Updated 4/13/25

Avista Corporation (AVA), a regulated utility based in Spokane, Washington, has delivered steady performance through a mix of disciplined capital investment, consistent dividend growth, and sound regulatory execution. With operations across Washington, Idaho, and Oregon, the company recently appointed Heather Rosentrater as President and CEO—marking a leadership transition grounded in deep institutional experience. Over the past year, AVA’s stock has climbed from $33 to over $43, supported by strong operating cash flow and a forward dividend yield of 4.84%. The company has also committed over half a billion dollars in infrastructure upgrades, while maintaining a payout ratio near 83%. Backed by a dependable management team, favorable rate case outcomes, and long-term earnings guidance between 4% to 6% annually, Avista presents a case built on operational resilience, shareholder returns, and regulated growth.

Recent Events

Over the past year, Avista has seen its stock rebound from a low of $33.00 to a recent high near $43.09. That’s a nearly 20% increase year-over-year, outpacing the broader market in a quiet, consistent way. This type of gradual climb is often music to the ears of those focused on preserving capital and generating income.

That said, the latest earnings report wasn’t without its bumps. Quarterly earnings saw a 20% decline compared to the previous year. Still, the top line inched up by 2.9%, and the company maintained strong EBITDA levels at $582 million. Not perfect, but certainly not distressing given the predictable nature of utility revenues.

Cash from operations came in at $534 million—strong enough to support dividend obligations, even as levered free cash flow dipped into the red. Much of that shortfall stems from infrastructure investments, not operational issues. Like most utilities, Avista carries a fair amount of debt—around $3.15 billion, with a debt-to-equity ratio above 120%. But that’s par for the course in this sector where regulated returns help keep lenders at ease.

Key Dividend Metrics

📈 Forward Dividend Yield: 4.84%

💰 Forward Dividend Rate: $1.96 per share

📉 Trailing Dividend Yield: 4.73%

🧮 Payout Ratio: 82.97%

📅 Last Dividend Payment: March 14, 2025

📆 Ex-Dividend Date: February 26, 2025

📊 Five-Year Average Yield: 4.49%

Dividend Overview

Avista’s current forward dividend yield of 4.84% is solid, especially when you compare it to its five-year average of 4.49%. That kind of spread often hints at a stock that may be slightly undervalued from an income perspective. And in this case, you’re getting that yield from a company with very low volatility—the five-year beta sits at just 0.37.

The company distributes $1.96 per share annually, and while that might not be sky-high, it’s consistent. The 83% payout ratio might raise eyebrows in other sectors, but for a utility, it’s right in the expected range. Utilities are in the business of passing along a good chunk of earnings to shareholders, and Avista sticks to that playbook.

The institutional ownership here is high—about 90%—which often signals confidence from pension funds, mutual funds, and other long-term capital allocators. Insider ownership is minimal, but that’s fairly normal in a company like this. It’s built to deliver returns to outside investors, not to be founder-controlled.

Dividend Growth and Safety

If you’re looking for fast dividend growth, AVA probably isn’t your name. But if you appreciate slow, steady increases, it fits the mold nicely. The most recent hike was from $1.90 to $1.96, which works out to a 3.2% raise. Modest, yes, but steady increases are what allow retirees and long-term planners to sleep well at night.

The payout ratio is up there, no doubt. But Avista operates in a world of predictability. Its customer base, pricing mechanisms, and cash inflows are all regulated and fairly immune to economic swings. That kind of environment makes a higher payout ratio more palatable.

One number to keep an eye on is free cash flow. It’s currently negative, but that’s tied to capital investment—laying the groundwork for long-term infrastructure and rate base expansion. These investments aren’t always popular in the short term, but they often result in future earnings growth, which can support higher dividends down the road.

Debt is a factor, too. At over $3 billion, it’s a big piece of the balance sheet. But with EBITDA at $582 million and enterprise value to EBITDA sitting at about 10.5 times, there’s still breathing room. And with interest rates still relatively manageable, Avista isn’t in any immediate crunch.

The current ratio comes in at 0.85, which means short-term liquidity is tight. That’s typical for a utility, though, and doesn’t necessarily point to trouble. These businesses are designed for stable operations and long-term commitments, not big swings in working capital.

Perhaps one of the most reassuring signs of dividend safety is history. Avista hasn’t cut its dividend in more than two decades. And with a business model centered around regulated returns and cautious financial management, there’s no real reason to expect that pattern to change anytime soon.

If you’re building a portfolio for income, AVA offers a blend of predictability, yield, and conservative financial management that checks a lot of boxes. It’s not glamorous—but it’s solid.

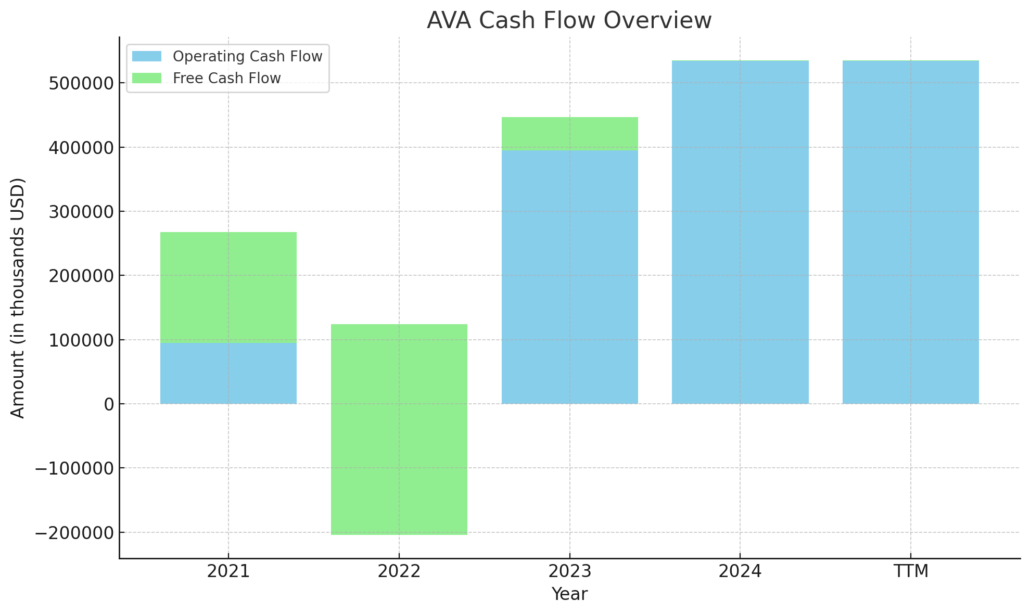

Cash Flow Statement

Over the trailing twelve months, Avista Corporation generated $534 million in operating cash flow, showing consistent strength in its core utility operations. That’s a notable improvement over 2022’s $447 million and a dramatic leap from 2021’s $124 million. This upward trend indicates a steady recovery in operational performance, backed by regulated revenue streams and stable customer demand.

On the flip side, Avista continues to spend heavily on capital projects. With $533 million allocated to capital expenditures, investing cash flow came in at a negative $539 million. The company has leaned on debt markets for support, issuing $84 million in new debt while repaying just $3 million. Despite the tight balance between operating inflows and investment needs, Avista eked out a positive free cash flow of $1 million over the TTM, a small but symbolic shift back into the black after years of negative free cash flow. The end cash position stands at $30 million, which is lean but not uncommon for a utility with predictable income and ready access to capital markets.

Analyst Ratings

Avista Corporation has experienced a range of analyst sentiment in recent months, showing a blend of cautious optimism and tempered expectations. 📊 The current consensus price target sits around $39.33, which suggests a modest downside compared to the recent trading levels. 🎯 This average is built from various projections, with the high end at $43.00 and the low near $37.00.

Earlier this year, there was a shift in tone from a few major firms. 🟢 Mizuho upgraded its rating from “Underperform” to “Neutral” and raised the price target from $32 to $36. This adjustment came as a result of improved clarity in regulatory matters and a better outlook for the company’s capital investments. Another positive move came from Guggenheim, which bumped its rating from “Sell” to “Neutral” and issued a target of $34, pointing to stabilization in earnings and a more even risk-reward balance. ⚖️

On the other side of the spectrum, Jefferies reiterated a “Hold” but trimmed its target slightly from $40 to $39, reflecting a more cautious near-term outlook. 🔶 Bank of America, meanwhile, began coverage with an “Underperform” and a $37 target, expressing concern about earnings variability and ongoing regulatory hurdles. 🚧

The takeaway from this mixed batch of ratings is that while Avista’s fundamentals and dividend profile continue to provide a base level of investor confidence, analysts remain watchful of macroeconomic pressures and utility-sector headwinds. 🧐

Earning Report Summary

Avista ended 2024 with a solid performance, reporting full-year earnings of $2.29 per share. That’s a small bump from the $2.24 reported the previous year, signaling a steady hand despite some of the typical headwinds that utilities face. The fourth quarter earnings came in at $0.84 per share, which was a bit softer than the $1.08 they posted in Q4 of 2023, but that kind of seasonal swing is fairly common in this space, especially when weather and energy usage can vary so much.

Leadership Reflections and Capital Focus

Heather Rosentrater, Avista’s new CEO, seemed upbeat about where the company stands. She pointed to strong operational execution, even in the face of rising power supply costs and other operational pressures. One of the big highlights for 2024 was a record $510 million in capital spending. That investment wasn’t just about maintaining infrastructure—it was about laying the groundwork for future growth and improving system reliability. There’s also a clear focus on wildfire prevention and mitigation, a growing concern for utilities in the western U.S.

Guidance and Strategic Direction

Looking to 2025, the company is projecting earnings between $2.52 and $2.72 per share. That kind of outlook shows confidence, not just in the financials but in the broader strategy as well. One project that could be a game-changer down the line is the North Plains Connector, a transmission line that could open up new opportunities in energy delivery and capacity.

Capital expenditures are expected to stay elevated, with around $525 million earmarked for 2025. The emphasis remains on strengthening infrastructure and continuing safety upgrades, particularly in high-risk areas. At the same time, regulatory developments are trending favorably. In Washington, Avista wrapped up its general rate cases with positive outcomes, including a return on equity bump to 9.8% and new deferral mechanisms to manage wildfire and insurance costs.

Avista’s commitment to returning value to shareholders also remains intact. The board approved a dividend increase for the 23rd year in a row, pushing the annual payout to $1.96 per share. It’s not a flashy move, but for income-focused investors, consistency like that is gold.

The company also shared its longer-term vision, targeting 4% to 6% annual earnings growth beginning in 2025. That guidance hinges on continued success in future rate cases, including filings expected soon in Oregon and Idaho. All in all, the tone from leadership is one of measured optimism, backed by strong operational results and a clear roadmap for the years ahead.

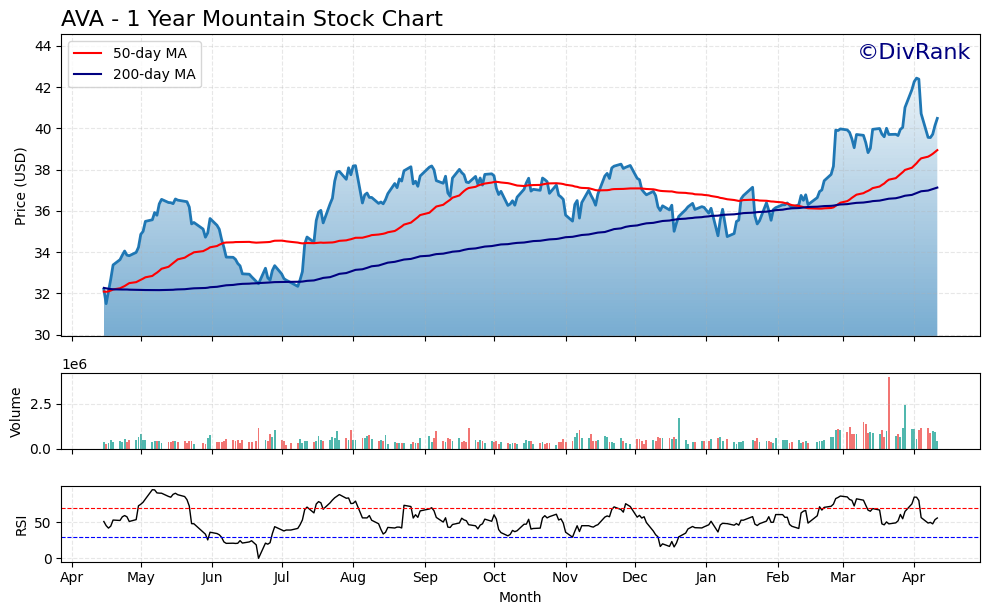

Chart Analysis

The stock performance of AVA over the past year reveals a steady climb with several key moments of consolidation and breakout. The chart presents a mountain-style visualization, and there are a few standout technical patterns worth noting for anyone following this name closely.

Price Trends and Moving Averages

Starting near $32 in April of last year, AVA moved upward with a couple of short-term pullbacks but maintained a consistent overall trajectory. The 50-day moving average (shown in red) crossed above the 200-day moving average (in blue) around late January, forming a classic golden cross pattern. This crossover is typically viewed as a signal of momentum shifting in favor of buyers, and the price action since then supports that narrative, with AVA pushing well into the $40s.

The stock recently surged to a new high above $43 before pulling back slightly. Despite that dip, it’s still trading comfortably above both moving averages, which suggests the overall trend remains intact. The 200-day line has been rising steadily and is now serving as a longer-term support level.

Volume Activity

Volume remained relatively muted through much of the year, with occasional spikes during notable price moves. There was a clear uptick in trading volume in March, right around the time the price broke out above previous resistance levels. This kind of volume confirmation helps validate the breakout and adds credibility to the rally. Since then, volume has tapered off slightly, which is natural after a strong move higher.

There’s been no major selling pressure visible in the volume bars, which supports the idea that recent pullbacks are more about profit-taking than a shift in sentiment.

RSI and Momentum

The Relative Strength Index (RSI) has been oscillating between the mid-40s and high 70s, occasionally brushing into overbought territory. Notably, the stock touched overbought levels a few times during strong upward pushes but has since cooled off without dropping into oversold conditions. This suggests the stock has seen healthy buying interest without being driven into excessive speculation.

The most recent RSI reading hovers just below 70, indicating strong momentum, but still leaving a bit of breathing room before it’s considered overheated again. That balance between strength and stability is often a healthy sign for sustained price behavior.

Final Take on Trend

AVA’s chart points to a stock that’s been moving upward with solid technical support. The steady climb in both price and moving averages, combined with controlled RSI movements and healthy volume spikes during key moves, all contribute to a picture of underlying strength. This isn’t a name showing erratic behavior—it’s more of a slow and steady riser, which aligns well with consistent market demand and confidence in its long-term direction.

Management Team

Avista Corporation recently welcomed a new leader at the helm. Heather Rosentrater officially took over as President and CEO at the start of 2025. Her background with the company dates back to 1999, where she began her career as an electrical engineer. Over the years, she’s held a range of leadership roles, giving her a deep, firsthand understanding of the company’s operational structure and long-term goals. Her appointment is notable for more than just experience—Rosentrater is the first woman to lead the company in its 135-year history. With her at the helm, Avista is expected to maintain its steady approach while also leaning into innovation and community-driven energy solutions.

Working alongside her is a strong executive team. Kevin Christie serves as Chief Financial Officer and Treasurer, and Bryan Cox holds the role of Senior Vice President and Chief People Officer. The leadership team brings deep expertise in finance, operations, and regulatory matters. Together, they’re focused on ensuring the company remains competitive while navigating the ongoing changes in the utility landscape.

Valuation and Stock Performance

As of mid-April 2025, Avista’s stock was trading around $40.48 at the close, with an after-hours bump to $42.00. That brings the company’s market cap to about $3.25 billion. Over the past twelve months, the stock has climbed steadily from its low point of $33.00, reaching a high of just over $43. This kind of movement shows a company that may not be flashy, but continues to earn quiet confidence from the market.

From a valuation standpoint, Avista trades at a price-to-earnings ratio of 17.68. That’s fairly in line with what’s typical for utility companies. The price-to-book ratio sits at 1.25, suggesting the stock is trading at a modest premium to its net assets. The dividend remains a major draw, currently yielding 4.84% on a forward basis. With a payout ratio just under 83%, the dividend appears sustainable, particularly given the company’s consistent cash flows and rate-regulated model.

Analysts have shown mixed views. Most ratings lean toward “Hold,” and the average price target sits near $39.33. This implies a fairly valued stock at current levels, though the strong dividend and defensive profile may still appeal to those looking for stability.

Risks and Considerations

There are a few risks investors should keep in mind. Avista operates in a heavily regulated environment. Changes to energy policy, rate structures, or environmental mandates could have a direct impact on earnings. At the same time, the regions where Avista does business have been increasingly exposed to wildfires and other climate-related disruptions, which can affect infrastructure and drive up operating costs.

Debt is another area worth watching. The company carries around $3.15 billion in total debt, and the debt-to-equity ratio sits above 121%. That’s not unusual for utilities, which often finance long-term infrastructure with borrowed capital, but it does limit flexibility in a rising interest rate environment.

Cash flow from operations remains strong, but the company continues to spend aggressively on capital improvements. Those investments are critical to the long-term reliability of the grid and regulatory compliance, but they can put pressure on free cash flow in the short run.

Final Thoughts

Avista continues to offer a compelling story built around consistency and quiet execution. The transition in leadership brings a fresh dynamic, but the core strategy remains intact—steady investment, reliable service, and a clear focus on regulated returns. While the stock may not generate the buzz of a fast-moving growth name, its role in a diversified portfolio is easy to understand.

It’s a company that has weathered market cycles, regulatory shifts, and environmental challenges with a calm, methodical approach. For those looking for something that prioritizes dependability over surprises, Avista fits that mold well. Its dividend track record, ongoing infrastructure investments, and experienced leadership team all point to a business that knows its strengths and plays to them.