Updated 4/13/25

Albany International Corp. (AIN) is a global industrial company focused on engineered fabrics and advanced composite materials, serving sectors like aerospace and paper manufacturing. With a steady hand at the helm under CEO Gunnar Kleveland, the company has shown disciplined execution, recently integrating its Heimbach acquisition to strengthen its Machine Clothing segment. Despite recent revenue softness and a dip in share price, Albany maintains solid fundamentals, highlighted by strong free cash flow, low payout ratios, and consistent dividend growth. Its Engineered Composites segment continues to gain traction, while the balance sheet remains healthy with ample liquidity. Analyst sentiment remains mixed but leans constructive, with a consensus price target that suggests room for upside from current levels.

Recent Events

It’s been a bumpy year for Albany International’s stock. Shares are down over 27% from their 52-week high, recently trading near $65 after peaking above $95. That might sound rough, but the pullback needs to be viewed in context.

Revenue is down 11.3% year-over-year, and earnings have taken a more noticeable hit, dropping nearly 42%. The softness is largely tied to a slowdown in industrial demand and some friction in their Machine Clothing segment. That said, Albany’s Advanced Materials business, especially its aerospace exposure, still offers long-term opportunity, even if it’s not firing on all cylinders just yet.

Despite the headline declines, the business remains solid underneath. The company generated $218 million in operating cash flow and $168 million in levered free cash flow over the past year. That kind of cash generation is a good sign, especially when earnings waver—it shows that the underlying business is still capable of supporting its commitments, including the dividend.

Key Dividend Metrics

💸 Forward Dividend Yield: 1.66%

📈 5-Year Average Dividend Yield: 1.10%

📆 Next Dividend Date: April 7, 2025

📉 Payout Ratio: 37.5%

🏦 Trailing Annual Dividend Rate: $1.05

📊 Recent Dividend Growth: Measured and consistent

Albany’s yield sits at 1.66%, which is higher than its five-year average. For a company that doesn’t rely on financial gymnastics to fund its dividend, that’s a pretty attractive spot. This isn’t a stock yielding 5%+—but it’s also not one likely to slash payouts when things get bumpy.

Dividend Overview

Albany International doesn’t chase headlines with dividend announcements, but it’s been quietly delivering dependable income for years. Right now, shareholders are looking at a forward dividend of $1.08 per share. That’s a slight bump from previous payouts and a sign that the company continues to prioritize returning cash to investors—even during tougher cycles.

The payout ratio stands at 37.5%, a clear sign the dividend is comfortably covered by earnings. That leaves plenty of room for flexibility, whether it’s reinvesting in the business or weathering temporary downturns.

What’s even more encouraging is the balance sheet. Albany carries just over $115 million in cash and has a healthy current ratio of 3.23, meaning it has more than three times the short-term assets needed to cover liabilities. Debt stands at about $387 million, which is manageable given the scale and stability of the business. The dividend isn’t coming at the expense of financial stability.

Dividend Growth and Safety

If there’s one word to describe Albany’s dividend policy, it’s cautious. Not in a negative way—more like deliberate. The increases have been small but steady, and they’re always backed by real results. No financial acrobatics, no borrowing just to keep investors happy. Just well-covered payouts that inch upward as the business grows.

Looking at the last five years, the dividend has grown modestly but reliably. The increase to $1.08 per share might not grab attention, but it represents a commitment to a strategy that puts longevity over flash. And the numbers back that up. With $168 million in free cash flow last year, the company is comfortably covering its dividend multiple times over.

Yes, earnings dropped recently, but the business still posted a net profit of nearly $88 million. There’s no sign the dividend is in danger. In fact, the payout ratio suggests there’s room to grow, even if growth slows temporarily.

Short interest in the stock has increased a bit lately, moving from about 457,000 to 680,000 shares. That shows some bearish sentiment, but it hasn’t translated into fundamental weakness where it matters. Cash generation is strong. The balance sheet is healthy. And the dividend looks rock solid because of it.

Institutional ownership remains high, and while that doesn’t always mean the stock is a sure thing, it’s a sign that large investors continue to see value here—especially in the form of dependable income.

Albany isn’t going to double overnight. But for investors who value steady dividends, sound financials, and long-term potential, it’s a name that deserves a closer look.

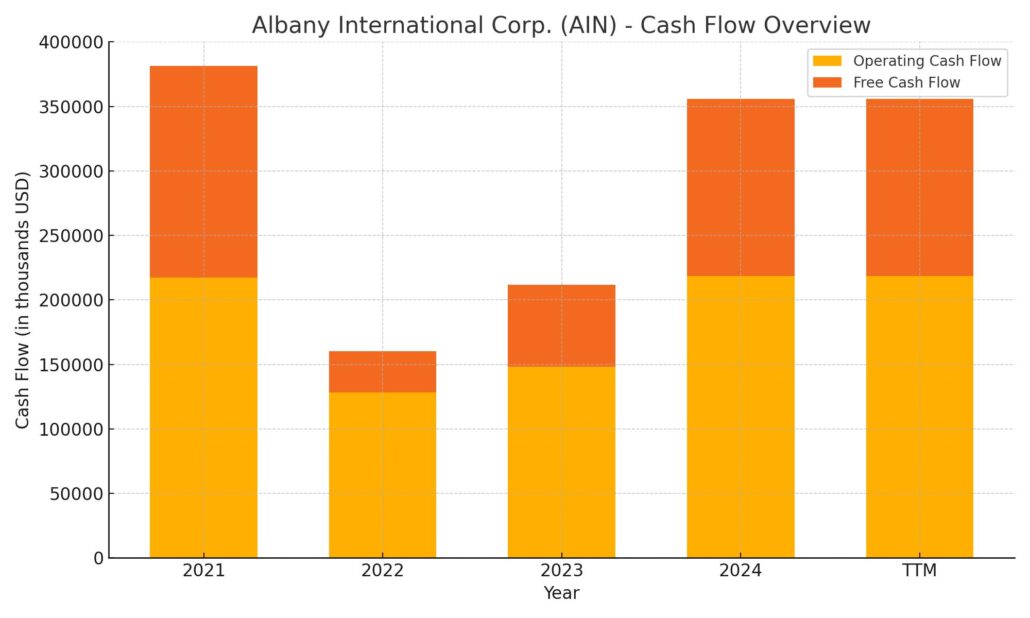

Cash Flow Statement

Albany International’s trailing twelve-month (TTM) cash flow performance shows a solid foundation in its core operations. The company generated $218.4 million in operating cash flow—up significantly from $148 million the previous year. This rebound places Albany back near its 2021 levels, signaling that even with revenue and earnings declines, the business is still spinning off strong cash from its day-to-day functions.

Free cash flow came in at $137.2 million, more than double last year’s figure. Capital expenditures remained steady at just over $81 million, suggesting that investment in the business hasn’t been aggressively curtailed. However, the financing side reflects a different story—Albany repaid nearly $280 million in debt while issuing $145 million, and also spent $14 million on share repurchases. This, combined with a sharp drop in year-end cash to $115 million from $173 million, highlights a strategic shift toward debt reduction and capital return, which may weigh on liquidity in the near term but aligns with a conservative financial approach.

Analyst Ratings

📉 Albany International (AIN) has seen a shift in analyst sentiment recently, with mixed reactions tied closely to its latest earnings performance and strategic decisions. Bank of America downgraded the stock from “Neutral” to “Underperform” after the company reported additional charges in its fourth-quarter results. Concerns over pressure on margins and a slower-than-expected payoff from the Heimbach acquisition added to the cautious tone. While the deal was aimed at strengthening its Machine Clothing division, it hasn’t yet translated into the kind of growth analysts hoped for.

📈 On the other side, Truist Financial maintained its “Buy” rating and even bumped up its price target from $85 to $88. That signals confidence in the company’s long-term outlook, despite the near-term hurdles. At the same time, StockNews.com dialed back its enthusiasm, shifting from “Buy” to “Hold” as a reflection of the uncertainty around recent performance trends.

💰 The average consensus price target across analysts stands at $81.25, suggesting roughly 25% upside from the current share price of $65.18. Targets range from $70 on the low end to $92 at the high, showing a healthy spread in expectations. Altogether, the mix of ratings reflects a market still gauging whether Albany can turn current headwinds into momentum.

Earning Report Summary

Albany International wrapped up 2024 with a strong finish, showing meaningful growth across its key business lines. The fourth quarter results came in solid, with revenue hitting $323.6 million—a noticeable bump from last year. That 20%+ jump wasn’t by accident. A big part of it came from the Heimbach acquisition, which is now fully integrated, as well as continued momentum in their Engineered Composites segment.

Profitability Moving in the Right Direction

Gross profit rose to nearly $120 million, up from just over $97 million in the same quarter last year. That tells us Albany isn’t just selling more—it’s making more on each sale, too. Operating income grew by over 10%, coming in at $41.8 million, and net income for shareholders climbed to $30.5 million. That works out to earnings of $0.97 per share, a nice jump from $0.58 in the fourth quarter of 2023. On an adjusted basis, earnings per share hit $1.22, well ahead of expectations.

EBITDA, which investors often watch for a cleaner view of operating performance, landed at $75 million, up 28% from the previous year. That’s a healthy sign for a business balancing growth and stability.

Leadership’s View on the Quarter

Company leadership struck an upbeat tone about the quarter. They pointed to the Heimbach integration as a clear win and highlighted the strength coming out of the Engineered Composites division. There’s confidence that the business has good momentum heading into 2025, with steady cash generation expected to continue. They also mentioned the balance sheet remains in great shape—always something dividend and long-term investors like to hear.

What’s Next for 2025

Looking ahead, Albany laid out its expectations for the new year. They’re guiding for revenue somewhere between $1.26 billion and $1.33 billion. The tax rate is expected to land in the 29% to 31% range, and capital spending should come in between $90 and $95 million. For earnings, they’re forecasting diluted EPS between $3.55 and $4.05, and adjusted EBITDA is expected to land in the $260 to $290 million range.

Breaking it down by business segment, Machine Clothing is expected to contribute between $760 and $790 million in revenue, while Engineered Composites is projected to bring in $500 to $540 million. Overall, it’s a guidance range that leans conservative but gives room for upside if trends continue improving.

Albany’s Q4 results and 2025 outlook paint the picture of a company that’s moving forward with intention—tight operations, smart acquisitions, and solid earnings power.

Chart Analysis

The past year has been a rough ride for AIN, and the chart doesn’t shy away from showing it. The stock’s been locked in a clear downtrend, with both the 50-day and 200-day moving averages sloping lower since late fall. There were moments of recovery—brief rallies in July and again around December—but each bounce was met with resistance, and the price continued to make lower highs.

Moving Averages and Trend Direction

The 50-day moving average (red line) has recently accelerated its decline and is sitting well below the 200-day (blue line), confirming persistent downward momentum. The price has also been trading beneath both moving averages for several months now, which tends to be a sign of continued bearish pressure. Attempts to reclaim the 50-day have been short-lived, and the rejection around the $80 mark earlier this year looks like a decisive turning point.

Volume Activity

Trading volume has remained fairly steady overall, but there are a few spikes that stand out—especially around sharp drops in price. This type of volume behavior often points to institutional selling or reaction to earnings or other news. It’s worth noting that even as the stock bounced slightly off recent lows, volume didn’t show a meaningful uptick, which suggests the rebound might lack strong conviction for now.

Relative Strength Index (RSI)

The RSI spent much of the last quarter hovering below the 50 mark, dipping into oversold territory several times—particularly during the sharp drop in early April. That’s a signal the stock may have been oversold in the short term, which aligns with the small price recovery seen in the most recent candles. But zooming out, the RSI behavior confirms weak momentum throughout the year, especially compared to the short bursts of strength seen during late summer.

Recent Price Behavior

The last five candles tell an interesting story. After a steep decline that brought the price down to the low 60s, the stock bounced back slightly. Several of those candles have long lower wicks, showing that buyers are stepping in on dips, trying to defend the price at those lower levels. That said, the upper wicks aren’t especially aggressive, and price is still sitting far below both moving averages. Any sustainable recovery from here will need stronger follow-through than what we’ve seen so far.

AIN appears to be trying to find a base after months of sliding lower, but the technical picture still leans cautious. The downtrend remains intact, and until the price can break above the moving averages and hold there, any upside might be limited to short-term relief rather than a trend reversal.

Management Team

Albany International is led by President and CEO Gunnar Kleveland, who stepped into the role in 2023. Kleveland brings a strong background in industrial operations, particularly from his previous leadership positions in aerospace and defense. His approach leans toward tightening operational discipline while still pushing the company forward strategically. That balance between efficiency and growth is becoming more evident as the company navigates its evolving business model.

Supporting him is a steady executive team. Robert Hansen serves as Chief Technology Officer and Senior Vice President, bringing technical depth to Albany’s innovation-driven segments. Joseph Gaug handles legal matters and corporate governance as Senior Vice President and General Counsel. In 2024, the company added Christopher Stone as President of Albany Engineered Composites. Stone’s experience in high-performance aerospace organizations like Lockheed Martin is expected to strengthen Albany’s foothold in defense-related composites. The board itself is diverse in background and experience, with members who’ve held leadership roles in finance, manufacturing, and industrial technology—offering both strategic oversight and practical expertise.

Valuation and Stock Performance

As of mid-April 2025, Albany International (AIN) closed at $65.18, showing a small bump on the day, but still trading significantly below its 52-week high of $95.47. That wide trading range over the past year tells the story of a stock that’s been under some pressure, largely due to broader industrial softness and some transitional challenges related to its acquisitions.

The current market cap sits around $1.99 billion, and the trailing price-to-earnings ratio is 23.28. That valuation places AIN somewhere between steady industrial names and higher-growth plays. It’s not inexpensive by traditional industrial standards, but the market seems to be pricing in some optimism about the longer-term strategy, especially as the engineered composites business scales up.

Analyst sentiment remains cautiously optimistic. The average 12-month price target sits at $81.25, representing decent upside from current levels. The most bullish targets go as high as $92, while the lower end of the range is around $70. This spread suggests differing views on execution risk and how much of the strategic vision has already been baked into the stock price.

Risks and Considerations

There are a few headwinds to keep on the radar. Albany is exposed to cyclical end markets—namely aerospace and paper manufacturing. A slowdown in commercial aircraft production or industrial capital spending could impact its revenue lines. While diversification through the composites segment helps, there’s still sensitivity to the broader economy.

Integration risk also looms. The Heimbach acquisition is a strategic move, but blending organizations, systems, and cultures always takes time. Missteps in realizing synergies or unexpected friction points could affect margins and distract from other operational goals.

The global nature of Albany’s business means foreign exchange fluctuations, supply chain disruptions, and shifting trade policies could all play a role in near-term volatility. Input costs, especially for specialized materials, are another variable. Though Albany manages its sourcing well, it’s not immune to global pricing shifts or bottlenecks.

Finally, this is a space where innovation matters. The company has to keep pace with competitors, particularly in engineered composites. If it falls behind on technology or fails to deliver on key development programs, growth expectations could get dialed back quickly.

Final Thoughts

Albany International has the feel of a company that’s quietly transitioning from a traditional industrial operation to something more specialized and forward-looking. There’s still a strong core in machine clothing, but the narrative is clearly shifting toward engineered materials and composites. That shift comes with growing pains, but also new opportunities.

The management team appears focused, and the numbers—while not flashy—support a case for steady progress. There’s a balance of risk and reward here. On one side, macroeconomic and integration challenges. On the other, long-term tailwinds in aerospace, ongoing cash generation, and a thoughtful capital allocation strategy.

As the stock trades near the lower end of its recent range, it reflects more of the caution than the potential. For those following the story, the next few quarters will be telling as Albany works to unlock value from its recent moves while managing through the current softness in industrial demand.