Updated 4/11/25

Operating in the specialty chemicals space, Balchem is involved in everything from human and animal nutrition to pharmaceutical and industrial ingredients. It’s a unique niche, and the company has been building on it for years with a steady hand. This isn’t a business chasing short-term hype or making splashy headlines with high-risk ventures. Instead, Balchem focuses on sustainable, measured growth. The kind of approach that may not turn heads right away but adds up over time. It’s the long game—and they play it well.

With a clean balance sheet, disciplined cash flow management, and a surprisingly strong dividend track record, Balchem is the type of stock that can quietly anchor a dividend-focused portfolio. Let’s take a look at what’s been going on lately and then get into the details that dividend investors really care about.

Recent Events

The latest financials paint a clear picture: steady growth and strong fundamentals. Over the trailing twelve months, revenue reached just under $954 million, with year-over-year growth of 4.9%. That in itself isn’t remarkable, but the 26% jump in earnings is. It shows that Balchem isn’t just growing—it’s getting more efficient while doing it.

Margins are healthy. Operating margin sits at 20%, and net margin is a solid 13.5%. These numbers indicate a business that’s well-run and knows how to protect its profits, even when costs are rising or the economic picture gets choppy.

The balance sheet is straightforward and reassuring. Total debt is around $208 million, while cash on hand is close to $50 million. That puts the debt-to-equity ratio at just 18%, a comfortable level that gives Balchem room to maneuver. Free cash flow is strong too, coming in at $129.3 million. That’s more than enough to cover dividends and still invest in the business.

Over the past year, the stock is up about 5.5%. That’s not eye-popping, but it’s solid—and it edges out the broader market. With a beta of 0.75, this isn’t a stock that tends to bounce around much. For income investors, that’s often more of a feature than a bug.

Key Dividend Metrics 🧮

💵 Forward Annual Dividend Yield: 0.56%

📈 5-Year Average Yield: 0.50%

📆 Dividend Growth Streak: 13 years

🔁 Payout Ratio: 22.14%

💰 Forward Annual Dividend: $0.87 per share

📅 Next Ex-Dividend Date: December 26, 2024

📊 Free Cash Flow Coverage: Solid

Dividend Overview

Let’s start with what some might see as a drawback—the yield. At 0.56%, it doesn’t exactly scream “income stock.” But that doesn’t mean the dividend isn’t worth your attention. In fact, what makes it compelling is the consistency and sustainability behind it.

Balchem isn’t trying to impress with big payouts. They’re keeping things lean, using only about 22% of earnings to fund the dividend. That’s a strong signal that the company isn’t overextending itself and can easily keep the payments flowing—even during tougher periods.

The company has a mature shareholder base, with more than 90% of shares held by institutions. That kind of ownership often correlates with long-term thinking and less short-term drama. Short interest is minimal too, so there’s not a crowd betting against the stock.

In other words, this is a name that flies under the radar but is built on solid fundamentals. It’s not trying to be flashy. It’s just doing the job—paying a dividend, growing earnings, and keeping the balance sheet tight.

Dividend Growth and Safety

If you’re in this for the long haul, this is where Balchem really earns its spot in a portfolio. The company has raised its dividend every year for the past 13 years. That kind of consistency doesn’t happen by accident—it reflects a business that’s generating real, repeatable cash flow and isn’t afraid to share it with shareholders.

But it’s not just about the streak. It’s about how the dividend is funded. With over $129 million in free cash flow and only about $28 million in annual dividend payments, Balchem has a lot of breathing room. They can continue to reinvest in the business while steadily increasing the payout over time.

From a margin perspective, things look healthy. A 20% operating margin and an 11.7% return on equity show that Balchem is managing its resources well. It’s generating strong returns without needing to leverage up or cut corners.

This isn’t a stock for someone who needs high yield right now. But for investors who value consistency, safety, and a business model built for the long term, Balchem’s dividend profile offers something rare: a reliable base that grows quietly in the background.

More to come in the next section when you’re ready to dig deeper.

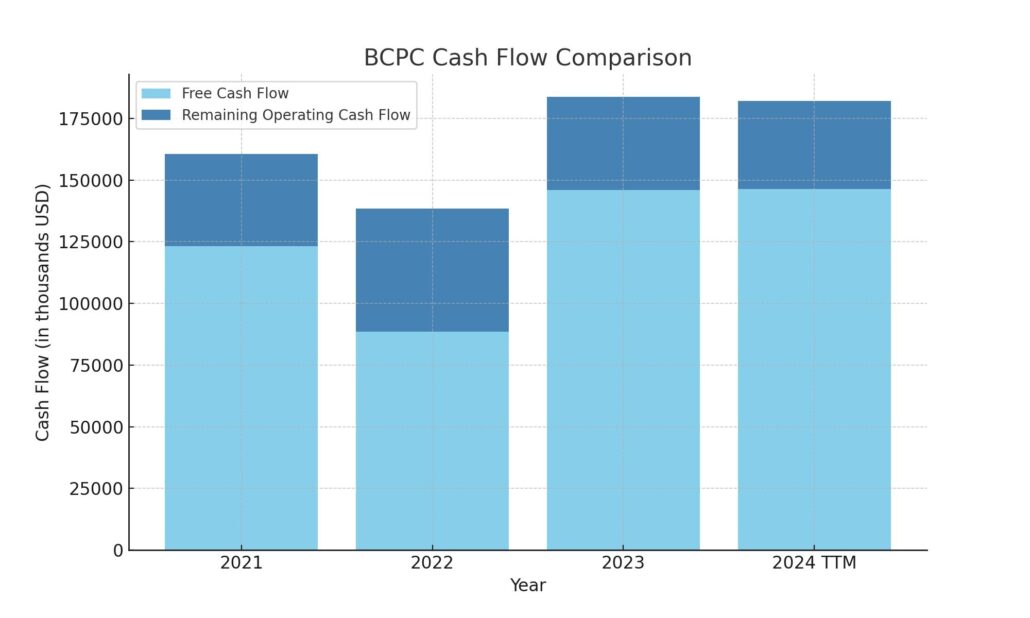

Cash Flow Statement

Balchem’s cash flow over the trailing twelve months reflects a steady operational engine. The company generated $182 million in operating cash flow, nearly flat compared to the previous year, showing consistent core earnings strength. With capital expenditures coming in at around $35.7 million, free cash flow totaled $146.3 million—again, nearly matching the prior year. This level of free cash generation shows the company has a solid grip on cost control and reinvestment discipline, maintaining a healthy balance between growth and cash preservation.

On the investing side, cash outflows were $59.7 million, a noticeable uptick from 2023 but far more controlled than 2022’s heavy $416 million investment year. Financing activity, however, saw a net outflow of $133.8 million, largely driven by $145.8 million in debt repayment. Balchem also modestly returned capital to shareholders through stock repurchases of $5.7 million. The cash position at year-end settled at $49.5 million, down from $64.4 million the year prior, but still stable given the scale of operations. Overall, the cash flow pattern shows a company that isn’t overextending itself, using its cash wisely to manage debt, invest selectively, and support shareholder value.

Analyst Ratings

📈 Balchem Corporation (BCPC) has recently drawn renewed interest from the analyst community, with HC Wainwright reaffirming a “Strong Buy” stance. 🟢 The firm also nudged its price target slightly higher, moving from $185 to $190. This subtle yet meaningful adjustment reflects growing confidence in the company’s operational consistency and long-term prospects.

🔍 The revised target suggests analysts see more room for upside, especially as Balchem continues delivering steady revenue growth and margin improvements. What stood out in recent earnings was the jump in profit despite a modest revenue climb—a sign of tight cost controls and solid execution. That’s likely what’s helping bolster sentiment among institutions following the stock.

💬 The broader analyst consensus also supports a bullish tilt. The average price target currently sits around $190.33, with most firms maintaining a favorable outlook. That implies a fair upside from where shares are trading now, reinforcing the idea that BCPC may still be flying a bit under the radar.

💡 With a stable cash position, conservative debt profile, and a growing free cash flow stream, it’s easy to see why analysts are leaning positive. They’re not just betting on past performance—they’re buying into the company’s capacity to keep compounding quietly over the years.

Earning Report Summary

Balchem wrapped up 2024 with a solid quarter and a strong finish to the year, delivering results that show steady momentum across its business segments.

Fourth Quarter Highlights

Revenue for the fourth quarter came in at $240 million, a noticeable bump of nearly 5% compared to the same time last year. It wasn’t just top-line growth—earnings showed real strength too. Net income rose to $33.6 million, which is a healthy 26% increase. Adjusted EBITDA also moved higher, landing at $62.8 million, up more than 13%. Earnings per share hit $1.03, and adjusted EPS came in slightly stronger at $1.13.

Cash flow was solid as well. Operating cash flow for the quarter totaled $52.3 million, while free cash flow came in at $39.8 million—both pointing to a company that’s generating reliable cash without needing to stretch.

Full-Year Performance

For the full year, total revenue reached $953.7 million, up just over 3% from 2023. That growth might not be flashy, but it’s consistent, which fits the company’s usual playbook. Full-year net earnings hit $128.5 million, climbing 18%, and adjusted EBITDA came in at $250.3 million—an increase of more than 8%. These are healthy numbers that show Balchem continues to execute well, even in a mixed economic environment.

What’s particularly notable is the cash discipline. The company generated $182 million in operating cash flow and turned that into $147.2 million in free cash flow. On top of that, they paid down nearly $120 million in debt over the course of the year and even managed to raise their dividend by a double-digit percentage. That speaks to both financial strength and shareholder focus.

Segment Breakdown

The Human Nutrition & Health segment continues to do the heavy lifting. Sales there grew to $147.3 million in the fourth quarter, up almost 7%, and operating earnings surged by nearly 34% to $33.8 million. That kind of margin expansion tells you the company is managing costs well while driving demand.

Specialty Products also turned in a solid performance, with sales climbing 6% to $32.9 million and operating earnings rising to $10 million—a gain of nearly 16%. It’s not often a smaller segment puts up that kind of growth, which adds another layer of confidence in the broader strategy.

Overall, it was a strong finish to a disciplined and growth-focused year for Balchem.

Chart Analysis

Balchem Corporation (BCPC) has had a somewhat choppy year on the chart, with some clear shifts in trend behavior and momentum signals that are worth noting.

Price Action and Moving Averages

Looking at the price movement, the stock made a strong push from late spring into early fall, climbing steadily past $180. But since then, the upward momentum has cooled off. The red line on the chart, representing the 50-day moving average, shows a clear peak and has been trending lower since around December. In contrast, the 200-day moving average, the thicker blue line, has remained on a steady upward climb but is now showing signs of flattening.

Recently, the price dipped below both moving averages, and the 50-day has now crossed under the 200-day, forming what’s commonly referred to as a death cross. While this isn’t necessarily a call for panic, it does signal a shift in sentiment and possible hesitation in the near term. The sharp drop at the far right of the chart also shows the stock breaking below some short-term support levels, which might take a little time to recover from.

Volume and RSI

The volume bars show that trading activity has picked up during periods of both sharp declines and rallies. Notably, the spikes in volume during the more recent downward moves suggest some distribution, where larger holders may have been stepping out. These aren’t extreme selloffs, but enough to note a change in tone from the accumulation phase seen earlier in the year.

As for the RSI at the bottom of the chart, the most recent move brought the reading down close to the oversold threshold of 30. This level tends to attract some buying interest, which is evident in the slight bounce off the lows, but momentum remains weak. Earlier in the chart, RSI spent quite a bit of time in the upper half, reinforcing the previous strength. Now, it’s more often in the lower zone, hinting that buyers have become more cautious or are waiting for stronger confirmation before stepping back in.

Overall, the chart reflects a transition from a strong uptrend into a more uncertain consolidation or potential downward phase. The technical signals suggest the need for patience, especially as the broader market and sector performance come into play.

Management Team

Balchem Corporation is led by Chairman, President, and CEO Ted Harris, who has been steering the company since 2017. He brings a deep background in specialty materials and chemicals, with prior leadership experience at Ashland Global Holdings and FMC Corporation. His approach has centered around focused growth, operational efficiency, and measured strategic expansion.

Martin Bengtsson serves as Executive Vice President and Chief Financial Officer. Since joining in 2019, his financial leadership has helped shape Balchem’s capital allocation strategy. His background includes over a decade at Honeywell in various senior finance roles, providing the kind of global corporate experience that translates well into Balchem’s growing footprint.

The broader leadership team includes Hatsuki Miyata as Executive Vice President, General Counsel, and Secretary, and Frederic Boned, who heads the Human Nutrition & Health segment. Martin Reid leads supply chain operations, while Job van Gunsteren manages the Specialty Products business. Together, the executive team blends legal, operational, and industry-specific know-how to keep the business running smoothly.

Balchem’s board includes a majority of independent directors and is structured to support transparent governance, long-term planning, and oversight without becoming overly involved in day-to-day decisions. This balance supports a long-term strategy rooted in sustainable growth and steady execution.

Valuation and Stock Performance

Balchem’s share price has moved up steadily over the past five years, gaining nearly 50% during that stretch. That kind of growth hasn’t come from headline-making moves, but rather from consistent performance and investor trust in the company’s stability and strategy.

From a valuation standpoint, the stock trades at a price-to-earnings ratio of roughly 38, slightly under its five-year average of around 43. That suggests the current valuation isn’t cheap, but it’s not excessive either when viewed in light of the company’s steady earnings and free cash flow generation. The price-to-book ratio sits near 4.25, a touch below the historical norm.

With a conservative debt-to-equity ratio of just 0.18, Balchem avoids the risks that come with over-leveraging. The company generates a return on equity of 11.4% and return on assets of 8.1%, supported by an EBITDA margin just over 24%. These are solid fundamentals that continue to attract long-term interest from institutional investors.

Analysts currently have an average price target of around $190, which leaves room for potential upside from recent levels. While the stock doesn’t trade at a discount, the valuation still reflects reasonable expectations based on long-term earnings growth and market position.

Risks and Considerations

Balchem has a strong track record, but it’s not without its vulnerabilities. Being in the specialty chemicals business, the company is exposed to fluctuations in raw material costs, which can be unpredictable. Shifts in commodity prices, changes in supplier dynamics, or disruptions in the supply chain could pressure margins if not managed carefully.

There’s also regulatory risk. A portion of Balchem’s products touch on food, health, and pharmaceuticals, all of which are heavily regulated industries. Any change in standards, especially across international markets, could increase compliance costs or delay product timelines.

The company’s growth strategy includes acquisitions, and while it’s been selective and strategic so far, M&A always comes with risks. Integration challenges, cultural fit, and unexpected liabilities are all part of the package, and even smaller deals can become distractions if not handled smoothly.

On the competitive front, the space Balchem operates in has plenty of capable players. Market share doesn’t move easily, and innovation, service quality, and price control are all key battlegrounds. Balchem has done well maintaining its niche, but it must continue innovating to stay ahead.

Lastly, the dividend yield is modest—around 0.56%—and won’t turn heads for those seeking current income. However, the low payout ratio shows there’s ample room for future growth, and the dividend track record is a positive for those focused on long-term total return rather than yield alone.

Final Thoughts

Balchem continues to show why slow and steady can win the race. This is a company that doesn’t rely on flash to deliver results. It leans into niche markets where it can build lasting relationships and defend margins. The leadership team is experienced, thoughtful, and consistent in how it allocates capital and expands the business.

While it may not be a high-flying stock in terms of daily moves or short-term excitement, the long-term performance has been anything but boring. With healthy margins, consistent cash generation, and a conservative balance sheet, Balchem remains positioned for dependable performance.

As always, there are headwinds to consider—rising input costs, regulatory shifts, and the inherent risks in acquisitions. But the company’s ability to navigate those challenges in the past gives some confidence that it can continue doing so going forward.

For those looking at businesses with staying power, disciplined growth, and a leadership team that plays the long game, Balchem checks a lot of boxes.