Updated 4/14/25

Ameriprise Financial (AMP) has built a strong reputation through over a century of experience in financial planning and asset management. With more than $1.5 trillion in client assets and a business model centered around long-term wealth advisory, the company continues to generate consistent cash flow and shareholder returns. Its leadership has prioritized operational efficiency, digital innovation, and disciplined capital allocation, all while maintaining a steady path of dividend growth and share buybacks. Despite recent market volatility, AMP has delivered solid earnings, strong asset flows, and a meaningful rebound in stock price, backed by high margins and robust free cash flow.

Recent Events

In the past year, Ameriprise has quietly outperformed the broader market, logging a 14% gain in its share price compared to the S&P 500’s 6% rise. That strength has come amid rising interest rates and economic uncertainty—conditions that have rattled other financial stocks.

The company’s latest earnings numbers were impressive. Net income jumped 184% year-over-year, while revenues climbed more than 11%. That kind of growth isn’t just luck. Ameriprise has kept a sharp focus on cost efficiency and capital return, and it’s working. Operating margin sits close to 37%, which is a strong indicator of internal discipline.

From a balance sheet perspective, the business is well-positioned. It has more than $8 billion in cash and a solid current ratio of 2.6. Debt levels are reasonable, with a total debt-to-equity ratio just over 70%. And return on equity? An eye-catching 68.3%. That’s not a typo—it’s a sign this company knows how to put capital to work.

All of this creates a strong foundation for the dividends that matter so much to long-term investors.

Key Dividend Metrics 📊

🪙 Forward Dividend Yield: 1.26%

💵 Forward Annual Dividend Rate: $5.92 per share

📈 5-Year Dividend Growth Rate: Solid and steady

🧾 Payout Ratio: 17.52%

📅 Last Dividend Paid: February 28, 2025

🔔 Ex-Dividend Date: February 10, 2025

📊 5-Year Average Yield: 1.66%

Dividend Overview

At first glance, a 1.26% yield might not turn many heads. But there’s more to this dividend than just the number. For starters, Ameriprise has consistently paid and raised its dividend, without stretching itself thin. The payout ratio is under 18%, which tells you everything you need to know about its sustainability.

That means AMP is playing a long game. It’s not trying to offer a sky-high yield at the risk of cutting it later. Instead, it’s delivering stable, growing returns while keeping plenty of room to handle unexpected bumps in the road.

And let’s not forget about buybacks. Ameriprise is known for combining dividends with aggressive share repurchases. That combo—returning capital through both dividends and reducing the share count—is a great recipe for long-term value creation.

Dividend Growth and Safety

This is where AMP really starts to shine for income-focused investors. The company has raised its dividend steadily over the years, and it’s done so with discipline. While the annual increases may vary, the trend is clearly upward.

Driving that growth is a strong cash flow engine. Ameriprise generated $6.59 billion in operating cash flow over the last twelve months, and levered free cash flow came in at $2.84 billion. Those are the kinds of numbers that give management options. And in AMP’s case, those options are often directed back to shareholders.

The balance sheet supports this too. With more cash than debt and a business model that doesn’t rely on heavy capital expenditures, AMP is well-insulated from financial stress. Add in the low beta of 1.23, and this stock tends to move less dramatically than more volatile names. That stability is worth its weight in gold for a dividend portfolio.

While the current yield is slightly below the five-year average, that’s mostly due to share price appreciation rather than a dip in the dividend itself. The dividend has been climbing—it’s just that the stock has done so even faster.

For dividend investors who are more interested in long-term sustainability than chasing high yields, Ameriprise fits the bill. It offers consistent dividend growth, a low payout ratio, strong earnings, and a commitment to returning capital in multiple ways.

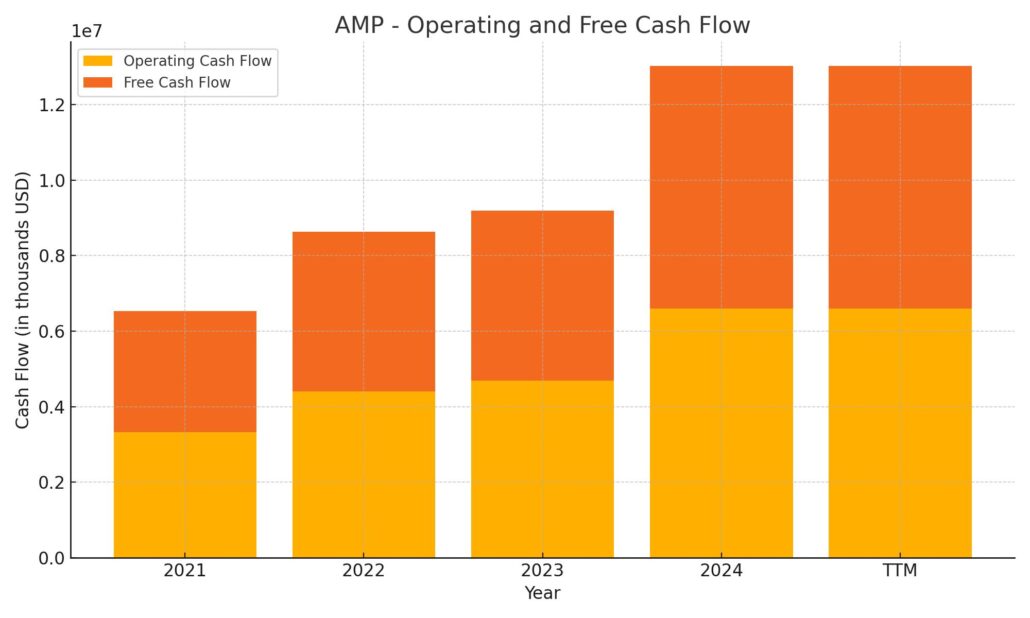

Cash Flow Statement

Ameriprise Financial’s cash flow story over the trailing twelve months paints a clear picture of operational strength and disciplined capital allocation. The company generated $6.6 billion in operating cash flow, marking a substantial jump from the previous year’s $4.7 billion. This rise reflects healthy underlying profitability and stable cash generation from its core businesses. After accounting for modest capital expenditures of $176 million, free cash flow came in at $6.4 billion—showing AMP’s strong ability to fund shareholder returns and maintain flexibility without needing to tap external financing.

On the investing side, cash outflows shrank significantly to just $551 million from much higher levels in prior years, signaling a pause or completion in larger investment phases. Meanwhile, the financing cash flow shows a return-heavy stance. AMP spent over $5.1 billion here, largely driven by share repurchases and debt repayments, offset slightly by new debt issuance. This signals a company confident in its balance sheet and focused on rewarding shareholders. With an end cash position of nearly $9.5 billion, AMP remains highly liquid while managing interest obligations and capital return with discipline.

Analyst Ratings

🟢 Ameriprise Financial (AMP) recently caught some positive attention after Raymond James upgraded the stock to “Strong Buy.” The firm pointed to the roughly 21% decline in AMP’s share price earlier in the year as a buying opportunity, viewing the pullback as disconnected from the company’s core fundamentals. The upgrade reflects growing confidence in Ameriprise’s consistent earnings performance and its focus on wealth management, which has been a stabilizing force during broader market volatility.

🟡 On the other side, UBS took a more cautious stance, downgrading AMP from “Buy” to “Neutral” while adjusting their price target to $570. This shift appears to reflect some hesitation about valuation at current levels, along with a belief that much of the near-term upside may already be priced in. Their revised target still sits above the current trading level, suggesting some potential for gains, but not enough to warrant a more aggressive rating.

📊 Across the board, the consensus 12-month price target from analysts currently stands at $517.44. Estimates range from a more conservative $428 up to a bullish $625. This spread highlights the range of sentiment in the market and underscores the importance of keeping an eye on company execution in the coming quarters.

Earning Report Summary

Ameriprise Financial wrapped up 2024 on a strong note, delivering a fourth quarter that reflected both earnings strength and continued growth in client assets. The company reported adjusted operating earnings of $947 million, which worked out to $9.36 per share. That’s a clear step up from the $7.20 per share they posted in the same quarter the year before. What’s driving this growth? In large part, it’s the rise in client assets as markets turned more favorable, pushing fee income higher across the board.

Total assets under management and administration climbed to $1.52 trillion, a solid 10% increase from a year earlier. Fee-based revenues also followed that trend, with management and financial advice fees growing by 19% to hit $2.72 billion. Investment income ticked higher as well, landing just under $900 million. The bottom line: Ameriprise is benefiting from both a growing client base and higher asset values, both of which feed directly into stronger top-line numbers.

Leadership Commentary and Strategic Focus

CEO Jim Cracchiolo didn’t hold back his optimism. He emphasized how well the firm is positioned to manage through different market environments and praised the ongoing investment in technology and advisor tools. That’s been a key focus for Ameriprise—keeping advisors equipped with digital platforms and insights that can elevate client service.

The Wealth Management segment was a standout, with client assets crossing the $1 trillion mark for the first time, up 14% from the prior year. Net inflows of $11.3 billion show that clients are not only sticking around but continuing to invest through the firm. On the Asset Management side, Ameriprise reported $681 billion in assets, and a good portion of their mutual funds and strategies remain highly rated, which helps attract and retain clients.

Capital Returns and Future Direction

Ameriprise continues to return capital to shareholders at an impressive clip. In Q4 alone, $768 million was returned through dividends and buybacks. That brought the total for the full year to $2.8 billion. It’s clear the company is maintaining a disciplined approach when it comes to balancing growth initiatives with rewarding shareholders.

Looking ahead, the focus remains on digital innovation and product expansion. Management appears committed to driving both organic growth and operating efficiency. If recent quarters are any indication, Ameriprise seems well-equipped to keep delivering for clients and shareholders alike—even as the economic backdrop continues to shift.

Chart Analysis

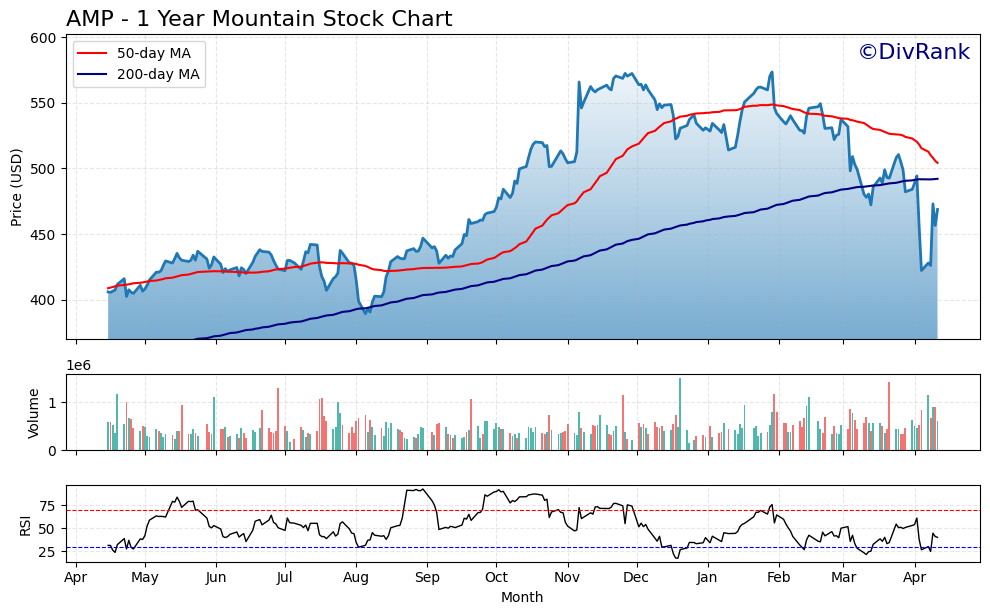

Price Movement and Trend Lines

AMP has had a dynamic year, with its stock price showing both steady gains and recent volatility. The chart reflects a strong upward move from early summer into late fall, with the price peaking just above $570. This rally was supported by a rising 50-day moving average, which acted as a reliable support until early this year. However, starting around February, the stock began a clear pullback, and the 50-day average has since curved downward, signaling short-term weakness.

Meanwhile, the 200-day moving average has continued on a steady upward path, providing longer-term support. The recent dip below this level was sharp and accompanied by a surge in volume, suggesting capitulation or panic selling. Interestingly, the bounce off the lows was equally swift, with the price rebounding back toward the 200-day line—an encouraging sign that buyers are stepping in at perceived value levels.

Volume Behavior

Volume has stayed relatively consistent throughout the year, but several spikes stand out. Notably, there’s a burst of activity during the sharp drop in early April, pointing to heavy institutional movement or forced selling. This kind of volume profile, especially during a bottoming pattern, often suggests a turning point as stronger hands accumulate shares while weaker hands exit.

RSI Patterns

The RSI chart shows several key inflection points. Back in late September and early November, the RSI touched overbought territory, which lined up with short-term peaks in the price. Since early this year, the RSI has mostly trended lower and dipped into oversold territory multiple times in March and early April. This typically reflects mounting bearish sentiment—but it can also indicate a potential reversal, especially when matched with strong support and high volume.

The most recent RSI rebound suggests momentum may be returning, although it’s still well below overbought conditions. The absence of extreme RSI levels now aligns with the idea that the stock is trying to stabilize rather than extend in either direction.

Final Observations

AMP’s recent correction has brought it back toward longer-term trend support, and the uptick in volume during the rebound is a healthy sign. The declining short-term average could continue to pressure the stock, but if price holds above the 200-day line and RSI gradually lifts, it may mark the early stages of a base forming. This chart tells a story of a stock that surged, corrected, and may now be finding its footing again.

Management Team

Ameriprise Financial is led by Chairman and CEO Jim Cracchiolo, who has held the top role since the company’s separation from American Express in 2005. Over the years, he’s helped steer the business into one of the more respected names in wealth and asset management. Cracchiolo is known for his long-term mindset, consistently favoring stability and sustainable growth over quick wins. That approach has helped Ameriprise navigate everything from market crashes to economic recoveries without losing focus.

The broader executive team brings deep experience across financial planning, asset management, and risk oversight. They’ve maintained a steady hand through volatile periods and kept the company focused on its core strengths. One of their most notable achievements has been the firm’s ability to maintain high margins and strong return on equity, all while continuing to invest in technology and client-facing platforms. The result is a business that feels modern and responsive without chasing fads. Their decision-making reflects clarity, especially in capital return, advisor development, and operational efficiency.

Valuation and Stock Performance

Valuation-wise, AMP sits at a forward P/E ratio of about 12.5, which is relatively low considering its consistency in earnings and growth in assets under management. The PEG ratio is just under 1, pointing to an attractive balance between growth and price. This is a firm that may not be cheap on every metric, but it’s also not priced like a premium growth stock—despite posting steady, growing results quarter after quarter.

Price-to-book comes in higher than most traditional financial firms, sitting around 8.5. That’s not unusual for a fee-based business where intangible assets like advisor networks and client relationships carry real long-term value. In businesses like this, book value doesn’t always tell the full story.

Over the past year, AMP’s stock has climbed roughly 14 percent, easily outpacing the broader market. The price hit a peak north of $580 before pulling back to the $460–470 range. That decline, in large part, tracked with a general market dip and some sector rotation, but the stock has started to bounce with renewed volume and momentum. What stands out is how consistently AMP has returned capital during this stretch—delivering regular dividends and executing share repurchases while maintaining financial flexibility.

The long-term chart shows a healthy, upward-trending name that moves with the market but maintains its own rhythm. Volatility is part of the story, but so is resilience.

Risks and Considerations

As strong as the business is, Ameriprise isn’t immune to broader risks. Market performance has a direct impact on its revenue stream. Most of the company’s earnings come from fees tied to assets under management, so a prolonged downturn in the market can put pressure on the top line. That said, AMP has historically shown it can manage through those cycles by keeping costs under control and deepening existing client relationships.

Another risk is increasing competition in the wealth management space. New platforms continue to emerge, and some traditional players are doubling down on digital transformation. While Ameriprise has invested significantly in its own tools and systems, staying ahead of technology and retaining top-tier advisors is a never-ending race. The advisor-client relationship is core to the firm’s success, and any disruptions there can affect growth.

Regulation is always on the radar too. The financial advisory landscape is heavily regulated, and any shift in tax laws, fiduciary standards, or compliance rules could impact operations. Ameriprise has navigated these challenges well in the past, but it remains an area that requires constant attention and agility.

Then there’s the economy. Rising interest rates, inflation, or potential slowdowns could weigh on investor sentiment and reduce activity levels. Even with a solid business model, external conditions can dampen inflows and overall performance.

Final Thoughts

Ameriprise Financial doesn’t chase headlines, and that’s one of its greatest strengths. Its business is built on financial advice, asset management, and long-term relationships—all backed by a strong capital return program and disciplined leadership. The consistency of its earnings, the reliability of its dividend, and its focus on advisor-led growth set it apart in a crowded space.

The company’s ability to adapt without overreacting, to grow without overextending, and to return capital without weakening its position says a lot about how it’s run. It’s a well-balanced firm that has figured out how to deliver solid results year after year.

For those watching how financial firms navigate uncertainty, Ameriprise is showing what steady hands and clear strategy can achieve. Even in a complex and fast-changing environment, it continues to deliver on its promises—without losing sight of the fundamentals that built the business in the first place.