Updated 4/14/25

Alpine Income Property Trust (PINE) is a net lease REIT focused on generating consistent rental income through a portfolio of single-tenant commercial properties across the U.S. With a 7.39% forward dividend yield and a history of steady AFFO growth, the company appeals to investors looking for dependable income. Leadership, led by CEO John Albright, has maintained a disciplined acquisition strategy, adding over $100 million in properties last year while selling selectively to optimize returns. Despite some recent tenant losses and a stock pullback to the $15 range, Alpine continues to operate with strong occupancy, solid rent collections, and a growing dividend. Trading at a discount to book value and backed by long-term leases, it offers a measured approach to income-focused real estate investing.

Recent Events

Alpine’s recent numbers show signs of quiet strength. Revenue grew 19.1% year-over-year, which is impressive for a net lease REIT. That kind of lift reflects both rent escalations and new acquisitions, reinforcing management’s strategy of slow and steady expansion.

Earnings, however, remain slim. Net income came in at just over $2 million for the trailing twelve months, which translates to an EPS of only $0.14. So if you’re looking at this as a growth play, you’re probably barking up the wrong tree. But for dividend-focused investors, that’s not necessarily a dealbreaker.

The company’s market cap has nudged higher in 2024, moving from just over $208 million at year-end to around $223 million more recently. A modest gain, but a sign that the market is giving it some credit for that revenue uptick.

Debt, as is often the case with REITs, is part of the picture. Alpine has just over $304 million in total debt, which puts its debt-to-equity ratio at 110.2%. While that’s not excessive in REIT land, it’s still a number worth keeping on your radar—especially given where interest rates are sitting these days.

Key Dividend Metrics

📈 Forward Dividend Yield: 7.39%

💵 Forward Dividend Rate: $1.14/share

📉 Payout Ratio: 792.86%

📆 Ex-Dividend Date: March 13, 2025

💸 5-Year Average Yield: 5.64%

📊 Trailing Yield: 7.26%

Dividend Overview

Here’s where things get more interesting for income investors. PINE is currently offering a forward yield of over 7%, which easily outpaces most equity income options in today’s market. That kind of yield can be a powerful draw for those who rely on dividend checks for income—or simply enjoy seeing those payouts roll in.

The dividend itself has remained steady, with modest increases over time. It’s not flashy growth, but it’s dependable. The current forward rate sits at $1.14 per share annually, and it has been paid consistently without major hiccups.

Now, it’s worth addressing the elephant in the room: the payout ratio. At nearly 793%, it looks unsustainable at first glance. But keep in mind, REITs operate differently. They use Funds From Operations (FFO) as a more accurate gauge of dividend coverage, which excludes depreciation and paints a clearer picture of cash flow. That said, a payout this high—even on a REIT-adjusted basis—still raises eyebrows.

The company’s operating cash flow came in at just over $25 million, which is a positive sign. But its levered free cash flow was actually negative by more than $22 million. That suggests the dividend isn’t being entirely covered by internally generated funds. Instead, it’s being supported by external financing, property sales, or other forms of capital recycling—fairly normal for REITs, but not ideal for long-term sustainability.

Dividend Growth and Safety

Alpine has managed to edge its dividend higher over the years, showing some commitment to returning more cash to shareholders. It hasn’t been a rocket ship of growth, but the trajectory has been in the right direction. Consistency is a theme here—and in the world of dividend investing, that counts for a lot.

Still, we have to talk safety. With the current payout ratio sitting where it is, Alpine’s dividend isn’t bulletproof. Net income is thin. Free cash flow is in the red. And even though operating cash flow offers some support, it’s not a slam dunk.

That said, this is the type of REIT that’s designed for defense. Its tenants are locked into long-term leases, and its properties tend to be located in strong retail corridors with solid economic backdrops. The company isn’t throwing capital at speculative developments or chasing aggressive growth.

With a price-to-book ratio of 0.88, the stock is trading below the value of its underlying assets. That offers a bit of a cushion, especially for investors who like their dividends backed by real estate rather than blue-sky forecasts. And with a beta of just 0.60, the share price has shown some resilience—another trait income investors appreciate during market turbulence.

In the end, Alpine is doing what it set out to do: generate reliable rent checks and return much of that income to shareholders. The high yield makes it attractive. The balance sheet and cash flow profile say “watch closely.” For those who understand the REIT structure and are comfortable with some leverage, Alpine remains a name that earns its place on the dividend radar.

Cash Flow Statement

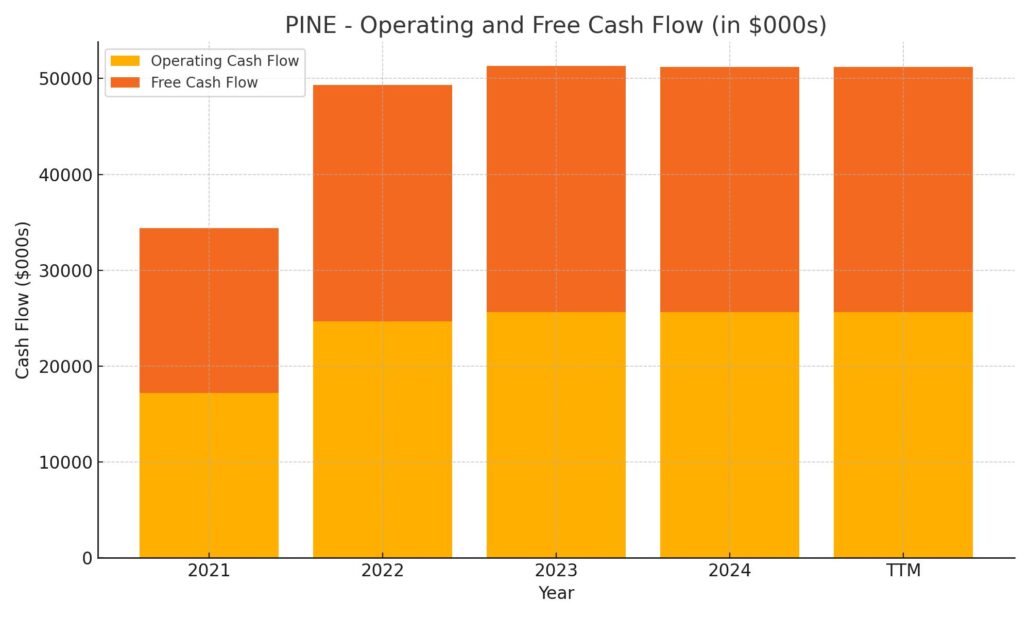

Alpine Income Property Trust’s cash flow statement for the trailing twelve months reflects a business leaning heavily into acquisition and growth mode. Operating cash flow came in at $25.6 million, essentially flat compared to the prior year. This consistency points to stable income generation from its lease portfolio. Notably, free cash flow matched operating cash flow, indicating no significant capital expenditures were reported, at least not separately.

Investing activities were aggressive, with cash outflows of nearly $57.8 million, a sharp increase from the prior year’s $13.6 million. That’s a clear signal of Alpine putting capital to work—likely in acquiring new properties. On the financing side, cash inflows totaled $26.5 million, reversing last year’s outflows. The company raised $122.4 million in new debt and repaid $96.9 million, keeping its debt profile in motion. Despite the cash outlays, Alpine finished with just under $8 million in cash on hand, down from nearly $14 million a year earlier. Interest expenses have climbed as well, reaching nearly $12 million, reflecting a heavier debt load in a higher-rate environment.

Analyst Ratings

📊 Alpine Income Property Trust (PINE) has recently attracted fresh attention from analysts, with updates that blend cautious optimism and steady confidence. Stifel Nicolaus, for example, revised its price target for PINE slightly downward to $19.25 from $19.50, while keeping its Buy rating unchanged. This minor tweak followed the company’s announcement of its Q1 2025 property activity—highlighting $79.2 million in acquisitions at a strong 9.0% cap rate and $11.7 million in asset sales at a 9.1% cap rate. The numbers reflect strategic movement within a tight market environment.

🎯 The average 12-month price target for PINE now sits at $19.14. That’s a notable premium over where shares are currently trading, suggesting analysts still see upside potential. Among the analysts covering the stock, the sentiment leans positive: seven out of nine rate it a Buy, while two recommend holding. No sell ratings are on the board right now, which is encouraging for income investors looking for stability and upside.

⚠️ Some caution flags have been raised, though. Analysts have pointed to the company’s higher leverage and its exposure to non-investment grade tenants as potential weak spots. Broader economic uncertainty and pressure on specific retail tenants are also factors keeping a few voices in the hold camp.

💼 Still, the overarching tone remains constructive. Analysts appear to appreciate Alpine’s consistency in delivering shareholder value through dividends and disciplined asset management. Even with a few clouds on the horizon, the trust continues to position itself as a steady, income-generating name in the REIT space.

Earnings Report Summary

Strong Finish to 2024

Alpine Income Property Trust wrapped up 2024 on a solid note. The numbers were steady, with adjusted funds from operations (AFFO) hitting $1.74 per share for the full year. That’s a healthy 17% jump from the previous year. In the fourth quarter alone, AFFO came in at $0.44 per share, also up nicely year-over-year. Revenue for the quarter totaled $13.8 million, most of which came from lease income, while a decent chunk—about $2.2 million—came from interest on commercial loans. For the year overall, total revenue landed at $52.2 million.

Active Year for Acquisitions and Lending

Alpine stayed busy in 2024. The trust picked up 12 new properties, spending over $103 million at an average cap rate of 8.2%. That’s not bad at all in today’s market. On top of that, it issued three commercial loans totaling a little over $31 million, bringing in average yields of about 10.7%. That combination of property deals and loan originations means Alpine deployed nearly $135 million in new investments over the year. On the flip side, they also sold off 15 properties for just under $62 million. Those were sold at a 6.9% cap rate—part of their plan to keep the portfolio balanced and efficient.

Portfolio Health and Tenant Quality

The portfolio looks strong. Alpine now owns 134 properties spread across 35 states, covering almost 4 million square feet. Occupancy stood at 98% at year-end, and the average remaining lease term was just under nine years—solid indicators of stability. What’s even more reassuring is that over half of Alpine’s rent comes from investment-grade tenants, which brings a layer of credit safety that income-focused investors appreciate.

Capital Position and Dividend Growth

From a financial standpoint, Alpine’s position is relatively healthy. The company had about $95 million in liquidity at year-end, including available cash and unused credit lines. Its net debt-to-EBITDA ratio came in at 7.4x, slightly better than last year. That’s a touch higher than some REIT peers, but not unexpected given the company’s ongoing investments. On the dividend side, Alpine bumped its quarterly payout to $0.285 per share, bringing the annualized figure to $1.14. That continues its track record of raising dividends annually since its IPO—not flashy, but dependable.

Outlook for 2025

Looking to 2025, Alpine offered guidance with FFO and AFFO expected to fall between $1.70 and $1.73 per share. There are a couple of hurdles ahead—namely, the Party City bankruptcy and a non-renewal from Cinemark. Those two events are expected to shave about eight cents per share from results. Still, management seemed confident that the impact can be managed with continued portfolio fine-tuning and disciplined property sales. The tone from leadership was forward-looking, focused on adapting where needed and continuing to deliver value to shareholders.

Chart Analysis

Price Trend and Moving Averages

PINE has had quite the ride over the past year. The chart shows a clear uptrend beginning in early summer, gaining strong momentum into the late summer and early fall. That sharp run took the stock from under $15 to nearly $18.50, but it couldn’t hold those highs. Since then, the price has pulled back and entered a slower grind lower, with more recent weakness showing up in April.

The 50-day moving average (in red) started climbing sharply around July, reflecting that summer surge. But since February, it’s been on a gentle downward slope. In contrast, the 200-day moving average (in blue) has steadily moved higher and recently overtook the 50-day—a technical setup often viewed as a sign of weakness ahead. This crossover didn’t come out of nowhere. It reflects the stock cooling off from its earlier momentum and finding it harder to stay above key support.

Volume and Participation

Trading volume has remained fairly consistent, though a few spikes are noticeable around sharp price moves. Notably, volume picked up during some of the recent declines, especially in early April, which could indicate stronger selling pressure. There aren’t signs of panic, but there’s certainly been more interest when the stock breaks lower, rather than when it’s inching higher.

Relative Strength Index (RSI)

Looking at the RSI near the bottom of the chart, the stock spent time in overbought territory around August and September, right during its peak rally. Since then, it’s mostly floated in the middle zone, with occasional dips toward oversold. The most recent reading has it down near the oversold line again, signaling that the recent pullback may be nearing a short-term bottom—though it’s not quite there yet.

Overall, PINE appears to be consolidating after a strong 2023 run, with the stock currently searching for a new footing. The longer-term trend still leans positive, thanks to the steady 200-day moving average, but the near-term picture is clearly more cautious.

Management Team

Alpine Income Property Trust is led by a management team that brings a mix of institutional real estate experience and operational discipline. At the top is John P. Albright, who serves as President and CEO. He’s been steering the ship since Alpine was formed in 2019, drawing on his past leadership roles at Archon Capital and Morgan Stanley. His background in real estate investment is reflected in the company’s steady hand and disciplined approach to portfolio growth.

Philip R. Mays, the company’s CFO and Treasurer, joined in mid-2024. He brings a history of finance leadership, including his most recent role as CFO of Shadowbox Studios and prior experience at Cedar Realty Trust. He also held the Chief Accounting Officer role at Federal Realty, so he understands the financial mechanics of REITs from top to bottom.

Steven R. Greathouse, who heads up investments, has been with Alpine from the beginning. He came from N3 Real Estate and also worked with Morgan Stanley, helping shape the firm’s property acquisition strategy. Daniel E. Smith, Alpine’s General Counsel and Corporate Secretary, and Lisa M. Vorakoun, the Chief Accounting Officer, round out the leadership team with backgrounds in corporate law and accounting, ensuring Alpine stays both compliant and financially transparent.

Together, this group brings both real estate savvy and financial rigor to the table, giving the company the leadership backbone it needs to handle both growth and risk.

Valuation and Stock Performance

Alpine’s stock performance over the past year has been a tale of two halves. After a strong move up in mid to late 2023 that brought the share price above $18, the stock has since retraced some of those gains and recently traded around $15.43. That puts it well off its highs, though not in a freefall. It reflects broader uncertainty in the market rather than any one glaring weakness in Alpine itself.

From a valuation standpoint, there are a few things that stand out. The price-to-book ratio is currently under 0.90, which suggests that the market is valuing the stock below the net worth of its underlying assets. That could point to undervaluation or simply reflect investor caution around the REIT sector right now. Either way, it offers potential room for upward movement if sentiment improves or fundamentals remain strong.

Analyst sentiment leans generally positive. The average 12-month price target is around $19, suggesting a decent upside from where the stock trades today. While it’s not the kind of target that screams momentum play, it reflects a belief that Alpine is doing the right things: collecting stable income, managing assets wisely, and returning capital to shareholders through a solid dividend.

Risks and Considerations

No company is without risk, and Alpine is no exception. One of the most visible concerns is the payout ratio. Sitting at over 790%, it looks unsustainable when compared to traditional earnings. Of course, REITs are judged differently—cash flow is what matters—but even by those standards, this is a thin cushion. The trust’s ability to continue paying and growing the dividend will depend on its ability to manage cash flow and maintain high occupancy levels.

Debt is another area to keep an eye on. Alpine’s debt-to-equity ratio is above 110%, which is elevated. It’s not out of line for the REIT sector, especially one that’s been growing, but it does increase sensitivity to interest rates and financing costs. Rising rates could pinch future acquisition plans or eat into cash available for dividends.

There are also tenant-specific risks. While Alpine does have a good portion of its rent coming from investment-grade tenants, it’s not immune to lease disruptions. The recent closure of Party City and the lease non-renewal with Cinemark are good examples of how even one or two tenant events can ripple through a year’s performance. Management already expects these two issues alone to reduce next year’s AFFO by about eight cents per share.

Then there’s the broader backdrop—macro volatility, changes in consumer behavior, and retail sector shifts all play a role in property performance. If economic growth slows or if there’s pressure on the types of tenants Alpine serves, there could be downstream effects on collections, lease renewals, or even property values.

Final Thoughts

Alpine Income Property Trust continues to carve out a space in the net lease REIT world by doing the simple things well. It collects rent from long-term tenants, manages a geographically diverse portfolio, and returns capital to shareholders with a healthy dividend. The management team has a clear playbook and the experience to adjust when needed.

At the same time, there are things to keep an eye on. The elevated payout ratio, modest debt levels, and some exposure to lower-credit tenants mean this isn’t a set-it-and-forget-it holding. That said, the stock’s current valuation and stable cash flows provide some cushion. With a yield that remains generous and a business model built on recurring income, Alpine stays on the radar as a potential fit for portfolios that value income and steady stewardship over flash and headlines.