Updated 4/14/25

Applied Materials (AMAT) plays a critical role in the global semiconductor ecosystem, supplying the advanced tools and technologies used to manufacture chips across a range of end markets, from consumer electronics to artificial intelligence. With a strong balance sheet, steady cash flow, and a growing dividend backed by less than a 20% payout ratio, the company has built a track record of rewarding shareholders even through industry cycles. Leadership continues to emphasize innovation, efficiency, and long-term positioning, while returning capital through both buybacks and dividends. Though the stock has pulled back from last year’s highs, AMAT’s valuation has become more compelling, and analysts remain constructive with a consensus price target well above current levels. Despite ongoing challenges tied to export controls and sector volatility, Applied’s consistent performance and strategic focus make it a company worth a closer look.

Recent Events

It’s been a bumpy ride lately. After hitting highs above $250 early last year, AMAT’s stock has slid down to around $144. That’s a meaningful drop, no doubt, but it doesn’t tell the full story. What’s interesting is how the underlying business has held up. Revenue is still growing—up nearly 7% year over year—despite a tough macro backdrop for semiconductors.

Operating margins are north of 30%, and net income margins are holding at nearly 23%. Those are enviable numbers in any sector, let alone one that often swings between feast and famine.

Earnings growth took a hit, down over 40% year over year last quarter, but that’s more a function of tough comps than a fundamental deterioration. The company is still generating over $7 billion in operating cash flow, and the balance sheet remains strong with more cash on hand than total debt.

It’s also worth noting that despite the volatility, AMAT continues to reward shareholders. Its upcoming dividend is scheduled for June 12, with the ex-dividend date on May 22—a sign that even during rough patches, management isn’t shying away from maintaining its commitment to income investors.

Key Dividend Metrics

📈 Dividend Yield: 1.27% (Forward)

💵 Annual Dividend Rate: $1.84

📆 Ex-Dividend Date: May 22, 2025

📊 Payout Ratio: 19.87%

🔁 5-Year Average Yield: 0.89%

🧱 Dividend Growth History: Strong, consistent increases

📉 Free Cash Flow Payout: Easily covered

Dividend Overview

AMAT isn’t chasing yield, and frankly, that’s not its role. The current yield of 1.27% may not grab headlines, but it’s well above the company’s five-year average, which has hovered under 1%. The increase is partly due to a higher dividend, but the recent price drop has also made the stock a bit more attractive from a yield perspective.

With an annual dividend of $1.84 and a payout ratio under 20%, Applied is paying out a small slice of its earnings—leaving plenty of room for reinvestment, flexibility, and future growth. It’s a smart, cautious approach that dividend investors can appreciate, especially in a cyclical industry.

Importantly, this isn’t a dividend that’s being financed with debt or financial engineering. AMAT’s free cash flow over the past year was nearly $4 billion after everything was paid for—more than enough to cover the dividend comfortably. And with $8.2 billion in cash on hand, there’s plenty of buffer for rainy days.

Dividend Growth and Safety

Let’s talk growth. AMAT has been quietly building a solid track record of dividend hikes. Over the past several years, the company has consistently raised its dividend, with increases often landing in the double digits. It’s a reflection of confidence, not just in short-term earnings, but in the durability of its long-term cash generation.

That growth has been supported by strong financial fundamentals. With a return on equity of 35% and return on assets above 15%, this is a company that knows how to convert investment into actual value. It’s efficient, profitable, and remarkably disciplined.

On the safety side, there’s not much to worry about. Debt levels are manageable, with total debt sitting at $6.6 billion against a much larger cash position. The company isn’t overleveraged, and with a debt-to-equity ratio just over 35%, the balance sheet looks healthy.

It’s also worth pointing out the shareholder base. Institutions own over 84% of the stock, which typically means professional investors are keeping a close eye on capital allocation decisions. That level of oversight can help keep the dividend policy aligned with shareholder interests.

For investors looking to build a dividend portfolio that balances growth and stability, AMAT offers a compelling mix. It might not yield as much as a utility or a REIT, but it brings something arguably more valuable—a growing, well-funded dividend from a financially sound business at the center of one of the most critical industries of the next decade.

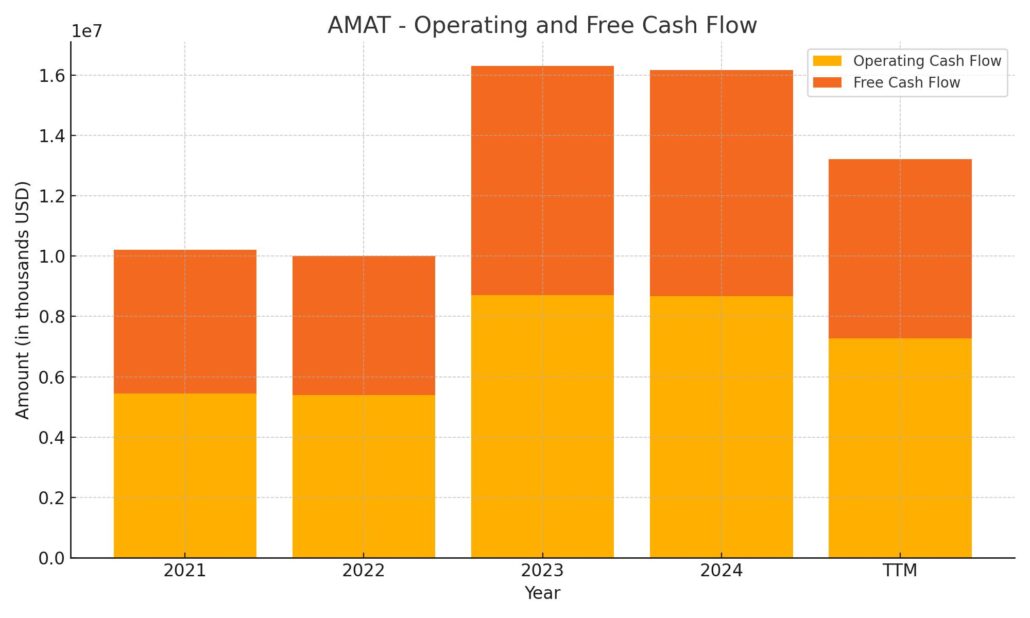

Cash Flow Statement

Applied Materials has continued to generate strong operating cash flow, bringing in $7.28 billion over the trailing twelve months. While that’s a step down from the $8.7 billion range seen in the prior two years, it’s still a solid figure, reflecting the company’s ability to produce consistent cash from its core operations. Free cash flow followed suit at nearly $5.94 billion, easily covering dividends and leaving room for buybacks and reinvestment.

On the investment side, capital expenditures ticked up slightly to $1.34 billion, suggesting a continued focus on long-term capacity and innovation. Financing outflows were significant at $5.1 billion, driven largely by $4.44 billion in share repurchases and over $600 million in debt repayment. The company’s end cash position is now at $6.36 billion, lower than the previous year but still well above pre-2023 levels. AMAT is clearly prioritizing shareholder returns while maintaining enough liquidity to stay flexible.

Analyst Ratings

🟢 Applied Materials (AMAT) has recently garnered positive attention from analysts, with several firms adjusting their ratings and price targets based on evolving market dynamics and the company’s strategic positioning.

📈 Jefferies upgraded AMAT from Hold to Buy, raising the price target to $195. This decision was influenced by a recovery in demand for DRAM and NAND memory, as well as strong growth in artificial intelligence and increased capital expenditure from cloud computing companies. Analysts noted that Applied Materials’ lower exposure to China compared to its peers makes it less vulnerable to new tariff threats and well-positioned to benefit from trends in moving semiconductor supply chains to the U.S.

💹 KeyBanc Capital Markets also upgraded AMAT to Overweight, setting a price target of $225. Their analysis highlighted Applied Materials’ diversification and market-leading technologies, which are expected to benefit from an AI-driven growth cycle. The firm’s focus on novel materials and leading market share in technologies enabling node transitions, improved chip efficiency, and advanced packaging positions it well for future growth.

🎯 The consensus among analysts reflects a positive outlook for AMAT, with a consensus price target of $213.14, suggesting a potential upside of approximately 47% from the current trading price. This average is derived from multiple analyst assessments, indicating a general agreement on the stock’s growth potential.

Earning Report Summary

Applied Materials started off fiscal 2025 with a solid quarter that came in better than many expected. Revenue reached $7.17 billion for the quarter, up about 7% from the same time last year. That’s not blockbuster growth, but in a market that’s seen plenty of ups and downs, it was a reassuring performance. Even more impressive was the company’s non-GAAP gross margin, which hit 48.9%—the highest it’s been in 25 years. Operating margin followed suit at just over 30%, showing the business is not only growing but doing so efficiently.

Profitability and EPS

On the earnings side, adjusted earnings per share came in at $2.38, a 12% improvement year-over-year. That’s a strong showing, especially when you consider the various challenges tech companies have been dealing with lately. On a GAAP basis, though, net income dropped to $1.19 billion, or $1.45 per share. That decline was largely due to a one-time tax-related adjustment, not operational weakness. So, while it might look like a step back on paper, the underlying earnings strength is still very much intact.

Leadership Commentary and Outlook

CEO Gary Dickerson sounded optimistic in his comments, pointing out that Applied continues to play a key role in enabling more energy-efficient AI technologies. He emphasized the company’s focus on close collaboration with customers to keep pushing innovation forward, especially in areas where efficiency and performance intersect.

CFO Brice Hill added more color on the financial side, highlighting the strength of the balance sheet and how the company is continuing to return capital to shareholders. Between dividends and buybacks, Applied returned $1.64 billion to investors in the quarter—something income-focused shareholders no doubt appreciated.

Looking ahead, the company expects second-quarter revenue to land around $7.1 billion, with adjusted EPS in the neighborhood of $2.30. They did note, however, that new U.S. export restrictions will likely trim about $400 million from fiscal 2025 revenue. China still represents a meaningful part of their business, accounting for 31% of revenue this past quarter, although that’s down from 45% a year ago.

All things considered, Applied Materials seems to be navigating a complex environment with confidence. Strong margins, steady earnings, and a clear strategy from leadership are giving investors plenty to feel good about, even with some regulatory headwinds in the mix.

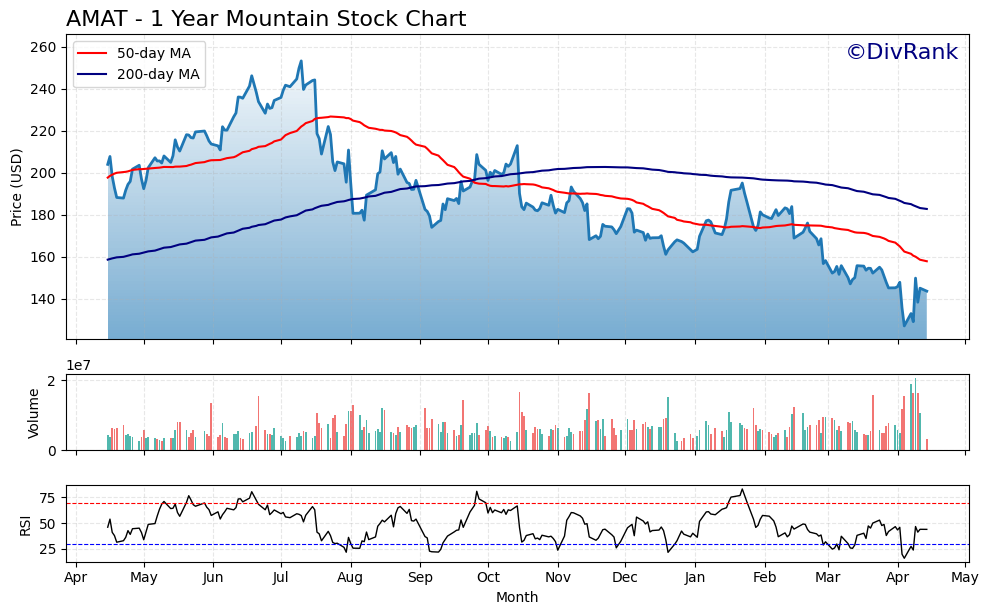

Chart Analysis

The chart for AMAT over the past year tells a pretty clear story of a stock that’s gone through a full cycle of strength, correction, and now, possible stabilization. There’s been a marked shift in momentum since the late summer months, and it’s worth looking at how the price action has evolved alongside volume and technical indicators.

Trend and Moving Averages

For much of the first half of the year, the stock climbed steadily, supported by a rising 50-day moving average that stayed above the 200-day line. That upward trend peaked around July, when AMAT traded above $250. From there, the tide shifted. The 50-day moving average began to slope downward and eventually crossed below the 200-day average in the fall—a classic death cross pattern that often signals a longer-term bearish phase.

Since then, the price has remained under both moving averages, with the 50-day acting as resistance through multiple failed attempts to break higher. This technical weakness continued into the new year, with lower highs and lower lows defining the chart.

Volume and Selling Pressure

Volume started to pick up around late February and early March, particularly during the selloffs. That spike in volume on red days suggests institutional distribution, which often adds weight to a downtrend. However, in early April, we saw a notable surge in volume on a green candle, hinting that buying interest may be starting to return at these levels.

That uptick in participation is a small but potentially meaningful shift, especially if it continues in upcoming sessions.

RSI and Momentum

The Relative Strength Index (RSI) dipped below the oversold level of 30 in March, confirming the selling pressure had reached an extreme. Since then, the RSI has started to recover and now sits just below neutral territory. This bounce off oversold levels can sometimes precede a shift in sentiment, particularly if price action starts to confirm with higher lows.

That said, RSI hasn’t broken into the bullish zone above 70, and until it does, momentum remains cautious at best. But from a longer view, the current RSI pattern suggests that the worst of the selling may be behind it, and the stock is entering a phase where accumulation could quietly begin.

Overall Takeaway

AMAT is still technically in a downtrend, but some early signs of a potential base are forming. Price has moved off the lows with higher volume, and RSI is no longer flashing deeply oversold conditions. The stock is still below both key moving averages, so there’s more work to do, but this could be the early part of a new setup if support holds and momentum builds.

Management Team

Applied Materials is led by CEO Gary Dickerson, who has held the role since 2013. Over the past decade, he has helped steer the company through major shifts in the semiconductor industry by focusing on product innovation and tighter integration with global chipmakers. Under his leadership, Applied has consistently emphasized next-generation technology development, particularly in areas tied to AI, advanced nodes, and energy-efficient computing.

Supporting him is CFO Brice Hill, whose steady financial oversight has helped reinforce Applied’s strong balance sheet and capital return strategies. His background in the semiconductor space adds depth to the leadership team’s ability to adapt to shifting market cycles. On the innovation front, CTO Omkaram Nalamasu plays a key role in driving material science breakthroughs that set Applied apart from its competitors. Together, this team combines technical insight with financial discipline, creating a framework for both resilience and long-term growth.

Valuation and Stock Performance

AMAT shares are currently trading around the $144 mark, which is a far cry from the highs of over $255 the stock reached in 2024. The recent pullback reflects broader headwinds across the semiconductor sector, but also positions the stock at a valuation that could be seen as reasonable given its track record. The forward price-to-earnings ratio of 15.65 suggests investors are getting a mature, cash-flow-generating business at a price not often seen in high-tech names.

The stock has been trending downward since late summer, under pressure from a mix of macroeconomic uncertainty and new export restrictions that have weighed on sector sentiment. Despite this, analysts have set a consensus price target of $213, implying room for a rebound if fundamentals stay on track. From a long-term standpoint, AMAT’s profitability metrics, including return on equity over 35%, continue to signal that the business is highly efficient at generating value.

Risks and Considerations

There are several headwinds investors should stay mindful of. One of the most pressing is the shifting geopolitical landscape, particularly between the U.S. and China. Applied Materials has already acknowledged that updated export controls could cut into revenue, with a projected $400 million hit this fiscal year. China still represents a sizable portion of AMAT’s customer base, so any escalation in restrictions could pose a more significant challenge.

The other major factor is the inherently cyclical nature of the semiconductor industry. When demand slows or capex from customers is delayed, companies like Applied can experience significant earnings volatility. The company also operates in a fiercely competitive market, with rivals constantly pushing to outpace each other on technological capability. This requires consistent R&D investment and agility, both of which AMAT has shown, but it’s a space where leadership positions can shift quickly.

Final Thoughts

Applied Materials remains a foundational name in the global semiconductor supply chain. The business has evolved over the years to meet the changing demands of the industry, whether that’s supporting AI workloads, leading-edge fabrication, or energy-efficient technologies. While recent stock performance has been underwhelming, the company’s strong leadership, prudent financial management, and long-term positioning all contribute to its appeal.

As the macro backdrop stabilizes and semiconductor demand picks up again, Applied’s role as a key enabler of next-gen chip manufacturing could reassert itself. For investors watching the space carefully, this is a company that continues to deserve attention, particularly as it navigates this phase of the cycle with measured execution.