Updated 4/14/25

Arbor Realty Trust (ABR) is a real estate investment trust focused on multifamily and commercial real estate lending, known for its consistently high dividend yield and deep-rooted leadership. Despite a challenging interest rate environment and a recent stock price pullback to around $10.53, Arbor has maintained its quarterly dividend and continues to generate strong free cash flow. The company is led by a veteran management team and operates a diversified platform that includes both agency and structured loan originations. With a price-to-book ratio under 1.0 and a dividend yield above 16%, the stock trades at a discount while still offering income potential. However, investors should weigh this against rising short interest, high leverage, and an ongoing federal investigation, which contribute to near-term uncertainty. Arbor’s recent earnings show resilience, but its ability to sustain performance will depend on credit quality, capital access, and broader real estate market conditions.

Recent Events

In the past year, ABR’s stock has taken a hit. It’s down over 13% while the broader market has kept climbing. Not exactly the trajectory dividend investors want to see, but it does raise the possibility that the current price is over-punished.

Part of that decline is tied to the broader pressure on interest-rate sensitive sectors. REITs in general have had to navigate a tougher borrowing landscape, and Arbor, with its hefty debt load—over $10 billion—has certainly felt that. The company’s revenue dropped 12.1% year-over-year in the most recent quarter, and earnings slid more than 30%. Not ideal, but not totally unexpected either.

Despite that, Arbor didn’t blink when it came to its dividend. They held steady, keeping the payout in place while others might’ve looked to trim. That move sent a clear message: management knows the dividend is central to ABR’s identity. But it also suggests they’re confident in their ability to weather the storm, or at least that they believe the benefit of maintaining the payout outweighs the risk of cutting it.

Key Dividend Metrics

📈 Dividend Yield: 16.35%

💸 Payout Ratio: 145.76%

📅 Ex-Dividend Date: March 7, 2025

📬 Most Recent Payment: March 21, 2025

📊 5-Year Average Yield: 10.67%

📉 52-Week Price Range: $9.66 – $15.94

💼 Current Price/Book: 0.83

🔍 Short Interest: 42.22% of float

This isn’t a stock you buy just for a modest boost to your income stream. This is for investors who want high yield and know how to live with some turbulence along the way.

Dividend Overview

That 16% yield is eye-catching, no question. But anytime a yield gets that high, it naturally prompts a second look. Is the payout sustainable? Is it a sign that something’s broken in the business? In ABR’s case, the answer isn’t black and white.

The payout ratio is certainly high, well over 100%. Traditionally, that’s a red flag, but REITs operate under a different set of expectations. Their earnings, as reported under GAAP, don’t tell the whole story. For income-focused REITs like Arbor, funds from operations (FFO) or adjusted funds from operations (AFFO) are often more relevant when judging whether the dividend is covered.

That said, it’s still aggressive. Arbor appears to be walking a tightrope, relying on a mix of recurring servicing income and a loan book that’s been, so far, reasonably stable. With a price/book ratio of just 0.83, the market isn’t giving full credit to ABR’s assets, suggesting some skepticism about their ability to maintain or grow earnings.

And then there’s the short interest—over 42% of the float is shorted. That’s an unusually high number, signaling that a lot of traders are betting against ABR. It could be that the dividend will eventually get cut, or that the company’s business model will struggle in the current rate environment. But so far, those bets haven’t been proven right. For income-focused contrarians, this might be exactly the kind of setup that feels worth the risk.

Dividend Growth and Safety

ABR isn’t just tossing out high dividends to make noise. Over the past few years, they’ve shown a real commitment to growing the payout. They’ve managed to bump it up several times in recent years, even as the macro environment has gotten more complicated. The five-year average yield of 10.67% already tells a story—this is a stock that’s been generous with income for a long time.

But growth looks more challenging right now. Earnings have taken a hit, and with that elevated payout ratio, there’s not a ton of room for further increases unless revenue starts heading north again.

Safety is the bigger question. Arbor’s business model gives it some built-in buffers, especially with its servicing platform providing a relatively stable source of income. The company’s current ratio of 3.53 shows it has solid short-term liquidity, and there’s over $500 million in cash on the books. So they’re not in immediate danger of missing payments.

But long-term sustainability depends on more than just short-term cash. If credit markets tighten further or if loan defaults start to rise in the real estate sector, Arbor will need to react quickly. Their ability to manage that risk while maintaining the dividend will be a key storyline for dividend investors over the next year.

For now, though, Arbor is holding the line—and doing so with one of the richest yields you’ll find in the market.

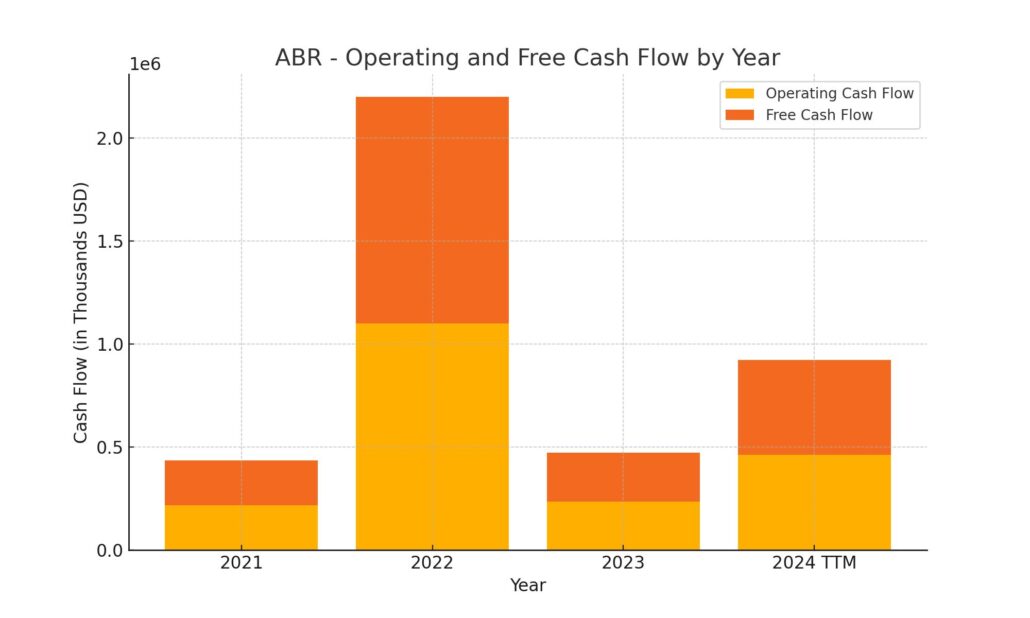

Cash Flow Statement

Arbor Realty Trust’s trailing twelve-month cash flow highlights a significant jump in operating performance, with $461.5 million in operating cash flow—almost double from the prior year. This improvement in core cash-generating ability is notable, especially when viewed against a backdrop of declining earnings. Free cash flow mirrors this at the same $461.5 million level, suggesting limited capital expenditures and a focus on maintaining liquidity.

On the investment side, Arbor posted positive investing cash flow of $1.15 billion, reversing years of heavy outflows. This swing suggests a slowdown or shift in deployment of capital into new loans or projects. However, financing activities saw a sharp outflow of $2.49 billion, reflecting continued debt repayments and a pullback from earlier periods of aggressive funding. In fact, Arbor repaid over $11.5 billion in debt during the TTM period. As a result, the company’s cash position declined to $660 million, down from over $1.5 billion the year before. The move shows a firm-wide pivot toward deleveraging and balance sheet stability while still sustaining a high level of free cash flow.

Analyst Ratings

📉 Arbor Realty Trust has seen mixed reactions from analysts recently, with several firms adjusting their outlooks based on the company’s financial performance and the broader macro environment. The overall consensus is leaning toward a “Hold” rating, reflecting some hesitation as rising interest rates and sector volatility continue to shape sentiment around REITs like Arbor.

📝 One recent change came from Keefe, Bruyette & Woods, who maintained their “Market Perform” rating but revised the price target downward from $12 to $11.75. Their rationale was tied to ongoing concerns about dividend sustainability and the company’s exposure to higher borrowing costs. This is particularly relevant given Arbor’s leverage-heavy balance sheet and its high payout ratio.

🔄 Raymond James also stepped back from a previously more optimistic stance, downgrading Arbor from “Outperform” to “Market Perform.” The downgrade suggests a more cautious view of how the company might navigate the current environment, especially with loan activity slowing and margins under pressure.

🎯 Despite the cooler analyst sentiment, the average 12-month price target for ABR is currently $13.71. That’s well above where the stock trades now, indicating that analysts still see potential upside, even if they’re treading more carefully. This blend of caution and opportunity captures the tension surrounding ABR at the moment—a high-yield stock that’s trying to stay steady in a shifting landscape.

Earning Report Summary

Arbor Realty Trust wrapped up the fourth quarter of 2024 with results that showed the company’s steady hand in a tougher lending environment. The numbers weren’t quite as strong as the same period last year, but they still reflected a business that’s holding its ground while focusing on long-term positioning.

Earnings Dip, But Core Business Holds Up

The company posted net income of $59.8 million for the quarter, which came out to about $0.32 per diluted share. Distributable earnings landed at $81.6 million, or $0.40 per share. Both figures were down from Q4 of the previous year, when earnings were notably higher. But in context—given how much the interest rate landscape has changed—this wasn’t all that surprising.

What really stands out is that Arbor chose to keep its dividend steady at $0.43 per share. That’s a strong signal to income-focused investors that the company is still confident in its cash flow and balance sheet, even with earnings coming under a bit of pressure.

Lending Activity and Portfolio Shifts

On the lending side, the agency business continues to be a strength. Arbor originated $1.38 billion in new agency loans during the quarter, helping push its servicing portfolio to just under $33.5 billion. Structured loan activity came in at $684 million, with runoff a little higher than that, trimming the portfolio slightly to around $11.3 billion.

One important move this past year was Arbor’s effort to reduce leverage. They managed to bring down their debt-to-equity ratio from 4:1 to 2.8:1—a meaningful shift in a capital-intensive business like this. That kind of deleveraging is exactly what investors like to see, especially when the cost of debt is climbing.

Leadership Commentary and Outlook

Management acknowledged that this is a challenging backdrop for originations. Higher rates have made it harder for deals to pencil out, which naturally weighs on loan volume. But they were clear in their messaging: Arbor isn’t just a one-trick pony. The servicing income continues to provide reliable revenue, and the balance sheet cleanup positions the company well for when lending activity picks up again.

They also raised $100 million through the issuance of senior notes, locking in capital to further strengthen their financial foundation heading into 2025.

All in all, this quarter showed a company focused on weathering the current environment without taking its eye off the future. It wasn’t a flashy report, but it was steady—and in this kind of market, steady counts for a lot.

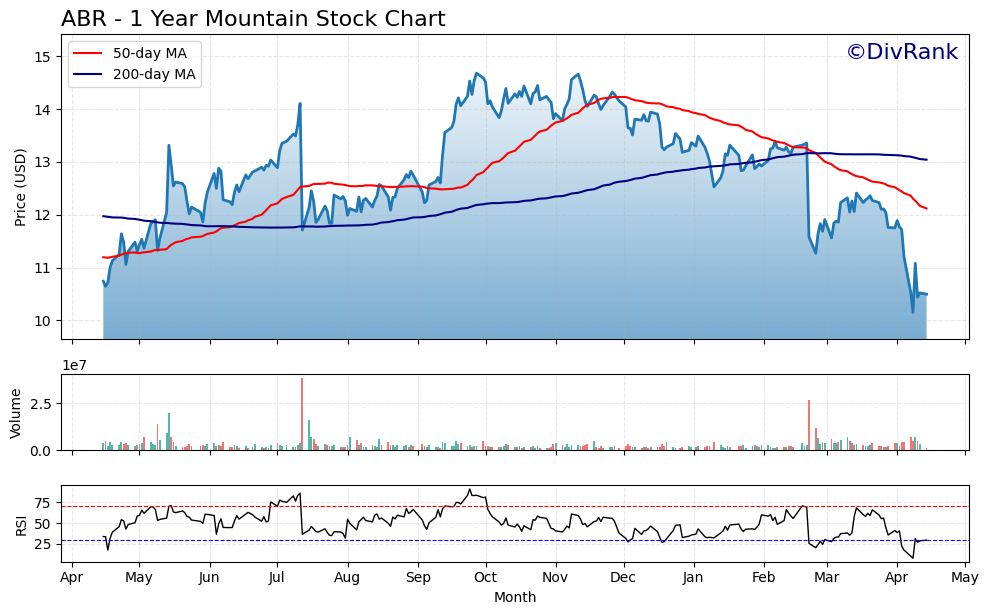

Chart Analysis

Price Movement and Moving Averages

Looking at the one-year chart for ABR, the stock had a strong run through most of 2023, peaking in the $15 range during the fall. The 50-day moving average (red line) was comfortably above the 200-day moving average (blue line) for a good stretch of time, confirming a longer-term bullish trend through much of the second half of the year. However, since the beginning of 2024, that momentum has clearly broken down.

The price has now slipped well below both moving averages, with the 50-day in a steep decline and falling beneath the 200-day—a textbook bearish crossover that suggests weakening sentiment. The recent sharp drop below $11 was accompanied by a spike in volume, likely reflecting institutional selling or some form of forced liquidation. After bouncing slightly, the stock is struggling to reclaim higher ground, staying pinned near its recent lows.

Volume and Momentum

Volume has picked up during selloffs, indicating strong distribution. These spikes tend to appear at moments of stress rather than accumulation, which supports the idea that sellers remain in control for now. The absence of sustained buying pressure suggests confidence hasn’t yet returned, at least not in the short term.

RSI Insights

The RSI (Relative Strength Index) has dipped into oversold territory multiple times in recent weeks, and it’s currently hovering around the 30 mark. That shows the stock is stretched on the downside, and short-term bounces are likely. However, the RSI hasn’t yet made a clear reversal or breakout, so momentum remains weak. It’s worth noting that the RSI spent much of last year in the 50 to 70 range—firmly in bullish territory—before rolling over in early 2024. This drop mirrors the broader breakdown in trend strength.

Overall Trend View

The chart tells the story of a stock that had a strong ride last year, supported by steady volume and upward momentum, but now finds itself under pressure. The moving averages, sharp drop in price, and weak RSI suggest a market adjusting to a different outlook, whether due to changing fundamentals, macro conditions, or both. Any meaningful recovery would need to see the price reclaim at least the 50-day moving average and hold above it, along with a clear shift in volume and momentum. For now, the trend is clearly to the downside.

Management Team

Arbor Realty Trust is guided by a leadership team with deep experience in real estate finance and capital markets. At the top is Ivan Kaufman, the founder, chairman, and CEO. He’s been at the helm since Arbor’s inception and has played a pivotal role in building the company’s identity as a niche lender in the multifamily and commercial real estate space. Kaufman is known for navigating through multiple economic cycles, which is no small feat in a sector that lives and dies by interest rate moves and market liquidity.

Paul Elenio, the Chief Financial Officer, has been instrumental in maintaining the financial discipline that supports Arbor’s lending and dividend strategies. His focus on capital structure and liquidity has helped the company weather challenging periods. Also central to operations is John Caulfield, the Chief Operating Officer, who oversees the firm’s large agency loan platform. The executive bench is further supported by Fred Weber on the structured finance side and Steven Katz, who handles residential financing investments. It’s a leadership group that blends institutional knowledge with a track record of execution in a demanding and ever-evolving industry.

Valuation and Stock Performance

As of mid-April 2025, ABR trades around $10.53, which is a far cry from its highs above $15 seen just months ago. The decline over the past year—roughly 15%—has mirrored broader headwinds in the REIT space, particularly among firms with exposure to rising borrowing costs and capital-intensive business models. What stands out, however, is the valuation backdrop.

Arbor is currently trading at a price-to-book ratio of 0.83. That’s a steep discount to its underlying assets and historically low for the stock. It suggests that the market is pricing in significant risk—whether related to credit concerns, refinancing pressure, or questions around dividend sustainability. Yet, analysts haven’t entirely turned away. The average 12-month price target sits at $13.26, implying potential upside from current levels.

Even with the lower stock price, the dividend yield remains unusually high, north of 16%. That kind of yield is typically reserved for companies the market believes are at risk of cutting their payout. Whether Arbor can defy those expectations will depend on its cash flow, loan performance, and access to capital in the months ahead.

Risks and Considerations

There are some real concerns surrounding Arbor right now. One of the bigger shadows over the company is a federal investigation into its loan practices. While the full details haven’t been made public, any legal uncertainty has a way of hanging over a stock, especially in the financial sector. It can limit investor appetite and complicate future financing.

Leverage is another area to watch. Arbor’s debt-to-equity ratio has come down recently, now sitting around 2.8 to 1, but it’s still on the high side. In a rising rate environment, that kind of balance sheet can create pressure on interest expense and limit flexibility. Add in the fact that the company’s dividend payout ratio is above 100%, and it’s clear that Arbor is walking a fine line between rewarding shareholders and managing long-term sustainability.

Then there’s the macro backdrop. The commercial real estate market is in a transitional phase. Some segments are holding up, but others—like office space—are still under stress. If property values dip or delinquencies rise, Arbor’s portfolio could face challenges that go beyond what’s already priced into the stock.

Final Thoughts

Arbor Realty Trust is the kind of company that draws attention because of its eye-catching yield and discounted valuation. But there’s a lot more to the story than just numbers on a screen. The leadership team has a long track record of managing through complex markets, and they’ve made strategic moves to stabilize the balance sheet. That’s worth noting.

At the same time, risks are clearly elevated. Legal concerns, leverage, and macro uncertainty make it a name that requires a steady hand and close attention. The next few quarters will likely be critical in determining whether Arbor can maintain its dividend, regain investor confidence, and begin to close the gap between its share price and its book value.

For those watching from the sidelines or already invested, this is a moment to stay informed, patient, and mindful of both the upside and the risk that come with a name like ABR.