Updated 4/14/25

Amcor plc (AMCR) is a global leader in consumer packaging, serving industries ranging from food and beverage to healthcare and personal care. With its headquarters in Switzerland and operations spanning multiple continents, the company has built a reputation for consistency, scale, and dependable cash flow. The stock currently trades around $9.33, offering a forward dividend yield of approximately 5.5% and a forward P/E ratio near 11, which positions it attractively among income-oriented names. Recent results show volume growth and improving margins, even as the company navigates headwinds in select sectors. A new CEO, an upcoming merger with Berry Global, and a continued focus on sustainability and innovation round out a company that’s both evolving and deeply rooted in essential packaging markets.

Recent Events

Amcor recently popped more than 3% in a single trading session, though the move didn’t come off any major news release. Instead, it seems tied to a shift in market sentiment, with investors leaning into defensive names. That’s Amcor’s sweet spot.

The most recent earnings showed a small drop in revenue—down 0.3% year-over-year—but net income and EPS growth painted a more positive picture. Earnings per share jumped over 21% compared to the same period last year, which suggests some tight cost control or operational improvements behind the scenes.

Margins are holding steady, too. An operating margin near 9% in a business that moves commodity-like products isn’t bad at all. And that’s in a market where cost pressures are anything but mild. With a low beta of 0.78, Amcor doesn’t move wildly with the market, which adds to its appeal for those who value capital preservation along with income.

On the flip side, there’s the debt. The company is carrying around $7.5 billion in total debt, and the debt-to-equity ratio is pushing 197%. That’s a heavy load. But it’s somewhat balanced by strong operating cash flow of $1.25 billion and over $690 million in free cash flow. So while the debt profile raises eyebrows, the cash generation helps calm the nerves.

Key Dividend Metrics 📊

📌 Dividend Yield: 5.47%

📌 Payout Ratio: 91.2%

📌 Annual Dividend Rate: $0.51

📌 5-Year Average Dividend Yield: 4.45%

📌 Dividend Growth: Gradual, steady increases

📌 Ex-Dividend Date: February 26, 2025

📌 Most Recent Dividend Paid: March 18, 2025

📌 Dividend Safety: Some pressure due to high payout and leverage

Dividend Overview

That 5.47% dividend yield is one of Amcor’s standout features right now. It’s comfortably ahead of what most blue chips are paying. This is a high-yield name by any standard, which naturally brings questions about how sustainable the payout is. A glance at the 91% payout ratio shows Amcor is returning nearly all of its earnings to shareholders. For some companies, that might be a flashing red light. For Amcor, it’s more of a yellow—caution, but don’t slam on the brakes just yet.

The real story is how dependable those dividends have been. Even in down cycles or during global disruptions, Amcor’s checks kept coming. That’s partly because its products are essential. People still need toothpaste, shampoo, and over-the-counter meds, regardless of what the economy is doing. That makes Amcor’s cash flows more stable than they might appear at first glance.

Still, that high payout ratio means there’s little wiggle room. A dip in earnings, a big capital expense, or unexpected market pressure could test the company’s ability to keep the dividend untouched. But as it stands, management has done a decent job balancing those demands, and they seem fully aware that the dividend is a core part of the investment appeal.

Dividend Growth and Safety

This isn’t a stock for dividend growth purists. The increases have been modest—more of a slow-and-steady pace than anything exciting. But those bumps have come with reassuring regularity. The forward dividend rate now sits at $0.51, which is up from around $0.47 a few years ago. Not jaw-dropping, but consistent.

Where things get more interesting is in how the company supports that dividend. Free cash flow is healthy enough to cover it, and the business continues to throw off solid returns—ROE is over 20%, which is impressive given the industry. But the leverage can’t be ignored. The debt levels are high, and while manageable for now, they do reduce the margin for error.

Short interest is a little elevated at just over 11%, suggesting some market skepticism. But the institutional ownership is fairly strong at around 59%, which implies that larger investors still see value in the name—likely in part because of its dependable yield.

With shares trading below both their 50-day and 200-day moving averages, sentiment isn’t exactly bullish. But valuation-wise, Amcor doesn’t look stretched. The forward P/E under 11 and a price-to-book of 3.56 suggest there could be room for upside if earnings continue to hold up.

For income investors, Amcor has always been more about what you get every quarter than what the share price does day to day. It’s not flashy, and it’s not trying to be. Instead, it quietly delivers on what it promises: predictable income from a product mix that the world still relies on, whether the headlines are good or bad.

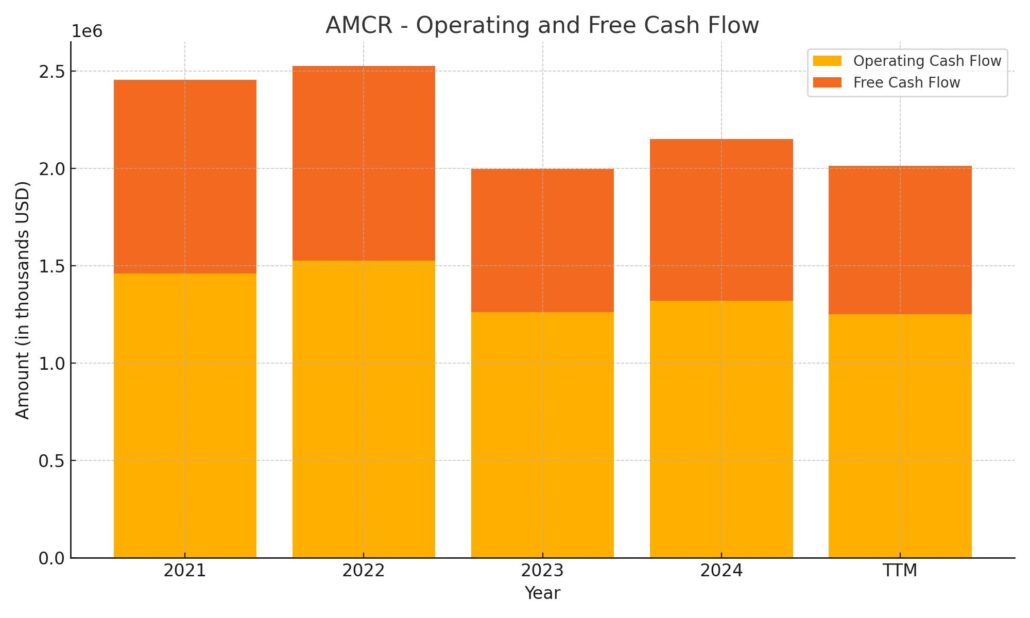

Cash Flow Statement

Amcor’s cash flow over the trailing twelve months shows a company maintaining a solid cash-generating core despite some year-over-year dips. Operating cash flow came in at $1.25 billion, slightly lower than the prior year but still robust enough to support both dividends and reinvestment. This level of cash generation also underpins a healthy free cash flow figure of $762 million, even after accounting for $490 million in capital expenditures. While that marks a modest decline compared to previous years, the numbers still reflect a company capable of funding operations without stretching itself.

On the investing and financing side, the company continued to pull back from aggressive capital deployment. Investing cash flow remained negative, largely driven by those capex commitments, but consistent with previous years. Financing activities also posted outflows, notably $809 million, which includes debt repayments and modest stock buybacks. Interestingly, despite ongoing debt service, Amcor issued nearly $1 billion in new debt—likely a move to manage maturities or refinance at favorable terms. The ending cash position declined to $519 million, continuing a multi-year downtrend, but still provides operational flexibility for the short term. Overall, the cash flow narrative points to a mature company managing capital with discipline.

Analyst Ratings

🟢 Amcor plc (AMCR) recently received an upgrade from a major brokerage firm, moving from a “Hold” to a “Buy” rating. This change reflects growing confidence in Amcor’s ability to maintain steady performance even in a slower macro environment. Analysts pointed to the company’s consistent earnings and its focus on operational efficiencies as key reasons behind the shift. Cost containment measures and stable demand across core packaging segments have helped keep margins healthy, which seems to be earning renewed trust from the analyst community.

📈 The current analyst consensus price target for AMCR is $11.46, suggesting a potential upside of nearly 23% from the current share price of $9.33. The range of price targets spans from $10.80 on the low end to $12.50 at the high end. While these projections don’t scream explosive growth, they do indicate a sense of stability and modest appreciation potential, particularly appealing to income-focused investors.

📊 The stock now carries a consensus rating of “Moderate Buy,” reflecting a mix of cautious optimism and respect for the company’s reliability. Analysts aren’t expecting fireworks, but they are seeing enough strength in the fundamentals to justify a positive shift in sentiment.

Earning Report Summary

Amcor’s latest earnings results painted the picture of a company making steady, thoughtful progress through a challenging environment. The numbers didn’t shout, but they spoke clearly enough—net sales came in around $3.2 billion for the quarter, nudging higher compared to the same time last year. What really stood out was volume growth, up a respectable 2.3%, and that was enough to push adjusted EBIT and EPS up by 5% each. Margins also got a small boost, with adjusted EBIT margin climbing 40 basis points year-over-year.

Leadership’s Take on the Quarter

During the earnings call, leadership didn’t sound overly celebratory, but there was a tone of quiet confidence. They acknowledged ongoing headwinds in specific areas—healthcare and North American beverages being the usual suspects—but emphasized that other parts of the business were holding up well. More importantly, they reiterated their full-year guidance, which always offers a layer of reassurance. They’re still expecting adjusted earnings per share to fall somewhere between $0.72 and $0.76, and free cash flow in the ballpark of $900 million to $1 billion.

A Merger on the Horizon

The company also shared updates on the upcoming merger with Berry Global. This isn’t just a back-office cost-saving exercise; it’s positioned as a long-term play to unlock growth, sharpen margins, and ultimately boost cash flow. Management mentioned $650 million in total synergy potential, with around 40% of that expected to be realized in the first year post-merger. That kind of upside could help Amcor reach a new level of financial flexibility and performance.

Capital Returns and Looking Ahead

On the capital front, Amcor hasn’t been shy about rewarding shareholders. About $750 million has been returned through dividends and share buybacks, a strong show of commitment to income-focused investors. The dividend was bumped up to $0.50 per share annually, which is a signal that management feels comfortable with the company’s cash flow outlook.

Looking ahead, the focus is still on innovation and building a more sustainable packaging portfolio. Amcor wants to drive low to mid-single-digit organic growth over time—not by chasing flash-in-the-pan trends, but by building steadily in categories where it already has a competitive edge.

The quarter didn’t deliver any jaw-dropping surprises, and maybe that’s a good thing. For a company like Amcor, consistency often speaks louder than drama.

Chart Analysis

The chart for AMCR over the past year shows a name that had a strong run through the middle of 2023 before gradually giving back some gains in late fall and into early 2024. After peaking near $11.50, the price started to roll over, with a pretty clean downward trend that developed as the red 50-day moving average began curving lower and eventually crossed below the 200-day moving average—a classic signal of momentum cooling off.

Moving Averages and Price Behavior

For much of the past year, AMCR’s price stayed comfortably above both the 50-day and 200-day moving averages. That support shifted in late October, when the stock lost its footing. The 50-day MA started slipping and eventually crossed under the 200-day in early January, forming what’s often referred to as a death cross. While not a guaranteed predictor of extended downside, it’s a technical reflection of a trend reversal, and the stock responded accordingly with a gradual decline into early spring.

But there’s been a sharp bounce recently. Price shot up off the lows near $8.40, and it’s now pressing back toward the short-term moving average. Whether this is just a relief rally or the start of a base-building phase remains to be seen, but the price movement shows buyers stepping in with a bit more conviction.

Volume and RSI Behavior

Volume started picking up noticeably toward the end of the chart. There were multiple sessions with volume spikes, some of them aligned with selloffs and others with rebounds, hinting at growing interest and possibly institutional activity. This uptick in volume adds weight to the idea that the recent bounce could be more than just noise.

Looking at RSI, the stock dipped into oversold territory multiple times in March and April. Those readings below 30 are usually a sign that the selling pressure may be running its course. The latest bounce pushed RSI back above 50, signaling some return of strength, though it hasn’t entered the overbought zone yet. There’s room for further upside before any technical red flags flash from momentum.

Trend and Sentiment Shift

After a stretch of weakness, there are early signs that sentiment around AMCR might be turning a corner. The stock seems to be trying to carve out a bottom, and while it’s still below both moving averages, the recent upward push suggests the potential for a trend shift if it can sustain follow-through. The challenge now is whether the stock can reclaim those averages and hold above them long enough to attract more buyers and build a new base.

Right now, it’s less about chasing momentum and more about observing how the price behaves around key levels. If the recent rally gets backed up by continued volume and improved RSI readings, this chart could start to look more constructive in the weeks ahead.

Management Team

Amcor’s leadership is anchored by CEO Peter Konieczny, who officially stepped into the role in September 2024 after serving as interim CEO earlier in the year. He’s been with the company for many years in a variety of leadership roles, including Chief Commercial Officer and regional president positions, which gives him deep insight into both the operational and strategic sides of the business. His background in management consulting and global packaging markets gives him the kind of experience that’s useful in navigating a company of Amcor’s scale.

Alongside him, CFO Michael Casamento continues to oversee the financial direction of the company. He’s been in the CFO seat since 2015 and has been involved with Amcor since 2014. With experience spanning corporate finance and operations across several regions, Casamento is seen as a steady hand. Other key members of the leadership team include Fred Stephan, Chief Operating Officer, who previously held leadership roles at Bemis and General Electric, and David Clark, the Chief Sustainability Officer, who plays a central role in shaping Amcor’s environmental strategy. The broader executive group brings together experience in legal, human resources, strategy, and operations—covering the key areas needed to support Amcor’s global ambitions.

Valuation and Stock Performance

AMCR’s stock has taken a bit of a ride over the past year. It climbed to a high of $11.48 back in September 2024 but has since pulled back, settling at $9.33 in April 2025. That’s roughly a 19% slide from its peak. While that drop might raise eyebrows, the recent bounce from the April lows and stabilizing chart action are worth watching. The share price seems to be trying to find a floor, and volume suggests renewed investor interest.

From a valuation standpoint, the forward price-to-earnings ratio of 10.92 makes it look reasonably priced, especially for a company with dependable earnings and a sizable footprint in essential consumer goods packaging. That multiple comes in under many sector peers, giving Amcor a bit of value appeal. Analyst price targets average around $11.46, which implies a decent upside from current levels. Add in the dividend yield, which hovers around 5.5%, and you’ve got a name that combines modest capital appreciation potential with a strong income stream. For many, that mix is compelling—particularly in a market where reliable yield is tough to find.

Risks and Considerations

There are definitely some things investors should keep on their radar. The most glaring is debt. Amcor’s debt-to-equity ratio is just under 200%, which is high by most standards. While the company continues to generate solid cash flow, carrying that kind of leverage can be risky, especially if interest rates stay elevated or cash flow takes a hit. The company’s ability to manage and potentially reduce that burden will be something to watch in the quarters ahead.

Another layer of risk is tied to the industry itself. Packaging, particularly plastic packaging, faces mounting pressure from consumers, regulators, and environmental groups. Amcor has committed to improving the sustainability of its offerings, but transitions like that take time and capital. How quickly they can innovate without losing cost competitiveness will matter.

Then there’s the merger with Berry Global. It’s a bold move with $650 million in synergy potential, but integration of two large players is rarely smooth sailing. There’s always the risk of cultural clashes, system integration hiccups, and distraction from core operations. Success here could be transformative, but the path isn’t without challenges.

Final Thoughts

Amcor is one of those companies that doesn’t chase headlines but quietly plays a critical role in the global consumer ecosystem. Its products are everywhere, even if its name isn’t always front and center. That kind of behind-the-scenes consistency can make for a compelling investment, particularly for those who value income and long-term stability.

The leadership team is experienced and seems focused on execution, which will be crucial as the company works through integration, navigates industry change, and manages its balance sheet. The valuation appears reasonable, and the dividend remains a central part of the story. While there are real risks—from leverage to regulatory pressures—Amcor has proven it knows how to manage through cycles. As long as it continues to adapt and deliver steady results, it’s likely to stay on the radar of investors looking for something durable in uncertain times.