Updated 4/14/25

Amgen Inc. (AMGN) continues to hold steady as a core player in the biotech space, supported by consistent cash flow, a shareholder-friendly dividend policy, and a pipeline that’s gaining traction. With a forward dividend yield of 3.33% and a growing portfolio led by therapies like Repatha and TEZSPIRE, the company has been delivering reliable results while expanding into new areas like obesity treatment. Recent quarterly earnings showed an 11% revenue increase and solid free cash flow of $10.4 billion, despite elevated debt levels following the Horizon Therapeutics acquisition. Leadership remains focused on innovation and capital discipline, with 2025 guidance calling for up to $35.7 billion in revenue and EPS as high as $21.20. Though challenges like competition and regulatory hurdles persist, Amgen’s balance of stability and growth potential continues to make it a compelling stock to watch.

Recent Events

Amgen has had quite a run lately, both in the lab and on the business side. The company wrapped up a major acquisition of Horizon Therapeutics, a move that cost nearly $28 billion and added a deeper rare disease portfolio to its pipeline. Big acquisitions always come with a price tag, and Amgen’s debt levels reflect that—now sitting at over $60 billion. That pushed the debt-to-equity ratio past the 1,000% mark, which definitely raises some eyebrows.

But Amgen isn’t new to high-stakes decisions. This is a management team with a track record of getting value out of what they buy. And it’s showing up already. In the most recent quarter, revenue jumped nearly 11% year-over-year. That kind of growth is reassuring, even if earnings took a hit—EPS dropped to $7.55, down from the prior year.

Still, Amgen’s operating margin is sitting comfortably above 50%, a sign that it’s managing its expenses and keeping things efficient despite the debt pile. That’s especially important for dividend investors who care more about reliable cash flows than quarterly earnings headlines.

Key Dividend Metrics

🪙 Forward Yield: 3.33%

📈 5-Year Average Yield: 2.99%

📆 Next Dividend Date: June 6, 2025

⛔ Payout Ratio: 119.05%

💸 Forward Dividend Rate: $9.52 annually

📉 Recent Dividend Growth: ~5.8%

🔍 Free Cash Flow (ttm): $13.73 billion

🧮 EPS (ttm): $7.55

Dividend Overview

At a glance, Amgen’s dividend looks pretty appealing. A 3.33% yield is comfortably above its five-year average, offering a little extra income cushion for those holding the stock. The payout currently sits at $9.52 per share annually, which is a nice return, especially for a healthcare company with Amgen’s reputation.

Now, about that payout ratio. It’s high—north of 119%. On paper, it looks like the company is paying out more than it earns. That would normally be a concern, but the story isn’t quite that simple. Free cash flow is strong, hitting almost $13.7 billion over the past twelve months, which more than covers the dividend. So while net income might be under pressure, the cash generation remains intact.

Amgen’s dividend has been growing steadily since it was introduced back in 2011. That kind of consistency gives investors peace of mind. The company’s approach to rewarding shareholders has been thoughtful and measured—this isn’t a business throwing cash around recklessly.

Dividend Growth and Safety

Over the last few years, dividend growth has cooled a bit, but it’s still moving in the right direction. Most recently, the increase was just under 6%. That’s slower than in previous years, where hikes were in the 7–10% range, but still respectable given the current environment.

The slowdown makes sense. After absorbing Horizon Therapeutics, Amgen took on a lot of debt. Rising interest costs and tighter financial margins are bound to have an impact. Even so, the dividend remains well-supported by cash flow, and the company has over $11 billion in cash on the books—a solid cushion.

Despite the higher debt, Amgen continues to show stability. The beta is just 0.58, which tells you the stock doesn’t swing wildly with the broader market. That kind of calm is welcome in any dividend portfolio, especially for those who are more income-focused than growth-chasing.

The market seems to have a similar read. Short interest is low—just over 2.6%—which suggests there’s not a lot of bearish sentiment around the stock right now. Add in the upcoming ex-dividend date on May 16 and the June payout, and Amgen remains a consistent name in the healthcare space for those who value regular income.

You won’t find fireworks here, but that’s the point. Amgen’s dividend story is about reliability, not surprise. There’s some pressure from debt and a slightly slower pace of growth, but the underlying business still generates the kind of cash that dividend investors can count on.

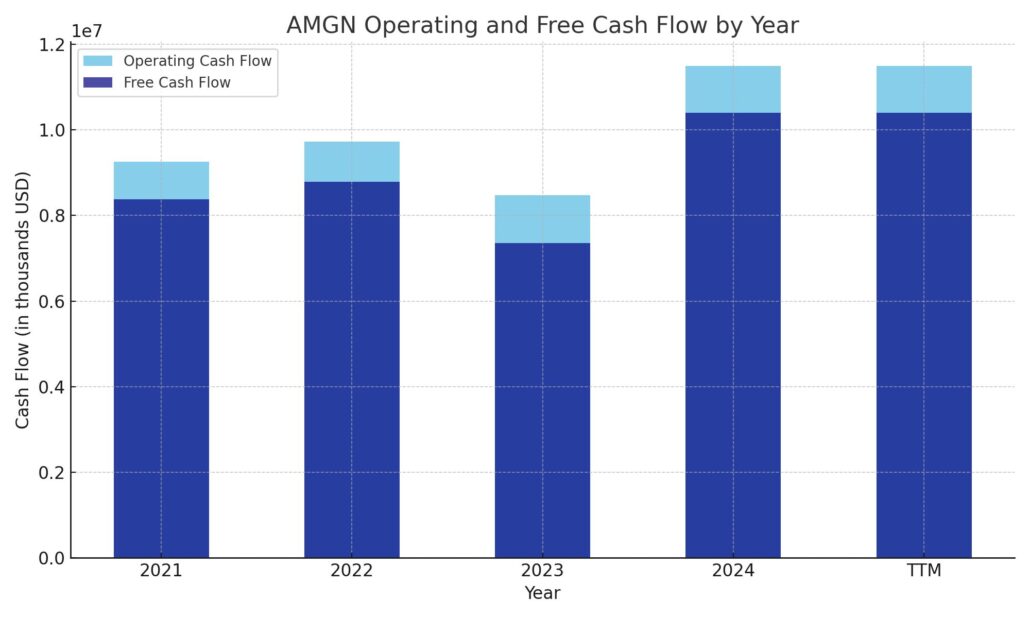

Cash Flow Statement

Amgen’s cash flow profile for the trailing twelve months shows a company that continues to generate strong, consistent cash from its core operations. Operating cash flow came in at $11.49 billion, which reflects a solid uptick from the previous year’s $8.47 billion. That strength has translated directly into robust free cash flow of $10.39 billion, comfortably covering dividend obligations and leaving room for financial flexibility.

On the investing side, outflows were significantly lighter than in 2023, when the Horizon Therapeutics acquisition heavily impacted the balance sheet. For the latest period, investing cash flow stood at -$1.05 billion, a more normalized figure. Financing activity shows a return to outflows as well, with $9.41 billion used—primarily from debt repayment and scaled-back share repurchases. Despite these capital uses, Amgen’s end-of-period cash rose to nearly $12 billion, the highest it’s been in recent years, reinforcing a healthy liquidity position.

Analyst Ratings

🔍 Amgen (AMGN) has been under the analyst spotlight lately, with a mix of cautious optimism and strategic recalibration. The current consensus price target hovers around $320.50, pointing to a mild upside from its recent trading levels.

📈 Morgan Stanley kept its “Equal-Weight” stance but nudged its price target up slightly from $328 to $330. The move reflects a balanced view—recognizing Amgen’s steady performance and strong margins, while staying on the sidelines as the market awaits more clarity on its obesity drug candidate, MariTide.

🚀 Over at Piper Sandler, the sentiment leaned more bullish. They reiterated an “Overweight” rating and raised their price target from $310 to $329. This bump reflects growing confidence in Amgen’s ability to generate earnings growth through its recently expanded pipeline and the Horizon Therapeutics acquisition, which continues to be a key narrative.

📉 Not all updates were upgrades, though. Some analysts noted the heavy debt load and higher payout ratio as watchpoints. While these haven’t triggered downgrades across the board, they have tempered enthusiasm for aggressive price target hikes. The sentiment overall remains constructive but measured, with analysts closely watching cash flow trends and upcoming data releases.

Earning Report Summary

Amgen finished 2024 on a high note, showing that it still knows how to deliver when it matters. The company posted strong results in the fourth quarter, with revenue climbing to $9.1 billion—up about 11% from the same period last year. That kind of top-line growth doesn’t happen by accident, and it came alongside adjusted earnings per share of $5.31, which was a solid 13% increase year-over-year.

That momentum came from more than one corner of the business. Products like Repatha and TEZSPIRE are clearly gaining traction, with Repatha’s sales jumping 45% to $606 million. TEZSPIRE also had a standout performance, closing in on the billion-dollar mark for annual sales with a 71% year-over-year increase. It’s a good sign that Amgen isn’t just leaning on legacy products, but seeing meaningful contribution from newer therapies as well.

Pipeline and Future Plans

The company’s pipeline remains a big part of the story going into 2025. One area drawing attention is obesity treatments. Amgen’s lead candidate, MariTide, is on track to enter late-stage trials by mid-year. Early data has been encouraging, and there’s clearly a lot of excitement about where this could lead. That said, not everything has gone smoothly—AMG 513, another obesity candidate, hit a bit of a roadblock with a clinical hold from the FDA due to some safety concerns. Still, leadership seems confident in the science and direction overall.

What Leadership Had to Say

During the earnings call, leadership emphasized the strength of Amgen’s diversified portfolio and the value of the Horizon Therapeutics acquisition, which is beginning to show up in the numbers. They were upbeat about the company’s ability to drive growth across both established and emerging therapies. There was also a strong focus on maintaining healthy margins and balancing innovation with cost discipline.

Looking to the year ahead, Amgen is guiding for adjusted earnings between $20.00 and $21.20 per share, with revenue expectations landing in the $34.4 to $35.7 billion range. That guidance shows confidence, especially considering the industry’s headwinds and broader economic uncertainty.

Overall, Amgen seems to be striking a solid balance—managing its mature product base while building a next-generation pipeline that could fuel growth for years to come. It’s the kind of performance that shows why the company continues to earn the attention of long-term investors.

Chart Analysis

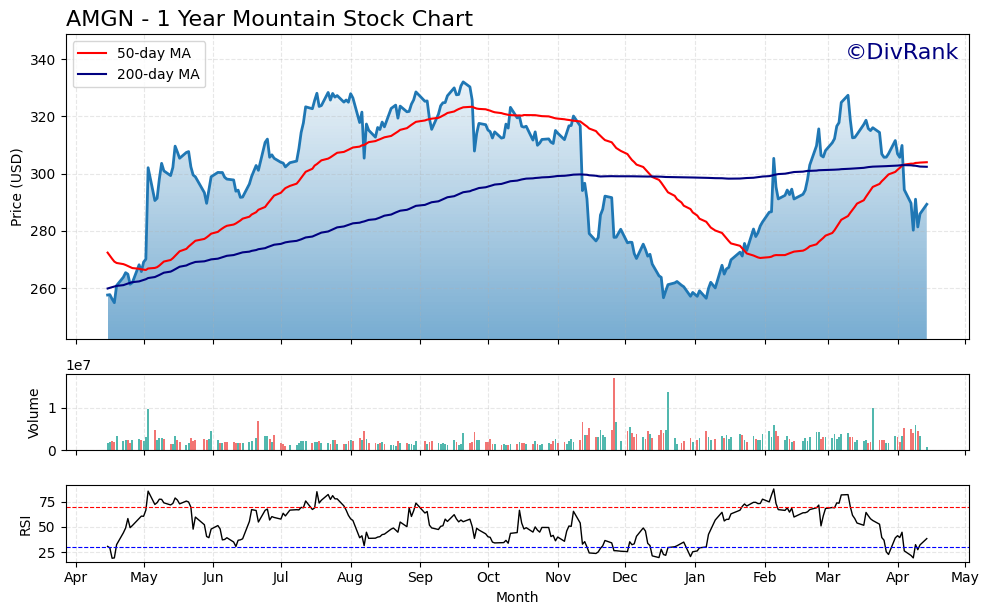

The one-year chart for AMGN shows a stock that’s been through a full cycle of momentum shifts, with moving averages and RSI offering some clear signals about what’s been driving recent price action.

Moving Averages

The red 50-day moving average shows a steep climb from late spring into early fall of last year, reflecting a solid stretch of bullish momentum. During that period, the stock pushed steadily above $320, making higher highs and showing strong follow-through. But the tide turned around late October, when the 50-day started to roll over and dipped sharply through the 200-day moving average by December. That cross—often seen as a bearish signal—was followed by a decline that brought prices back toward the $260–270 range.

More recently, the 50-day has begun curling upward again, narrowing the gap with the flatter 200-day line. This is often a sign that downside momentum is slowing and consolidation is taking place.

Price Action and Volume

Price has been somewhat choppy since February, trading below both moving averages and showing signs of struggling to regain its prior highs. The big spikes in volume around late March and early April suggest institutional interest stepped in—possibly around earnings or headline news—but the price failed to hold the gains.

There was a sharp pullback in early April that tested the $280 range again. This dip has taken the price below the 200-day average, a level that had previously offered support. That shift from support to resistance is something to keep an eye on if the stock fails to break back above $300 with conviction.

RSI Trends

The Relative Strength Index has been bouncing around quite a bit. It pushed into overbought territory near 70 in mid-February but has since slipped under 30 twice in recent weeks. That move into oversold conditions may suggest sellers are getting exhausted. However, a quick recovery in RSI would strengthen the case for a technical rebound.

Right now, the RSI is still sitting on the lower end of the range, which could either be a warning of lingering weakness or an early setup for a bounce. A move back above 50 would be more encouraging.

Management Team

At the helm of Amgen is Robert A. Bradway, who has held the role of Chairman and CEO since 2012. His background in investment banking has shaped the company’s strategic approach, particularly in how it handles acquisitions and capital allocation. Under his leadership, Amgen has pushed into new therapeutic areas, expanded internationally, and steadily built out its pipeline through both internal research and external deals.

The executive team supporting Bradway brings a mix of operational expertise and scientific depth. Peter Griffith, the CFO, has been instrumental in maintaining financial discipline, especially as the company navigated its high-profile acquisition of Horizon Therapeutics. Esteban Santos, who oversees operations, has helped scale Amgen’s manufacturing footprint while improving efficiency. On the research front, James Bradner and Howard Chang lead the scientific direction with a focus on first-in-class innovations. Together, this group has helped guide Amgen through industry shifts while keeping an eye on long-term growth.

Valuation and Stock Performance

Amgen’s current stock price sits at $289.71, which puts it closer to the middle of its 52-week range. The high over the past year was $346.85, while the low dipped to $253.30. That spread tells a story of a stock that’s been in flux—partly driven by market-wide volatility, but also reflecting company-specific events like trial results, drug approvals, and acquisition-related movements.

From a valuation perspective, Amgen trades at a forward P/E ratio of 13.83. That figure is attractive when compared to many peers in the biotech space, especially given Amgen’s profitability and consistent cash flow generation. The consensus price target from analysts sits around $320.50, signaling a modest upside from current levels.

The stock’s long-term performance has been steady, though not without periods of stagnation. Over the past year, performance has largely mirrored that of the broader healthcare sector. Strong revenue growth from therapies like Repatha and TEZSPIRE, coupled with excitement around the company’s obesity candidate MariTide, have helped support investor sentiment—even as earnings have seen some pressure.

Risks and Considerations

While Amgen continues to be a solid performer in many areas, there are notable risks that shouldn’t be ignored. One of the biggest is the debt load. After the Horizon deal, Amgen’s total debt jumped significantly, pushing its debt-to-equity ratio into four-digit territory. That kind of leverage limits financial flexibility and can become a headwind if interest rates remain elevated.

Another concern is the high payout ratio. At over 119%, the dividend now exceeds net income, which can be uncomfortable for income-focused investors. Though free cash flow covers the dividend more comfortably, it’s still something worth watching closely in future quarters.

On the regulatory front, the FDA’s clinical hold on AMG 513 raises questions about how smoothly Amgen can advance its pipeline. And while MariTide looks promising, it will have to compete with some heavyweights in the obesity space. Any delays or safety issues could significantly affect market expectations.

There’s also the matter of patent cliffs. As with all major pharma and biotech names, a portion of revenue depends on aging products that may lose exclusivity. Continued investment in the pipeline is essential to offset that risk, but success is far from guaranteed.

Final Thoughts

Amgen stands at an interesting point in its corporate journey. It’s a mature, cash-generating company with a proven record of shareholder returns. The leadership team is experienced and has shown it can manage through both growth cycles and setbacks. The pipeline has exciting elements, particularly in obesity and rare diseases, which could drive the next leg of expansion.

At the same time, rising debt, increased competition, and regulatory hurdles serve as balancing forces to all that optimism. The stock isn’t priced for perfection, and that may be a good thing. It reflects a market that recognizes the company’s strengths but isn’t ignoring its risks.

For those who follow healthcare closely, Amgen remains a name worth watching. Its next chapter depends heavily on how well it executes its innovation strategy and whether it can manage its capital structure effectively in a shifting economic environment.