Updated 4/11/25

Headquartered in Maine with roots going all the way back to 1887, this is a community-focused bank that sticks to what it knows. With more than 50 branches across Maine, New Hampshire, and Vermont, BHB keeps things local, steady, and grounded. It doesn’t chase fads. It doesn’t overextend. Instead, it leans into responsible growth and relationship-driven banking.

While the market often rewards flashy, Bar Harbor just keeps moving forward, step by step.

Recent Events

The most recent quarter ending in December 2024 came in strong. Revenues ticked up slightly, up 2.3% year-over-year, landing at nearly $149 million. Net income, on the other hand, saw a bigger jump—up more than 10% from the same time last year. That’s not something to gloss over, especially considering the uncertain rate environment banks are navigating right now.

The bank’s profitability remains healthy, with a 29% profit margin and an operating margin closing in on 42%. Both suggest good expense control and disciplined lending. Return on equity landed at 9.78%, and return on assets held steady at 1.08%. Those numbers aren’t groundbreaking, but they show a bank that knows how to earn a return without taking outsized risks.

Investors have quietly taken notice. Shares are up nearly 15% over the past year, which is a solid beat against the broader market. There hasn’t been a lot of noise around the move—it’s been a slow, steady climb, much like the bank itself.

Key Dividend Metrics

💰 Dividend Yield: 4.32%

📈 5-Year Average Yield: 3.77%

🧾 Trailing Dividend Rate: $1.18

💸 Payout Ratio: 41.55%

🔒 Dividend Safety: Well-covered by earnings and supported by a stable balance sheet

📅 Most Recent Dividend: Paid March 20, 2025

📆 Ex-Dividend Date: February 20, 2025

Dividend Overview

At its current share price, BHB is paying out a 4.32% dividend yield—well above its five-year average of 3.77%. It’s not just high, though. It’s sustainable. The company’s payout ratio sits at a comfortable 41.5%, which means there’s still a large chunk of earnings being retained to grow the business or reinforce the balance sheet.

The annual dividend payout of $1.20 per share is well-supported by earnings, which came in at $2.84 per share over the trailing twelve months. Management hasn’t rushed to raise the dividend aggressively, but they’ve kept it steady—and that matters. Steady income is what dividend investors are really after. Not every company needs to shoot for the stars when it comes to dividend growth. Sometimes, what matters more is showing you can pay and keep paying.

For those who care about stability, BHB’s low beta of 0.65 is worth a look. This isn’t a name that’s going to move wildly with every twist and turn in the market. That’s exactly what many income investors prefer—less drama, more predictability.

Dividend Growth and Safety

Bar Harbor’s dividend track record is built on quiet reliability rather than rapid-fire hikes. The most recent dividend increase was modest, moving from $1.16 to $1.18. That small bump still signals the same thing—it’s a company that wants to share profits but isn’t about to stretch just to impress.

Looking at the broader picture, BHB’s balance sheet supports the dividend well. With $91 million in cash and a total debt position of $316 million, the company has more than enough flexibility. It generated over $52 million in operating cash flow over the past year, more than enough to comfortably cover the dividend and still have capital left over.

With a book value of $30 per share and a current market price hovering around $27.66, the stock is actually trading below book. That kind of valuation, paired with a well-supported dividend, isn’t something you see every day. It suggests the market might be undervaluing the steady, boring quality of this bank—which, for income investors, might just be the point.

Short interest is barely a blip at 0.5% of shares outstanding, which means the market isn’t betting on trouble here. That quiet confidence, paired with consistent performance, adds another layer of reassurance for those looking at this as a long-term income play.

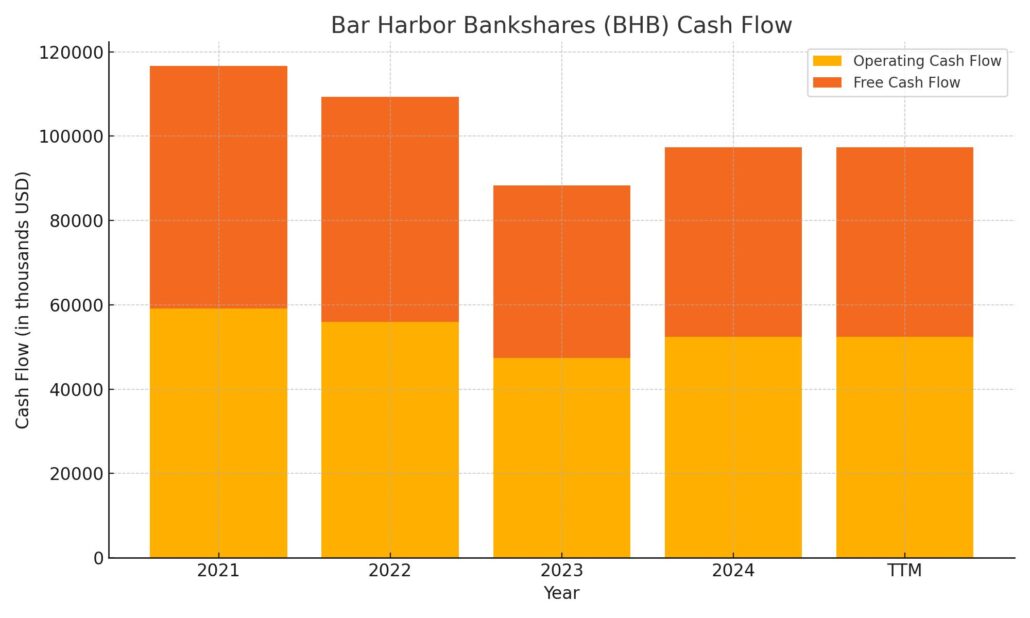

Cash Flow Statement

Bar Harbor Bankshares generated $52.4 million in operating cash flow over the trailing twelve months, showing a consistent ability to convert earnings into cash. That figure represents a modest increase from the previous year and aligns with the bank’s steady performance over time. Free cash flow stood at $45 million, after accounting for $7.4 million in capital expenditures—showing there’s still ample flexibility after covering reinvestment needs.

On the investing side, cash outflows totaled $141.9 million, which reflects heavier investment activity compared to recent years. This appears to be a return to more normalized capital allocation following 2022’s unusually high $408 million outflow. Financing cash flow was positive at $66.8 million, a reversal from the more muted $17.4 million the prior year. The bank ended the period with $72.2 million in cash, a drawdown from past years, but still a healthy cushion for ongoing operations and dividend payments.

Analyst Ratings

📊 Bar Harbor Bankshares (BHB) currently carries a consensus rating of “Hold” from the two analysts actively following the stock. 🎯 The average price target sits at $34.50, pointing to a potential upside of roughly 14.6% from the current share price. Analysts’ expectations remain tightly grouped, with price targets ranging from $34.00 to $36.00—suggesting a clear, steady view on the bank’s valuation.

🏦 One analyst, from a prominent financial research firm, has reaffirmed a “Market Perform” rating and recently adjusted the price target to $35.00. That update was based on the bank’s consistent earnings, stable loan performance, and sound capital position, while also recognizing broader sector pressures that continue to affect regional banks.

📉 Another rating came in the form of a “Hold” from a separate institution, setting a target at $33.00. While not signaling explosive growth, this view acknowledges the disciplined financial management and dependable dividend policy that BHB has demonstrated. The takeaway is straightforward—analysts see BHB as a solid, middle-of-the-road performer, not a high-flyer, but certainly a name offering predictability in uncertain times.

Earning Report Summary

Bar Harbor Bankshares closed out 2024 on a steady note, posting earnings that were just a bit better than expected. The bank reported diluted earnings per share of $0.72 in the fourth quarter, which came in above what most analysts were looking for. That’s also a healthy jump from the $0.65 it posted in the third quarter, showing some positive momentum as the year wrapped up. Net income for the quarter was $11 million, bringing the full-year total to around $43.5 million. It’s a touch lower than the previous year’s $44.9 million, but that dip came largely from higher funding costs as deposits continued to reprice in a higher rate environment.

Margin Pressure and Income Growth

Net interest income landed at $113.8 million for the quarter, down slightly from $117.7 million the year before. The bank’s net interest margin also dipped to 3.15% from 3.29%. That’s not a huge surprise considering the pressure most regional banks are feeling as they adjust to more expensive funding and loan yields that are finding their footing. On the bright side, non-interest income rose to $36.9 million, thanks in part to stronger performance in trust and investment management services. That business saw more assets come under management, which helped offset some of the pressure on lending margins.

Deposit Trends and Balance Sheet Health

Assets ended the year at $4.1 billion, up about $86 million, driven by continued loan growth. At the same time, the bank saw a shift in its deposit base, with more customers moving toward money market and time deposit accounts. Total deposits increased to $3.3 billion, which reflects how folks are continuing to search for better yields on their cash. On the credit side, things remain very stable. The allowance for credit losses came in at $28.7 million, and net charge-offs were minimal—just 0.01% of average loans.

Operational Strength

Bar Harbor also improved its efficiency ratio, bringing it down to 59.84% from just over 61% the quarter before. That’s a sign they’re doing a good job managing costs without cutting corners. Return on assets held at 1.09%, and return on equity came in at 9.52%. Overall, it was a solid showing—nothing flashy, but a steady, measured quarter that reflects the bank’s careful approach to growth and risk in what remains a pretty tricky rate environment.

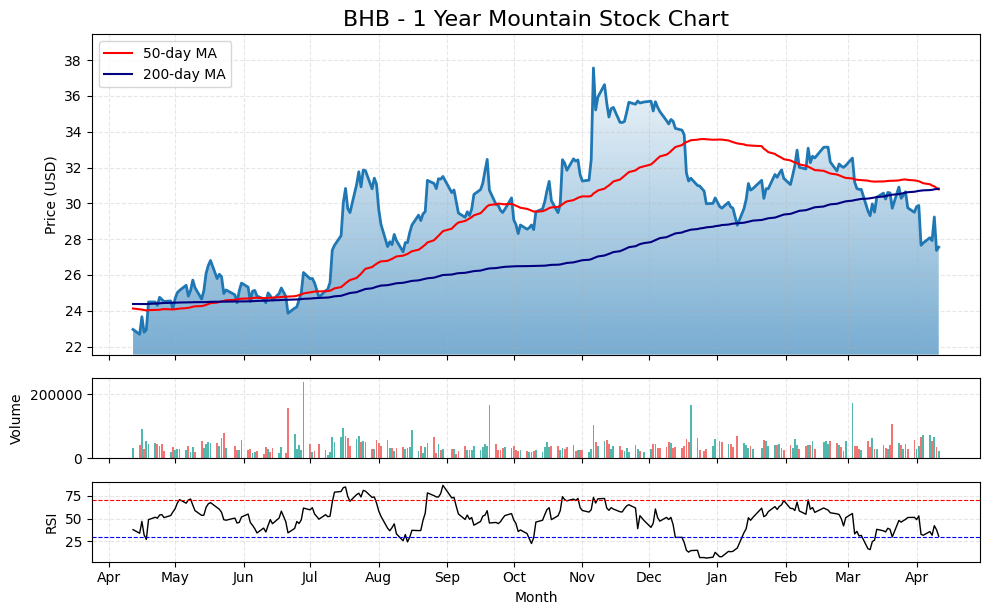

Chart Analysis

Price Trend and Moving Averages

The chart for BHB over the past year shows a strong upward trend through much of 2023, peaking in late fall with the stock reaching above $36. That strength was accompanied by the 50-day moving average staying well above the 200-day moving average for a good stretch of time, especially between August and January. But that momentum began to fade around February. The 50-day line turned downward and has now crossed under the 200-day, a bearish signal that reflects some cooling sentiment.

Price action recently has been soft, with the stock falling below both moving averages and settling near the lower end of its yearly range, around $28. The steady grind downward over the past couple of months, paired with that moving average crossover, suggests that upside enthusiasm has tapered off, and the stock is struggling to find support.

Volume Behavior

Trading volume has remained relatively steady throughout the year, with occasional spikes that coincide with price volatility—both on sharp upward moves and some of the bigger drops. There hasn’t been an overwhelming increase in volume during the recent decline, which may suggest that selling pressure isn’t panic-driven but rather more gradual rotation out of the name or profit-taking after the strong rally into late 2023.

Relative Strength Index (RSI)

The RSI line has been bouncing in the midrange for the most part but has recently dipped toward the lower 30s, approaching oversold territory. That suggests sellers have been in control lately, but it also opens the door to a potential technical bounce if the price holds current levels or finds a floor. Historically, when BHB’s RSI gets down to these levels, there’s been a tendency for at least a short-term recovery in price.

Looking at the full picture, the chart reflects a cooling-off phase following a strong run-up. There’s been a clear shift in momentum since the start of the year. Whether the recent pullback finds footing or turns into a more prolonged downtrend will depend on whether support holds in the $27–$28 range and if volume confirms any reversal signs in the coming weeks.

Management Team

Bar Harbor Bankshares is led by a steady and experienced team with strong ties to community banking. At the top is Curtis C. Simard, who has served as President and CEO since 2013. His leadership has guided the bank through measured expansion across northern New England, all while keeping its focus rooted in personalized, relationship-based service.

Working alongside him is Josephine Iannelli, Executive Vice President, CFO, and Treasurer. She brings a sharp eye for financial detail and a disciplined approach to managing the bank’s operations. Her presence is key in ensuring BHB continues to run efficiently while maintaining healthy margins. John Mercier serves as Chief Lending Officer and oversees loan strategies with a clear emphasis on solid underwriting and managing risk across a diverse portfolio.

The broader executive team includes Marion Colombo, EVP of Retail Delivery, who oversees branch operations and customer experience, and Jason Edgar, President of Bar Harbor Wealth Management, who heads up investment and trust services. Together, this team blends growth and tradition, maintaining the bank’s small-town roots while executing on smart, scalable strategies.

Valuation and Stock Performance

BHB is currently trading with a price-to-earnings ratio around 10.7, putting it on the more attractively valued side compared to many regional banking peers. The stock’s price-to-book ratio sits just under 1, indicating that shares are trading close to the company’s actual book value. For value-minded investors, that often signals a margin of safety, especially when paired with consistent earnings and stable operations.

The dividend yield sits at roughly 4 percent, supported by a conservative payout ratio of around 43 percent. It’s a yield that doesn’t stretch the balance sheet but still provides meaningful income. Over the past year, the stock has moved within a range of $23.26 to $38.47. While it’s off its highs, recent weakness hasn’t been unusual given the broader environment for regional banks. The year-to-date performance is slightly down, but it’s worth remembering that this name has never been about chasing short-term spikes. Its long-term track record of consistent dividends and solid earnings gives it staying power.

Risks and Considerations

While Bar Harbor Bankshares is fundamentally sound, there are a few risk factors that investors should keep in mind. Regional banks are facing a more complex landscape, including tighter regulatory oversight and increased competition for deposits. As interest rates have moved up, the cost of funding has followed, putting pressure on net interest margins. The bank will need to navigate those headwinds with the same care it has shown in the past.

There’s also geographic concentration to consider. BHB is deeply rooted in northern New England, and while that gives it a strong local presence, it also means regional economic changes could have an outsized impact. Slower growth or demographic shifts in these areas might limit new lending or deposit opportunities. On the technology side, like all banks, Bar Harbor must continue to invest in digital security and infrastructure to stay ahead of cybersecurity threats and evolving customer expectations.

Managing credit risk will be another ongoing priority. Though BHB’s loan book has remained healthy, no bank is immune to broader economic slowdowns, especially if those ripple through small businesses or local housing markets.

Final Thoughts

Bar Harbor Bankshares brings together a thoughtful management team, disciplined operations, and a business model built for consistency. It may not be the most talked-about name in the financial world, but it quietly delivers. Its valuation looks reasonable, the dividend is sustainable, and its leadership has shown an ability to manage through cycles without overreacting or chasing trends.

For those looking for reliability and a measured approach to banking, BHB stands out. It’s not about rapid growth or bold pivots. It’s about doing the basics well, year after year. And sometimes, that’s exactly what works.