Updated 4/14/25

AptarGroup (ATR) operates at the intersection of packaging innovation and global consumer demand, delivering specialized dispensing and drug delivery systems for industries like healthcare, beauty, food, and beverage. With a market cap around $9.5 billion and a forward P/E of 26.32, the company balances stability with growth. Its consistent free cash flow, strong return on equity, and a 31% payout ratio underpin a reliable dividend profile. Leadership under CEO Stephan Tanda has focused on expanding high-margin pharma offerings and steady execution across all segments. Recent earnings reflected margin expansion and double-digit EPS growth, while analysts see moderate upside from current levels. With new product innovation, a $500 million share buyback program, and a long track record of shareholder returns, Aptar continues to reinforce its position as a dependable, long-term investment supported by operational strength and disciplined capital management.

Recent Events

The most recent quarterly results were quietly impressive. Earnings per share jumped nearly 62% year-over-year—a serious acceleration by Aptar’s standards. Revenue growth was more subdued, up just over 1%, but in many ways that’s typical. This company doesn’t chase big top-line expansion. It leans into margin improvement and consistent execution instead.

Right now, operating margin is sitting at 14.28%, while net margin is a solid 10.45%. For a business that’s heavy on recurring demand and light on capital intensity, those numbers suggest a well-tuned machine. And the free cash flow tells the same story: over $316 million in levered free cash flow on a trailing basis gives them breathing room for both reinvestment and shareholder returns.

From a valuation standpoint, the stock isn’t cheap—trading at over 26 times forward earnings—but it rarely is. Investors tend to pay a premium for predictability and a stable payout, especially in a defensive niche. The current enterprise value of about $10.3 billion reflects that confidence.

Key Dividend Metrics

📈 Dividend Yield: 1.25% (Forward)

💵 Forward Dividend Rate: $1.80 per share

🔁 5-Year Average Yield: 1.23%

📊 Payout Ratio: 31.10%

📆 Dividend Frequency: Quarterly (Last paid: Feb 26, 2025)

📉 Beta: 0.59

💰 Free Cash Flow Coverage: Strong – ample coverage with $316M in free cash flow

Dividend Overview

This isn’t a stock you buy for a big yield. It’s a stock you hold because you trust the dividend will show up quarter after quarter, with a slow and steady raise every year or so. At 1.25%, the forward yield is right around the company’s five-year average. Not eye-popping, but in line with what long-term investors have come to expect.

The real comfort comes from the payout ratio, which sits at just over 31%. That’s conservative by any standard and suggests Aptar isn’t stretching itself to return cash to shareholders. In fact, it leaves a healthy margin for future increases, especially if earnings continue to grow.

And while the dividend may not be a major source of income on its own, the combination of consistent payouts and low stock volatility (with a beta of just 0.59) adds up to a smooth ride for income-focused investors. It’s the kind of name that might not impress in a bull market but tends to shine when the ride gets rough.

Dividend Growth and Safety

One of the most reassuring aspects of Aptar’s dividend is its consistency. While the company hasn’t made aggressive hikes, it has raised the payout every year for nearly three decades. That track record alone sends a signal: management is committed to returning value to shareholders without taking unnecessary risks.

From a safety perspective, the dividend looks rock solid. Debt levels are manageable, with just over $1 billion in total debt and $226 million in cash. The debt-to-equity ratio is below 44%, which is reasonable for a company with steady earnings and strong cash generation.

Earnings growth is also stepping up. After years of moderate improvement, the latest quarter saw a meaningful earnings surge—over 60% growth year-over-year. That kind of jump gives them even more room to increase the dividend or buy back shares if they choose to.

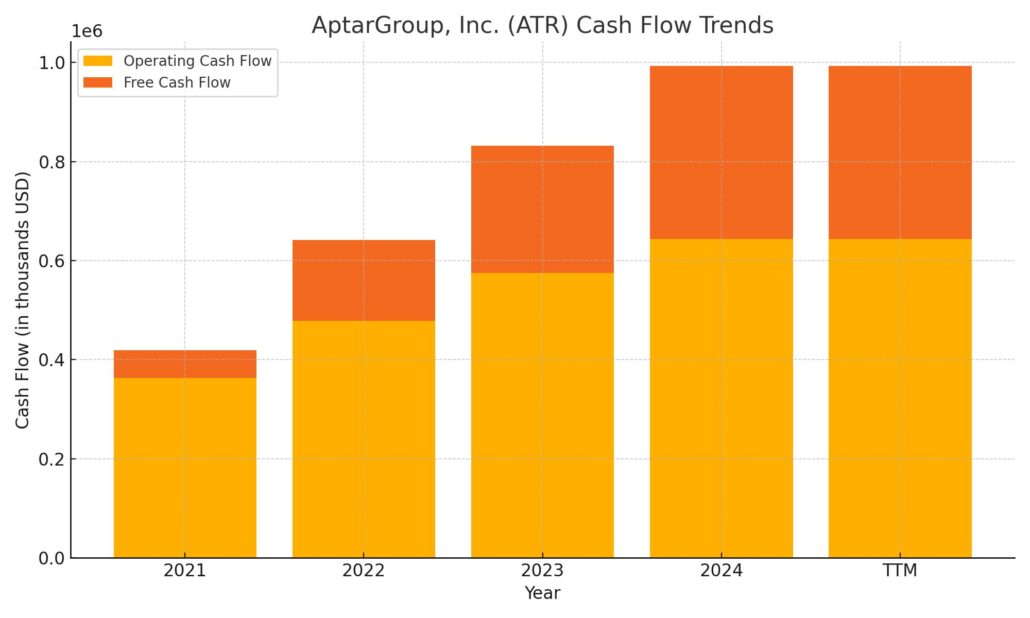

Cash flow continues to be a high point. Operating cash flow is over $640 million, and with capital expenditures staying in check, that translates into substantial free cash for shareholder returns. The company has shown no signs of overreaching, and that discipline tends to pay off over the long run.

One more subtle but telling detail: institutional investors hold more than 93% of the float. That level of professional ownership is usually a vote of confidence, and it tends to support a steady, disciplined capital allocation strategy—including dividends.

So while AptarGroup might not dazzle with growth or yield, it has built a quiet but convincing case as a dependable dividend payer. It’s the kind of stock that earns a spot in portfolios meant for the long haul—quietly compounding, rarely complaining.

Cash Flow Statement

AptarGroup’s trailing twelve-month (TTM) cash flow shows a business operating from a position of financial strength. Operating cash flow has climbed to $643 million, marking a notable improvement from $575 million the prior year and continuing a steady upward trajectory over the past several years. This growth reflects improved earnings quality and efficient working capital management. Capital expenditures came in at $294 million, leaving the company with $349 million in free cash flow—more than enough to comfortably support dividends and provide optionality for strategic spending or debt repayment.

On the financing side, AptarGroup returned a meaningful amount of cash to stakeholders while also managing its debt profile. Debt repayments over the TTM period totaled $397 million, showing a proactive stance on deleveraging. Meanwhile, share repurchases and dividends accounted for a combined outflow of just under $100 million, suggesting a balanced capital return approach. Despite these outflows and consistent investment in the business, cash on hand still increased slightly to $224 million. The pattern here is clear: Aptar is generating more cash, spending strategically, and maintaining flexibility—exactly what dividend-focused investors should want from a dependable mid-cap.

Analyst Ratings

📉 AptarGroup (ATR) has recently seen mixed analyst opinions, reflecting a nuanced view of its financial prospects. 🏦 Bank of America downgraded the stock from a “buy” to a “neutral” rating, adjusting its price target to $173.00. This move was driven by a revised outlook on the company’s earnings, with analysts signaling a more cautious stance on short-term profitability.

📈 On the other hand, Raymond James initiated coverage with an “outperform” rating and set a price target of $200.00, showing confidence in the company’s growth potential. Similarly, Jefferies shifted their stance to a “buy” rating, raising the target from $155.00 to a much more bullish $215.00. These upgrades highlight optimism around Aptar’s expanding margin profile and consistent free cash flow.

📊 The broader consensus from Wall Street points to a “moderate buy” rating. The average price target among covering analysts now stands at approximately $181.60. That represents a roughly 28% upside from the current share price. These contrasting views underline differing expectations for the pace and scale of Aptar’s profitability and operational momentum going forward.

Earning Report Summary

Solid Finish to 2024

AptarGroup wrapped up the year with a steady fourth quarter, showing the kind of performance that reflects consistency more than flash. Sales for the quarter reached $848 million, up slightly from the year before. When adjusted for currency shifts, core sales were up about 2%, which is a reasonable pace given the environment. The real standout, though, came in profitability. Net income rose sharply—up 62% year over year to $101 million. That translated to earnings per share of $1.49, with the adjusted number landing a bit higher at $1.52. Margin improvements and a favorable tax rate helped push those numbers higher.

Pharma Leads, Beauty Lags

Breaking things down, the Pharma segment continues to be the workhorse for Aptar. It posted 4% growth in core sales, helped along by solid demand for its drug delivery systems and a nice bump from royalty income. The Closures segment also had a strong showing, growing 7% on the back of better food and beverage demand and more efficient plant operations. Not everything was rosy, though. The Beauty segment saw a 3% decline in core sales. That dip was linked to softer tooling sales and some weakness in the fragrance and skincare areas, particularly in the prestige category.

Strong Full-Year Numbers

For the full year, revenue hit $3.58 billion, which is a 3% increase from the previous year. Net income climbed 32%, totaling $375 million. Adjusted EPS for 2024 reached $5.64, up a solid 18% from the year before. Just as important for long-term investors, cash generation was strong. Operating cash flow was up 12%, and free cash flow saw a 40% increase. That kind of cash performance gives Aptar plenty of room to keep investing in the business while also rewarding shareholders.

A Look Ahead

Leadership sounded cautiously optimistic heading into 2025. CEO Stephan Tanda emphasized growth opportunities in the Pharma and Closures businesses, though he acknowledged some headwinds from currency swings and higher expected tax rates in the first quarter. The company’s EPS guidance for Q1 is between $1.11 and $1.19—not off-the-charts, but right in line with the company’s steady, methodical approach.

Aptar also rolled out a $500 million share repurchase program and kept its dividend pace steady with a declared quarterly payout of $0.45 per share. The combination of rising earnings, strong cash flow, and capital returns paints a picture of a company staying focused on delivering value the old-fashioned way—through execution, not excitement.

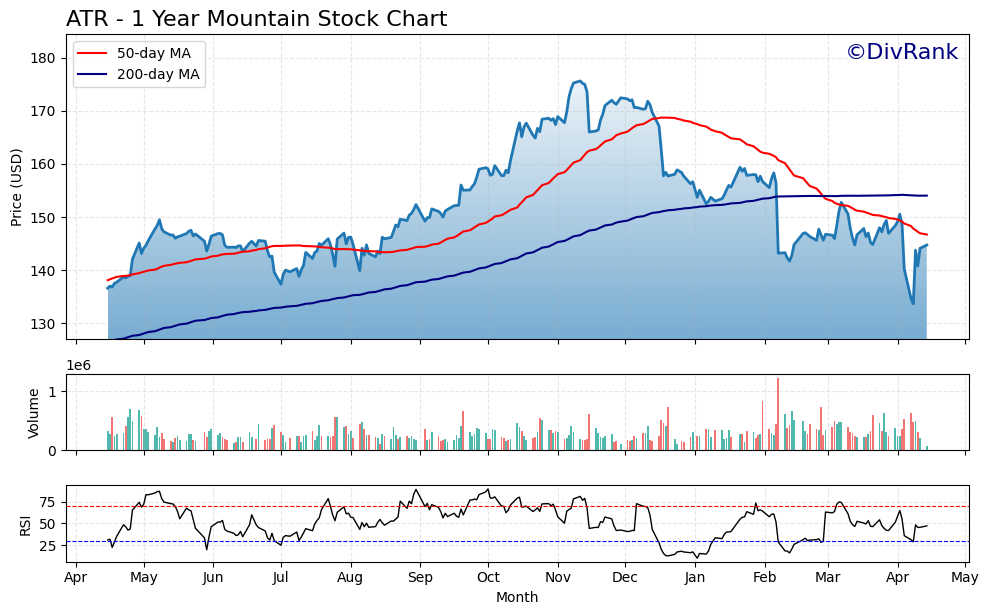

Chart Analysis

Price Trend and Moving Averages

Looking at the past year of price action for ATR, there’s been a noticeable shift in momentum. The stock climbed steadily through most of 2023, peaking in late November before starting a gradual but persistent decline. The 50-day moving average (shown in red) has rolled over and now sits below the 200-day moving average (in blue), forming what’s commonly seen as a bearish crossover. This change in moving average direction confirms the recent downtrend and suggests that the stock has lost short-term momentum.

That said, ATR has bounced off recent lows, showing signs of resilience just above the $135 level. This support zone has held multiple times over the past year and looks like a key level that buyers are defending. The current price is just below both the 50- and 200-day moving averages, so it’s in a bit of a technical recovery phase. Sustained closes above those levels would be an encouraging signal of strength returning.

Volume Activity

Volume has remained relatively stable throughout the year, though there have been occasional spikes that coincide with sharper price moves. Notably, higher volume days have aligned with sharp dips and recoveries, suggesting active institutional participation around key price levels. This can be a healthy sign when a stock is trying to base and reverse direction.

RSI Momentum

The relative strength index (RSI) adds another layer to the story. For much of late 2023, RSI hovered around the overbought threshold near 70, reflecting strong bullish momentum. But since the turn of the year, RSI has spent more time closer to the 30 level, briefly dipping into oversold territory during April’s decline. This recent dip followed by a rebound hints at a potential short-term bottom, although the index is still well below the midpoint of 50, showing that momentum remains cautious.

Overall, the chart shows a stock that had a strong run but has since entered a consolidation phase. It’s working to find footing again, with some encouraging technical signals beginning to emerge. How it behaves around the moving averages over the coming weeks will likely set the tone for the next leg of its journey.

Management Team

AptarGroup’s leadership is anchored by CEO Stephan Tanda, who has led the company since 2017. With past executive experience at Royal DSM and DuPont, Tanda brings a deep understanding of global operations and strategic expansion. During his tenure, Aptar has sharpened its focus on innovation, particularly in the pharma and consumer health spaces, while maintaining a disciplined approach to capital allocation and long-term planning.

Supporting him is CFO Vanessa Kanu, who joined in early 2025. Kanu comes with a strong financial background across several multinational corporations, and her arrival adds a layer of financial rigor to the executive team. The broader leadership group includes seasoned executives across Aptar’s Pharma, Beauty, and Closures segments. Their combined focus on operational excellence and customer-centered innovation has helped keep Aptar competitive in markets that rely heavily on reliability and quality.

Valuation and Stock Performance

As of mid-April 2025, ATR trades just under $145. The stock has seen a modest rebound after dipping earlier in the year, and is currently sitting below both its 50- and 200-day moving averages. The overall chart suggests the stock has entered a consolidation phase following a strong rally last fall.

With a market cap of roughly $9.5 billion, Aptar is firmly in mid-cap territory. Its forward price-to-earnings ratio sits at 26.32, which puts it in line with others in the sector. The PEG ratio of 4.47 suggests that the stock might be priced at a premium relative to expected growth, but the premium reflects the company’s stability, strong cash flow, and low volatility.

Analyst sentiment has remained generally constructive, with a consensus price target around $183.75. This implies a potential upside from current levels, though not an overly aggressive one. Rather, it speaks to the market’s view of Aptar as a steady performer with clear visibility into earnings.

Risks and Considerations

AptarGroup operates across multiple regions, which naturally exposes it to foreign exchange swings. Currency headwinds can compress earnings even when operations are performing well. This is a factor to keep an eye on, especially with the dollar having shown strength against several major currencies over the past year.

There’s also the competitive nature of the industries Aptar serves. While its position in pharma drug delivery systems is strong, the consumer and beauty segments are highly competitive and often price-sensitive. Innovation remains essential here, not just to drive growth, but also to defend existing market share.

Additionally, regulatory changes in healthcare and pharmaceuticals can create new hurdles or opportunities, depending on how the company positions itself. With Aptar’s growing presence in drug delivery systems, any shift in regulation or reimbursement policy could have ripple effects on its top and bottom lines.

Final Thoughts

AptarGroup is the kind of company that leans into consistency over flash. The leadership team has created a solid foundation, blending innovation with financial conservatism. Its business spans essential industries—healthcare, food, personal care—which gives it a defensive quality that doesn’t go unnoticed.

The valuation may not scream bargain, but what investors are paying for is stability, disciplined execution, and a dependable stream of earnings. Risks remain, particularly in areas tied to global markets and regulatory complexity, but Aptar has shown over the years that it knows how to navigate those waters.

Whether it’s the strength of the balance sheet, the commitment to capital returns, or the focus on niche innovation, AptarGroup continues to present itself as a company that knows who it is and where it adds value. It doesn’t need to reinvent itself—it just needs to keep doing what it does well.