Updated 4/13/25

Arrow Financial Corporation (AROW) is a regional bank headquartered in upstate New York, operating through Glens Falls National Bank and Saratoga National Bank. It offers a full range of traditional banking services to both individual and business customers across its local markets. The company has established a reputation for conservative management, steady financials, and a reliable dividend track record. Backed by a leadership team with deep institutional knowledge and a well-rounded board, Arrow maintains a disciplined approach to lending and capital allocation. With a forward dividend yield above 4.6%, a payout ratio just over 60%, and a strong liquidity position, AROW has positioned itself as a consistent performer. While recent earnings have seen some pressure, including a 42% drop in net income year-over-year, the company remains financially stable. Analysts maintain a consensus price target of $30, and the stock trades near book value, offering potential value in today’s market.

Key Dividend Metrics

📈 Forward Dividend Yield: 4.64%

💵 Trailing 12-Month Dividend: $1.09

📆 Dividend Payout Ratio: 61.58%

📅 Dividend Growth (5-Year Average Yield): 3.73%

🎯 Ex-Dividend Date: February 10, 2025

📊 Annual Dividend Rate: $1.12

Dividend Overview

Arrow’s dividend story isn’t flashy, but it’s dependable. The bank has been steadily paying and slightly raising its dividend over the years, sticking to a quarterly payout structure that hasn’t wavered much. The current quarterly dividend is $0.28 per share. No big spikes or cuts—just the kind of steady rhythm income-focused investors tend to appreciate.

Back in 2022, Arrow executed a modest stock split at a 103:100 ratio. It didn’t create waves, and that’s kind of the point. Management runs this company in a quiet, measured way. While other banks chase headlines, Arrow sticks to its knitting.

Even as earnings dipped in the most recent quarters, the dividend kept coming. The payout ratio is sitting at around 62%, which is on the higher end of comfortable but still manageable. What makes this more palatable is the bank’s strong cash position and low debt. That gives it some flexibility if earnings remain soft in the short term.

Dividend Growth and Safety

Arrow’s dividend has been growing—but modestly. This isn’t a stock you buy expecting rapid dividend hikes. Instead, it’s more about consistency. Over the past five years, the average dividend yield has hovered around 3.73%. That’s moved up recently, with the current yield sitting above 4.6%. In today’s market, that’s competitive, especially considering the relatively low-risk nature of the business.

Looking ahead, don’t expect rapid growth in the dividend. With earnings under pressure and revenue down, management is likely to take a cautious approach. That said, the dividend doesn’t look to be in any immediate danger. The payout ratio remains under control, and the bank’s traditional, conservative operating style helps maintain stability.

Arrow also benefits from a solid ownership base. Institutions hold a little over 52% of the stock, with insiders owning just under 3%. That balance suggests the company is supported by long-term investors who are in it for the reliable income, not for speculation.

This is a business that doesn’t overextend itself. The bank isn’t chasing risky loan growth or branching out into overly complex financial products. Instead, it sticks with what it knows—serving its community with traditional banking—and that makes the dividend more defensible.

Arrow Financial may not be the flashiest name on the dividend radar, but it offers something a lot of investors still value: predictability. And in a world where markets can shift quickly, there’s something to be said for a bank that just keeps paying, quarter after quarter.

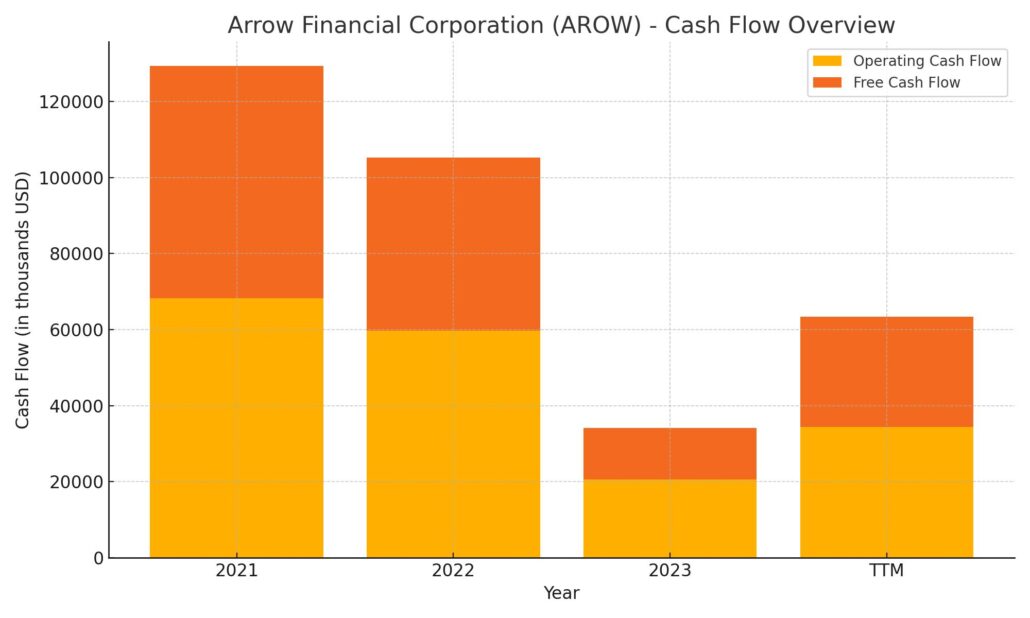

Cash Flow Statement

Arrow Financial Corporation’s cash flow picture over the trailing twelve months shows a company maintaining steady operational efficiency despite broader challenges. Operating cash flow came in at $34.47 million, a noticeable improvement from the $20.58 million posted in the previous year. That uptick reflects stronger internal cash generation, even as net income has declined, suggesting improved working capital management or other operational adjustments. Free cash flow, which strips out capital expenditures, also saw a healthy increase to $28.87 million. That figure provides a clearer picture of the cash Arrow has on hand after maintaining its physical assets—an important measure for dividend-paying firms.

On the investing side, the company reported a significant cash outflow of $88.95 million, which continues a multi-year trend of heavy investment activity. While sizable, this isn’t surprising for a bank actively managing its securities and loan portfolios. Financing activities added $66.49 million back into the cash pile, largely driven by new debt issuance of $102.1 million, which offset repayments totaling $120.06 million. Despite these inflows and outflows, Arrow ended the period with $154.55 million in cash—up slightly from the prior year—providing a solid liquidity cushion for ongoing operations and dividend coverage.

Analyst Ratings

📊 Arrow Financial Corporation (AROW) currently carries a consensus rating of “Hold” from analysts, reflecting a measured outlook based on recent financial results. 🎯 The average price target is $30.00, suggesting a potential upside of around 24% from its current share price of $24.13.

📉 In early 2025, one analyst revised their target from $32 to $30 while maintaining a “Hold” rating. That adjustment came in response to noticeable earnings pressure—net income dropped by more than 42% over the past year, while revenue declined 4.6%. Those kinds of drops tend to grab attention, even in a small regional bank, and they’ve understandably tempered enthusiasm.

🔍 Another firm initiated coverage in early 2024 with a “Market Perform” rating. That aligned with the broader consensus: Arrow isn’t expected to dramatically outperform the market in the near term, but it also doesn’t appear to be facing any existential risks. It’s a steady ship, but not necessarily a fast one right now.

📌 The current mood from analysts is largely one of observation. No upgrades or downgrades have surfaced recently, and the general tone suggests that most are waiting to see signs of stabilization in earnings before adjusting their stance. Arrow’s next few quarters could be key to shifting that narrative.

Earning Report Summary

Steady Performance in a Tough Environment

Arrow Financial wrapped up 2024 with results that were pretty stable overall, even as many regional banks struggled with margin pressure and slower loan demand. Net income for the year came in at $29.7 million, just slightly below the previous year’s $30.1 million. On a per-share basis, earnings held at $1.77, showing that despite the headwinds, the company was able to keep things on track. The fourth quarter wasn’t a standout, but it wasn’t a disappointment either, with $4.5 million in profit and earnings of $0.27 per share.

Interest Income Pulled Its Weight

One area where Arrow saw some lift was in net interest income, which rose to $111.7 million from $104.8 million the year before. That gain was largely thanks to stronger interest income—essentially the return on loans and investments—outpacing the higher interest costs tied to deposits. Non-interest income, which includes things like fees and investment gains, did take a hit though. It slipped 3.6% to $28.1 million, with the biggest drag being a $2.9 million loss on securities. That’s a sharp reversal from the small loss reported the previous year.

Rising Costs and Balance Sheet Growth

Operating expenses climbed a bit, up 4.5% for the year to $97.3 million. Most of that came from higher salary and benefit costs, which isn’t all that surprising given inflation and the competitive labor environment. But on the positive side, Arrow’s total assets ended the year at $4.3 billion, up 3.3%. That growth was driven by an expanding loan book—total loans rose 5.8% to reach $3.4 billion. Deposits also nudged higher, up 3.8% to $3.8 billion, which speaks to steady customer relationships and a stable funding base.

Shareholder equity closed the year at $400.9 million, up 5.6%. Book value per share rose 6.8%, a solid move in the right direction. All told, Arrow’s year-end numbers reflected a cautious but competent approach. There were no fireworks, but also no major red flags—a year of managing through challenges while keeping the fundamentals intact.

Chart Analysis

Price Action and Moving Averages

The stock chart for AROW over the past year shows a clear transition in momentum. From April through mid-November, the price followed a strong uptrend, supported by a rising 50-day moving average that stayed comfortably above the 200-day line. That upward slope peaked around the $33–34 range in late fall. But since then, the story has shifted. The 50-day moving average turned downward in December and crossed below the 200-day average in March, forming a bearish crossover. Price action has followed suit, breaking below both moving averages and trending lower into April.

This crossover, often referred to as a “death cross” in technical circles, typically signals weakening sentiment and a more cautious outlook from market participants. What’s also notable is that recent price candles have consistently closed beneath the 200-day moving average, suggesting that this level has now flipped from support to resistance.

Volume and Participation

Volume has remained relatively steady throughout the year, with a few notable spikes—particularly around late October and early January. These bursts of activity often point to institutional positioning or reactions to earnings or news. However, recent selling pressure hasn’t been met with corresponding surges in volume, which might imply a lack of strong conviction behind the latest drop. That said, volume has slightly picked up as the price dipped sharply in early April, which could signal capitulation or growing bearish sentiment.

Relative Strength Index (RSI)

The RSI has told a pretty consistent story since the start of the year. After several overbought readings during the summer rally, it dropped into oversold territory in January and has hovered near the lower end of the range ever since. Lately, the RSI has stayed close to or below 30, a level typically associated with a stretched downside. This can sometimes indicate a potential bounce, but the fact that it has lingered down here without a strong rebound points to persistent weakness.

The overall chart picture suggests a stock that’s gone from strength to caution. The moving average trend has flipped, momentum is on the downside, and sentiment appears muted. The recent breakdown in April, especially with RSI staying weak and volume nudging higher, could be an important signal to watch in the coming weeks.

Management Team

Arrow Financial Corporation is led by President and CEO David S. DeMarco, who has been with the company since 1987. DeMarco brings a deep understanding of Arrow’s operations, having served in multiple leadership roles, including as President and CEO of Saratoga National Bank, one of the company’s key subsidiaries. His long tenure reflects a stable leadership approach and strong alignment with the bank’s regional mission.

Supporting him is a seasoned executive team. CFO Penko K. Ivanov brings decades of experience in financial services, while Chief Information Officer Michael Jacobs focuses on keeping the company’s technology infrastructure current and secure. Chief Credit Officer David D. Kaiser oversees credit risk and underwriting standards, which are crucial for a bank that prioritizes steady, disciplined lending practices. Together, this team has guided Arrow through both expansion and more turbulent financial periods with a focus on long-term consistency.

Arrow’s board of directors includes professionals from various industries, giving it a broad perspective. Members like Tenée Casaccio, an architectural firm president, and Dr. Kristine Duffy, a college president, help root the bank’s decision-making in community needs. The board’s makeup reinforces Arrow’s focus on stable, regionally centered growth and long-term value for shareholders.

Valuation and Stock Performance

Arrow Financial’s stock, trading under the symbol AROW, has had a fairly wide range over the last 12 months, swinging between a low of $21.50 and a high of $34.63. As of the most recent close, shares are sitting at $24.13. That puts the stock near the lower end of its range, which could reflect broader caution in the regional banking sector more than anything specific to Arrow’s operations.

In terms of valuation, the stock is currently trading with a price-to-earnings ratio around 14.7, and a price-to-book ratio close to 1.01. These levels suggest a fair valuation based on current earnings and book value. There’s no strong premium baked into the share price, but there also doesn’t appear to be a heavy discount. It’s valued like a steady performer—not a breakout candidate, but also not one the market sees as troubled.

The beta on AROW is around 0.74, which implies that it tends to move less than the broader market. That’s consistent with its profile as a conservative, dividend-focused bank. The past year has seen the stock rise modestly, and with a consensus analyst price target of $30, there’s moderate upside if earnings and balance sheet stability continue to hold up.

Risks and Considerations

While Arrow’s steady hand is a plus during uncertain times, that same approach can limit growth opportunities. This isn’t a bank that will surprise investors with bold moves or rapid expansion. Its conservative lending standards and regional focus mean growth tends to be slow and deliberate. That works well during downturns, but can be a drag in more optimistic markets.

Geographic concentration is another consideration. Because Arrow operates primarily in upstate New York, its fortunes are tied closely to the health of that specific region. A localized economic downturn—say, tied to industry-specific struggles or population shifts—could have a more direct impact than it would for a larger, more geographically diversified institution.

The regulatory environment also presents risk. As compliance expectations evolve and digital infrastructure demands grow, smaller regional banks like Arrow may face cost pressures. The need to invest in cybersecurity, online banking platforms, and mobile functionality can strain margins if not managed carefully. And while Arrow has been slow but steady on this front, continued investment is essential to meet customer expectations and defend its market share.

Loan quality and interest rate risk remain front and center, especially as the yield curve stays volatile. A higher interest rate environment can benefit net interest margins, but it also increases the pressure on borrowers—especially commercial customers with variable-rate loans. Arrow’s conservative underwriting helps, but credit risk can’t be ignored.

Final Thoughts

Arrow Financial doesn’t pretend to be something it’s not. It’s a bank built on steady fundamentals, long-standing community relationships, and an aversion to excessive risk. The leadership team has been consistent, the board is well-rounded, and the financial performance, while not flashy, is reliable. That kind of approach doesn’t lead to massive stock rallies, but it does create a foundation that tends to support long-term value.

The current valuation reflects this balance—there’s enough upside potential to keep it interesting, especially if earnings begin to recover from recent pressure. The dividend is well-covered, the balance sheet is in solid shape, and the company continues to prioritize shareholder return.

For investors who are looking for stability in an uncertain economic backdrop, Arrow Financial represents a business that stays in its lane. It won’t chase trends, and it won’t be the story on the front page. But sometimes, the best opportunities are found in those quiet corners where predictability and patience still count.