Updated 4/14/25

Allegion plc (NYSE: ALLE) is a global provider of security products and solutions, including locks, access control systems, and connected technologies serving both commercial and residential markets. Since its spin-off from Ingersoll Rand in 2013, the company has built a reputation for steady financial performance, strong free cash flow, and a disciplined approach to capital allocation. With a forward dividend yield of 1.63% and a low payout ratio, Allegion offers a reliable income stream supported by consistent earnings growth. The leadership team, led by CEO John H. Stone, has emphasized innovation and operational efficiency as key drivers for long-term growth. While the stock has seen recent volatility, analysts maintain a hold consensus with a price target around $137.67. Backed by a resilient core business and expanding capabilities in electronic access, Allegion continues to deliver on its long-term strategy with a focus on value, stability, and financial strength.

Recent Events

Allegion’s latest earnings update shows a company that continues to perform steadily, even in a shifting economic environment. Revenue climbed 5.4% year over year, but more importantly, earnings surged over 21%. That kind of bottom-line growth speaks to strong cost control, smart pricing, and a product lineup that customers continue to value.

Cash flow has been one of Allegion’s standout strengths. Operating cash flow over the past year came in at $675 million, with nearly $466 million in free cash flow. That gives Allegion plenty of flexibility to cover its dividend and still invest in its growth strategy. The company is also sitting on a healthy $503 million in cash, and with a current ratio above 2, it’s well positioned to handle short-term obligations.

Yes, debt is higher than ideal, with a debt-to-equity ratio above 140%. But Allegion has managed this leverage prudently over the years. What dividend investors care most about is whether the dividend is safe—and the numbers here suggest it is.

Key Dividend Metrics

🪙 Forward Yield: 1.63%

📈 5-Year Average Yield: 1.34%

💰 Annual Dividend: $2.04 per share

🧮 Payout Ratio: 28.15%

📆 Next Ex-Dividend Date: June 13, 2025

✅ Cash Flow Coverage: Strong—FCF easily covers dividend

📊 Dividend Growth Streak: 10+ years post-spin-off

📉 Dividend Yield vs. Sector: Slightly below average but consistent

Dividend Overview

If you’re looking for a stock with a flashy dividend yield, Allegion might not be it. The current forward yield of 1.63% won’t make anyone rich overnight. But that yield is paired with something many high-yielders lack: staying power. The dividend is reliable, backed by solid earnings, and supported by a low payout ratio.

At just over 28% of earnings, Allegion isn’t overextending itself. That kind of breathing room gives the company the flexibility to reinvest in its business while still growing its dividend. And with strong free cash flow in the picture, that payout is well-covered.

Next up on the calendar, the stock goes ex-dividend on June 13, with the payment arriving on June 30. Allegion has maintained a dependable cadence with these payments, and for income-focused investors, that kind of rhythm adds peace of mind.

Dividend Growth and Safety

Where Allegion shines is in its track record of growing its dividend consistently over time. Since the company became independent, the quarterly dividend has climbed from $0.32 to $0.51. That’s a nearly 60% increase in ten years, and it reflects the kind of disciplined financial approach dividend investors appreciate.

The payout is also well protected. With nearly $466 million in levered free cash flow against an annual dividend bill of roughly $176 million, Allegion has more than enough coverage. That’s not just a safety margin—it’s a sign that future increases are very much on the table.

Even though debt levels are a bit elevated, Allegion’s return on equity is sitting north of 40%, which tells you they’re putting that capital to productive use. The company also has a decent cash buffer and strong liquidity metrics. From a dividend safety standpoint, that’s a solid foundation.

This isn’t a company trying to dazzle with sky-high yields. It’s a business that rewards patience and pays investors with steady, growing income. If you’re the type who likes to reinvest dividends and hold for the long term, Allegion might quietly become one of the better performers in your income portfolio over time.

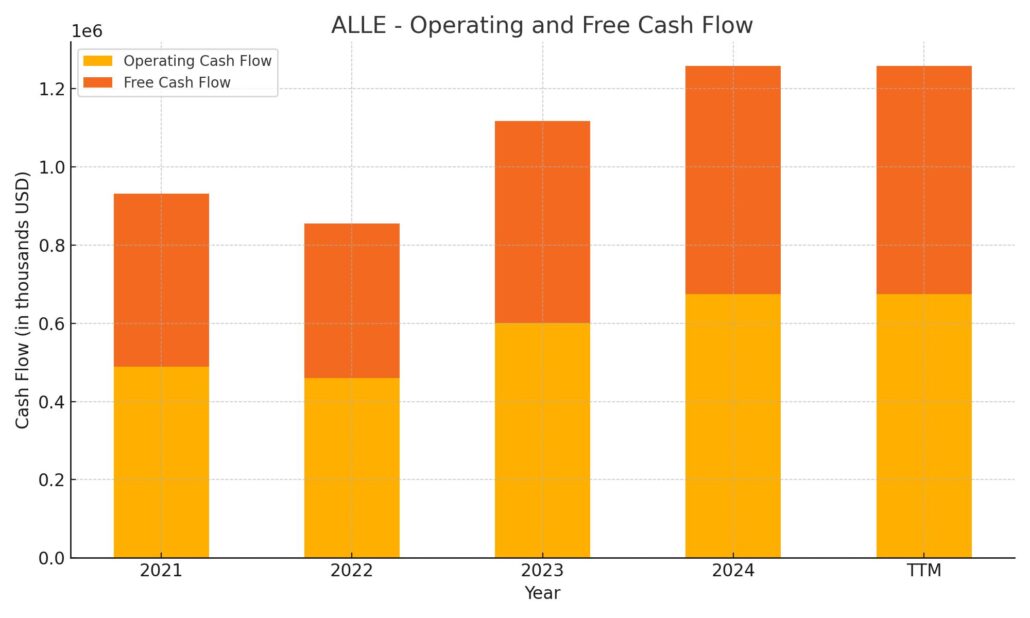

Cash Flow Statement

Allegion’s trailing twelve-month cash flow highlights the company’s ability to consistently generate healthy operating income, with $675 million in operating cash flow—up from $600 million the prior year. This improvement reflects efficient earnings conversion and supports strong free cash flow of $582.9 million. That level of free cash flow provides ample cushion for dividends, share repurchases, and other capital allocation priorities.

On the investing side, Allegion spent $92.1 million on capital expenditures and a total of $228.4 million in net outflows, a modest increase compared to last year. Financing activities show a net outflow of $394.5 million, largely driven by $413.3 million in debt repayments and $220 million spent on share repurchases. Despite these outflows, the company ended the period with $503.8 million in cash, up from $468.1 million, indicating strong financial flexibility.

Analyst Ratings

📉 Allegion plc (NYSE: ALLE) has seen a mix of analyst updates lately, with sentiment leaning neutral. The overall consensus is a “Hold” rating, and the average analyst price target currently stands at $137.67. That implies a modest upside from where the stock is trading now, suggesting analysts expect it to move mostly in line with the broader market over the coming months.

🔻 Barclays kept its “Underweight” stance but trimmed its price target from $130 to $126. Their note pointed to pressure in Allegion’s international operations and growing interest expenses as key headwinds.

⚖️ Morgan Stanley maintained its “Equal-Weight” rating, inching its price target up from $137 to $139. Their view appears rooted in valuation—seeing the stock as fairly priced in light of current performance trends.

⚠️ Wells Fargo echoed that cautious tone, reaffirming an “Equal-Weight” rating while lowering its target slightly from $140 to $135. Their concern centers around potential softness in the residential segment, which could drag on revenue momentum.

🔄 Baird also opted to stick with a “Neutral” call but revised its target downward from $152 to $144. This adjustment hints at tempered expectations despite Allegion’s stable fundamentals.

📊 Overall, analysts seem aligned on one thing: while Allegion remains fundamentally sound, the upside appears somewhat limited in the near term.

Earning Report Summary

Allegion wrapped up 2024 on a high note, showing solid momentum in its fourth-quarter and full-year results. The company pulled in $945.6 million in revenue for Q4, which marked a 5.4% uptick from the same period last year. Net earnings hit $144.1 million, or $1.65 per share, and when adjusting for some one-time items, that figure came in at $1.86 per share—about 11% higher than the year before. Margins also held strong, with operating margin for the quarter improving to 19.5%, and the adjusted number nudging up to 22.1%.

Full-Year Performance

For the full year, Allegion reported $3.77 billion in revenue, up 3.3% compared to 2023. Earnings per share landed at $6.82, or $7.53 on an adjusted basis—an increase of more than 8% from the previous year. One of the highlights of the year was free cash flow, which came in at $582.9 million, up nearly 13%. That kind of cash generation gives Allegion the breathing room to keep investing in growth while also rewarding shareholders.

Segment Highlights

The Americas segment was the real driver this time around. It posted 6.4% revenue growth in Q4, thanks to both better pricing and volume gains across non-residential and residential markets. Margins in this region improved too, with the adjusted operating margin reaching 27.4%. On the international side, growth was more muted. Revenues in that segment rose by just 1.5%, and organic revenue actually dipped slightly due to softer volumes. Margins also saw some pressure internationally, slipping to 15.8% on an adjusted basis.

Outlook and Leadership Commentary

Looking ahead to 2025, Allegion is expecting modest but steady growth. The company guided for revenue to rise between 1% and 3%, with organic growth falling in the 1.5% to 3.5% range. Adjusted earnings per share are forecasted to land somewhere between $7.65 and $7.85. Cash flow should remain healthy too, with free cash flow expected to stay at 85% to 90% of net income.

CEO John H. Stone praised the team for delivering another strong year and credited Allegion’s ability to stay focused on customers and innovation. He sounded optimistic about the road ahead, pointing to a solid strategy and a clear commitment to long-term value. While economic conditions may remain uncertain, the company feels well-positioned to navigate the landscape and keep delivering results.

Chart Analysis

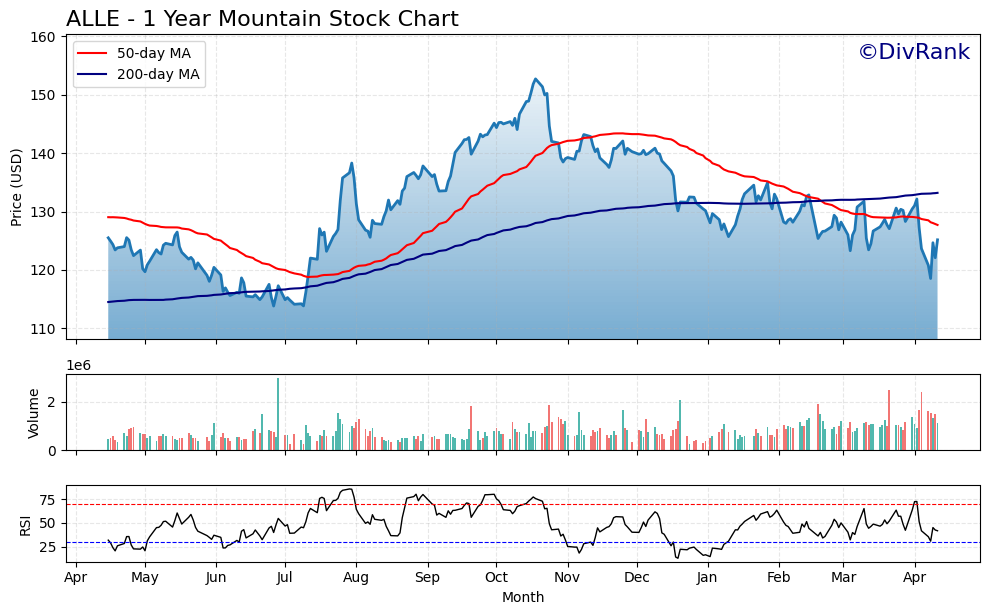

The stock chart for ALLE over the past year reveals a story of rising strength followed by a gradual unwind, with some signs of stabilization beginning to appear.

Moving Averages and Price Action

Early in the year, ALLE traded below both the 50-day and 200-day moving averages. That changed by midsummer, when momentum picked up and pushed the stock well above both lines, peaking around mid-October near the $155 mark. The 50-day moving average sharply accelerated upward during this period, confirming the strength of the rally. However, by December, the price began to soften, and the red 50-day line started bending lower. As of the most recent data, the 50-day has now dipped below the 200-day, forming a classic death cross—a technical signal that often points to a weaker trend ahead.

Despite this, price has found some footing near the $120 level multiple times since March, suggesting a base may be forming. If the stock can hold this support and start climbing back above the short-term average, the downtrend may begin to lose steam.

Volume Behavior

Volume was relatively muted during the early stages of the chart, but there were several spikes during the big summer move. A noticeable surge in volume appeared again in March and early April, likely tied to reactions around earnings and general market sentiment. These volume bursts could be indicative of institutional involvement, possibly positioning for a longer-term play if fundamentals remain intact.

RSI Momentum

The RSI has had a few notable moments this past year. It crossed into overbought territory in late summer and stayed elevated during the climb, then sharply pulled back in December. Since then, the RSI has mostly hovered between 40 and 60, never fully dipping into oversold conditions but not showing major strength either. Recently, it touched levels near 70 again, which shows some upside momentum trying to build—but whether that sticks will depend on what happens next around the 50-day average.

Overall, ALLE is in a watch-and-wait phase technically. The sharp run-up from last year is in the rearview mirror, but the stock hasn’t broken down completely. A new trend could emerge if the price continues to hold above recent lows and starts to reclaim moving average territory.

Management Team

Allegion’s leadership has been steering the business with a clear focus on long-term growth and operational discipline. Leading the charge is John H. Stone, who stepped into the role of President and CEO in 2022. He brought with him years of experience from his time at Deere & Company, where he led global operations and worked closely on integrating advanced technologies across industrial equipment lines. That same forward-thinking approach is starting to show through at Allegion as the company evolves beyond traditional mechanical security into more tech-enabled access solutions.

Working alongside him is Mike Wagnes, the Senior Vice President and Chief Financial Officer. He’s no stranger to the company, having been part of Allegion’s fabric for over 15 years. His experience spans several roles, including a stint as Vice President and GM of the Commercial Americas business. That operational background adds another layer of insight to the financial planning process, helping maintain a strong balance sheet while driving shareholder value.

The rest of the executive team includes names like Dave Ilardi, who leads the Americas region, and Nick Musial, Allegion’s Controller and Chief Accounting Officer. It’s a group that blends operational know-how with global awareness, which continues to be a strength for the business as it pushes forward into more advanced access control and security technologies.

Valuation and Stock Performance

Allegion’s stock price has been on a bit of a journey over the past year. Currently trading around $125, it’s down from its 52-week high of $156.10, reached back in October. That pullback reflects broader market pressures and some investor caution around slowing residential construction trends, but it hasn’t dented the company’s financial strength or strategic progress.

Looking at valuation, Allegion seems reasonably priced compared to its earnings and expected growth. Its forward P/E ratio is sitting around 16, which suggests the market still sees meaningful upside, especially if margin expansion continues and cash flows remain strong. The price-to-book ratio of 7.19 highlights the profitability baked into the company’s model and the premium investors are willing to pay for that consistency.

Analyst price targets hover around $137 to $138, giving the stock some runway from current levels. Much of that confidence comes from continued strength in the Americas segment, which has delivered consistent growth and healthy operating margins. The international business still has room to improve, but overall, the company’s solid base in non-residential markets provides a level of resilience that investors tend to value.

Risks and Considerations

Even with strong fundamentals, Allegion isn’t without its risks. The most immediate is its exposure to the construction cycle—especially non-residential building activity. A slowdown in commercial or institutional construction would likely impact order volumes, particularly for mechanical locking products and access systems. And while the company has done a good job managing costs, persistent inflation in raw materials could still squeeze margins if not offset by pricing.

Global operations also come with their own set of variables. Currency fluctuations can affect earnings when translating international revenue, and regulatory shifts in certain markets could add pressure or delay projects. There’s also the matter of execution risk—particularly when expanding into newer technology-driven areas. Allegion has made solid progress in connected and electronic access control, but it needs to keep that momentum going to stay ahead of competitors.

On top of all that, the security space is evolving fast. Competitors, both established and new, are investing heavily in smart lock technologies and integrated building systems. Allegion must keep investing in innovation and product development to protect and grow its share of that market. Lagging behind in tech adoption would risk eroding what has otherwise been a strong brand reputation.

Final Thoughts

Allegion continues to operate with a strong foundation, led by a management team that understands both the mechanics of the business and the evolving direction of the industry. The stock may not be trading at all-time highs, but the underlying performance remains solid, and the ability to consistently generate free cash flow gives the company flexibility most competitors would envy.

With a global footprint, a growing technology offering, and a focus on operational efficiency, Allegion is positioned to navigate a wide range of market environments. While there are challenges to watch—particularly around economic cycles and competitive dynamics—the business continues to deliver steady returns and remains focused on long-term value creation.