Updated 4/13/25

Assured Guaranty Ltd. (AGO) operates in the financial guaranty space, insuring municipal bonds and infrastructure-related debt. With a strong capital base, a long-tenured management team, and a focus on disciplined underwriting, the company has steadily delivered shareholder value through dividends and consistent buybacks. Its stock trades at a notable discount to book value, and its low payout ratio leaves ample room for continued dividend growth. Despite some recent earnings volatility and exposure to interest rate movements, AGO maintains a resilient balance sheet, a forward-looking strategy, and an active presence in the U.S. public finance market.

Recent Events

AGO’s share price has had a choppy ride over the past 12 months, reaching as high as $96.50 and dipping down to $72.57. As of April 11, it closed at $80.79—a number that puts it somewhere in the middle of its range, but certainly not at peak valuation.

Earnings have taken a hit recently. The most recent quarterly report showed a staggering 95% drop in earnings growth compared to the prior year. That sounds dramatic, but the business has some unique quirks—particularly around how earnings are affected by fair value adjustments and reserves. Even so, AGO turned in $373 million in net income over the last twelve months, with earnings per share coming in at $6.87.

Cash levels remain strong at nearly $1.5 billion, and while total debt sits at $1.78 billion, the company’s leverage ratio is manageable. What’s also notable is the ongoing share repurchase activity. AGO has been actively shrinking its share count, a strategy that helps enhance per-share metrics and signals confidence from management.

Key Dividend Metrics

📈 Forward Yield: 1.68%

💵 Annual Dividend: $1.36 per share

📊 5-Year Average Yield: 1.86%

📉 Trailing Yield: 1.55%

🧮 Payout Ratio: 18.05%

📅 Last Dividend Date: March 19, 2025

🔔 Ex-Dividend Date: March 5, 2025

These numbers don’t scream high yield, but they tell a different story when you consider the consistency and coverage behind them.

Dividend Overview

For those who prioritize dividend stability over flashy payouts, AGO hits the right notes. The current yield of 1.68% won’t lead any lists, but it’s backed by one of the most conservative payout ratios in the financial sector—just over 18%. That kind of breathing room allows the company to keep paying even in tougher quarters.

This is a management team that clearly values flexibility. Instead of stretching for a higher yield, they’re balancing dividends with buybacks. It’s a sensible move, especially when the stock is trading at just 0.73 times book value. That tells you the market might be undervaluing AGO’s assets, and management seems content to capitalize on that.

Another quiet advantage is the stock’s beta, which sits below 1 at 0.84. It’s less reactive to overall market swings, which works in favor of income investors who don’t want excessive volatility in their portfolios.

Dividend Growth and Safety

AGO has a reputation for slowly but steadily increasing its dividend. Over the past year, it bumped the annual payout from $1.24 to $1.36 per share, a roughly 10% increase. That kind of progression shows a deliberate, long-term approach. You won’t see sudden double-digit hikes, but you’re also not likely to face unexpected cuts.

Behind the scenes, the dividend is backed by solid fundamentals. With nearly $30 per share in cash and a business that doesn’t require heavy capital investment, there’s more than enough capacity to keep the dividend flowing. Free cash flow is another bright spot—AGO reported $758.88 million in levered free cash flow over the last year. That’s a lot of dry powder relative to the modest dividend outlay.

Unlike some firms that rely on debt to maintain dividends, AGO’s approach is refreshingly self-sufficient. The company’s interest obligations are well-covered, and its current ratio, while slightly under 1, is consistent with how insurance firms typically manage liquidity.

Insiders own close to 7% of the shares, which isn’t massive but does suggest a degree of alignment with shareholders. Institutional investors hold over 97%, reinforcing the view that this stock is widely viewed as a safe, income-oriented play by major market players.

For dividend investors, this is a company that doesn’t overpromise but quietly delivers. The dividend is secure, growing, and part of a broader capital return strategy that prioritizes long-term value.

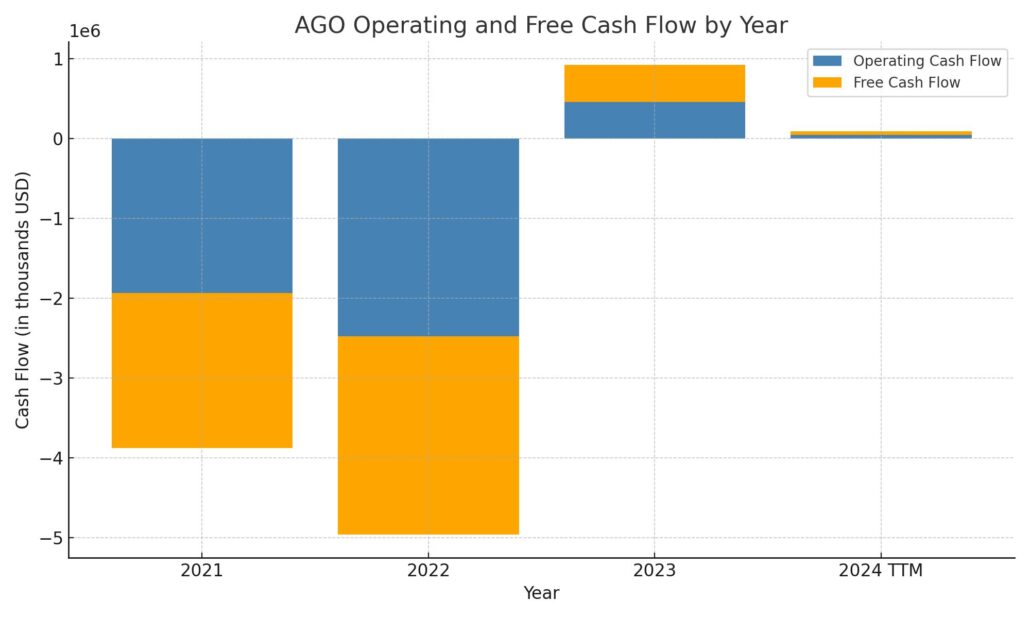

Cash Flow Statement

Assured Guaranty’s trailing twelve-month cash flow tells a story of conservatism and discipline. Operating cash flow dropped sharply to just $47 million, a significant decline from $461 million the year prior. While that figure might raise eyebrows, it’s worth noting the company still maintained positive free cash flow at the same level, indicating that core operations—while less cash generative recently—are not bleeding. Past years show some volatility, but nothing out of line for a firm whose results can swing based on the timing of claims and investment gains.

On the investing side, AGO brought in $780 million, far outpacing prior periods. This likely reflects asset sales or maturities, rather than new investments, and it helped offset the hefty $983 million in cash returned to shareholders via financing activities—primarily stock buybacks. There’s no sign of fresh debt issuance, and the company continues to chip away at existing obligations. The end cash balance sits at $128 million, a drop from last year but still reflective of a company managing its cash with a steady hand. Overall, the movement here points to a firm that remains aggressive on capital returns, while maintaining enough liquidity to support its commitments.

Analyst Ratings

📈 Assured Guaranty Ltd. (AGO) has experienced shifting analyst sentiment over the past several months. 🟢 Keefe, Bruyette & Woods upgraded the stock to “Outperform” back in July 2024, raising the price target from $87 to $92. Their move was driven by signs of strengthening capital reserves and a more favorable risk profile in AGO’s municipal bond portfolio. However, this came just a few months after the same firm had downgraded AGO to “Market Perform” in April, citing potential softness in the muni bond market and concerns over interest rate volatility. That downgrade still came with a higher price target of $92, up from the previous $75, indicating that while short-term caution was warranted, the long-term outlook remained stable.

🔄 UBS has continued to maintain a “Neutral” stance. Their last update in November nudged the target price upward from $87 to $95. This reflects a balanced view—confidence in AGO’s strong balance sheet, tempered by broader market uncertainties, especially in fixed income segments where the company has exposure.

🎯 The current average price target among analysts sits around $107.50, with individual targets ranging from $95.95 on the low end to as high as $121.80. That spread shows some divergence in expectations, but the overall tone is constructive, pointing to modest upside potential from current levels.

Earning Report Summary

Assured Guaranty kicked off 2024 with a solid earnings report that highlighted strength in its core business and smart moves on the investment side. The first quarter numbers showed some impressive year-over-year growth, giving investors reason to feel encouraged about where the company is headed.

Strong Income Growth

Net income came in at $109 million, which works out to $1.89 per diluted share. That’s a healthy 35% jump compared to the same time last year. On an adjusted operating basis, things looked even better—AGO reported $113 million in earnings, or $1.96 per share, marking a 66% gain from the prior year. These results suggest the company is doing a good job navigating the current environment while keeping costs under control and revenues flowing.

Insurance Business on the Rise

The insurance segment, which drives much of AGO’s business, put up strong numbers. Adjusted operating income rose to $149 million, up from $117 million a year earlier. A big part of that came from higher net earned premiums, as well as fair value gains on the trading side. The total revenue for this segment landed at $229 million, with credit derivative and premium revenues making up more than half of that.

Investment Performance Holding Steady

On the investment front, AGO posted $83 million in net investment income—roughly in line with the same quarter last year. What really stood out, though, was the turnaround in trading securities, where the company recorded a $26 million gain. That’s a big swing from the $2 million loss in the same quarter of 2023. Additionally, earnings from affiliated investments ticked up to $40 million, showing that those holdings continue to add value.

All told, it was a strong quarter across the board. From underwriting activity to investment gains, the pieces came together nicely for AGO to start the year on the right foot.

Chart Analysis

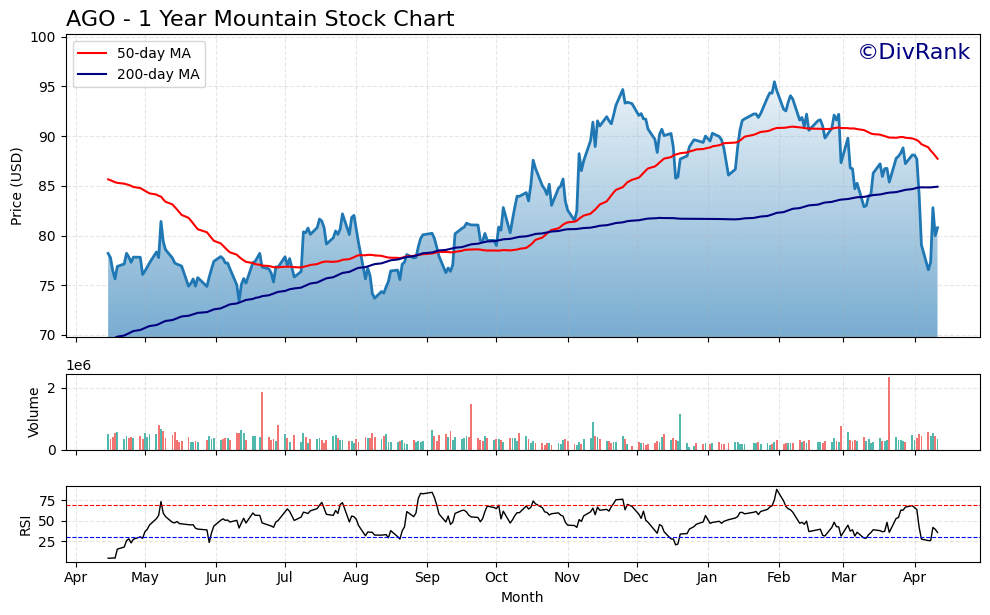

Assured Guaranty Ltd. (AGO) has had an eventful twelve months on the chart, marked by clear technical shifts and changes in investor sentiment. The pattern shows a few distinct phases that help tell the story of how the stock has behaved and where things may be headed next.

Price Trends and Moving Averages

For most of the past year, AGO trended upward, especially between late summer and early winter, when it broke above both the 50-day and 200-day moving averages. That stretch from October through January shows clear bullish momentum, with the price comfortably above the red 50-day line. But things started to shift heading into March, when the stock rolled over and crossed below the 50-day average. That move, followed by a drop beneath the 200-day in April, suggests a technical breakdown.

Now, with the price back below both moving averages, there’s some caution in the air. The 50-day moving average is curling down, while the 200-day is still rising slightly but beginning to flatten. That signals possible longer-term pressure unless the stock regains its footing quickly.

Volume Activity

Volume has been mostly steady throughout the year, though there are several noticeable spikes. One major burst came recently in early April, during the sharp price drop. That kind of high-volume selling typically reflects broader market unease or negative sentiment tied to news or earnings. However, it’s also possible that institutional players were involved, which can sometimes precede a rebound or rebalancing phase.

RSI Momentum

The relative strength index (RSI) adds another layer to the picture. There were multiple points where AGO entered overbought territory, especially in November and February, followed by pullbacks. More recently, RSI dipped into oversold levels in early April, suggesting the stock may have become stretched to the downside. It’s bounced slightly from there, which could point to a short-term stabilization.

Taken as a whole, the chart shows a stock that experienced strong momentum, then lost steam and broke through key support zones. The recent volatility and RSI recovery hint at a possible reset or bottoming attempt, but the price will need to climb back above the moving averages to regain longer-term strength. This kind of movement reflects a transition period, where the market is still figuring out how to value the next chapter.

Management Team

Assured Guaranty Ltd. is led by a well-established team with deep experience in insurance, credit analysis, and financial markets. At the center is Dominic J. Frederico, who has held the role of President and CEO since 2003. His leadership has been instrumental in shaping the company’s direction, particularly during major milestones like the acquisition of Assured Guaranty Municipal in 2009. Before joining AGO, Frederico served in top leadership roles at ACE Limited, now known as Chubb, where he built a strong reputation in the insurance space.

Supporting Frederico is Robert A. Bailenson, recently appointed as Chief Operating Officer after a long tenure as CFO. The CFO role has now been taken over by Benjamin G. Rosenblum, who brings a technical and analytical perspective from his actuarial background. Other key leaders include Ling Chow as General Counsel, Stephen Donnarumma as Chief Credit Officer, Jorge A. Gana as Chief Risk Officer, and Holly Horn, who oversees ongoing portfolio monitoring as Chief Surveillance Officer. The team blends operational discipline with strategic clarity and has shown a steady hand through both stable periods and challenging ones.

Valuation and Stock Performance

AGO’s stock has had its share of swings over the past year, trading between a low of $72.57 and a high of $96.50. As of mid-April 2025, shares are priced around $80.79, placing it well off the highs but still within a healthy valuation range. The company’s current market cap sits just over $4 billion, and with a trailing P/E ratio of around 12.2, it’s trading at a discount compared to many peers in the financial sector.

One of the notable aspects of AGO’s valuation is the gap between market price and book value. With an adjusted book value per share reaching $170.12, the stock continues to trade at a significant discount to its underlying assets. That makes share repurchases particularly impactful, and management has leaned into that with ongoing buybacks. Analyst price targets cluster around the $107 mark, suggesting a fair amount of room to the upside if the business remains steady.

In addition to valuation, the company has steadily increased its dividend and currently offers a yield around 1.57%. While that yield isn’t eye-catching on its own, it’s backed by strong free cash flow and a low payout ratio, which gives it room to grow and plenty of coverage.

Risks and Considerations

There are some specific risks worth considering. AGO’s fortunes are closely tied to the municipal bond market. That means trends in issuance volume, default rates, and the broader interest rate environment all feed directly into the company’s results. If credit quality deteriorates or municipal borrowing slows, AGO may see pressure on premium income and deal flow.

Interest rate shifts can also affect the value of AGO’s investment portfolio, which in turn impacts reported earnings. Rising rates might boost future returns, but they can lead to temporary mark-to-market losses and weigh on portfolio valuations. Additionally, some of the firm’s exposure to structured products, like CLOs and other alternative assets, adds a layer of complexity. These investments can deliver higher returns but come with their own set of risks and can be more sensitive to economic shocks.

Regulatory and accounting changes present another consideration. Because the business straddles insurance and investment spaces, changes in rules governing reserves, capital ratios, or reporting could have ripple effects. While AGO has proven adaptable in the past, these are variables that need to be monitored closely.

Final Thoughts

Assured Guaranty brings a steady, measured presence to the financial sector. The leadership team is experienced and has shown it knows how to balance growth with risk management. The stock trades at a conservative valuation, especially when compared to its underlying book value, which creates a margin of safety not always found in this space.

The company has demonstrated a clear commitment to returning capital to shareholders, whether through a growing dividend or regular share repurchases. That kind of discipline resonates with long-term holders who value consistent capital allocation strategies. While there are risks tied to interest rates and credit markets, the company’s balance sheet and management track record help mitigate some of those concerns.

All in, AGO represents a well-capitalized, conservatively run financial name with steady income potential and a leadership team that’s proven itself through more than one market cycle.