. The most pressing near-term issue stems from new tariffs on imported electronics from key markets like China and Mexico. These added costs could either squeeze margins or be passed on to customers, neither of which is ideal in a competitive retail space. Consumers already facing inflation fatigue may hesitate to pay more, putting pressure on unit sales.

The business also leans heavily on discretionary spending, which means any significant pullback in consumer confidence or a broader economic slowdown could hurt demand. Best Buy has built up a loyal customer base, but it competes directly with online-first players and discount-focused retailers that can easily steal market share when money gets tight.

From a financial standpoint, the company’s high debt-to-equity ratio—around 144%—stands out. It’s not immediately alarming, but it does indicate that the balance sheet is more leveraged than some investors may like, especially in a rising rate environment. Liquidity also looks tight with a current ratio just slightly above 1.0, meaning there’s not a ton of slack if conditions worsen.

Execution risk is another factor. As the company pushes into new areas like health technology and small-format stores, it’ll need to prove it can maintain margins and scale these initiatives effectively. The pivot could pay off in the long run, but it requires investment and patience, and missteps along the way would likely weigh on results.

Final Thoughts

Best Buy is navigating a tough retail landscape, but it’s doing so with experience and a clear strategy. Leadership appears focused and measured, making smart moves to stay competitive while managing risk. While the stock has taken a hit over the past year, that pressure has pushed valuation to levels that may appeal to patient investors.

The balance of risk and reward is something to watch closely. Tariffs and macroeconomic uncertainty are real headwinds, and the company needs to continue executing well on its shift toward service and subscription-based models. At the same time, the fundamentals aren’t broken. Cash flow is strong, profitability remains intact, and the dividend yield is among the highest in the sector.

Whether the stock rebounds in the near term or not, the foundation is there. It’s a company that’s been through cycles before and still finds ways to deliver. The current moment may be more about surviving the turbulence than sprinting ahead, but there’s still a sense of control in how the business is being run—and that counts for something.