Updated 4/11/25

Scotiabank, officially known as The Bank of Nova Scotia, is one of those legacy financial institutions that’s been quietly delivering for generations. Headquartered in Toronto and founded way back in 1832, the bank has grown to become one of Canada’s “Big Five” banks. But it’s not just a domestic play—it has a broad international presence, especially in Latin America and the Caribbean. That mix of steady homegrown business and higher-growth international exposure gives it a unique profile.

For dividend investors, BNS offers something valuable: consistency. Even during turbulent periods, the bank has maintained its dividend, showing a level of dependability that’s becoming harder to find. While the market has thrown its fair share of curveballs lately, Scotiabank continues to do what it’s done for nearly two centuries—deliver stable returns and reward patient shareholders.

Recent Events

The latest earnings release wasn’t exactly a blockbuster. Net income was down sharply, with earnings off nearly 47% compared to the same quarter last year. That kind of drop would be alarming for most companies, but for banks, it’s not uncommon when they’re building up loan loss provisions in response to economic uncertainty. Scotiabank, with its significant exposure to international markets, is particularly sensitive to global shifts.

Revenue also declined, dropping 8.3% year-over-year to $28.86 billion over the trailing twelve months. The pressure came from both domestic and international operations, but especially from Latin America, where currency fluctuations and slowing economic growth weighed on results.

Despite those hurdles, the bank stayed the course with its dividend. It’s scheduled to pay out its next dividend on April 28, 2025, with the ex-dividend date landing on April 1. That consistency, even amid soft earnings, tells you how seriously the bank takes its dividend history.

Key Dividend Metrics

📈 Forward Dividend Yield: 6.35%

💵 Annual Dividend Rate: $2.97

📅 Ex-Dividend Date: April 1, 2025

📊 Payout Ratio: 87.42%

📉 5-Year Average Dividend Yield: 5.72%

🔁 Most Recent Stock Split: 2-for-1 in 2004

Dividend Overview

Scotiabank is offering a dividend yield that’s hard to ignore—6.35% on a forward basis. That’s among the highest yields you’ll find in the North American banking sector, and it’s backed by a long track record of consistent payments.

The trailing yield looks even juicier at 9.32%, but that’s largely due to the stock’s recent price pullback. The yield jumped because the price fell—not because the bank hiked its dividend. Still, it’s a strong sign that investors are being compensated for weathering some short-term market turbulence.

Yes, the payout ratio is high. At 87.42%, it’s not leaving a huge margin for error. But this isn’t new territory for Scotiabank. It’s had years where earnings dipped and the payout ratio moved higher temporarily, only to balance out as the cycle turned. What’s reassuring is the bank’s immense cash position—more than $444 billion in total cash—giving it the flexibility to maintain that dividend if needed.

Dividend Growth and Safety

Scotiabank has a pretty clean dividend history. With the exception of a freeze during the early days of the pandemic (a move that followed regulatory guidance for all Canadian banks), it’s been growing its dividend steadily for years. That consistency builds confidence, especially when you’re relying on the income.

The pace of growth has slowed a bit recently. The bank is focusing more on preserving capital and strengthening its balance sheet than aggressively raising dividends. That’s probably the right move, given the earnings pressure and the unpredictable rate environment.

Return on equity sits at 8.01%, which is decent but not stellar. It shows the bank is still profitable, but there’s room for improvement in efficiency and margin growth. Meanwhile, its book value per share is $68.08, and the price-to-book ratio is a modest 1.08. From a valuation standpoint, that’s relatively conservative for a major bank, and it adds a layer of downside protection for long-term holders.

There’s also something worth noting on the sentiment front—short interest has climbed, with a short ratio of 23.66. That’s quite high, suggesting there are traders betting against the stock. For income investors, that’s less of a concern unless it starts to affect the dividend, which doesn’t seem to be the case for now.

The bank has made it clear it’s not trying to grow at any cost. The focus is on operational strength and keeping the dividend intact. With a profit margin still over 23% and a stable operating base, that strategy makes sense.

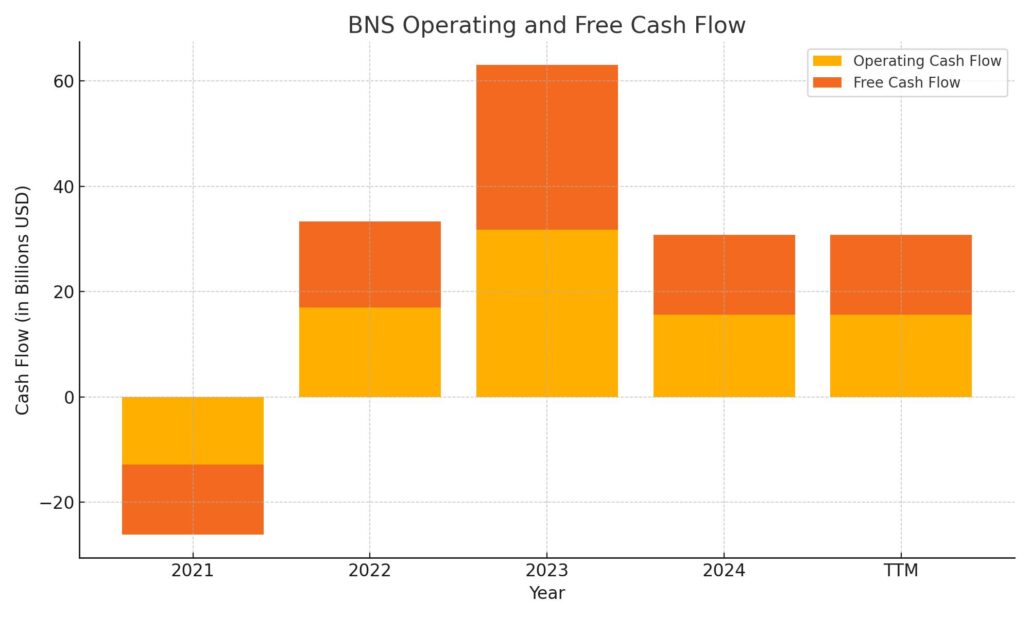

Cash Flow Statement

Scotiabank’s trailing twelve months (TTM) show a solid resurgence in free cash flow, reaching $15.16 billion. That marks a strong rebound from the prior year, where free cash flow had been nearly double at $31.28 billion, but still reflects robust internal capital generation. Operating cash flow came in at $15.65 billion, sharply down from the previous year’s $31.72 billion, signaling a normalization after a particularly strong stretch in fiscal 2023. Capital expenditures remained modest at $489 million, showing the bank’s typical discipline on the investment side.

On the financing side, BNS continued its trend of net cash outflows, spending more cash than it raised. The bank repaid $3.55 billion in debt and spent another $300 million on share repurchases, while raising just $1 billion in new debt and issuing nearly $2.95 billion in new equity. The end cash position decreased to $9.41 billion, down slightly from $10.17 billion the year before. While overall cash flows are tighter than the previous year, the bank is clearly prioritizing liquidity and shareholder returns while keeping investment spending lean.

Analyst Ratings

📊 Bank of Nova Scotia (BNS) has recently received mixed attention from analysts, with most maintaining a neutral stance. The consensus among analysts hovers around a “Hold” rating. 📉 The average 12-month price target currently sits near $71.20, suggesting some moderate upside from current trading levels. This reflects a wait-and-see approach as the bank navigates challenges across both its domestic and international portfolios.

📉 RBC Capital, for instance, maintained its “Sector Perform” stance earlier this year, trimming its price target slightly from $83 to $81. The shift was largely tied to pressures in BNS’s Latin American segment, where economic and currency headwinds have made growth less predictable. 🌎 While BNS continues to invest in international expansion, especially in Pacific Alliance countries, the returns are still uneven, making some analysts hesitant to push their ratings higher.

🔍 Barclays came out with an “Underweight” rating and a $70 target price earlier this year, pointing to elevated credit costs and slower earnings momentum. While not a dramatic downgrade, it signals a more cautious view of the bank’s near-term growth potential.

🎯 The overall analyst sentiment reflects a measured confidence in BNS’s ability to maintain its dividend and manage risk, even if capital appreciation may take longer to play out.

Earning Report Summary

Scotiabank kicked off fiscal 2025 with a mixed but mostly encouraging first-quarter performance. The bank posted adjusted earnings of C$2.2 billion, or C$1.76 per share, which came in above what most analysts were expecting. That beat was fueled by stronger-than-expected revenue growth in some of its less-talked-about segments, particularly capital markets and wealth management.

Solid Performance Outside the Core

One of the more interesting takeaways this quarter was how well Global Banking and Markets did. Earnings in that segment jumped 33% compared to the same quarter last year. Meanwhile, Global Wealth Management also impressed, with a 23% increase in earnings. That bump was largely thanks to higher mutual fund fees and an uptick in assets under administration. These aren’t always the first places investors look when analyzing a Canadian bank, but they clearly played a big role this time around.

A Softer Showing at Home

Back on home turf, things were a bit more muted. Canadian Banking brought in C$914 million in earnings, which was down about 6% from the year before. The drop was mostly due to an increase in loan loss provisions—essentially, the bank setting aside more capital just in case borrowers start falling behind. Given the interest rate environment, that kind of caution makes sense.

International Banking Holding Its Own

Internationally, the bank turned in a decent performance. Earnings came in at C$657 million. What stood out more than the earnings figure, though, was how efficiently the international operations are running. The productivity ratio improved to 51%, which shows they’re keeping a close eye on expenses.

Capital Position and Credit Risks

On the capital side, Scotiabank has continued to strengthen its position. Its capital ratio is up about 140 basis points since the end of 2022, and deposits grew 4% over the past year. That helped bring the loan-to-deposit ratio down to 105%, which adds some stability going forward.

Credit risks, however, are still hanging around. The bank booked C$1.2 billion in provisions for credit losses this quarter, reflecting ongoing pressure from higher borrowing costs and inflation.

Despite these headwinds, management still believes earnings growth for 2025 could land at the higher end of their 5% to 7% target range, as long as economic conditions don’t throw too many surprises.

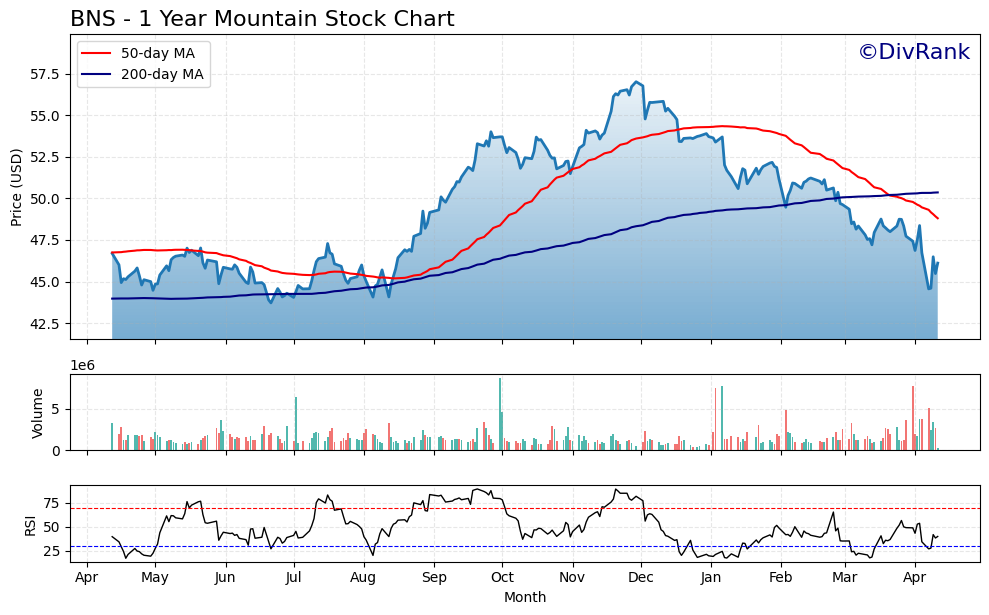

Chart Analysis

BNS has had a volatile year, and the one-year mountain chart captures that rollercoaster of sentiment and price action. Starting last spring, the stock hovered just under $47 before dipping toward $44 by early summer. What followed was a sharp and sustained rally through the fall, taking the price well past $55. That move was supported by rising volume and positive price momentum, signaling strong buying interest at the time.

Moving Averages Tell the Trend Story

The red 50-day moving average made a strong upward move starting in August and peaked in early January, closely tracking the price during its ascent. Since then, the 50-day has turned down sharply, crossing under the 200-day average in March—commonly known as a death cross. This shift typically points to a loss of short-term momentum and suggests caution. Meanwhile, the 200-day average (in blue) has stayed relatively steady but is starting to flatten out, showing that the longer-term trend is losing steam.

Volume and Price Behavior

Volume spikes are noticeable around key inflection points, especially in late December and again in late March. The increased volume on down days more recently implies heavier selling pressure, particularly as the price broke below the 200-day moving average. Still, there’s been a slight bounce in early April, with the price trying to reclaim the $46–$47 zone, though volume hasn’t confirmed a strong reversal yet.

RSI Suggests Oversold Reactions

Looking at the RSI, the stock dipped below 30 multiple times in March and April, entering oversold territory. Historically, these levels have triggered some degree of bounce, which is exactly what’s playing out now. Back in early June and again in late September, similar RSI dips preceded short-term rallies. The recent pattern suggests there’s at least temporary relief after sustained selling.

Price Structure Hints at a Support Zone

There’s a noticeable shelf of price support around $44, where the stock found footing multiple times over the past year. Each time BNS approached this level, it managed to recover—although with increasingly less conviction. That could become a critical line to watch going forward. A break below that level might open up more downside, but for now, it seems to be holding.

The chart paints a picture of a stock that’s gone from strong momentum to cautious re-evaluation. The big run-up in the back half of 2023 brought in some optimism, but the recent pullback, capped by a bearish moving average crossover, suggests the market is looking for clarity before making its next move.

Management Team

Scotiabank’s leadership has evolved over the past couple of years, signaling a clear shift in its strategic direction. At the helm is Scott Thomson, who stepped into the role of President and CEO in late 2022. He brings deep operational and strategic experience from his time leading Finning and serving in executive roles at Talisman Energy. His leadership so far seems focused on tightening efficiency while strengthening the bank’s international footprint, particularly in key growth regions.

Backing him is a strong executive bench. Raj Viswanathan, Group Head and CFO, has been instrumental in managing the bank’s capital and financial direction. Francisco Aristeguieta, who leads International Banking, adds significant value with his global banking experience. In 2024, Travis Machen took over as Group Head of Global Banking and Markets after previous leadership roles at major U.S. investment banks, giving the bank a more competitive edge in capital markets.

The rest of the executive team rounds out Scotiabank’s leadership depth. Jacqui Allard oversees Global Wealth Management, and Aris Bogdaneris heads Canadian Banking. Together, this leadership group brings a mix of global insights and operational rigor, which is critical as Scotiabank adjusts to shifting economic conditions both at home and abroad.

Valuation and Stock Performance

Scotiabank’s stock price has seen its share of turbulence over the past year. After peaking above $57, shares have retreated and are now hovering just under $46. The move reflects broader economic uncertainty, internal restructuring, and market skepticism around global banking exposure. Even so, it’s not all negative. The price-to-earnings ratio currently sits around 13.4, which is in line with historical averages and fairly valued relative to other large Canadian banks.

The average analyst price target is about $71.20, which suggests room for upside if earnings stabilize and macro headwinds ease. A lot of that depends on how the bank’s international strategy plays out and whether loan losses stay under control. So far, there’s a sense that the market is being cautious but not outright bearish.

Dividend investors have held steady with BNS largely because of the income it generates. The current forward yield of 6.35% is well above average for the sector. With a payout ratio nearing 87%, it’s generous—but not yet a red flag. The dividend remains covered, though any significant earnings drop could tighten that margin.

Risks and Considerations

There are a few things that could weigh on Scotiabank’s path forward. One of the biggest is its exposure to emerging markets, especially in Latin America. While these regions can offer higher growth, they also come with increased risk—political instability, inflation, and currency swings can all dent performance in unpredictable ways.

Closer to home, the Canadian housing market continues to loom as a potential pressure point. With rates having risen sharply and household debt levels remaining elevated, there’s always concern about credit quality. A meaningful uptick in defaults would hit the bank’s balance sheet and potentially force it to scale back growth plans or reassess capital priorities.

There are also more modern challenges to consider. Like all large financial institutions, Scotiabank is navigating cyber threats, increased regulatory scrutiny, and rising operational costs linked to compliance and technology upgrades. While the bank has been investing heavily in these areas, they remain ongoing considerations for anyone tracking risk.

Lastly, global macro trends—slowing GDP growth, inflationary pressures, and geopolitical instability—can feed into tighter financial conditions. For a bank like Scotiabank with its broad footprint, these crosscurrents make for a tougher environment in which to predict earnings with much precision.

Final Thoughts

Scotiabank is a complex institution going through a period of adjustment. The leadership team is reshaping priorities and focusing on execution, while the business shifts to find stability in both developed and emerging markets. There’s a lot going on beneath the surface—some of it encouraging, some of it requiring a close watch.

With a long track record, solid capital base, and consistent dividend history, the stock continues to hold appeal for income-seeking investors. But at the same time, the macroeconomic landscape and operational risks can’t be ignored. How well the bank balances its international ambitions with home-market fundamentals will likely determine the kind of value it can deliver in the years ahead.