Updated 4/11/25

Based in Wisconsin, BFC runs a network of community banks that stick to the fundamentals—relationship-based lending, conservative underwriting, and long-term growth through smart acquisitions. This is a bank that knows its lane and stays in it. It focuses on serving small and mid-sized businesses, along with personal banking clients who value a hometown approach. As big banks chase scale and technology, Bank First is building loyalty through trust and local presence. That approach has helped it quietly grow into a strong regional player with an enviable profitability profile.

Now, we’re not just here to talk about the bank’s model. The real question for dividend investors is this: does BFC deliver income you can count on?

Recent Events

Over the past year, BFC’s stock has moved steadily higher—up over 25% while the broader market gained just a few percent. That kind of outperformance from a small regional bank says a lot. Even so, it hasn’t been a smooth ride under the surface.

The most recent quarterly numbers showed a significant pullback in revenue, down nearly 39% from the year before. Net income took a hit too, dropping close to 50%. That kind of drop would usually rattle investors, but BFC held firm thanks to its reputation for being disciplined and well-capitalized.

The banking sector has been navigating a tougher rate environment, and smaller banks are especially vulnerable when margins compress. BFC isn’t immune—but it’s managing the shift with quiet efficiency. Its profit margin remains north of 40%, and return on equity is a solid 10%. Those aren’t numbers you see every day in regional banking.

📊 Key Dividend Metrics

💰 Forward Dividend Yield: 1.86%

📈 5-Year Average Yield: 1.29%

🔁 Payout Ratio: 23.85%

🗓️ Dividend Date: April 9, 2025

📉 Ex-Dividend Date: March 26, 2025

🏦 Trailing Annual Dividend Rate: $1.55

🚀 Forward Annual Dividend Rate: $1.80

Dividend Overview

Let’s be honest—BFC isn’t a high-yield name. You’re not getting 5% here, and that’s okay. What makes this dividend appealing is how it’s handled: thoughtfully, conservatively, and with a clear eye toward sustainability.

The payout ratio tells the story. At just under 24%, the bank is handing out less than a quarter of its earnings in dividends. That’s a wide margin of safety. If profits dip, the dividend doesn’t need to. If profits grow, there’s room for the payout to follow. This kind of discipline is exactly what income-focused investors look for when assessing the reliability of a dividend.

There’s also strong coverage from earnings. With trailing twelve-month EPS at $6.50 and a dividend of $1.80, BFC is comfortably covering its payout more than three times over. That’s not just sustainable—it’s rock-solid.

And let’s not forget the trend. The current yield is sitting above the five-year average, signaling two things: the dividend has been growing, and the stock price hasn’t outpaced that growth to the point where the yield gets compressed. It’s a nice balance of price appreciation and income growth.

Dividend Growth and Safety

BFC has been gradually ramping up its dividend over the years, and it’s done so without drama. The increase from $1.55 to $1.80 represents a healthy boost—over 16%—but what’s more important is the pattern behind it. This isn’t a company reacting to market pressure or trying to impress. It’s just quietly delivering more income to shareholders as earnings grow.

What keeps that dividend safe? First off, cash. The bank has over $260 million in cash on hand, plenty to cover its payout multiple times. Add in its modest debt load and strong capital base, and there’s little reason to doubt its ability to keep delivering, even in a more challenging environment.

Another quiet strength? The people running the show have skin in the game. Insiders own over 10% of the stock, and institutions own more than a third. That kind of alignment usually results in cautious, shareholder-friendly decisions—especially around dividend policy.

Volatility is also low. With a beta of just 0.32, BFC doesn’t swing wildly with market sentiment. That’s good news for anyone depending on consistent income, especially in uncertain times.

For investors who value income that’s not just paid, but paid reliably, Bank First Corporation checks a lot of boxes. The dividend isn’t loud or flashy—but it’s steady, growing, and backed by a business that knows how to keep things on track.

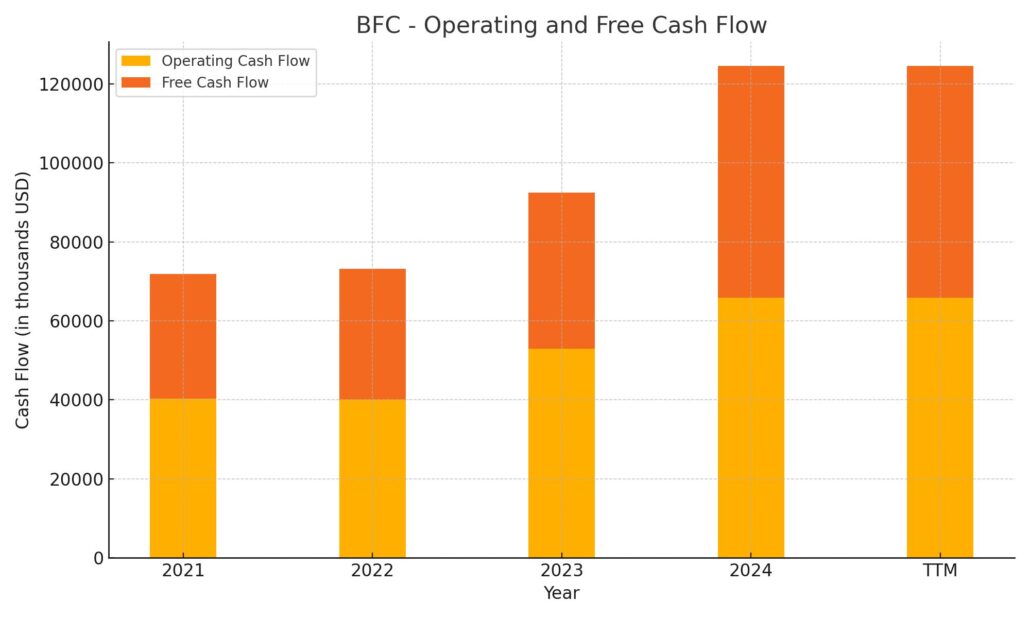

Cash Flow Statement

Bank First Corporation’s cash flow profile over the trailing twelve months paints a picture of operational strength and active financial maneuvering. Operating cash flow came in at $65.8 million, showing a solid increase from the prior year’s $52.9 million. That’s backed by rising free cash flow, now at $58.6 million—another sign the bank is generating consistent cash from its core business after accounting for capital expenditures. These figures reflect a steady capacity to support dividends, reinvestment, and balance sheet flexibility.

The real movement, though, shows up in investing and financing activities. The bank saw a significant outflow of $252.9 million from investing, which likely ties to acquisition activity or investment in securities. On the financing side, there was a hefty inflow of $200.9 million—mainly from new debt issuance totaling $140 million, partially offset by $44.1 million in repayments and $31.9 million in share repurchases. Despite the cash shuffle, BFC ended the period with over $261 million in cash, a slight increase from the year before, and a healthy reserve for a regional bank. The cash flow statement confirms BFC’s ability to support shareholder returns while managing capital needs with discipline.

Analyst Ratings

📊 Bank First Corporation (BFC) has been under the watchful eye of analysts, with recent evaluations reflecting a cautious yet stable outlook. 🧐 Piper Sandler, a notable firm in the financial sector, has maintained a “Neutral” rating on BFC, adjusting the price target from $99 to $104 in October 2024. 📈 This adjustment suggests a modest upside potential of approximately 7.66% from the current trading price.

🧠 The consensus among analysts leans towards a “Hold” rating, indicating a balanced view of the stock’s future performance. The average price target stands at $104, with projections ranging from $104 to $104, reflecting a clear consensus on the stock’s valuation.

🔍 This cautious stance is influenced by various factors, including the bank’s financial performance and market conditions. While BFC has demonstrated resilience, analysts are closely monitoring its earnings trajectory and shifts in economic sentiment to assess future prospects. 💼 Investors focused on dividend strength and long-term positioning may find the current analyst stance a useful gauge for short-term expectations.

Earnings Report Summary

Bank First Corporation wrapped up 2024 with earnings that showed both resilience and the impact of a more challenging rate environment. Net income for the fourth quarter came in at $17.5 million, translating to $1.75 per share. That’s down from $3.39 per share during the same quarter last year, when results were boosted by one-time gains. For the full year, earnings totaled $65.6 million, or $6.50 per share, slightly lower than the $74.5 million, or $7.28 per share, reported in 2023.

While the headline numbers dipped, there were encouraging signs across the board. The bank continued to grow its loan book and deposit base, with total loans climbing 5.2% year over year to $3.52 billion and deposits rising 6.7% to $3.66 billion. Total assets now stand at $4.5 billion, up from a year ago.

Net Interest and Noninterest Performance

Net interest income was solid at $35.6 million in the fourth quarter. The net interest margin settled at 3.61%, which was a touch lower than the previous quarter but still better than where it stood at the end of 2023. On the noninterest side, income came in at $4.5 million—a sharp drop from the prior year, largely because last year included a substantial one-time gain from selling a subsidiary. On the flip side, noninterest expenses were well managed, dropping to $19.3 million from nearly $29 million in the prior-year quarter.

Dividend and Balance Sheet Highlights

The bank’s board maintained its quarterly dividend at $0.45 per share, keeping pace with the previous quarter. That payout marks a 28.6% increase from the dividend at the same time last year. Asset quality also remains strong, with nonperforming assets holding at just 0.21% of total assets—a reassuring number for income-focused investors.

There were a few notable moves during the quarter as well. Bank First redeemed $8.3 million in debt securities tied to a previous acquisition and sold off $50 million in U.S. Treasury securities, which came with a realized loss of $7.8 million. These steps speak to a proactive approach in managing the balance sheet in a changing rate environment.

Overall, while the headline earnings softened, the underlying fundamentals and strategic decisions tell a story of a well-run bank navigating a shifting landscape with care.

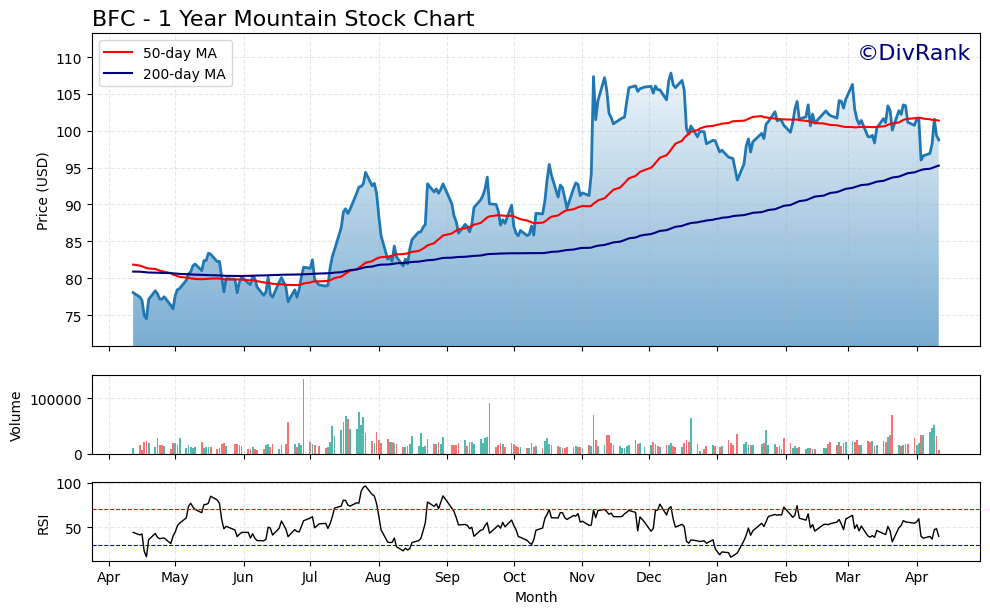

Chart Analysis

The chart for BFC over the past year shows a steady, upward progression, followed by some consolidation and healthy pullbacks. There’s nothing erratic or overly speculative here—just a measured climb with some natural pauses along the way.

Price Movement and Trends

The price made a strong move from the mid-$70s last spring to peaks above $105 by winter. That steep climb, especially in October and November, was accompanied by rising volume, hinting at broader market interest and perhaps institutional buying. After hitting highs, the stock has since leveled off in a range between $95 and $105, which is a typical cooling-off pattern after a strong run.

The 50-day moving average (in red) crossed above the 200-day moving average (in blue) in August, forming a golden cross—a classically bullish signal. That relationship has held through the winter, even as the stock moved sideways more recently. The 50-day line has begun to slope downward just a bit, suggesting a period of digestion rather than weakness. Meanwhile, the 200-day average continues its steady ascent, showing that the long-term trend remains intact.

Volume and Market Participation

Volume has remained relatively stable across the year, with a few notable spikes during the summer rally and again in late March. Those higher-volume days aligned with price breakouts or quick selloffs, both of which often attract traders but can also be moments of recalibration in the broader market. For the most part, volume is balanced, supporting the idea that the current levels are being accepted as fair value.

Relative Strength Index (RSI)

Looking at the RSI in the lower panel, the stock has spent much of the year above the midpoint line, indicating steady bullish momentum. It did approach overbought conditions a few times—particularly in late October and February—but those moments were followed by gentle corrections rather than sharp reversals. Currently, the RSI hovers around neutral territory, suggesting there’s room for the stock to move in either direction depending on broader sentiment and upcoming news.

In sum, BFC’s chart tells the story of a well-behaved stock that has steadily appreciated and is now consolidating its gains. The current setup reflects a stock that is finding its footing after a strong year, with support still intact and no major red flags in sight.

Management Team

Bank First Corporation is led by a seasoned management team with deep roots in Wisconsin’s banking landscape. At the helm is Michael Molepske, who serves as CEO and Chairman of the Board. He joined the bank in 2005 and was appointed CEO in 2008. Molepske brings a strong background in commercial lending and credit administration, having previously held senior roles at Associated Bank. His leadership has been instrumental in guiding Bank First through periods of growth and strategic acquisitions.

Supporting Molepske is Kevin LeMahieu, the Chief Financial Officer since 2014. LeMahieu’s extensive experience in public accounting and financial services has been vital in overseeing the bank’s financial operations and reporting. Another key figure is Jason Krepline, the Chief Lending Officer, who has been with Bank First since 2005. Krepline has played a significant role in expanding the bank’s lending portfolio, particularly in the Sheboygan market. The management team’s collective experience and strategic vision have contributed to the bank’s steady performance and growth.

Valuation and Stock Performance

Bank First’s stock has demonstrated resilience over the past year. As of the latest trading session, the stock is priced at $98.56. Over the past 12 months, the stock has seen a range between $74.90 and $110.49, reflecting investor confidence and the bank’s solid fundamentals. The stock’s beta of 0.30 indicates lower volatility compared to the broader market, which can be appealing to investors seeking stability.

In terms of valuation, Bank First trades at a trailing P/E ratio of 15.28, with a forward P/E of 14.37. The price-to-book ratio stands at 1.55, suggesting a premium valuation relative to book value. Analysts have set a 12-month consensus price target of $96.50, indicating a neutral outlook in the near term. The bank’s consistent earnings and prudent management approach continue to support its valuation metrics.

Risks and Considerations

While Bank First has shown strong performance, there are risks to consider. The banking sector is sensitive to interest rate fluctuations, which can impact net interest margins. Additionally, economic downturns could affect loan demand and credit quality. Bank First’s focus on the Wisconsin market means it’s more exposed to regional economic conditions. However, the bank’s conservative lending practices and strong capital position help mitigate some of these risks.

Another consideration is the competitive landscape. As larger banks and fintech companies continue to innovate, regional banks like Bank First must adapt to changing customer expectations and technological advancements. Maintaining a balance between personalized service and digital offerings will be crucial for sustained growth.

Final Thoughts

Bank First Corporation has established itself as a stable and well-managed regional bank. Its experienced leadership, consistent financial performance, and strategic growth initiatives position it well in the current banking environment. While there are challenges inherent in the sector, Bank First’s prudent approach and strong community ties provide a solid foundation for continued success.