Updated 4/14/25

American States Water Company (NYSE: AWR) is a California-based utility providing water and electric service across multiple states, with additional operations through long-term military contracts. With a 69-year streak of consecutive dividend increases, it holds one of the longest records of dividend growth in the country. The company has recently reported strong earnings growth, supported by favorable rate adjustments, increased consumption, and strategic infrastructure investments. While valuation has come under scrutiny, with the stock trading at a premium to peers, AWR continues to deliver steady performance backed by experienced leadership and low volatility. Its consistent operating cash flow, robust regulatory relationships, and disciplined capital planning make it a reliable option for income-focused investors.

Recent Events

Over the past year, American States Water has seen a healthy uptick in financial performance, helped by regulatory rate approvals and operational stability. Revenues grew 14.3% year-over-year, hitting $595 million over the trailing twelve months. At the same time, earnings growth has been strong, with net income climbing to $118.9 million and diluted earnings per share jumping nearly 40%. That kind of growth, especially in a utility, isn’t something you see every day.

The company has also been actively investing in infrastructure. That’s resulted in negative free cash flow lately, but it’s not cause for alarm. In the world of utilities, large capital investments are routine, and it usually means they’re strengthening the network for long-term performance. Still, with total debt nearing $938 million and a debt-to-equity ratio a bit above 100%, it’s worth keeping tabs on how this affects future flexibility.

What’s reassuring, though, is AWR’s low volatility profile. The stock’s five-year beta sits at just 0.56. That kind of stability tends to appeal to investors who aren’t looking to ride the market’s daily swings. It’s a steady ship in calmer or rougher waters.

Key Dividend Metrics

💰 Forward Dividend Yield: 2.38%

📈 5-Year Average Dividend Yield: 1.84%

📆 Consecutive Years of Dividend Increases: 69

📊 Payout Ratio: 56.5%

💵 Forward Annual Dividend: $1.86 per share

🧾 Ex-Dividend Date: February 18, 2025

📅 Next Dividend Payment: March 3, 2025

📉 Dividend Growth CAGR (10-Year Estimate): ~9%

📉 Free Cash Flow Coverage: Currently negative

Dividend Overview

If you’re an investor who likes seeing a dividend roll in every quarter—without surprises—AWR fits that bill. It’s currently paying out a forward annual dividend of $1.86 per share, translating to a yield of 2.38%. That might seem modest on the surface, but it’s actually above the company’s five-year average yield. Combine that with 69 years of uninterrupted dividend increases, and you start to see the draw.

It’s not a yield-chasing play. Instead, this is the kind of stock you hold for peace of mind and compounding dividend growth. The current payout ratio of 56.5% gives plenty of room for continued increases. Even if growth slows temporarily, AWR isn’t in a tight spot when it comes to covering its dividend.

The consistency of their business model plays a big role here. Water utilities, especially regulated ones, operate in a space where demand doesn’t fluctuate wildly. That gives AWR a foundation of predictable cash flow, which supports reliable payouts. Layer on their DoD contracts, which stretch out over multiple years, and you’ve got a clear line of sight on income.

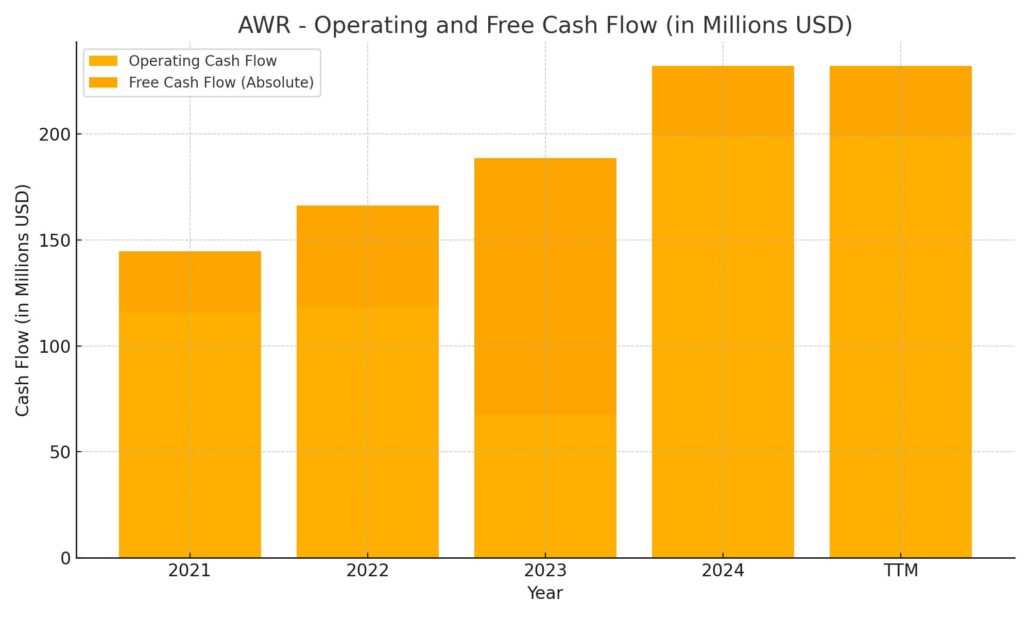

One thing to keep an eye on is the free cash flow, which is currently in the red due to ongoing infrastructure upgrades. Utilities often operate this way—investing heavily upfront with a long-term payback period. Still, it’s a factor income investors should track, especially if it persists over multiple quarters.

Dividend Growth and Safety

What stands out about American States Water isn’t just that it pays a dividend—it’s how it’s grown that dividend. Over the past decade, the company has managed to raise its dividend at an average clip of around 9% per year. That’s impressive for any company, but especially notable for a utility. That kind of growth adds up, especially for long-term holders reinvesting dividends along the way.

The safety of the dividend also looks solid. With a payout ratio under 60% and a strong return on equity north of 14%, AWR isn’t stretching itself too thin. Management has shown a clear commitment to maintaining and growing the dividend without taking undue risks.

There are a few caution lights worth noting. The company’s current ratio is sitting below 1.0, which suggests liquidity could be a little tight in the near term. And the debt load, while manageable, does edge up their financial risk slightly. But within the context of the utility sector, these figures aren’t unusual—and AWR has historically navigated these challenges well.

On the earnings front, recent growth has helped reinforce the dividend outlook. With a trailing twelve-month operating cash flow of just under $199 million, the company has enough financial muscle to keep up its dividend rhythm—even with ongoing capital expenses in the background.

Investors looking at AWR today might not find the highest yield on the market, but what they will find is a company that takes its dividend seriously. It’s not just about making the next payment—it’s about making the next 40. And for income-focused investors, that level of consistency is often more valuable than short-term headline numbers.

Cash Flow Statement

American States Water Company reported operating cash flow of $198.7 million over the trailing twelve months, marking a sharp recovery from the previous year’s $67.7 million. This level of operating cash inflow reflects stronger earnings and more stable billing collection in its utility services. However, capital expenditures also rose significantly to $232 million, in line with the company’s ongoing infrastructure investments. As a result, free cash flow remained negative at -$33.2 million, though it narrowed compared to previous periods.

On the financing side, the company raised $88.8 million through equity issuance and added another $64.6 million via new debt, offsetting a smaller $44.9 million in debt repayments. These financing activities helped maintain liquidity, pushing the ending cash balance to $26.7 million—up meaningfully from $14.1 million a year earlier. The use of both equity and debt to fund capital projects is typical for a utility of this size and nature, particularly given the long-term return horizons of such investments.

Analyst Ratings

🔻 In early February 2025, Bank of America Securities downgraded American States Water Company (NYSE: AWR) from a neutral stance to underperform, adjusting the price target downward from $85 to $71. The primary concern cited was the stock’s valuation, which was trading at a significant premium compared to its peers in the water utility sector. AWR’s price-to-earnings ratio hovered around 25x, and its price-to-book ratio stood at 3.2x—representing a 32% premium over the sector average and 11% higher than its direct water utility peers. While the analysts acknowledged the company’s management strength and reliable dividend track record, they expressed caution over whether such a valuation premium could be maintained in an environment with sustained high interest rates.

🔻 Similarly, in January 2025, Wells Fargo shifted its rating on AWR from equal weight to underweight and lowered its price target from $84 to $77. Their concerns echoed those of Bank of America, pointing to overvaluation and macroeconomic pressure from rates that could weigh on utility performance over the near term.

📊 Despite these recent downgrades, the broader analyst consensus remains neutral, with a hold rating being the prevailing view. The average price target currently sits around $79.33, indicating a modest upside from recent trading levels. While not a momentum play at this stage, AWR’s consistent fundamentals continue to earn it a place on many watchlists.

Earning Report Summary

Strong Finish to the Year

American States Water Company wrapped up 2024 on a high note, delivering a fourth quarter that showed real momentum. Earnings per share came in at $0.75, which was a solid jump from the $0.55 posted in the same quarter last year. What helped move the needle? Mostly higher rates across its regulated water and electric segments, along with some one-time benefits related to regulatory decisions. The water utility business saw a meaningful lift thanks to final approvals on its general rate case, and the electric side got a boost from retroactive rate adjustments.

Leadership sounded upbeat about the quarter. The tone was confident, with management emphasizing the role of consistent regulatory execution and a steady focus on customer service. These factors, they said, continue to drive operational success and earnings quality. The company also benefited from a favorable tax adjustment, which added to the quarterly strength.

Full-Year Numbers and Looking Ahead

For the full year, earnings per share landed at $3.17, slightly below the $3.36 mark from 2023. But when you strip out some one-off items from last year, it turns out that 2024 was actually stronger on a normalized basis. The core business showed growth, and that’s what matters most to long-term investors.

A big part of AWR’s story in 2024 was investment. The company pumped more than $235 million into its water and electric infrastructure, reinforcing its long-term commitment to system reliability and regulatory support. Over on the contracted services side, their ASUS division had a solid year too. It kicked off operations at two new military bases and locked in over $56 million in new project awards, helping support that segment’s contribution to overall results.

On the financial side, cash flow was much stronger this year. Operating cash flow jumped to nearly $199 million, up significantly from the year before. That improvement came from both better billing collections and increased customer usage. CFO Eva Tang mentioned that the company plans to keep leaning into its at-the-market equity program, with a target of raising around $60 million in 2025. It’s a way to help fund growth without putting too much pressure on the balance sheet.

All in all, the tone from leadership was forward-looking. They’re staying focused on executing capital projects, maintaining strong relationships with regulators, and continuing to build value for shareholders—especially through dependable dividends and stable earnings.

Chart Analysis

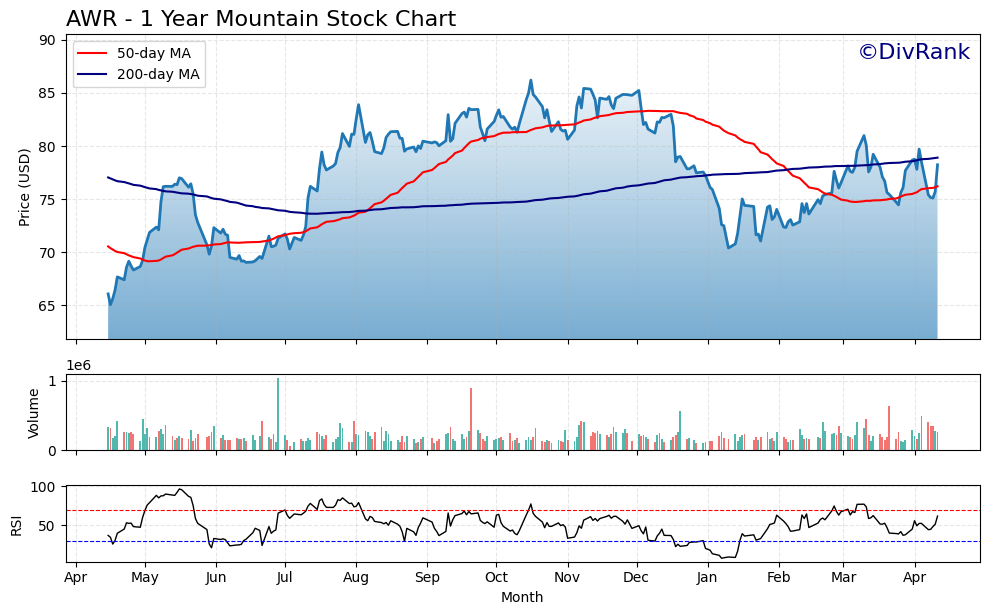

Overall Price Movement

AWR has shown some interesting movement over the past 12 months. Starting from the low $60s range last spring, the stock steadily climbed throughout the summer, peaking in the mid-$80s by early November. That rally was backed by relatively consistent buying volume and aligned closely with the stock crossing above its 50-day and 200-day moving averages.

What followed, though, was a clear pullback. From November through mid-January, price softened, dipping below both the 50-day and 200-day lines. This breakdown showed weakness as sellers took control, and the moving averages began to diverge—especially with the 50-day sloping downward.

Moving Averages

The 50-day moving average has been rolling over since late November, reflecting that loss in short-term momentum. It recently began curling back upward in early April, suggesting renewed interest. At the same time, the 200-day moving average continued to rise, a signal that long-term trend strength remains intact.

The stock is now trading right around both of these key moving averages, with price action making multiple attempts to reclaim and stay above them. This kind of consolidation can often precede a more decisive move.

Volume and Momentum

Volume stayed mostly steady through the year, with some noticeable spikes during selloffs in January and rebounds in March. These higher-volume days around turning points hint at institutional activity—likely rebalancing or reacting to valuation shifts.

Relative Strength Index (RSI) dipped into oversold territory earlier in the year but has since rebounded. It’s currently hovering near the 60 mark, suggesting improving momentum without being overextended. It shows that the recent rally hasn’t become overheated, leaving room for further upside if buying continues.

Recent Candlesticks

Looking at the last five candles, there’s a mixed story. The most recent candles show longer wicks on both ends, pointing to indecision and a tug-of-war between buyers and sellers. However, price has managed to stay above the short-term support level near $75. A break above the recent highs could invite more confidence and push toward the $80 range again. If it fails to hold above the moving averages, the $72 level could be the next area to watch.

AWR appears to be regaining its footing after a few months of softness. With the long-term trend still intact and signs of stabilization returning, the stock looks to be building a base that could set up the next leg higher.

Management Team

American States Water Company is led by a seasoned executive team with deep roots in the utility space. At the forefront is Robert J. Sprowls, who has been with the company for over two decades and serving as President and CEO since 2009. Before stepping into that role, he held key financial leadership positions, including CFO and Treasurer, which brings a strong operational and financial understanding to his leadership style. His long tenure has been defined by a steady focus on infrastructure investment, regulatory engagement, and growing shareholder value.

Eva G. Tang, who serves as CFO, Senior Vice President of Finance, Treasurer, and Corporate Secretary, has been an integral part of AWR’s financial management since 2008. She oversees financial planning, investor relations, and capital strategy. Under her guidance, the company has maintained strong financial footing even while executing a multi-year capital investment program. The leadership team also includes experienced operational and engineering leaders who help maintain reliability and efficiency across AWR’s water and electric services. This leadership group has remained focused on keeping the company financially sound while meeting evolving infrastructure and regulatory demands.

Valuation and Stock Performance

AWR’s stock recently traded around $78, climbing back from its recent lows in the mid-$60s. The 52-week high is $87.50, while the low sits near $66. These swings reflect a broader trend in the utility sector as investors reprice assets in a higher interest rate environment. The stock currently trades at about 24.7 times trailing earnings, which is relatively high for a utility. This premium reflects investor confidence in the company’s long-term reliability and dividend strength, though it may also limit near-term upside.

Looking at broader market behavior, the company’s beta of 0.56 shows its lower-than-average volatility, which often attracts investors seeking defensiveness rather than aggressive growth. The price-to-book ratio stands around 3.3, higher than some industry peers, adding to the view that AWR trades at a premium. Still, despite the valuation questions, the company has continued to hold investor interest. The average analyst price target sits around $79 to $81, suggesting the stock is generally viewed as fairly valued at current levels.

Risks and Considerations

AWR operates in a heavily regulated space, and much of its financial performance depends on favorable rate case outcomes. While the company has historically navigated these challenges well, any adverse regulatory decisions could dampen earnings and cash flow. The majority of its operations are in California, which adds another layer of exposure to political and environmental variables, including drought risk, evolving water quality standards, and climate-related mandates.

Another important point is the company’s capital expenditure profile. With more than $230 million invested in infrastructure this past year alone, AWR continues to rely on a mix of operating cash flow and financing activity to support its growth. Its current debt-to-equity ratio, just above 1.0, remains within manageable limits, but any increase in borrowing costs could change the equation. Free cash flow remains negative as the company funds these investments, and while not uncommon in the sector, it’s something that could weigh on flexibility if it persists.

Investors should also consider interest rate sensitivity. Utilities often act as bond-like investments, meaning they can come under pressure when rates rise. As borrowing costs increase, their relative yield becomes less attractive, and their financing becomes more expensive. For companies like AWR that are consistently investing in infrastructure, this macro environment plays a bigger role than it might for less capital-intensive businesses.

Final Thoughts

American States Water Company continues to represent the kind of long-term, steady operator that appeals to income-focused investors looking for reliability. Its leadership team has delivered on execution for decades, even in shifting market conditions. Despite a premium valuation, the company’s history of dividend growth, regulatory consistency, and low-volatility profile make it a reliable presence in a portfolio.

That said, there are headwinds to consider. The valuation could limit near-term returns, especially in a rising-rate backdrop. Regulatory dependency and capital demands are always part of the picture in the utility world. But AWR has shown over time that it knows how to manage through cycles, maintain service quality, and deliver to shareholders without taking on excessive risk. For those looking for stable performance and long-term visibility, AWR remains a name worth watching.