Updated 4/14/25

AMERISAFE, Inc. (AMSF) offers workers’ compensation insurance to high-risk industries like construction and trucking, with a long-standing focus on underwriting discipline and capital strength. Headquartered in Louisiana, the company has maintained strong profit margins, consistent dividend growth, and minimal debt under the leadership of CEO Janelle Frost. With a current dividend yield over 3% and a payout ratio around 50%, AMSF continues to appeal to investors seeking reliable income. The stock has traded between $42 and $60 over the past year, with recent movement below its 50-day moving average, though it remains technically supported by its 200-day trend. Recent earnings showed steady underwriting results despite pressure on investment income and overall profitability. Management’s approach remains conservative, with an emphasis on operational efficiency and long-term value.

Recent Events

Amerisafe recently reported its financial results for the most recent quarter, and the numbers told a mixed story. Revenue was down about 7.6% year-over-year, and earnings per share dropped more than 30%. That kind of decline isn’t ideal, but it didn’t come as a shock. The industries that Amerisafe serves are closely tied to the broader economy, and slower hiring trends in sectors like construction and manufacturing have a direct impact on the company’s premium volume.

Still, the company ended the year with a healthy profit of $55.4 million and a net margin near 18%. There was no panic in the boardroom, and no slash-and-burn cost-cutting either. Instead, Amerisafe did what it usually does—it kept things steady and kept paying its dividend.

The stock price has softened a bit recently and is trading below both its 50-day and 200-day moving averages, sitting around $48. For yield-focused investors, though, that dip has actually made the stock more appealing. The forward dividend yield is now over 3.2%, which is quite attractive in today’s market.

Key Dividend Metrics

📈 Forward Dividend Yield: 3.22%

💸 Trailing Dividend Yield: 3.03%

📆 Dividend Payout Ratio: 51.2%

💰 5-Year Average Dividend Yield: 2.34%

🏦 Free Cash Flow Coverage: Strong (FCF of $43.28M vs. dividends of ~$29.7M)

📊 Dividend Growth History: Consistent annual increases

🧾 Most Recent Dividend: $0.39/share, paid March 21, 2025

🔍 Ex-Dividend Date: March 7, 2025

Dividend Overview

When you look at the numbers, Amerisafe’s dividend checks a lot of boxes for income investors. The forward yield of 3.22% stands well above the company’s five-year average, which has hovered around 2.34%. This isn’t just the result of a falling stock price—it’s backed by steady growth in dividend payouts over the years.

The most recent quarterly dividend came in at $0.39 per share, continuing a long-running streak of regular payments. The payout ratio sits at a comfortable 51%, which gives the company room to absorb bumps in earnings without putting the dividend at risk.

Amerisafe has also shown a willingness to reward shareholders when business conditions allow, with occasional special dividends in past years. That didn’t happen this year, but the company has made it clear that returning excess capital to shareholders is part of its long-term approach.

Dividend Growth and Safety

Amerisafe may not be a household name, but it behaves a lot like a classic dividend stock. The company has increased its base dividend nearly every year, showing a clear commitment to consistent, long-term payouts. That kind of track record speaks volumes about how management views shareholder returns.

The dividend payout ratio, sitting just above 50%, strikes a nice balance. It’s high enough to provide investors with solid income, but low enough to maintain flexibility. Amerisafe also carries very little debt—just $428,000—while holding over $53 million in cash. With a strong current ratio of 2.02, the company is in a good position to handle short-term obligations without stress.

On the cash flow side, the numbers continue to support the dividend. Last year, Amerisafe generated more than $43 million in free cash flow, compared to an estimated $30 million in total dividends paid. That margin of safety gives investors some breathing room, even during quarters when earnings come under pressure.

It’s also worth noting how the company behaves during less-than-ideal conditions. Despite a 31% drop in quarterly earnings year-over-year, the dividend was neither paused nor reduced. That level of consistency builds trust, especially for those relying on their portfolio for income.

If there’s one area to keep an eye on, it’s revenue growth. The company’s client base is tied closely to economic cycles, and if the broader economy continues to slow, premium volumes could see further declines. But that’s more of a watch item than a warning flag at this point.

For long-term investors who prioritize stability and income, Amerisafe offers a compelling mix of yield, safety, and conservative management. Its low beta of 0.34 also makes it a smoother ride during turbulent markets. You won’t get explosive gains here, but you’ll get something more important to many investors—dependability.

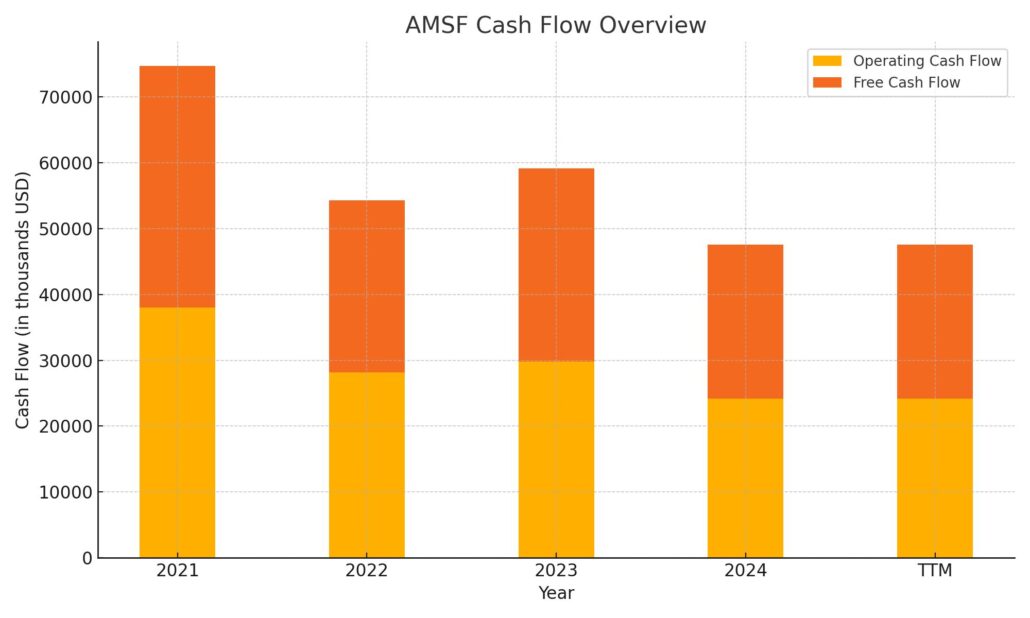

Cash Flow Statement

Amerisafe’s latest trailing twelve-month (TTM) cash flow statement shows a business that remains operationally sound, though slightly less efficient than in prior years. Operating cash flow came in at $24.2 million, a decline from $29.8 million the year before. This dip reflects some of the earnings pressure seen recently, but it’s still enough to comfortably cover dividends and maintain operations. Free cash flow stands at $23.35 million, down from nearly $30 million the previous year but still respectable given the company’s low capital expenditure needs, which remain minimal at under $1 million.

Investing cash flow was positive at $72.4 million, largely driven by movements in the company’s investment portfolio—a typical dynamic for an insurance provider with float to manage. Financing activities show a consistent trend of capital return to shareholders, with outflows of $91.2 million in the TTM, including $5.1 million in share repurchases and continued dividend payments. The cash position at year-end was $44 million, slightly higher than the prior year, indicating that despite the reduced earnings, Amerisafe hasn’t compromised its liquidity. It’s clear the company continues to prioritize shareholder returns while maintaining a disciplined approach to cash management.

Analyst Ratings

📊 Analysts have maintained a cautious stance on AMERISAFE (AMSF) in recent months. The consensus rating currently stands at “Hold,” reflecting a balanced view of the company’s prospects. This perspective is influenced by concerns over a narrowing reserve cushion and the potential impact of rising medical costs on financial performance. Additionally, increased competition for policyholders and the possibility of higher workers’ compensation claims frequency amid economic uncertainty have played a role in shaping this outlook.

🟢 Despite these headwinds, the stock has attracted some favorable attention. One research firm recently reinstated coverage with a “Market Outperform” rating and attached a price target of $65, signaling confidence in Amerisafe’s longer-term value proposition. On the other hand, a separate analyst team shifted their stance from “Buy” to “Hold,” pointing to risks around reserve levels and potential earnings softness ahead.

💰 The average one-year price target from analysts sits at approximately $56.33, offering some upside from the current trading level. Price targets span from a low of $50 to a high of $65, highlighting a range of expectations tied to the company’s performance and broader industry trends.

📉 In short, while AMERISAFE faces some near-term challenges, analysts appear split between caution and optimism, making it a name to watch for dividend-focused investors tracking valuation and risk-reward potential.

Earnings Report Summary

Solid Core Despite a Softer Bottom Line

Amerisafe closed out the fourth quarter of 2024 with net income of $13.2 million, which was noticeably down from $19.2 million during the same stretch last year. For the full year, earnings came in at $55.4 million, compared to $62.1 million the year before. On a per-share basis, that works out to $0.69 for the quarter and $2.89 for the year. It wasn’t their strongest earnings season, but it wasn’t unexpected either given the economic backdrop and some internal headwinds.

What stood out, though, was their underwriting performance. The combined ratio for the fourth quarter came in at 86.1%, and for the year, it landed at 88.7%. That’s well below the 100% threshold, meaning they’re still writing profitable policies. Even with pressures on other parts of the business, the core insurance operation continues to do its job effectively.

Growth in Premiums, But Investment Income Takes a Hit

Voluntary premiums told a better story. They rose 8.5% in the fourth quarter and finished the year up 4.6%. That’s a healthy signal that their specialized focus in high-risk industries is still resonating with clients. However, investment income didn’t hold up as well. It dropped over 14% in Q4 and fell 6.8% over the year. The decline came down mostly to a reduced base of investable assets, much of that due to a previously issued special dividend that took cash off the books.

Looking Ahead

CEO Janelle Frost acknowledged the mixed nature of the results. She pointed to the competitive environment and noted the company’s ongoing focus on disciplined underwriting and smart claims handling. In her view, these are the key levers that will allow Amerisafe to stay consistent, even if some of the outside pressures stick around for a while.

One clear sign of the company’s continued confidence: the board approved another dividend increase. The quarterly payout moved up 5.4% to $0.39 per share, with a distribution date set in late March 2025. It’s a small bump, but in a year where profits were down, it sends a message. Leadership is still prioritizing shareholder returns and clearly believes the company is on stable footing.

Amerisafe might not be immune to market shifts, especially in its investment book, but its tight operational control and consistent underwriting results show that the fundamentals are still in place. It’s the kind of report that doesn’t dazzle—but quietly reassures.

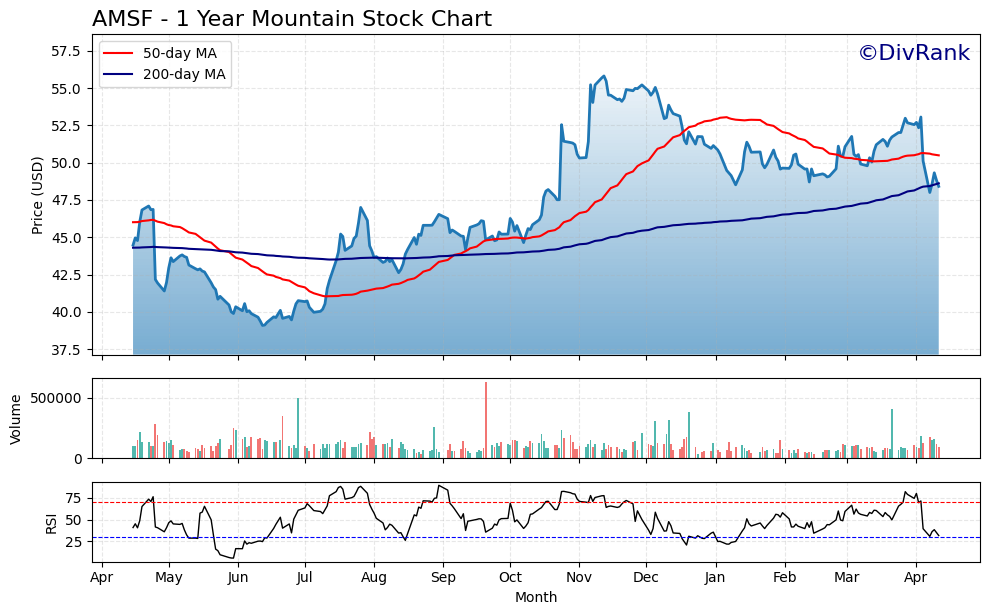

Chart Analysis

Price Movement and Trend Behavior

AMSF has had a fairly eventful 12 months. Starting off last spring with a dip below $40, the stock gradually pushed higher, forming a clear uptrend by mid-summer. The move that started in July was particularly notable, with the price reclaiming the $45 level and gaining momentum into the fall. A sharp breakout in late October pushed it above $55, which marked the high point of the year.

That rally eventually cooled, and since then, the stock has been trading in a broad sideways range. There’s been a modest pullback recently, and the price just slipped below its 50-day moving average. At the same time, it remains close to the 200-day moving average, which could act as a support level. This type of consolidation after a rally isn’t unusual, especially when a stock is coming off a stretch of strong gains.

Volume and Relative Strength Index

Volume stayed fairly light for much of the year, with occasional spikes that lined up with sharp price movements. The highest volume bars coincided with significant upward pushes in price, suggesting that buying interest tends to come in waves. Nothing here suggests panic selling, even during the recent dip.

The RSI offers an interesting perspective. It spent a good part of the second half of the year above 70, indicating overbought conditions during the rally. Most recently, it’s started to drift lower, but it hasn’t touched oversold territory yet. This supports the idea that the recent move lower might be more of a healthy pause than a sign of major breakdown.

Moving Average Cross and Technical Health

There was a golden cross in the fall—when the 50-day moving average crossed above the 200-day—which typically signals a positive longer-term outlook. That cross aligned closely with the breakout to new highs, reinforcing its strength at the time. Now, the 50-day average is starting to flatten and turn slightly downward, which is worth watching, but the longer-term 200-day trend is still rising, showing that overall momentum hasn’t fully reversed.

The recent slip below the 50-day average might feel a bit concerning, but given how extended the stock had become, it’s more of a cooling-off than a collapse. If the price holds near or above the 200-day line in the coming weeks, that would be a positive sign for continued stability.

Overall, AMSF’s chart shows a name that’s run up nicely over the past year, pulled back modestly, and is now in a key technical zone where it’s testing longer-term support. There’s no major red flag here—just a stock taking a breather after a strong run.

Management Team

At the helm of AMSF is Janelle Frost, who has served as President and CEO since 2015. Her tenure has been marked by a disciplined focus on underwriting profitability, capital strength, and operational efficiency. She’s not one to chase growth for the sake of headlines, and that conservative mindset has shaped the entire organization. Under her leadership, Amerisafe has avoided the expansion pitfalls that can trap insurers during economic upswings, choosing instead to stay focused on core strength and consistency.

The broader leadership team echoes this tone. With decades of experience across insurance, claims, finance, and regulatory affairs, they’ve structured operations around careful risk control and sustained value creation. The company has long prioritized maintaining a strong balance sheet, and leadership has followed through on that vision. Their approach is steady, with a clear emphasis on quality underwriting and disciplined cost control rather than chasing premium at the expense of profitability.

One trait that sets this team apart is their consistent capital return strategy. Dividend increases have been steady, not splashy, and special dividends have occasionally been issued when cash reserves allowed. That kind of decision-making reflects a leadership group focused on stewardship rather than short-term optics.

Valuation and Stock Performance

AMSF currently trades at a trailing price-to-earnings ratio of 16.75 and a forward P/E of about 22.4. While that forward multiple might seem slightly elevated, especially when compared to broader financials, it aligns reasonably with the company’s dependable earnings and conservative financial profile. The stock’s price-to-book ratio is above 3.5, a figure that may raise eyebrows, but it reflects the market’s willingness to pay for a business with high underwriting quality and minimal leverage.

Over the past year, shares have seen a fairly wide trading range, moving between a low of around 42 and a high of just over 60. The rally into the fourth quarter of 2024 was significant, driven by continued strong combined ratios and growing investor comfort with the insurer’s positioning. Recently, the stock has pulled back from those highs and is now hovering just below 50.

From a total return standpoint, especially when accounting for the dividend, AMSF has held up well. It’s not a fast mover, but that’s part of its appeal. The stock’s beta sits well below 1, which helps dampen volatility during periods of market stress. While the share price itself isn’t breaking records, it’s been a model of consistency—something many investors value when building around income and capital preservation.

Valuation metrics suggest the company is not cheap in the traditional sense, but investors aren’t buying AMSF for deep value. They’re paying a fair price for quality and predictability, particularly in a sector that can be highly cyclical and price-sensitive.

Risks and Considerations

Amerisafe isn’t immune to broader economic cycles, particularly because of its industry concentration. A large part of its business serves employers in construction, logging, and trucking—areas that are highly sensitive to labor trends and overall economic activity. If job creation slows in these spaces, premium growth will likely follow suit.

There’s also the risk of a pricing war in the workers’ compensation market. While pricing has remained stable, increased competition could force the company to defend its book by sacrificing margin, or it may choose to walk away from less profitable business, limiting growth. Given their past behavior, Amerisafe would likely prioritize margin over volume, but that still has implications for future earnings.

Another piece to watch is investment income. As a conservatively managed insurer, Amerisafe invests primarily in high-quality, low-risk instruments. That’s helped preserve capital, but it also means their portfolio yield is sensitive to changes in interest rates. With rates stabilizing, there may be less upside from fixed-income returns, especially compared to recent periods when bond yields surged.

Claims volatility is an ever-present risk in workers’ compensation. A single high-cost incident or an uptick in claims frequency could shift loss ratios significantly, even with Amerisafe’s historically strong claims handling and reserving strategy.

Finally, there’s the matter of liquidity. With relatively low average daily trading volume, the stock can see wider bid-ask spreads or exaggerated price movements during periods of lower activity. That’s something to be aware of, particularly for those with larger positions or shorter time horizons.

Final Thoughts

AMSF continues to offer a steady and disciplined approach in a sector known for swings and surprises. It doesn’t make a lot of noise, but the company has managed to create a track record of consistency that speaks louder than short-term headlines.

With a dividend yield just over 3 percent and a payout ratio around 50 percent, it stands out for those seeking stable cash flow without chasing excessive risk. The most recent earnings report showed the same hallmarks of past quarters: strong underwriting, careful cost control, and a focus on risk-adjusted returns. Leadership clearly believes in letting the numbers do the talking.

Technically, the stock has pulled back from recent highs, and is now sitting near longer-term support levels. It may not be a traditional value pick, but it’s trading at a level that reflects the quality of the business and the confidence the market has in management’s ability to navigate future challenges.

The approach from the top down remains methodical. There’s no push for rapid expansion or speculative moves. Instead, the focus is on delivering shareholder value in measured, dependable ways. That includes maintaining a strong balance sheet, sticking to their underwriting playbook, and rewarding shareholders without stretching the company’s resources.

AMSF won’t be the fastest-moving stock in a portfolio, but for investors looking for clarity, control, and consistency, it continues to hold its place as a quiet but capable operator in a niche market.