Updated 4/14/25

American Tower Corporation (AMT) plays a central role in global wireless infrastructure, operating over 225,000 communications sites across multiple continents. Structured as a REIT, the company generates steady, contracted revenue from long-term leases with major telecom carriers, supported by built-in rent escalations. It has consistently grown its dividend, backed by strong free cash flow and disciplined capital allocation. The stock recently regained momentum, with a favorable technical setup and rising analyst sentiment following operational efficiencies and market refocusing. With leadership tightening its strategic focus, investing in high-return assets like data centers, and maintaining balance sheet strength despite a high debt load, AMT is positioned to benefit from ongoing 5G expansion and increasing data consumption.

Recent Events

The past year has brought a mix of headwinds and resilience for American Tower. Revenue dipped year-over-year, with the most recent quarter showing an 8.6% decline. That may sound rough at first glance, but it doesn’t tell the full story. Despite the topline slip, profitability actually improved. Net income surged, climbing over 1,300% from the prior year. Operating margins held strong at 46%, thanks to careful cost control and solid execution on leasing.

The real estate investment trust (REIT) structure means AMT is no stranger to using debt, and there’s plenty of it on the books — $43.95 billion, to be exact. But context matters. This is a company built on stable, contracted income streams, and most of that debt is long-term and fixed-rate. Cash flow remains solid, with $5.29 billion in operating cash over the past twelve months and $4.37 billion in levered free cash flow.

Shares have started to regain some momentum, rising nearly 20% over the past year. The recent move back above $213 per share puts it on solid technical ground, and while investors buying today missed the April 11 ex-dividend date, the next payout isn’t far off.

Key Dividend Metrics

📈 Forward Yield: 3.19%

💵 Forward Annual Dividend: $6.80 per share

🕒 5-Year Average Yield: 2.53%

📅 Ex-Dividend Date: April 11, 2025

✅ Dividend Growth (Trailing 5 Years): 13.8% CAGR

📊 Payout Ratio: 118.38%

📈 Dividend Date: April 28, 2025

Dividend Overview

Let’s talk dividends. AMT has steadily grown its payout year after year, and that trend doesn’t seem to be fading. At a forward yield of 3.19%, the stock currently offers a higher yield than its five-year average, suggesting it might still be priced at a bit of a discount for income-focused investors.

That $6.80 per share annual dividend isn’t just a number — it’s the product of years of methodical growth. AMT has increased its dividend every year since becoming a REIT, and it’s not just inching up the payout. We’re talking consistent, double-digit increases, something not many REITs can say right now.

Yes, the payout ratio appears high at over 118%, but that figure includes GAAP net income, which isn’t the cleanest measure for REITs. The more relevant number here is AFFO, and based on cash flow, AMT has had no problem covering the dividend. The model — recurring leases with built-in growth — supports a reliable, rising income stream.

Dividend Growth and Safety

This is where AMT sets itself apart. Over the past five years, dividend growth has averaged nearly 14% annually. That’s not just above average — it’s elite, especially in the REIT world. That kind of consistent income growth speaks volumes about the stability and cash generation of the business.

Management has made it clear that dividend growth is a core part of the strategy. It’s not a byproduct of spare cash at the end of the quarter — it’s a priority in how the business allocates capital. And with over $4.3 billion in levered free cash flow generated in the past year, there’s plenty of fuel to keep that growth going.

Debt, of course, is something to watch. Leverage is high, but so is the predictability of the revenue. AMT isn’t flipping properties or speculating on rent trends. It owns hard infrastructure that’s deeply embedded in the digital economy. These towers have long lives, minimal upkeep, and rent escalators that often keep pace with inflation.

On top of that, the company isn’t reliant solely on the U.S. for growth. With a presence in Latin America, Africa, and Asia, there’s diversification that adds to both the opportunity and the risk profile. But so far, AMT has managed that exposure well.

The dividend story here isn’t flashy, but it’s strong. Consistent growth, strong cash flow support, and a management team committed to keeping the payout rising — those are the ingredients dividend investors tend to look for. AMT offers all three in a sector that’s only going to become more essential as data usage keeps climbing.

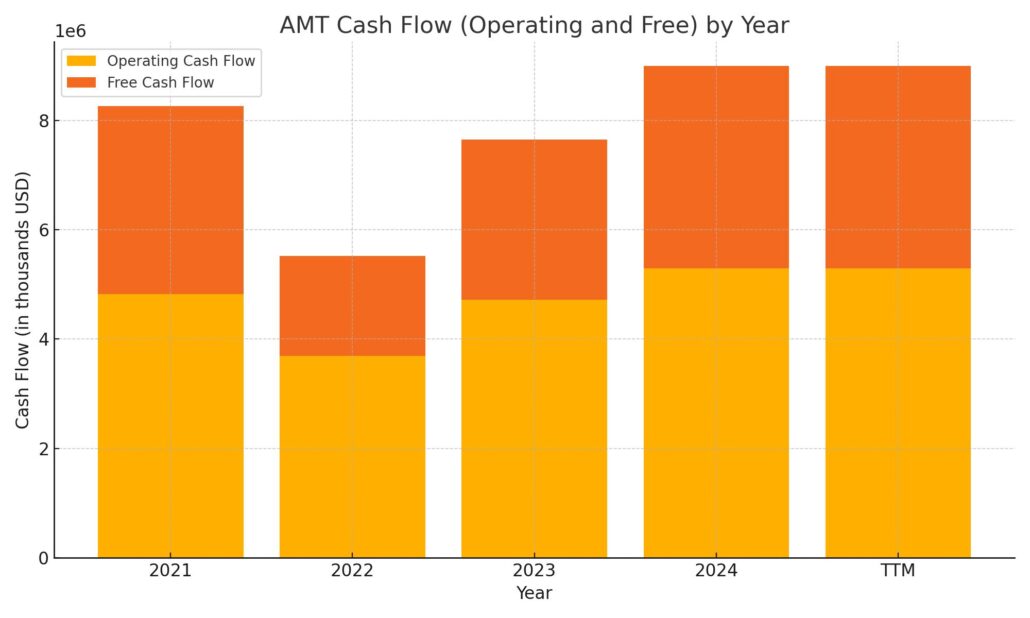

Cash Flow Statement

American Tower’s trailing twelve-month cash flow reveals a steady and efficient engine behind its dividend reliability. Operating cash flow came in at $5.29 billion, reflecting solid consistency compared to $4.72 billion the prior year. That growth in core cash generation underscores the stability of AMT’s leasing model, even amid headwinds like foreign exchange pressure and rising costs. Free cash flow also improved meaningfully, rising to $3.7 billion — a healthy jump from $2.92 billion a year ago. With capital expenditures remaining relatively flat year-over-year at $1.59 billion, the company continues to invest in growth while preserving financial flexibility.

Investing cash flow swung to a positive $410 million, a notable reversal from deep outflows in previous years. This suggests a slowdown in aggressive expansion and acquisitions, potentially a shift toward optimization and integration. Financing cash flow, on the other hand, showed a significant outflow of $5.45 billion, reflecting both high debt repayments and reduced new borrowings. Interest payments have climbed to $1.42 billion, a clear sign of the cost of carrying heavy debt in a higher-rate environment. Despite this, the ending cash position held steady at just over $2.1 billion, showing AMT’s ability to maintain liquidity while managing its capital structure with discipline.

Analyst Ratings

📈 American Tower Corporation (AMT) has recently caught some attention on Wall Street, with several analysts shifting to a more bullish stance. Morgan Stanley upgraded the stock from ‘Equal-Weight’ to ‘Overweight’ in early April, raising its price target from $213 to $250. The reasoning was centered around AMT’s strong and steady cash flow, as well as its dependable revenue model built on long-term infrastructure leases. Analysts also highlighted AMT’s strategic exposure to global markets, which they believe positions it well for consistent growth.

🏗️ Wells Fargo followed suit a couple of weeks earlier, also moving from ‘Equal-Weight’ to ‘Overweight’. Their price target went from $210 to $230, reflecting renewed confidence in AMT’s fundamentals. They pointed out the company’s operational consistency and the opportunities in international markets, especially as mobile data usage continues to accelerate worldwide. AMT’s ability to maintain financial discipline while still investing in growth played a big part in the improved outlook.

📊 Barclays, while already optimistic on the name, nudged its target higher as well — from $214 to $223 — and maintained its ‘Overweight’ rating. They emphasized the durability of AMT’s business model and the continued strong demand for wireless infrastructure.

💰 As it stands, the consensus 12-month price target for AMT sits at about $234.95. That reflects roughly 10% upside from current levels, with target estimates ranging from $204 on the low end to as high as $250. Analyst sentiment is leaning positive, and the consistency of these upward revisions suggests a growing belief in AMT’s long-term positioning.

Earning Report Summary

American Tower’s latest earnings update gave investors a clearer view of where the company stands and where it’s headed. The fourth quarter of 2024 delivered steady results, and leadership took the opportunity to outline a sharper, more focused strategy moving forward.

Solid Revenue and Cash Flow Growth

The company reported just over $2.5 billion in total revenue for the quarter, up around 3.7% from the same time last year. Most of that growth came from the core property segment, which continues to benefit from rising demand for wireless infrastructure. Organic tenant billings grew by more than 5%, showing that the underlying leasing activity is still very healthy.

Earnings also moved in the right direction. Adjusted EBITDA climbed modestly, while AFFO per share – a key measure for REITs – hit $10.54, up almost 7% year-over-year. On a currency-neutral basis, that growth would’ve been closer to 9%, suggesting stronger performance beneath the surface.

Trimming the Fat and Sharpening the Focus

One of the more telling parts of the quarter was the company’s continued effort to tighten operations. Cash SG&A expenses were reduced by about $35 million compared to the year before, reflecting a real push toward cost discipline. Management also pointed to a series of asset divestitures – including towers in India, Australia, and New Zealand – as part of a plan to focus on higher-quality, core markets. They’re also in the process of exiting the fiber business in South Africa.

CEO Steve Vondran made it clear on the earnings call that the company is prioritizing balance sheet strength, operational efficiency, and smart capital deployment. It’s not just about growing for the sake of it anymore – it’s about growing where the return potential is strongest.

Looking Ahead with 5G and Data Centers

The future direction looks centered around developed markets and the ongoing global build-out of 5G networks. Leadership mentioned a $600 million investment in data centers as a key initiative, aiming for returns in the mid-teens. There are also new tower builds in Europe planned, which fits with the company’s strategy to double down on areas with long-term demand.

They’re not ignoring risks either. Things like carrier consolidation, FX volatility, and rising interest rates remain concerns. But the company seems well aware of these factors and appears to be planning accordingly.

American Tower’s tone this quarter was one of quiet confidence. They’re not chasing flashy deals or spreading themselves too thin. Instead, they’re sharpening their focus, tightening operations, and putting capital where it can do the most good – all while keeping a steady dividend flowing to shareholders.

Chart Analysis

American Tower Corporation (AMT) has had a volatile but ultimately constructive year on the price chart, showing signs of renewed strength following a period of consolidation. The stock has made a noticeable recovery from its lows and is currently riding positive momentum that has taken it back above both key moving averages.

Price and Moving Averages

The 50-day moving average, shown in red, has recently turned sharply higher and just crossed above the 200-day moving average, a pattern often referred to as a golden cross. This is typically seen as a positive technical signal, suggesting that short-term momentum is now stronger than the longer-term trend. Meanwhile, the 200-day moving average has flattened and begun to edge higher, indicating a potential shift in the broader trend after months of sideways to downward movement.

The price itself has climbed off its December lows near $180 and made a strong push to the $220 range before pulling back slightly. This kind of breakout above the long-term average is often interpreted as the market starting to revalue the stock more favorably, possibly pricing in improving fundamentals or easing external pressures.

Volume and Participation

Volume patterns show several spikes in activity, particularly during the recent uptrend in March and early April. Higher volume on up days tends to suggest conviction behind the move. That’s what seems to be happening here — demand has increased at higher prices, which typically bodes well for continuation.

There’s also a clear rise in buying volume during recent sessions, especially as the price reclaimed the moving averages. The consistency of volume around breakouts adds credibility to the current rally and suggests there’s institutional interest stepping in.

Relative Strength Index (RSI)

The RSI has remained mostly in the mid-to-upper range through much of the past year. It flirted with overbought levels above 70 multiple times — particularly in June, late October, and more recently in March — but never stayed there too long. That kind of behavior often points to healthy momentum without excessive froth.

Currently, the RSI is in the 60s, suggesting positive momentum but with some breathing room before overbought territory. The previous dips in RSI near 30 during October and early January were followed by swift rebounds in price, highlighting a pattern where the stock finds strong support after pullbacks.

Broader Trend View

Looking across the full year, AMT has transitioned from a downtrend into what now appears to be a steady recovery. The structure of higher lows and higher highs from January onward reinforces this. There’s now a solid base that’s been forming around the $180–$190 range, and the breakout above $210 signals a shift in sentiment.

With the price currently back above both moving averages and volume rising on the upswings, the setup suggests a more constructive long-term technical outlook. If this trend continues, it could offer a solid backdrop for steady capital appreciation alongside income potential.

Management Team

American Tower’s leadership has remained remarkably stable over the years, which helps explain much of the consistency in its performance. At the helm is Steve Vondran, who took over as CEO in early 2024. He’s been with the company since 2000, holding a range of executive roles across legal, operations, and corporate development. That kind of long tenure brings a deep understanding of both the industry and the internal mechanics of the business — something investors tend to appreciate, especially in a complex global operation like this one.

Under Vondran’s leadership, there’s been a noticeable focus on financial discipline and operational focus. He’s emphasized trimming non-core assets, simplifying the portfolio, and tightening costs. That’s not just talk. The company has already exited several markets where returns weren’t stacking up and has continued to sharpen its strategy around high-growth, high-return opportunities.

The broader leadership team blends technical expertise with global experience. CFO Rod Smith, who’s been in place since 2020, has overseen major shifts in capital allocation and cost structure. His focus on maintaining investment-grade credit ratings while funding long-term projects shows a clear understanding of how important balance sheet strength is in this rate environment.

Overall, the management team doesn’t chase hype. They communicate clearly, stay disciplined, and make moves that seem grounded in long-term value creation rather than quarterly optics.

Valuation and Stock Performance

Valuation for AMT has fluctuated over the past year, largely in response to interest rate expectations, global macro conditions, and investor appetite for REITs in general. Right now, the stock is trading at around 30 times trailing earnings and a forward multiple closer to 33. That’s not cheap in absolute terms, but it’s fairly consistent with the company’s historical range. AMT rarely trades at a discount because of its consistent cash flows and strong operating margins.

Compared to the broader REIT sector, which often includes office, retail, and residential names, AMT commands a premium. But that premium is earned. The company’s infrastructure is essential, its contracts are long term, and its tenants are mostly investment-grade telecom operators. There’s also the added appeal of global exposure and long-term secular tailwinds from mobile data growth and 5G expansion.

Looking at performance, shares have rebounded nicely from the lows seen in late 2023. From a trough near $170, the stock has recovered to the $210–$220 range, showing a solid 20 percent gain off the bottom. It’s still trading below its all-time highs near $240, which gives it some room to run if current trends hold. The 50-day moving average has turned up sharply, and the recent golden cross with the 200-day moving average adds technical support to the recovery narrative.

AMT’s dividend yield of around 3.2 percent sits well above its five-year average, making the stock more attractive than it has been in recent years. With consistent dividend growth and a strong history of payout increases, many investors are comfortable paying a bit more for quality here.

Risks and Considerations

While the business model is stable, AMT isn’t without its risks. One of the biggest overhangs is its reliance on debt. The company carries over 43 billion dollars in long-term debt, which is a byproduct of its REIT status and capital-intensive nature. As interest rates rose in recent years, so did the cost of servicing that debt. So far, AMT has managed this well thanks to a largely fixed-rate debt profile, but any further tightening or refinancing cycles could start to pinch cash flows.

Currency risk is another important factor, particularly given the company’s sizable exposure to emerging markets. While geographic diversity brings opportunities, it also adds volatility. Foreign exchange swings have impacted reported earnings in the past, and this could continue to be an issue going forward, especially with a strong U.S. dollar.

Carrier consolidation is also something to keep an eye on. If wireless providers merge or streamline their operations, demand for tower space can temporarily decline. That said, the trend so far has been toward more network density, not less. Still, fewer carriers could lead to more pricing pressure, especially in developed markets.

Lastly, regulatory risks exist, particularly in countries where infrastructure regulations can change quickly or where political environments are unstable. While AMT has historically managed these well through local partnerships and strategic exits, they remain a consideration when evaluating future growth potential.

Final Thoughts

American Tower sits at the intersection of infrastructure and technology, offering something rare: stability with growth potential. The stock has weathered rate hikes, currency swings, and even a global pandemic without missing a dividend increase. That’s not by accident. It’s the product of a clear strategy, experienced leadership, and a business model designed to handle economic shifts.

While it’s not the flashiest name in the market, it consistently delivers results. The current setup — with improving technicals, strong underlying cash flow, and a focus on high-return capital deployment — suggests the company is well positioned heading into the next phase of network expansion. As demand for mobile data continues to climb and 5G infrastructure rolls out globally, AMT’s role remains critical.

The company’s ability to invest in growth, return capital to shareholders, and maintain operational discipline creates a compelling combination. Risks are always part of the picture, but so is the track record of navigating them well.

Whether it’s the consistency in management, the predictable revenue model, or the steadily rising dividend checks, there’s a quiet strength in this name that speaks for itself.