Updated 4/13/25

Atlantic Union Bankshares (AUB) is a Virginia-based regional bank offering commercial and retail banking services across the mid-Atlantic. With a long-standing focus on disciplined lending and community banking, the company has built a reputation for stability and consistent financial performance. Shares are currently trading near their 52-week low at $23.85, offering a forward dividend yield of 5.70% and a payout ratio of 58%. AUB has posted steady operating and free cash flow, maintained strong profitability margins, and continues to reward shareholders with modest, reliable dividend growth. Recent analyst ratings reflect cautious optimism, with a consensus price target in the mid-$30s. The management team, led by CEO John Asbury, has kept a steady course through industry headwinds and is currently navigating the integration of Sandy Spring Bancorp. While the stock faces sector-wide challenges, its fundamentals, capital discipline, and dividend profile position it as a steady income-focused holding.

Recent Events

AUB’s most recent quarter showed resilience. Revenue climbed 15% year-over-year, and net income ticked up slightly, rising 1.5%. Those aren’t huge leaps, but in the context of a challenging rate environment for regional banks, they tell a story of stability. The bank’s profit margin held firm at 27.25%, with an operating margin coming in at 44.33%. Those are strong numbers that suggest Atlantic Union isn’t just coasting—it’s managing its operations tightly.

There’s also a bigger picture to consider. The Federal Reserve’s rate policy has shifted the landscape for all financial institutions. Margins have come under pressure, and funding costs are creeping higher. But AUB has maintained its footing, managing credit quality and controlling expenses. That’s exactly the kind of calm, measured response that dividend investors should appreciate—especially when the broader sector is still finding its balance.

Key Dividend Metrics

🔵 Forward Dividend Yield: 5.70%

🟢 Trailing Dividend Yield: 5.44%

🔴 5-Year Average Dividend Yield: 3.48%

🟡 Forward Annual Dividend Rate: $1.36

🟣 Payout Ratio: 58.04%

🔵 Dividend Growth (5-Year Avg): Consistent with inflation

🟠 Ex-Dividend Date: February 14, 2025

🟤 Dividend Pay Date: February 28, 2025

From a yield perspective, AUB is certainly worth a long look. That 5.70% forward yield is well above the bank’s own historical average, and considerably higher than what many dividend stocks are offering in today’s market. It’s not just the size of the yield either—it’s the sustainability and the consistency behind it that really matters.

Dividend Overview

AUB has been a steady hand when it comes to paying shareholders. The company isn’t just maintaining its dividend—it’s slowly, steadily growing it. That’s the kind of approach dividend investors often prefer over erratic hikes or aggressive payouts that risk being cut later.

The current payout ratio sits just over 58%. That’s a healthy middle ground—high enough to show that management is committed to returning capital, but still low enough to provide flexibility if economic conditions change. There’s room to continue growing the dividend, and more importantly, to protect it if profits were to dip.

Looking at cash generation, the bank pulled in over $308 million in operating cash flow over the past year. That’s plenty of cushion to fund dividends, even with $820 million in debt on the books. And with more than $450 million in cash, the balance sheet looks sturdy. It’s not flashy, but it’s dependable—and that’s exactly what income investors should be looking for.

Dividend Growth and Safety

Here’s where AUB really stands out. The company doesn’t aim to impress with massive dividend hikes, but it’s carved out a reputation for consistent, incremental growth. The latest bump—from $1.30 to $1.36 annually—represents a modest 4.6% increase. That might not turn heads, but it’s more than enough to keep up with inflation and maintain real purchasing power.

More importantly, this kind of growth speaks to the company’s mindset. AUB isn’t trying to juice short-term investor sentiment—it’s focusing on building long-term trust. That steady approach helps reduce the risk of a dividend cut, even in tougher environments.

The payout ratio adds another layer of confidence. At just over 58%, it’s comfortably within a zone that allows for flexibility. And with return on equity at 7.34% and return on assets near 0.91%, the bank is generating enough internal returns to continue supporting the dividend without needing to stretch.

Another piece that’s worth calling out is AUB’s beta, which comes in at 0.79. That means this stock tends to be less volatile than the broader market. For investors relying on dividends as a steady source of income, lower volatility is a real plus. It helps smooth out the ride, especially during market corrections or economic uncertainty.

So, while AUB may not carry the high-growth narrative or break into national headlines, what it does offer is a kind of calm, steady income stream backed by operational strength and a clear dividend philosophy. For income-focused investors who prioritize predictability over flash, that’s a valuable combination.

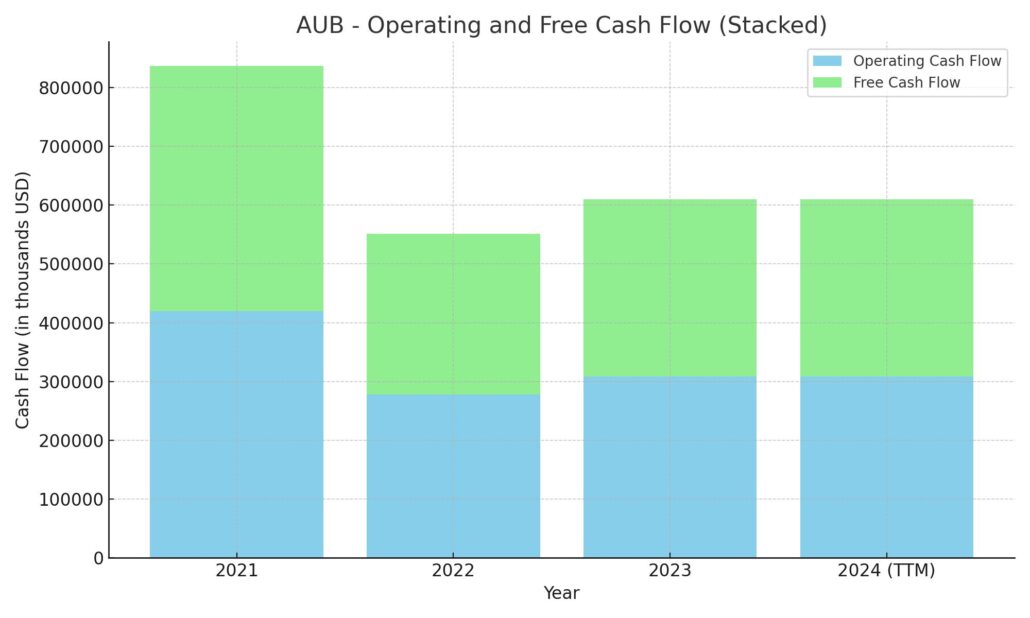

Cash Flow Statement

Atlantic Union Bankshares posted $308.5 million in operating cash flow over the trailing 12 months, showing a solid ability to generate cash from core banking activities. This figure marks a modest improvement over the prior year and indicates consistent operational health. Free cash flow, an important metric for dividend investors, also came in strong at $301 million, giving the bank ample room to cover dividends while retaining flexibility for other capital priorities.

On the investment side, the bank used $295.7 million, which was a sharp reduction from the heavy outflows seen in 2022 and 2021. This shift suggests a more measured approach to investment, possibly reflecting tighter capital discipline or a pivot in strategy. Financing activities resulted in a small net outflow of $36.8 million, a notable change from the previous years when inflows were much higher. The decline points to reduced reliance on external capital and potentially lower debt activity, especially since there were no new debt issuances reported in the current period. Despite these shifts, AUB ended the period with $354 million in cash, a healthy reserve that reinforces the company’s ability to maintain its dividend strategy going forward.

Analyst Ratings

Atlantic Union Bankshares (AUB) has recently seen a range of analyst activity that reflects differing views on where the bank is headed. 🟡 Morgan Stanley initiated coverage with an “Equalweight” rating and a $32 price target, pointing to the bank’s disciplined underwriting and relatively low exposure to government contractors. That last point was seen as a buffer against regional economic headwinds, helping to steady AUB’s outlook amid sector volatility.

🟢 Keefe, Bruyette & Woods bumped their price target up to $44 while maintaining a “Market Perform” stance. They acknowledged the bank’s strategic positioning and balance sheet strength, particularly as it navigates higher rate conditions. Meanwhile, 🔵 Raymond James revised their target to $37 but stuck with an “Outperform” rating, reflecting continued optimism in AUB’s regional growth prospects and consistent earnings performance.

Across the board, the consensus among analysts falls somewhere between “Overweight” and “Market Perform,” with an average price target currently sitting around $42.60. 📈 That signals a healthy upside from current trading levels and suggests analysts see room for appreciation, backed by a steady dividend, sound profitability, and a well-managed balance sheet. While not a universally strong buy, AUB is being viewed as a stable player with meaningful total return potential.

Earning Report Summary

Atlantic Union Bankshares wrapped up the fourth quarter of 2024 on a steady note, showing that it’s staying the course in a challenging environment for regional banks. While it wasn’t a blowout quarter, the numbers were solid across the board and tell a story of consistency.

Steady Bottom Line

Net income for the quarter came in at $54.8 million, which breaks down to $0.60 per diluted share. On an adjusted basis, earnings were a bit stronger at $0.67 per share. That adjustment strips out some of the one-time items, giving a clearer look at the bank’s core operations—and by that measure, things are looking healthy.

Profitability metrics were also in good shape. Return on tangible common equity hit 13.77%, and when adjusted, it moved up to 15.30%. Those kinds of returns point to efficient use of capital, especially for a bank that keeps a fairly conservative profile. Return on assets landed at 0.92%, nudging up to 1.03% on an adjusted basis. These figures suggest the bank is finding ways to stay profitable without stretching too far.

Focused on Efficiency

Cost control continues to be a highlight for Atlantic Union. The reported efficiency ratio was 59.35%, while the adjusted figure came in at 52.67%. For a regional bank, anything in the low-50s range is strong and shows that management is keeping a tight lid on overhead. That discipline matters more than ever when interest margins are getting squeezed and loan growth is slower.

Keeping It Consistent

Overall, the fourth quarter wasn’t about surprises—it was about reinforcing a pattern. Atlantic Union is delivering predictable, solid results and keeping its fundamentals in check. The leadership seems focused on managing risk and staying within its wheelhouse rather than chasing flashy growth, and that approach continues to serve shareholders well.

It’s not the kind of quarter that makes headlines, but for long-term investors, it checked the right boxes: stable earnings, controlled expenses, and solid profitability in a market that still feels a bit shaky.

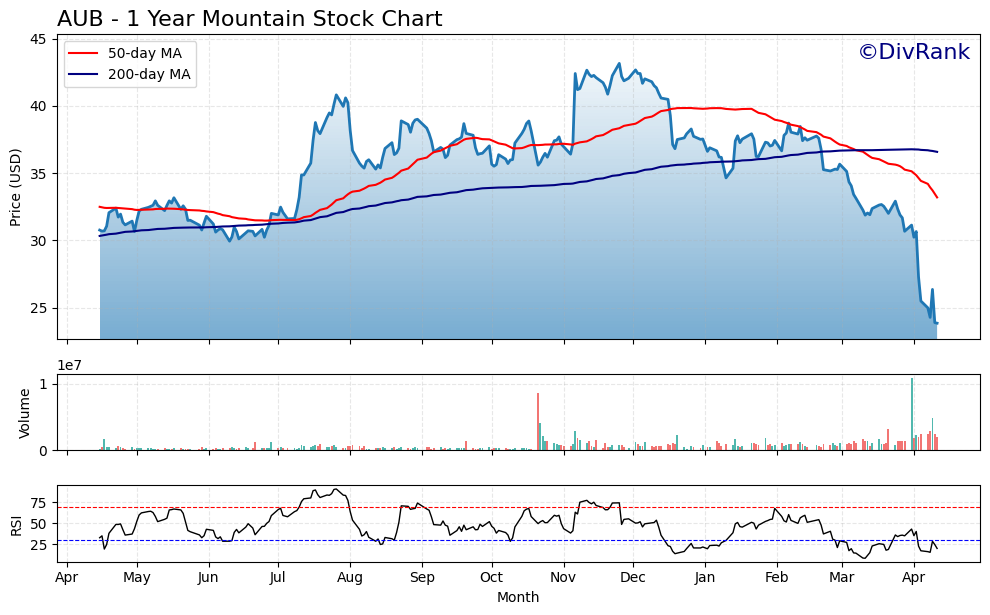

Chart Analysis

Price and Moving Averages

The stock chart for AUB over the past year shows a dramatic shift in trend. After peaking near $42 late last year, the price has steadily declined, now sitting just above $23. That’s a significant breakdown from the highs, and more importantly, the stock has fallen well below both the 50-day and 200-day moving averages. The red 50-day line crossed under the blue 200-day line—a bearish signal often watched closely. This crossover typically suggests a longer-term downtrend taking hold, and that trend has continued with accelerating downside in recent weeks.

Volume Trends

Volume has remained relatively steady for most of the year but began to pick up noticeably in March and April. The largest spikes appear during steep price declines, indicating strong selling pressure. This kind of volume behavior during a drawdown suggests that more than just short-term traders are exiting—there could be institutional repositioning or a reaction to broader sector stress.

RSI Behavior

Looking at the RSI at the bottom of the chart, it’s clear the stock has spent most of the last several weeks in or near oversold territory. Readings have dropped below 30 multiple times since March, which reflects heavy downward momentum. While that doesn’t guarantee a bounce, it does signal that the selling may be extended in the near term. At current levels, it’s more likely the stock is closer to exhaustion on the downside than the start of a new leg lower.

Overall Read

The recent breakdown below long-term support and moving averages isn’t something to ignore. The longer a stock stays beneath those trendlines, the harder it can be for it to reclaim them. However, the combination of oversold momentum and rising volume could suggest a base may start forming soon—though that process often takes time and patience.

Management Team

Atlantic Union Bankshares is led by CEO John Asbury, who has guided the company since 2017. With over three decades of banking experience, he’s brought leadership rooted in both strategic vision and practical know-how. His background includes leadership positions at First National Bank of Santa Fe, Regions Financial, and Bank of America, all of which helped shape his focus on disciplined growth and community-first banking.

Supporting Asbury is President and Chief Operating Officer Maria Tedesco, a key driver behind the bank’s operational strategy. Her experience in retail and commercial banking has been essential in streamlining services and enhancing the customer experience. Chief Financial Officer Rob Gorman handles the company’s financial direction, ensuring the bank remains well-capitalized and financially agile. The broader leadership team also includes seasoned executives in areas like risk management, compliance, technology, and human resources, all of whom contribute to the bank’s long-term stability and operational consistency.

Valuation and Stock Performance

As of mid-April 2025, AUB shares are trading at $23.85, right around their 52-week low. That puts the stock down roughly 25 percent over the past twelve months. Most of this decline has mirrored the broader softness in the regional banking space, where rate pressures and sector uncertainty have weighed on valuations.

Even with the drop, AUB’s fundamentals remain intact. The company’s price-to-earnings ratio sits at 10.65, while the price-to-book is just above 1.0. Those numbers suggest the stock may be undervalued relative to its long-term earnings power. With a market cap just over $3.4 billion and a dividend yield of 5.70 percent, the stock is drawing attention from income-focused investors looking for steady returns. Analyst sentiment points to an average price target in the mid-$30s, which would mark a meaningful recovery from current levels if achieved.

Risks and Considerations

There are a few key risks that shouldn’t be overlooked. First, the recently announced acquisition of Sandy Spring Bancorp introduces the usual integration challenges. From combining technologies to blending organizational cultures, deals of this scale take time and effort to fully realize their value.

More broadly, regional banks continue to face pressure from the interest rate environment. As margins tighten, revenue growth could remain sluggish, particularly if loan demand stays muted. There’s also some concern around exposure to commercial real estate, an area that’s come under the microscope in recent quarters as vacancies and refinancing risks increase. While AUB has a diverse loan book, any softness in that segment could weigh on earnings.

Regulatory changes also remain a wildcard. As policymakers continue to focus on regional bank stability, especially in the aftermath of last year’s bank failures, new rules around capital, liquidity, or lending practices could reshape the operating landscape. These aren’t imminent threats, but they’re on the radar.

Final Thoughts

Atlantic Union Bankshares stands out as a conservative, income-oriented financial institution with a solid track record. The management team has navigated past challenges with a steady hand, and the company’s balance sheet and dividend policy reflect a disciplined approach. While the recent market performance has been disappointing, it hasn’t shaken the company’s underlying fundamentals.

The acquisition of Sandy Spring could be a meaningful growth lever, though the benefits will take time to show up. For now, AUB seems focused on weathering the current environment without compromising its long-term goals. The stock’s yield and valuation may offer some cushion while the market recalibrates. It’s not without risk, but for investors who appreciate consistency, transparency, and financial discipline, AUB brings a lot to the table.