Updated 4/14/25

Ares Management Corporation (NYSE: ARES) offers a distinctive blend of income and growth through its leadership in alternative asset management. With nearly $500 billion in assets under management and a growing presence across private credit, real estate, and infrastructure, Ares has become a consistent performer in a rapidly evolving space. The firm posted strong cash flow growth in 2024, raised a record $93 billion in new capital, and continues to expand its fee-generating platform. Backed by an experienced leadership team, a rising dividend yield currently at 3.25%, and a shareholder-aligned strategy, Ares stands out as a well-positioned income-generating stock. Despite recent price target revisions from analysts, the consensus outlook remains constructive, with an average target near $170. With robust operating fundamentals and a disciplined capital return strategy, Ares has steadily carved out a space among dividend stocks that combine recurring revenue with long-term expansion potential.

Recent Events

Over the last year, shares of Ares have posted a modest gain, rising a little over 6%. While that performance may not steal headlines, it’s quietly outpaced the broader market. And more importantly for dividend-focused investors, the real story is happening underneath the surface.

In its most recent quarter, Ares announced a quarterly dividend of $1.12 per share, payable at the end of March 2025. That’s a sizable increase over last year, a clear sign of the company’s confidence in its future earnings stream. The dividend hike didn’t happen in a vacuum—it followed a year of solid growth, with total revenue up nearly 20% from the prior period.

Ares’ role in the fast-growing private credit space has become even more relevant as traditional lenders pull back. Institutions are increasingly turning to firms like Ares to fill that lending gap, and it shows in the numbers. Net income saw a modest bump, while management continues to focus on scaling efficiently and returning capital to shareholders.

Key Dividend Metrics

📈 Forward Dividend Yield: 3.25%

💵 Annual Dividend (Forward): $4.48 per share

📊 5-Year Average Dividend Yield: 2.83%

🧮 Payout Ratio (ttm): 182.35%

⏳ Ex-Dividend Date: March 17, 2025

📆 Most Recent Dividend Payment: March 31, 2025

Dividend Overview

Ares’ current yield of 3.25% makes it an appealing candidate for investors seeking steady income. It’s a healthy step up from the average yield in the broader market, and it comes with a track record of reliability. Even more compelling, the company has consistently raised its dividend in recent years.

Now, that payout ratio—182%—might raise some eyebrows. But that figure is based on GAAP net income, which isn’t the most accurate way to assess firms like Ares. A better lens is their Distributable Earnings, which more directly reflect the company’s capacity to pay and grow the dividend. Through that lens, the payout appears much more manageable.

What sets Ares apart is how central the dividend is to their overall strategy. It’s not a side benefit—it’s a core part of how they deliver value to shareholders. Since going public, Ares has never cut its dividend. In fact, they’ve steadily increased it over time, even during periods when market conditions were less than ideal.

The firm does carry a high debt load, with over $13 billion on the books and a debt-to-equity ratio nearing 178%. That sounds heavy, and it is—but it’s also not unusual in the world of asset managers, who often use leverage to enhance returns. Importantly, Ares also holds nearly $2.8 billion in cash and generated about the same in operating cash flow over the past year. That kind of liquidity gives them flexibility, even in a tighter credit environment.

Dividend Growth and Safety

Over the past five years, Ares has increased its dividend at an average annual clip of roughly 9%. That’s well above inflation and signals a firm committed to growing income for its investors. It’s not just a high yield—it’s a growing one.

A big part of that is tied to their business model. Ares earns most of its revenue from management and performance fees. Those fees are generally sticky, recurring, and less vulnerable to short-term market fluctuations. That provides a cushion for the dividend, even when public markets are volatile.

There are risks, of course. Rising rates, shifts in regulation, or performance issues in their funds could put pressure on earnings. But the overall structure of their income gives the dividend a strong base. Add in the fact that nearly 80% of shares are institutionally held and over 12% are held by insiders, and you’ve got a leadership team and shareholder base that’s clearly invested in the long game.

Their return on equity is sitting near 18%, while the operating margin is close to 24%. That tells you the company is using its capital efficiently—and that’s exactly what dividend investors want to see when evaluating the durability of a payout.

Even with a higher beta, which suggests the stock moves a bit more than the broader market, there’s enough in Ares’ financials and strategy to support its reputation as a reliable, income-generating name. For those comfortable navigating the world of alternatives, Ares brings something unique to the dividend table: a solid yield, a growing payout, and a model built for long-term consistency.

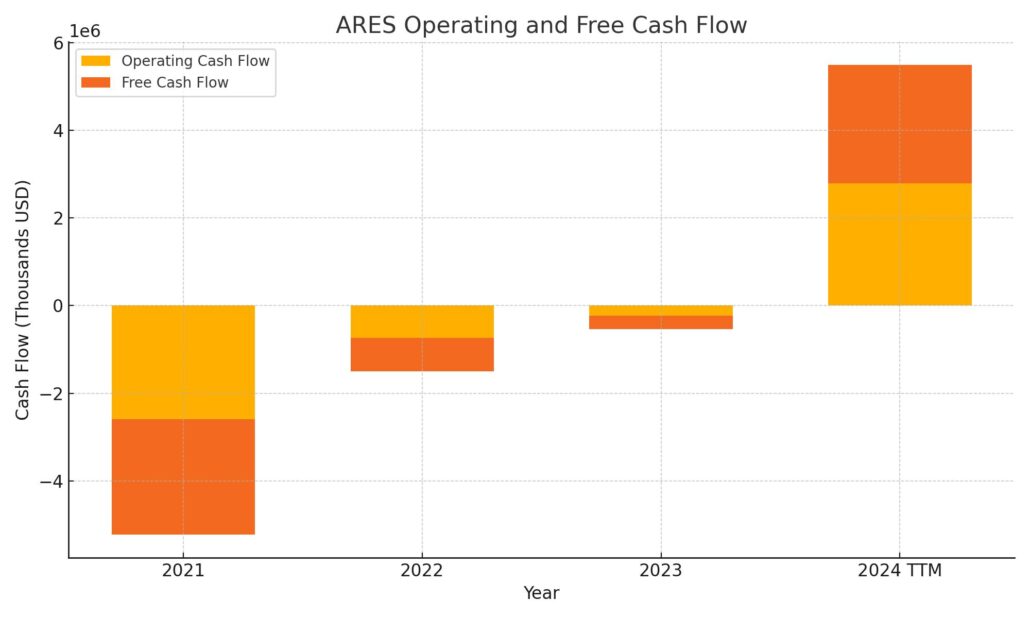

Cash Flow Statement

Ares Management Corporation has posted a significant turnaround in its cash flow profile over the trailing 12 months. Operating cash flow came in at just under $2.8 billion, a major improvement from the negative figures seen in each of the prior three years. This surge points to a strong recovery in the company’s core operations, with positive free cash flow of nearly $2.7 billion reinforcing the strength of its underlying business. Compared to the steep cash burn in 2022 and 2021, the current year reflects solid execution and improved capital discipline.

On the financing side, cash outflows were substantial, at roughly $1.43 billion. While Ares raised over $2.3 billion in new debt and nearly $1.9 billion in equity issuance, those proceeds were more than offset by debt repayments exceeding $4.5 billion. The investing cash flow remained modestly negative, driven by typical capital expenditures and investment activity. Despite the sizable debt repayment, the company still ended the period with a cash position of approximately $1.5 billion—its highest in recent years. The sharp rebound in operating and free cash flow highlights Ares’ ability to generate liquidity internally, even while navigating a capital-intensive business model.

Analyst Ratings

📈 Ares Management Corporation (NYSE: ARES) has recently been the subject of some mixed activity from Wall Street analysts, with a combination of price target cuts and fresh optimism. TD Cowen lowered its price target from $216 down to $161, while maintaining a buy rating. Their move was largely driven by a broader sector reassessment ahead of the next round of earnings—less about Ares specifically, more about recalibrating expectations across the board.

🔄 Wells Fargo made a similar move, adjusting its price target from $187 to $156, though it too kept an overweight rating in place. Goldman Sachs followed suit with a trim to its price target from $188 to $166, also sticking with its buy recommendation. None of these firms seem to be questioning Ares’ long-term potential, but rather dialing back near-term projections in light of shifting valuations across the alternative asset management space.

🚀 On the flip side, JMP Securities took a more bullish stance by upgrading Ares from market perform to outperform, assigning a fresh price target of $165. That kind of confidence typically points to belief in the company’s fundamentals and strategic positioning.

📊 The current analyst consensus lands at a moderate buy, with an average price target hovering around $169.87. That suggests meaningful upside from the current share price and a generally positive outlook, even amid recalibrated targets.

Earnings Report Summary

Ares Management wrapped up 2024 with some solid momentum, and there’s a lot for income-focused investors to take away from its recent earnings release. This was a quarter that showed steady progress—not a flashy one, but definitely the kind of performance that builds confidence in a long-term story.

Strong Finish to the Year

For the fourth quarter, Ares posted net income of $177.3 million, which works out to $0.72 per share. More importantly for how the firm runs its business, after-tax realized income landed at $434.7 million, or $1.23 per share. That’s a better indicator of the cash actually available to return to shareholders, and it tells a more encouraging story than the GAAP figure.

Fee-related earnings came in at just over $396 million, which is really where Ares continues to flex its muscle. Its business model leans heavily on recurring fees, so this steady climb shows that the machine is running smoothly. Despite a choppy market environment, Ares continued to raise capital, deploy capital, and lock in long-term client relationships.

Leadership Commentary and What’s Ahead

On the call, CEO Michael Arougheti pointed to a few standout themes. The firm raised a record $93 billion in new commitments during the year, pushing assets under management up to $484 billion. That’s not just a headline number—more importantly, a big chunk of those assets haven’t even started paying fees yet. That’s future revenue already lined up.

Arougheti also mentioned how market conditions seem to be shifting toward a more active environment in 2025. After a quiet stretch in dealmaking, there’s growing optimism that Ares is positioned to capitalize when activity picks up again.

CFO Jarrod Phillips added some color on what lies beneath the topline numbers. According to him, around $95 billion in assets are currently not contributing to fee income. Once those assets come online, they’ll likely give earnings a lift without requiring a huge increase in operational cost—always a good sign for margin expansion.

Dividend Consistency

The dividend got another bump, with the company declaring $1.12 per share for the quarter, payable at the end of March. That’s a reflection of both confidence in the business and the firm’s clear commitment to returning capital to shareholders. For those focused on dependable income, it’s reassuring to see Ares stick to this upward path in its payouts.

Overall, this wasn’t a quarter that tried to dazzle. Instead, it was a reminder that Ares is executing well, growing deliberately, and staying focused on the long game. There’s consistency in the numbers and a measured tone in the leadership’s outlook—two things that tend to go over well with long-term investors.

Chart Analysis

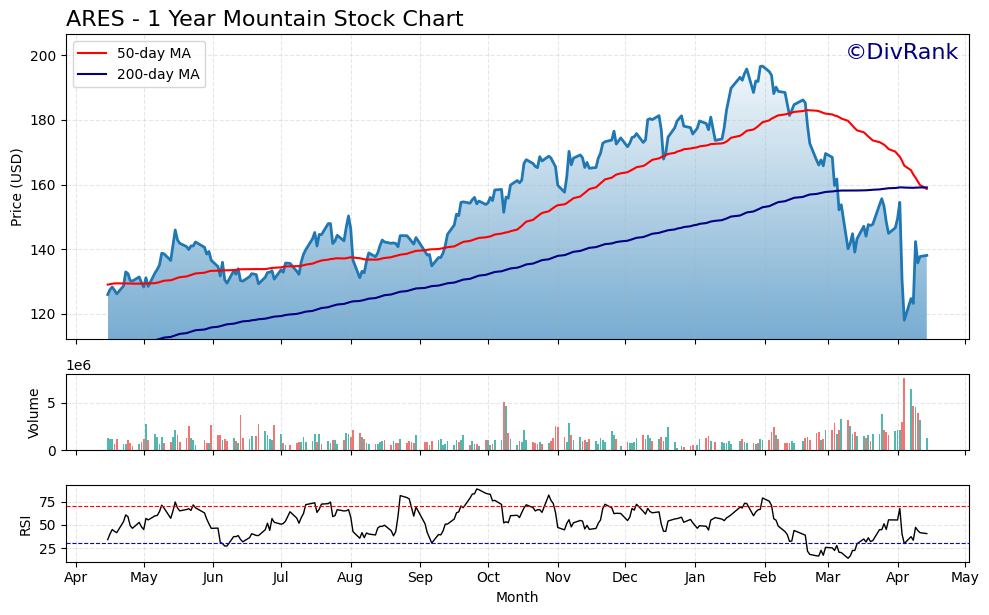

The stock chart for ARES over the past year reveals a story of steady strength followed by a sharp reversal, and most recently, a bounce attempt from oversold conditions.

Moving Averages and Price Trend

For most of the year, ARES maintained a clean uptrend with the price hugging or riding above the 50-day moving average. That support held through much of 2023, pushing the stock to a peak above $200 by early February 2024. The 200-day moving average stayed consistently upward, reflecting broader long-term strength.

But things took a turn in March. The stock broke below both moving averages with increasing momentum. The 50-day has since curled lower, now sitting above the price as resistance, while the 200-day is beginning to flatten. That breakdown marks a clear change in tone for the stock. The price recently attempted a rebound, but remains below both key averages, suggesting a recovery is still in progress rather than confirmed.

Volume Behavior

Volume spiked during the March decline, which often signals capitulation. That was followed by another surge in buying volume during the recent rally attempt. This pattern—heavy selling met with high-volume buying—can hint that larger players may be stepping in around support zones, although confirmation would come only if the stock can reclaim and hold above key levels.

Relative Strength Index (RSI)

The RSI dipped below 30 in early April, which is typically seen as an oversold reading. That aligns with the recent bounce in price. Currently, RSI is moving back toward neutral territory. It’s not in overbought range, which gives the stock some breathing room to climb further if momentum returns.

Overall Read

ARES spent most of the year in a healthy, upward trend before falling into a markdown phase. The recent bounce suggests there’s interest at lower levels, but the path back to stability will likely hinge on whether the stock can clear its moving averages and rebuild investor confidence. The volume surge and RSI recovery are encouraging signs, but the chart still shows a need for follow-through before declaring a longer-term bottom is in.

Management Team

Ares Management’s leadership group brings deep, relevant experience across private credit, real estate, private equity, and infrastructure. At the top is Michael Arougheti, the CEO and co-founder, who’s been instrumental in shaping the firm’s multi-strategy platform since its inception. His ability to steer Ares through different market environments has been a key factor in the company’s continued expansion.

What stands out is how this team focuses on execution. They don’t overpromise. Instead, they work steadily to raise capital, expand fund offerings, and manage operations efficiently. Their track record of integrating acquisitions and scaling without letting costs spiral shows strong operational discipline.

Jarrod Phillips, the CFO, plays a big role behind the scenes, particularly in maintaining capital flexibility and financial transparency. Chairman Tony Ressler, also a co-founder, maintains an active presence and supports the strategic vision. Insider ownership is substantial, with over 12% of shares held by executives. That’s a strong sign that leadership is aligned with long-term investors, not just chasing quarterly results.

Valuation and Stock Performance

ARES stock had a solid run through much of last year, climbing steadily and topping out above $200. But like many names in the sector, it pulled back in early 2024 as investors reassessed valuations. The stock now trades in the $130s, a sizable correction but not one that’s fundamentally concerning given the broader shift in asset manager multiples.

From a valuation standpoint, Ares still trades at a premium on traditional metrics. The trailing P/E ratio is high, around 67, though the forward P/E is far more reasonable at about 26. That reflects expectations for strong earnings growth in the coming quarters. Its price-to-book ratio is also elevated, typical for asset-light businesses that earn through fee streams rather than holding large hard assets.

Ares’ beta is 1.34, so it tends to move more than the market. That volatility is worth noting, especially for conservative investors, but it also reflects the leverage and private market exposure that can amplify returns during strong periods. Long-term, the stock has outperformed and compounded well, particularly when factoring in the dividend.

Institutional ownership remains high, and the stock pays a dividend that yields over 3%, striking a nice balance for both growth and income-minded shareholders.

Risks and Considerations

While Ares has a strong platform, there are some risks worth noting. Leverage is one. With over $13 billion in debt and a high debt-to-equity ratio, the company is dependent on continued access to credit markets. That’s fine in normal conditions, but it can add pressure if market sentiment shifts or interest rates spike.

Regulatory risk is also something to keep in mind. As private credit and alternative strategies become more mainstream, they’re drawing more attention from policymakers. Changes to rules governing transparency, fees, or fund structures could impact the business model over time.

There’s also the cyclical nature of parts of the business. While a lot of revenue comes from recurring management fees, performance fees still play a role. If fundraising slows or investment returns lag, it could weigh on Distributable Earnings, which Ares uses to fund the dividend.

GAAP payout ratios are high, but management leans on more meaningful internal metrics like Distributable Earnings when setting dividend policy. That’s not unusual in this space, but it’s something to be aware of. The model is sustainable, but not bulletproof.

Final Thoughts

Ares Management stands out for its ability to deliver both yield and growth through a business built on fee-based, scalable revenue. It’s not the kind of company that makes splashy headlines, but the strategy is working. Fundraising is strong, assets under management keep growing, and the firm has a good handle on costs and returns.

The dividend is growing, and the payout strategy is backed by real earnings strength. Leadership is experienced, and their interests are clearly aligned with shareholders. While the stock isn’t cheap on a valuation basis, the premium reflects a track record of consistent performance in a complex space.

For investors willing to understand the dynamics of an alternative asset manager, Ares offers a unique mix. It brings the consistency of fee income with the potential upside of growth markets like private credit and infrastructure. It’s not without risks, but for the right investor profile, Ares presents a compelling income-generating opportunity in a part of the market that’s steadily gaining relevance.