Updated 4/14/25

American Water Works (AWK) is the largest publicly traded water utility in the U.S., serving over 14 million people across 24 states. With a business grounded in essential services and supported by long-term regulatory agreements, the company has built a track record of steady earnings, consistent dividend growth, and disciplined capital investment. Over the past year, the stock has rebounded more than 25%, supported by strong financial results, a growing customer base, and strategic infrastructure upgrades. Earnings per share for 2024 came in at $5.39, up from $4.90 the previous year, while the dividend was raised to $3.06 annually. The company is also navigating a leadership transition, with President John Griffith set to take over as CEO in mid-2025. Despite trading at a premium, AWK continues to attract investors with its dependable performance, growth-focused reinvestment strategy, and commitment to long-term shareholder returns.

Recent Events

AWK has had a quietly strong run over the past year. After dipping to just above $113 last fall, the stock rebounded sharply, now trading around $146—a solid 26% gain over the past 12 months. Much of that move came alongside a wave of investor interest in defensive plays, especially utilities with consistent cash flows and reliable dividend histories.

On the financial front, the company has delivered impressive results. Revenue is up 16.4% year over year, now sitting at $4.68 billion on a trailing twelve-month basis. Net income climbed to $1.05 billion, and earnings per share hit $5.39. Perhaps more eye-catching, earnings growth accelerated 39.8% year over year. That kind of performance isn’t what you’d typically expect from a utility—and it signals strong operational execution and favorable regulatory support.

Despite its solid fundamentals, AWK isn’t trading at a deep discount. The forward P/E stands at 25.45, and the PEG ratio is hovering near 3.8. But for long-term dividend investors, valuation metrics often take a back seat to the bigger question: can this company keep paying, and keep growing, its dividend?

Key Dividend Metrics 📊

💰 Forward Dividend Yield: 2.09%

🔁 5-Year Average Dividend Yield: 1.77%

📈 Dividend Growth Rate (5-Year Avg): ~9%

🛡️ Payout Ratio: 55.71%

📅 Last Dividend Paid: $0.765 on March 4, 2025

⛔ Ex-Dividend Date: February 7, 2025

Dividend Overview

AWK’s dividend isn’t going to blow anyone away with yield alone. At just over 2%, it’s modest—especially compared to utilities that pay north of 4%. But there’s more to it. That yield actually sits a bit above the company’s five-year average, which suggests shares may still offer relative value in a market where defensive income plays have become more popular.

The annual payout currently stands at $3.06 per share. With a payout ratio just under 56%, American Water Works maintains a healthy balance: rewarding shareholders while still retaining earnings for infrastructure investment and long-term growth. That’s crucial for a utility company, where capital needs are ongoing and substantial.

What separates AWK’s dividend from others is how it’s managed. Increases are regular, measured, and based on real earnings power—not financial engineering or one-time boosts. For income investors looking for predictability and gradual growth, this kind of discipline matters.

Dividend Growth and Safety

Where AWK really begins to stand out is in its dividend growth profile. Over the past five years, the company has increased its payout at an average rate of around 9% annually. That’s well above inflation and stronger than many peers in the utility sector. This isn’t just about maintaining a yield—it’s about building wealth through a growing income stream.

Backing this growth is a strong operational base. The company generated $2.04 billion in operating cash flow over the past year. While levered free cash flow came in negative, that’s not unusual for utilities with heavy capital investments. In AWK’s case, it’s investing in water infrastructure—expanding systems, upgrading plants, and maintaining service reliability. That spending supports long-term earnings and dividend capacity.

Debt is on the higher side, with total debt of $14.12 billion and a debt-to-equity ratio of nearly 137%. But again, that’s typical in the utility space, where borrowing is part of the model. What helps offset that leverage is the company’s low beta of 0.67—meaning it tends to move less than the broader market—and the highly regulated, recession-resistant nature of its business.

In terms of safety, the dividend appears well-covered by earnings, with room for continued growth. Profit margins are strong at 22.4%, and operating margins are even higher at nearly 34%. That kind of profitability gives AWK the flexibility to manage its capital structure while continuing to grow the dividend.

For investors who value consistency over drama, American Water Works continues to deliver. It’s not a name that generates noise, but it does generate income—and that’s exactly what dividend-focused portfolios are built for.

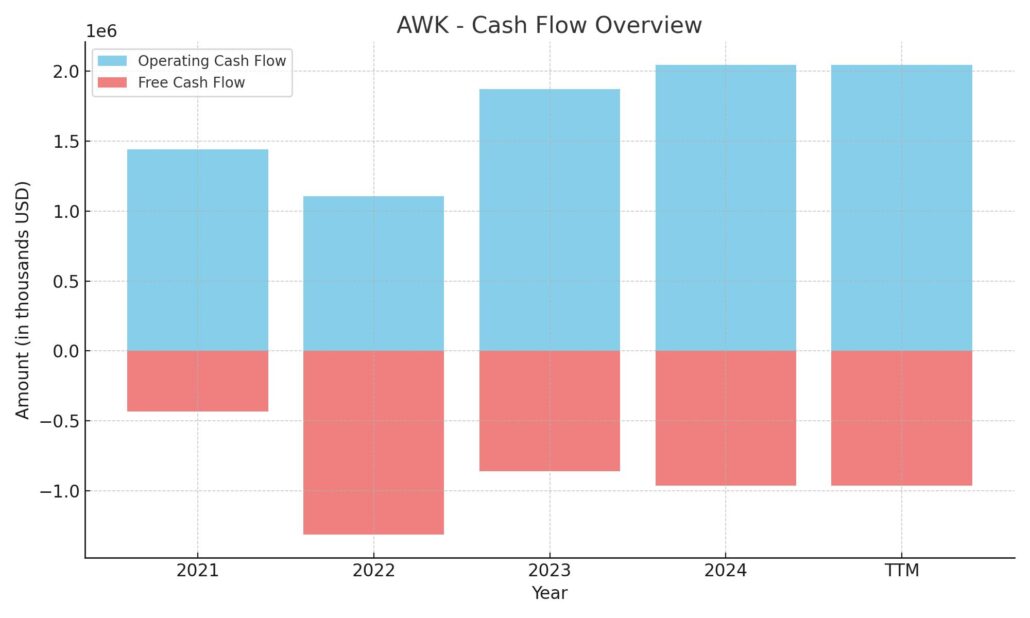

Cash Flow Statement

American Water Works’ cash flow picture over the trailing twelve months highlights the classic profile of a capital-heavy utility company. The firm generated $2.05 billion in operating cash flow—an increase from the prior year and a sign of robust core operations. However, capital expenditures continued to climb, reaching $3.01 billion, which pulled free cash flow into negative territory at -$963 million. This reflects the company’s ongoing infrastructure investments, a necessary cost in a business where growth and maintenance go hand in hand.

On the financing side, AWK brought in $1.11 billion, largely funded through $1.44 billion in new debt issuance. This was used to support capital spending and offset the free cash flow shortfall. Interest payments for the year totaled $483 million, reflecting the growing cost of servicing debt. Despite the negative free cash flow, AWK maintained its dividend and ended the period with $140 million in cash. While the balance sheet shows strain from heavy reinvestment, the consistent operating inflow suggests that the core business remains strong and capable of supporting its long-term financial commitments.

Analyst Ratings

American Water Works (AWK) has recently seen mixed sentiment from analysts, with several shifts in price targets and outlooks. The consensus rating currently leans toward a “Hold,” reflecting a cautious but steady view of the stock’s short-term potential. Analysts continue to recognize AWK as a dependable, lower-volatility name within the utility space, though near-term valuation concerns are keeping enthusiasm in check.

📈 Seaport Research recently raised its price target on AWK from $140 to $156 while maintaining a Buy rating. Their view is centered on the company’s position in a defensive sector and its ability to consistently deliver solid earnings in uncertain markets. This upgrade also reflects confidence in AWK’s infrastructure investments and its long-term rate base growth.

📉 On the flip side, JPMorgan lowered its target from $148 to $140, citing current valuation levels and some regulatory headwinds that could slow future earnings growth. Jefferies also adjusted its expectations, nudging its target up slightly from $105 to $115 but still signaling a more conservative take on AWK’s potential upside.

🎯 The average 12-month analyst price target now sits around $140.80, with estimates spanning from a low of $115.00 to a high of $159.00. That puts the midpoint fairly close to where the stock is currently trading, hinting at limited short-term upside but reinforcing the stock’s role as a stable income generator.

While sentiment is not overwhelmingly bullish, AWK continues to be viewed as a dependable name in the utility sector with a steady hand on growth and dividends—even if analysts aren’t expecting fireworks in the months ahead.

Earning Report Summary

American Water Works wrapped up 2024 on a high note, turning in solid numbers that reflect both operational strength and disciplined growth. The fourth quarter saw earnings per share hit $1.22, up significantly from $0.88 a year ago. For the full year, the company posted EPS of $5.39, which is a noticeable step up from $4.90 in 2023. Stripping out some of the noise like weather-related adjustments and interest income, the adjusted EPS came in at $5.18—still an impressive 8.6% jump year over year.

Steady Revenue Growth and Investments

Revenue for the fourth quarter climbed 16% to $1.2 billion. That kind of top-line growth isn’t typical for utilities, which makes it all the more notable. For the year, net income hit just over a billion dollars, giving American Water a profit margin of around 22%. These numbers tell a story of a company that’s not just growing, but doing so efficiently.

A lot of that growth is being reinvested back into the business. Capital investments hit $3.3 billion for the year, funding upgrades across the system and positioning the company for long-term returns. Along the way, American Water completed 13 acquisitions, adding about 70,000 new customer connections—a sign of steady, methodical expansion.

Leadership Transition and Looking Ahead

There’s a leadership change on the horizon. CEO M. Susan Hardwick announced she’ll be stepping down in May 2025. John Griffith, currently serving as president, is slated to take over the role. The transition is expected to be smooth, with Griffith already deeply involved in the company’s growth strategy.

Looking into 2025, American Water expects earnings to land somewhere between $5.65 and $5.75 per share. The long-term outlook remains the same: a steady 7–9% annual growth in both EPS and the dividend. That kind of consistency is exactly what long-term investors tend to appreciate, especially in a company delivering an essential service like water.

Chart Analysis

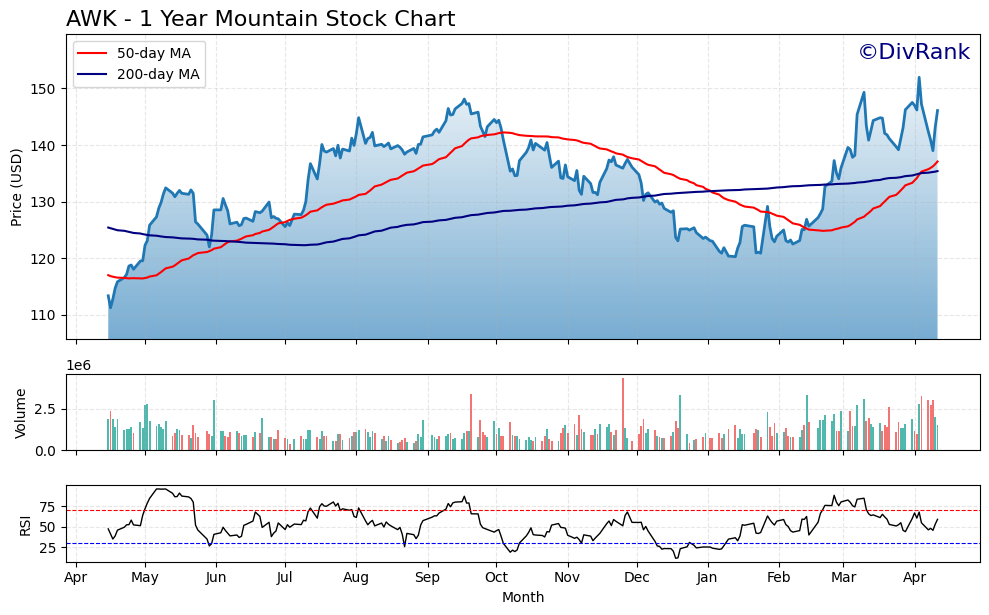

Price and Moving Averages

AWK has shown a notable recovery over the past year, rising from just under $115 in early spring to touch above $155 in late March. After a steady climb through mid-year, the stock faced pressure in the fall, dipping below its 50-day moving average and briefly losing support at the 200-day line. That pullback, however, was short-lived. The chart now shows a strong rebound, with the price crossing back above both the 50-day (red line) and 200-day (blue line) moving averages—an encouraging signal of regained momentum.

What’s worth noting is how the 50-day moving average, which had turned downward during the late fall and winter dip, has recently curled back up. Meanwhile, the 200-day average continued its gradual upward slope, suggesting underlying strength in the broader trend. The crossover pattern from below could be interpreted as a re-confirmation of bullish direction after the correction that played out in Q4.

Volume Trends

Volume has been relatively stable through most of the year, with brief spikes during price inflection points—particularly during the March surge. These surges in trading activity tend to validate moves like breakouts or reversals, and in this case, the rising volume supports the recent uptrend. There hasn’t been any sustained selling pressure reflected in the volume bars, which gives some confidence that the latest price move wasn’t purely speculative.

RSI Behavior

The Relative Strength Index (RSI) at the bottom of the chart reveals a few important moments. Back in May and again in late March, RSI readings pushed into the overbought zone above 70. While these spikes can sometimes signal short-term exhaustion, in both cases, the stock either consolidated or pulled back slightly without major damage. Most of the year, RSI stayed balanced between 40 and 65—right in the sweet spot that tends to support a sustainable uptrend.

At present, RSI has eased off its recent highs but remains comfortably above the midline. That positioning suggests the stock isn’t overextended right now, and there may still be room for further upside without triggering a strong reversal.

Recent Candle Action

Looking at the most recent five candles, the price action tells an interesting story. After a sharp move higher, a tall upper wick appeared—often a sign of intraday selling pressure. But instead of reversing, the next candles held ground with relatively tight bodies and smaller wicks, suggesting buyers are still showing up on dips. This type of consolidation near the highs is usually a healthy sign after a quick run-up, indicating that traders are not rushing for the exits and that momentum may still be in play.

Taken together, the chart shows a stock that went through a natural period of correction, respected long-term support, and has now reestablished an upward trend with improving technical signals.

Management Team

American Water Works is currently moving through a well-planned leadership transition, and it’s happening from a place of solid footing. Susan Hardwick, who has served as CEO since 2022, will step down in May 2025. Her time at the helm has been marked by stable earnings growth, focused capital investments, and a steady hand in navigating regulatory environments. Under her leadership, the company maintained its direction without wavering from its long-term goals.

John Griffith, the current President, is set to succeed her. He’s no stranger to the business, having already been involved in shaping the company’s operational and financial strategies. His experience in infrastructure and utility management makes him a natural fit for the role. This transition feels more like a continuation than a reset, which is ideal for a company that prioritizes consistency.

The broader leadership team blends regulatory knowledge, capital markets expertise, and infrastructure planning. This combination is critical when you’re managing aging systems, maintaining rate stability, and still delivering shareholder value. The team’s approach isn’t about dramatic changes but about measured execution—something that aligns closely with the company’s long-standing identity.

Valuation and Stock Performance

Valuation-wise, American Water Works is not the cheapest option in the utility space, but it rarely is. The stock trades at a forward P/E of around 25, a level that suggests investors are paying for stability and consistent earnings rather than aggressive growth. The price-to-book ratio is at 2.76, and its EV/EBITDA is close to 16, reinforcing the idea that this is a premium-priced name in a traditionally defensive sector.

That said, the stock’s performance over the past year has been solid. After bottoming out around $115 in late 2023, it has climbed back to around $146, a gain of over 25%. That rebound reflects renewed investor confidence, possibly helped along by stronger-than-expected earnings and improving sector sentiment. While it hasn’t quite recaptured its previous highs near $155, it’s within striking distance.

What makes the performance even more meaningful is the context. This isn’t a stock driven by hype or speculative news—it moves based on earnings, regulatory updates, and capital investments. That makes its climb feel more grounded. When you also factor in the dividend—which has been growing steadily—total returns over time become quite attractive, even if the daily price action is more subdued.

Risks and Considerations

Even with all its strengths, there are risks investors should keep in view. Regulatory exposure is one of the biggest. As a regulated utility, American Water’s ability to raise rates and recover costs depends on approval from various state commissions. While the company generally has good relationships with regulators, outcomes can still be uncertain, especially when political or economic pressures mount.

Another area to watch is interest rates. With more than $14 billion in total debt, changes in borrowing costs matter. Higher rates can make it more expensive for the company to fund new projects or refinance existing obligations. While the company has managed this well so far, it’s a variable that needs monitoring.

Then there’s the capital intensity of the business. Maintaining infrastructure is expensive, and while the company continues to invest heavily, it’s operating with negative free cash flow. That’s common for utilities, but it does mean dividend growth and capital expansion rely on consistent access to financing.

Environmental factors also come into play. Climate change, extreme weather, and water resource management all pose operational challenges. While the company has a diversified service area and solid risk management practices, unexpected events can always affect operations and costs.

And of course, valuation itself is a potential headwind. With shares trading at a premium, expectations are already priced in. If growth slows or earnings disappoint, there’s limited cushion. The stock isn’t overvalued by speculative standards, but it does leave less room for error.

Final Thoughts

American Water Works continues to offer a steady, grounded investment profile. It’s not a fast-moving stock, and it doesn’t need to be. The company generates stable revenue from an essential service, manages its capital with discipline, and rewards shareholders with consistent dividends.

The most recent earnings were strong, the leadership transition is unfolding smoothly, and the company remains committed to its long-term targets. Valuation is on the higher end, but it reflects the quality and reliability investors expect from a company like this.

Risks remain, particularly around regulation, interest rates, and capital needs, but they’re well-known and, so far, well-managed. As long as the company stays focused on its core mission and continues to deliver, it will likely remain a dependable name in a sector where dependability is the biggest asset. The story isn’t about rapid change—it’s about steady progress, and that can be just as powerful.