Updated 4/14/25

Archer-Daniels-Midland (ADM) plays a central role in the global agriculture and food supply chain, with operations spanning grain trading, oilseeds processing, and nutritional ingredients. With over 50 consecutive years of dividend growth and a current yield above 4%, ADM continues to appeal to investors looking for consistent income from a business tied to essential demand. Recently, the stock has faced pressure from declining margins, regulatory scrutiny, and global market uncertainties, pushing shares down more than 30% from their 52-week high. While navigating these headwinds, ADM’s leadership has launched a restructuring plan aimed at simplifying operations and improving long-term efficiency. Despite short-term challenges, the company maintains solid cash flow, a disciplined capital return strategy, and a valuation that may offer potential for long-term holders focused on income and stability.

Recent Events

It’s been a choppy stretch for ADM. The stock has come down more than 24% from its 52-week high, now sitting near $46 after peaking around $66 last year. That’s not a small slide, and it’s caught the attention of investors who follow core, dividend-rich names.

Revenue is still substantial at $85.5 billion for the trailing twelve months, but the year-over-year revenue growth turned negative, down 6.4%. That’s raising concerns about margin pressure and weakening demand across some of its business lines. The profit margin is sitting at 2.1%, and operating margins are even slimmer at 1.6%. These are tight numbers that don’t leave much margin for error—especially in a capital-heavy business.

Debt’s playing a bigger role in the story, too. With $11.5 billion in total debt and a debt-to-equity ratio north of 51%, leverage is becoming something to watch. Interest rates have been climbing, which means servicing that debt is more expensive. Still, ADM’s balance sheet isn’t in dangerous territory. The current ratio is 1.39, which means they’re covering short-term obligations comfortably.

Valuation-wise, ADM looks discounted. A forward P/E around 10.8 and a price-to-book just under 1 suggest that the market is pricing in caution. That’s usually when income-focused investors start to pay attention—especially when the dividend yield starts to creep higher.

Key Dividend Metrics

🌾 Forward Dividend Yield: 4.45%

📈 5-Year Average Yield: 2.65%

💸 Payout Ratio: 54.79%

💰 Annual Dividend: $2.04 per share

🕒 Dividend Growth Streak: 50+ years

📅 Last Dividend Date: March 11, 2025

📉 Stock Performance (52W): -24.26%

Dividend Overview

This is where ADM starts to shine for income investors. The current dividend yield of 4.45% is well above its five-year average, mostly because the share price has dropped, not because of any change in the dividend itself. That’s often where opportunity hides in plain sight.

The payout ratio, a solid 54.79%, gives ADM a fair amount of flexibility. It’s not overextending itself to keep paying the dividend, but it’s also not so low that the payout looks like an afterthought. This is a company that takes its dividend seriously, and it’s backed that up with more than five decades of continuous increases.

The most recent dividend was paid out in March, and if the company stays on its current schedule, investors can expect another one this summer. While many names in the market are cutting or pausing dividends during uncertain periods, ADM has kept things steady.

Dividend Growth and Safety

Consistency is one thing, but growth is what turns a good dividend payer into a great one. ADM raised its dividend again this year, from $2.00 to $2.04 per share. Not a massive bump, but another notch in a long streak of annual raises. Over the last decade, the company has consistently delivered mid-single-digit dividend growth.

Cash flow remains healthy. Operating cash flow is sitting just under $2.8 billion, and free cash flow is still positive at $787 million. Even though margins are tight and revenue has softened, the company continues to throw off enough cash to comfortably cover the dividend.

Diversification helps here, too. ADM doesn’t rely on one crop, one geography, or one segment. From soybeans to wheat, from feed to fuel, its revenue streams are spread out in a way that smooths out some of the volatility that comes with the ag business.

Now, there are real concerns—especially if margins keep compressing or if global demand slows further. In that case, dividend growth could be more modest going forward. But the risk of a dividend cut seems low based on what we’re seeing now. The company has proven it can handle cycles, and the balance sheet, while carrying more debt than ideal, still looks manageable.

For long-term dividend-focused investors, ADM doesn’t need to be exciting—it just needs to be dependable. And right now, it’s yielding over 4%, maintaining a solid payout, and continuing to invest in a business that feeds both the world and its shareholders.

Cash Flow Statement

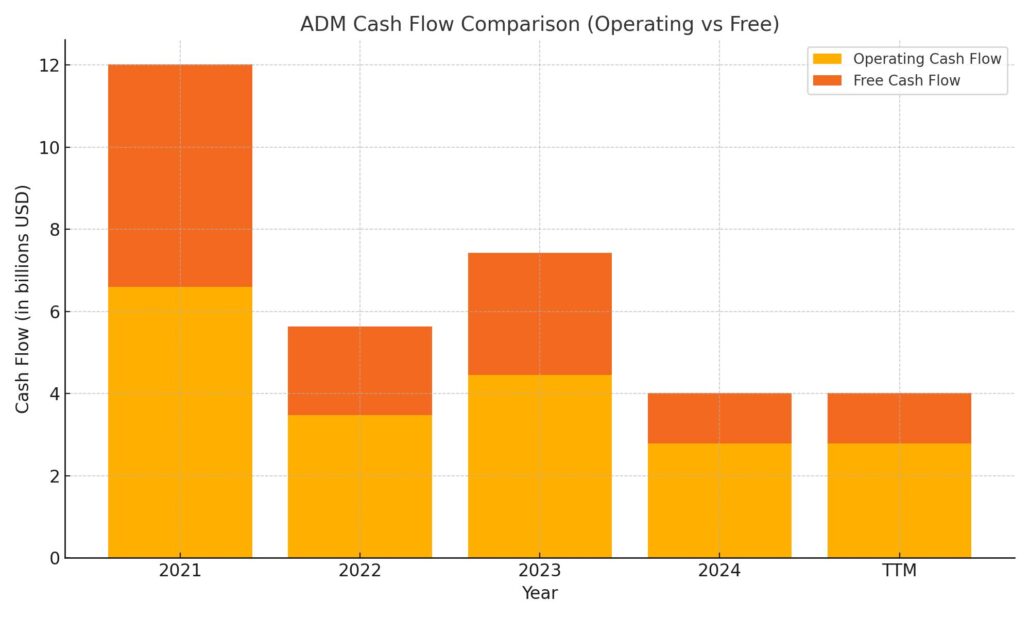

Over the trailing twelve months, ADM generated $2.79 billion in operating cash flow, a noticeable decline from previous years. This drop continues a downward trend from 2021, when operating cash flow reached over $6.5 billion. The decline reflects tighter margins and reduced earnings, which have affected the company’s ability to generate cash from its core operations. Still, operating cash flow remains solidly positive, supporting ADM’s dividend payments and basic capital needs.

On the investing side, ADM spent $2.7 billion, primarily on capital expenditures, which came in at $1.56 billion. That level of investment has stayed relatively consistent, indicating ADM is maintaining its asset base rather than aggressively expanding. Financing cash flow showed a $1.53 billion outflow, driven by share repurchases of $2.33 billion, showing ADM’s continued return of capital to shareholders despite the earnings pressure. Free cash flow for the period was $1.23 billion—down sharply from $2.97 billion the year prior—but still more than enough to cover the current dividend. The company’s ending cash position declined again to $3.92 billion, a continuation of its multi-year slide from $7.45 billion in 2021.

Analyst Ratings

📉 Archer-Daniels-Midland (ADM) has recently faced a wave of analyst downgrades and lowered price targets, reflecting a more cautious outlook on its short-term performance. 🧾 In January 2025, one major firm downgraded ADM from ‘Neutral’ to ‘Underperform’ and reduced its price target from $63 to $54. The move was primarily due to anticipated earnings pressure and uncertainty surrounding biofuel demand, which has been a volatile segment for ADM.

📉 Another firm issued a ‘Sell’ rating, pointing to continued softness in agricultural markets and rising concerns about trade policy impacts. Even with ADM taking steps to manage costs—including significant layoffs aimed at streamlining operations—analysts remain hesitant about its ability to maintain profitability in a challenging macro environment.

🔻 Elsewhere, other financial institutions have followed suit. Barclays revised its price target from $50 to $48 while maintaining an ‘Underweight’ rating. Morgan Stanley took its target from $52 down to $47 but held onto an ‘Equal-Weight’ rating. BMO Capital also reduced its view slightly, moving from $51 to $49 and keeping a ‘Market Perform’ stance. The recurring theme across these downgrades has been margin compression, weaker-than-expected revenue, and uncertainty in key end markets.

📊 The current analyst consensus rates ADM as a ‘Hold,’ with an average price target hovering around $48.80. While this represents a modest upside from current trading levels, it reflects tempered expectations amid ongoing operational and market headwinds.

Earning Report Summary

A Mixed Quarter with Some Bright Spots

Archer-Daniels-Midland (ADM) wrapped up the final quarter of 2024 with a mix of wins and setbacks. The company delivered adjusted earnings per share of $1.14, which came in above what most analysts were expecting. That was a bit of a bright spot in an otherwise tough quarter. On the flip side, revenue dropped to $21.5 billion, down about 6.5% from the same period last year. That shortfall raised some eyebrows, especially given how closely watched this name is in the ag and commodities world.

What really stood out in the earnings details was the performance across segments. Ag Services & Oilseeds took a noticeable hit, with operating profits sliding by 32%. That’s mostly due to weaker margins in the crush business and some lingering uncertainty around biofuels. On the brighter side, Carbohydrate Solutions actually edged up a bit, posting a 3% gain in operating profit. And the Nutrition segment made a solid comeback, turning in an $88 million profit after a rough patch earlier in the year. That rebound came thanks to improved volumes and a tighter handle on costs.

Leadership Focused on Leaner Operations

ADM’s CEO, Juan Luciano, didn’t sugarcoat things in the call. He acknowledged the difficult environment, pointing to global economic pressures and policy uncertainty that’s been hitting the agriculture space. But he was also clear that the company is taking action. One of the big moves ADM is making is a strategic cost-cutting plan that includes trimming the workforce by up to 700 jobs. The goal? Streamline operations and generate between $500 million and $750 million in savings over the next few years.

Looking ahead, ADM laid out its 2025 earnings guidance in a pretty cautious tone. The company expects adjusted earnings per share to land somewhere between $4.00 and $4.75. It’s a range that reflects the unknowns ahead, especially around global trade, crop pricing, and energy policy. Still, the sense from leadership was that ADM is positioning itself to stay resilient, even if conditions remain bumpy for a while.

The report didn’t paint a perfect picture, but it did show a company that knows how to navigate turbulence and adapt. There’s still a long road ahead, but for long-term investors, ADM’s response to recent headwinds shows it’s not just standing still.

Chart Analysis

Price Trend and Moving Averages

ADM has been in a steady downtrend over the past year, with its share price moving from around $65 to the low $40s before a recent bounce. The 50-day moving average (red line) has remained consistently below the 200-day moving average (blue line) since late summer, confirming the overall bearish trend. The downward slope of both averages points to prolonged selling pressure and a lack of sustained upward momentum.

There was a brief attempt at a recovery in March, but it quickly rolled over. The latest uptick in April shows a sharp rebound from near-yearly lows, which could be a short-term reaction to oversold conditions, especially when you consider the stock is still trading well below both key moving averages.

Volume and Momentum

Looking at volume, there’s a noticeable spike in early April, suggesting a wave of buyers or possibly short covering stepping in at those lower levels. Outside of that, trading volume has been relatively muted throughout the decline, indicating that the selling wasn’t always aggressive but rather persistent over time.

The RSI, or relative strength index, dipped well below 30 multiple times in recent months—clearly into oversold territory. Every time it approached or crossed that threshold, the stock staged some form of short-lived rally. Most recently, it bounced off the 30 level again, hinting at another potential shift in short-term momentum. However, without a break above the 50-day average, these rallies haven’t shown staying power.

Overall Chart Setup

This chart tells the story of a company under pressure. The long, grinding decline combined with repeated RSI dips below 30 reflects investor hesitation and ongoing concern. While there are flashes of strength, they’ve been unable to shift the longer-term trend. The price remains boxed in by resistance from above and weak volume follow-through on any upward move. Until that 50-day average flattens or turns upward with price support behind it, this chart remains in correction mode.

Management Team

Archer-Daniels-Midland (ADM) is led by CEO Juan R. Luciano, who has been steering the company since 2015. Luciano brings an industrial engineering background and spent over two decades at Dow Chemical before joining ADM in 2011. His leadership has centered around transformation—shifting ADM’s focus beyond traditional ag commodities into higher-margin areas like nutrition and specialty ingredients. He’s been a steady hand during both expansion phases and more recently, during restructuring efforts.

The executive bench includes Christopher Cuddy, currently overseeing both North America operations and serving as Global President of Carbohydrate Solutions. His role recently came under scrutiny due to an internal accounting review within his division, a situation that has prompted ADM to revise several years of financial filings. Other senior leaders like Kristy Folkwein, the Chief Information Officer, and Regina Jones, General Counsel, are supporting the company through this restructuring. The broader leadership group is focused on trimming inefficiencies, reducing complexity, and tightening controls, all while trying to keep the company competitive in a changing ag landscape.

Valuation and Stock Performance

ADM’s stock has had a tough year. It peaked at just over $66 and has since drifted down to around $46, a decline of about 30% from its highs. The slide has been influenced by a mix of accounting-related headlines, softer earnings, and external pressures in the agricultural and biofuel markets. Despite that, the stock’s valuation looks appealing by many traditional metrics.

With a trailing P/E ratio around 12.8 and a forward P/E just over 10, ADM is trading at a discount to many of its industry peers. The price-to-book ratio has dipped below 1, a sign the market may be undervaluing its assets. The dividend yield, now hovering above 4.4%, is another piece of the valuation story that adds appeal, particularly for income-oriented investors. While sentiment has been shaken, the business model still generates strong cash flow, and the company hasn’t wavered on returning capital to shareholders.

Risks and Considerations

There’s no getting around the fact that ADM is dealing with some weighty risks right now. The internal accounting investigation into its Nutrition segment has already led to leadership reshuffling and the need to revise six years of financial statements. That has understandably raised concerns about internal controls and financial transparency.

Beyond that, ADM is heavily exposed to commodity cycles, trade policy, and global economic shifts. Prices for corn, soybeans, and other inputs can swing widely from year to year, and weather volatility adds another unpredictable layer. Regulatory changes in energy and biofuels policy—especially in the U.S. and Europe—can also move the needle on ADM’s margins.

Another layer of risk comes from its recent cost-cutting plan. While trimming expenses by up to $750 million may help earnings longer-term, eliminating up to 700 positions worldwide could create disruption internally. ADM is betting that simplification will bring greater efficiency, but there’s always a near-term cost to making these kinds of operational shifts.

Final Thoughts

ADM has been through many cycles in its long history, and this moment is another test of resilience. The accounting issues and resulting scrutiny have clearly weighed on the stock and investor sentiment. Still, the core business remains intact. Its diversification across ag services, carbohydrates, and growing nutrition platforms means it isn’t solely dependent on any single market or commodity.

The leadership team appears focused on navigating through the current headwinds by tightening controls and simplifying operations. At the same time, the stock’s lower valuation and elevated yield provide a cushion for investors willing to weather short-term uncertainty. For those keeping an eye on long-term potential, ADM still offers a unique mix of global reach, scale, and commitment to capital returns, even as it works to rebuild confidence in the near term.