Updated 4/11/25

Originally founded in 2004 and listed publicly in 2018, Bank7 carved out its spot in the banking world by focusing on smaller business lending, often in industries larger institutions overlook. That approach hasn’t just built a loyal client base—it’s also produced impressive financials. With a lean structure and strong asset quality, the bank has been consistently profitable while maintaining an agile balance sheet. And when you pair that with a rising dividend, suddenly you’re looking at a small-cap stock that’s not so easy to ignore.

Recent Events

Bank7’s most recent performance makes a pretty strong case for itself. Over the past year, it delivered nearly 92% revenue growth and a massive 939% jump in quarterly earnings. That’s not a typo. Even more impressive is how they did it—without piling on debt. The company holds more than $240 million in cash and only about $1.87 million in total debt. That kind of clean financial position is a major advantage, especially in a higher interest rate environment.

Investors have taken notice. The stock is up more than 28% over the past 12 months, far outpacing broader market benchmarks. But despite the strong rally, the stock still trades at just 7.23 times earnings—well below typical banking multiples. That low valuation, combined with high profitability and minimal leverage, gives investors a strong margin of safety.

The stock has pulled back from its 52-week high of $50.26 and now sits around $34.76. That pullback, in context, doesn’t look like a red flag—it looks like a more reasonable entry point after a strong run.

Key Dividend Metrics

🪙 Forward Dividend Yield: 2.69%

📈 5-Year Average Yield: 2.45%

💵 Trailing 12-Month Dividend Rate: $0.69

📆 Most Recent Dividend Date: April 4, 2025

🚨 Ex-Dividend Date: March 20, 2025

🧾 Payout Ratio: 18.6%

📊 Dividend Growth (YoY): Up from $0.69 to $0.96

🛡️ Balance Sheet Strength: $240M in cash, $1.87M in debt

📚 Book Value per Share: $23.46 (vs. ~$34.76 share price)

Dividend Overview

Bank7’s dividend may not have a huge yield, but what it does have is consistency—and room to grow. The company currently pays out just 18.6% of its earnings as dividends. That’s very conservative, particularly in the banking world where many peers hand out 30% to 50% of profits.

This lean payout policy leaves plenty of dry powder. Should management choose to raise the dividend again—or if earnings continue to climb—it can do so without breaking a sweat. And with profitability numbers this strong, it’s not hard to see that happening. Net income margins are nearly 47%, and return on equity is brushing 24%. Those are strong numbers even for much larger banks.

The current 2.69% yield sits comfortably above the 5-year average of 2.45%, which might catch the attention of income seekers looking for above-average yields with stability. And because of the steady quarterly payout cadence, investors can plan on a regular income stream. The most recent dividend was paid on April 4, following a March 20 ex-dividend date.

Dividend Growth and Safety

This is where Bank7 really starts to differentiate itself. Over the past year, the dividend has jumped from $0.69 to a forward rate of $0.96—a 39% increase. That’s no token bump. It’s a real signal that the board and management see continued strength in earnings and want to share that with shareholders.

What’s reassuring is that the bank didn’t have to stretch to make that increase happen. The payout ratio stayed below 20%, even with the higher dividend. That speaks volumes about the underlying business strength. Management clearly values capital discipline and has been careful not to overextend.

With insiders holding over 56% of shares, you can be sure their interests are aligned with shareholders. These folks are collecting the same dividends and watching the same payout increases, which adds another layer of confidence to the picture.

The company’s cash position, low debt, and high profitability give it a strong foundation. While some banks get aggressive with leverage or stretch for yield, Bank7 has taken a different path—one grounded in steady, sustainable performance.

And with only about 9.45 million shares outstanding, the total dividend obligation is relatively small. That means continued dividend increases wouldn’t require major shifts in capital allocation.

There’s no flashy headline here, no complex strategy to decode. Just a company quietly doing what dividend investors want: running a profitable business, managing risk carefully, and sharing the rewards with shareholders.

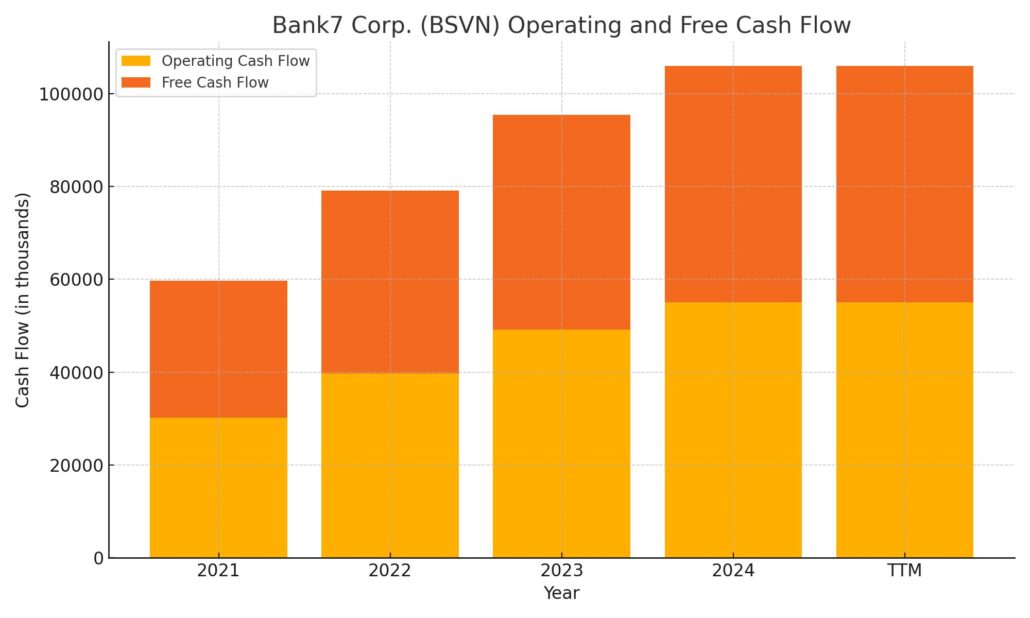

Cash Flow Statement

Bank7 Corp.’s cash flow picture over the trailing twelve months reflects both financial strength and operational momentum. Operating cash flow came in at $55 million, showing consistent growth from prior years and reinforcing the bank’s ability to generate solid internal cash from its core business. Free cash flow followed closely at nearly $51 million, after factoring in modest capital expenditures. This steady cash generation adds to the bank’s ability to support its dividend and maintain financial flexibility without leaning on external funding.

On the investing side, the numbers flipped positive with $80 million in inflows, a sharp contrast to significant outflows in the previous years. This change suggests a period of asset repositioning or reduced investment activity, possibly linked to balance sheet optimization as interest rates shifted. Financing activities, meanwhile, showed $82 million in outflows—likely tied to repayments and return of capital. Still, with over $234 million in ending cash and minimal debt, Bank7 is sitting on a sizeable cushion. That cash position speaks to prudent financial management and leaves room for continued shareholder returns or selective growth opportunities.

Analyst Ratings

📊 Bank7 Corp. (BSVN) has recently drawn positive attention from analysts, with a general consensus leaning toward optimism. 🟢 Among the three analysts covering the stock, two currently rate it a buy, while one maintains a hold rating. The average price target is $50.67, suggesting a potential upside of around 17.26% from the recent trading level of $43.21.

🔍 Notable analyst updates include Piper Sandler reaffirming an overweight rating and setting a price target at $55.00. Meanwhile, Keefe, Bruyette & Woods also expressed confidence, maintaining an outperform rating with a target of $52.00. These consistent signals show a belief in the company’s ability to continue delivering strong results in a competitive banking environment.

📈 Much of the bullish sentiment comes from Bank7’s impressive financial performance. With a profit margin nearing 47% and return on equity around 24%, it’s clear that the bank is managing its capital well. Analysts have highlighted the combination of efficient operations, conservative lending practices, and consistent earnings as driving forces behind their ratings. ⚠️ That said, some note the broader headwinds facing the banking sector, such as interest rate pressures and regulatory developments, as factors worth monitoring going forward.

Earning Report Summary

Bank7 Corp. kicked off 2025 with a mixed bag in its first-quarter earnings. Net income came in at $10.3 million, which was a step down from $11.3 million during the same stretch last year. That’s about an 8% dip. Earnings per share also followed suit, landing at $1.08 compared to $1.21 a year ago.

Earnings Beat, But Revenue Missed the Mark

While profits were a bit lighter, the bottom line still managed to come in ahead of analyst expectations. EPS was projected around $1.02, so they cleared that bar. On the flip side, revenue came in at $22.6 million—just shy of the $23 million forecast. Not a huge miss, but noticeable.

What’s Behind the Numbers

Management pointed to a few headwinds—namely, a tougher interest rate environment and some pressure on the cost side. Operating expenses crept up, squeezing margins a bit. Still, leadership made it clear they’re staying the course with a conservative lending strategy, and the bank’s capital position remains solid.

Looking Ahead

Even with a softer quarter, Bank7’s tone was steady and confident. The focus remains on controlled growth and keeping things tight on risk and cost. The team sees long-term opportunities and isn’t looking to chase short-term wins at the expense of their balance sheet. They’re keeping things efficient, cautious, and very deliberate.

Chart Analysis

BSVN’s one-year price chart reveals a clear story of momentum building through mid-2023, peaking toward the end of the year, and then gradually cooling off. The chart shows an initial phase of steady accumulation through spring and early summer, followed by a strong upward breakout that pushed the stock from around $30 to a high near $45.

Moving Averages Turning

The red line represents the 50-day moving average, and the blue line is the 200-day. For much of last year, the 50-day rode above the 200-day, confirming strong upside momentum. That started shifting in early 2024. The 50-day began curling downward in February, and now in April, it has crossed under the 200-day. This crossover often signals a longer-term change in trend and is something to take seriously.

The stock price itself has dropped sharply in the past few weeks, now falling below both moving averages. This kind of breakdown tends to indicate weakness, with the price struggling to find a near-term floor.

Volume Behavior

Volume remained light for most of the year until the recent selloff, where several spikes are clearly visible. These volume bursts during the decline suggest stronger conviction on the downside, meaning sellers have been in control. There hasn’t been a significant volume spike on a green day that would hint at strong buying interest stepping in—at least not yet.

Relative Strength Index

The RSI dipped below 30 recently, entering oversold territory. That’s worth noting because this level often attracts interest from buyers looking for value, especially when the underlying company is fundamentally solid. However, the RSI has lingered in the lower range for a while now, which could indicate prolonged weakness or a broader shift in sentiment.

Overall Price Structure

From a structural standpoint, the rally last summer looks like a classic markup phase, with price consolidating around higher levels through the fall. The plateau seen from November to January formed a soft top, followed by a gradual deterioration. What’s unfolding now resembles a markdown phase, where the price breaks key support levels and slides back toward earlier consolidation zones.

The chart tells us the stock is in the later stages of a cycle. The crossover of moving averages, persistent low RSI, and sharp drop in price support that picture. The next few weeks will be key to seeing if the stock finds a base or continues sliding.

Management Team

Bank7 Corp. is guided by a management team that has kept a steady hand on the wheel through various economic cycles. Tom Travis, who has served as CEO since 2014, brings a grounded, practical approach to leadership. His focus has been clear from the start—grow responsibly, lend conservatively, and protect the balance sheet. Alongside him, Jason Estes, the bank’s President and Chief Credit Officer, plays a crucial role in maintaining the quality of the bank’s loan book. His experience in risk assessment has helped Bank7 avoid the pitfalls that sometimes trip up smaller regional lenders.

On the financial side, CFO Kelly Harris manages the numbers with a close eye on efficiency and liquidity. This leadership group, paired with a seasoned board, has delivered results without chasing growth for growth’s sake. They’ve maintained a strong return on equity while keeping debt levels low and capital ratios healthy. You can see the fingerprints of that discipline across the company’s performance metrics. There’s also a strong insider ownership presence here, which often translates to decisions that favor long-term stability over short-term headlines.

Valuation and Stock Performance

At its current level around $34.86, BSVN is down from its 52-week high of $50.26 but still well above the $26.07 low posted over the past year. The pullback from the highs has been part of a broader cooling across the regional banking space, especially with ongoing uncertainty around interest rate direction and tightening lending conditions. But even with the decline, Bank7 remains attractively priced based on fundamentals. Its trailing price-to-earnings ratio is just 7.23, which is well below the industry average and suggests the stock is trading at a discount relative to its earnings power.

On the income side, the dividend yield sits at 2.69%, with a very manageable payout ratio of 18.6%. That tells you there’s room for continued dividend growth without putting stress on capital. Over the last five years, the average yield has hovered around 2.45%, so the current figure is comfortably above the norm. With strong operating metrics like a return on equity of nearly 24% and solid free cash flow generation, the valuation picture here remains compelling for those who appreciate a more measured, sustainable path to returns.

Risks and Considerations

Even the most stable names come with their share of potential bumps. In Bank7’s case, the biggest risks center on macroeconomic forces and the banking sector’s changing regulatory environment. Interest rate swings can impact both net interest margins and lending activity. As rates have moved higher, some banks have benefited from wider spreads, but it also raises the cost of funding and slows loan demand. If the Fed pivots or if rates remain elevated longer than expected, that dynamic could weigh on earnings.

The bank’s concentration in specific geographic markets like Oklahoma and Texas also presents some exposure to regional economic shifts. If those local economies were to slow, Bank7 could feel the impact more directly than a national bank with wider diversification. Also, while the bank’s conservative approach has worked well so far, it may limit its ability to pivot quickly or take advantage of emerging trends that call for a more aggressive posture. It’s a balancing act—staying disciplined while remaining competitive.

Competition from both traditional banks and fintech platforms is another factor. As more consumers and businesses adopt digital banking tools, regional banks are under pressure to keep up technologically without sacrificing service quality or taking on unnecessary costs. Bank7 has made strides here, but it’s something to keep on the radar.

Final Thoughts

Bank7 Corp. offers something that’s become rare in the financial sector: consistency. It’s not trying to be the biggest player in the room, but it knows its strengths and sticks to them. The management team has proven it can operate profitably through different economic environments, all while keeping risk in check. That kind of steady execution builds trust over time.

The current valuation gives investors a margin of safety, especially with a low payout ratio and a dividend that’s not just sustainable but has room to grow. Add to that strong returns on equity and a clean balance sheet, and it’s clear there’s a lot to like for those who favor long-term quality over short-term excitement.

Of course, nothing is without risk. But with Bank7, those risks are measured and understood. It’s a name that won’t always make headlines, but it may just keep showing up in portfolios that value discipline, reliability, and income growth with a side of upside.