Updated 4/13/25

Advanced Drainage Systems (WMS) plays a central role in water management and stormwater infrastructure across residential, commercial, and public sectors. The company has grown steadily through innovation, disciplined operations, and a focus on sustainable practices like recycling and long-term infrastructure investment. With a solid balance sheet, consistent free cash flow, and a leadership team focused on operational execution, WMS continues to build on its strengths. Despite a pullback in share price over the past year, analysts remain moderately optimistic, supported by durable margins, healthy demand in core segments, and a forward-looking approach to growth. The dividend, while modest, is well-covered and positioned for future increases.

Recent Events

The last year has been a bit of a cooldown period for WMS shares. After peaking above $180, the stock has slid nearly 35%, now trading closer to $105. That pullback wasn’t about fundamentals falling apart—it was more about valuation recalibration, rising rates, and shifting investor sentiment toward industrials and construction-related names.

Even with earnings dipping 23% year-over-year in the most recent quarter, revenue actually rose 4.3%, which shows the business isn’t struggling—just operating in a more tempered environment. Profitability remains solid, with operating margins near 19% and net margins just under 16%. Notably, return on equity is a strong 36.7%, a sign that WMS is putting its capital to work efficiently.

The balance sheet carries some weight—$1.41 billion in debt—but that’s not necessarily a red flag. With nearly $489 million in cash and a current ratio of 3.2, the company has room to maneuver. Whether that means continuing to invest in growth, keeping a buffer for market turbulence, or increasing dividends, they’ve got flexibility.

Key Dividend Metrics 🧮

📅 Dividend Yield: 0.61% (Forward)

💸 Annual Dividend: $0.64 per share

🧱 Payout Ratio: 10.37%

📈 5-Year Average Yield: 0.45%

💡 Dividend Growth Trend: Positive

🛡️ Dividend Safety: High – well covered by cash flows

🏦 Free Cash Flow (ttm): $251.57M

🔁 Dividend Date: March 14, 2025

⚠️ Ex-Dividend Date: February 28, 2025

Dividend Overview

Let’s be clear—WMS isn’t a high-yield stock. At just over 0.60%, the dividend isn’t going to replace your paycheck. But that number only tells part of the story. The payout ratio is sitting just above 10%, which is incredibly conservative. That means management isn’t stretching to make those payments. They’re leaving themselves room to grow the business and the dividend in tandem.

If you’re looking for something that offers income with growth potential behind it, this setup should grab your attention. The consistency of earnings, combined with a cautious capital return strategy, makes the current dividend reliable and scalable. It’s not flashy, but it is stable—and in today’s market, that matters.

The other thing to like here is that this isn’t a stock trying to win over income investors with unsustainable yields. Instead, it’s a business that has organically built enough strength to share profits in a way that’s likely to continue and expand. That quiet consistency can be more valuable over time than a headline-grabbing payout.

Dividend Growth and Safety

WMS’s dividend isn’t just safe—it’s got room to run. With a payout ratio barely crossing 10%, the company could double its dividend and still be comfortably within a sustainable range. That kind of margin of safety is rare, especially for a business with nearly $3 billion in annual revenue and strong cash generation.

Over the past few years, the dividend has grown steadily, even if it hasn’t grabbed much attention. What stands out is the discipline behind it. Management hasn’t overpromised, and they’ve kept the dividend in line with what the business can handle—no more, no less.

Free cash flow supports this story. At $251 million over the trailing twelve months, it covers the current dividend several times over. Operating cash flow of $557 million adds another layer of protection. Simply put, this is a business that can afford its dividend even in tougher times, which gives investors some much-needed peace of mind.

One detail to keep in mind is the stock’s beta, which is around 1.48. That means WMS tends to move more than the broader market, up or down. While that volatility might concern some, long-term investors who stick through the swings are rewarded with a high-quality industrial company that quietly builds value.

This isn’t the kind of dividend stock that tries to wow you upfront. Instead, WMS is setting the stage for long-term compounding. For those who value a growing income stream backed by real cash flow and financial discipline, this is the kind of name worth watching.

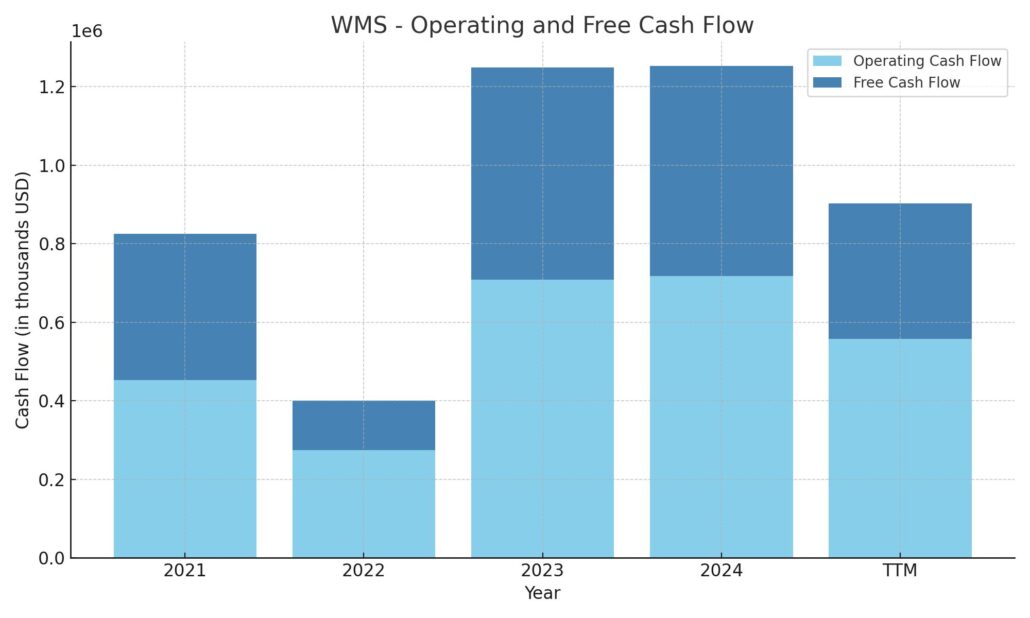

Cash Flow Statement

Advanced Drainage Systems reported $557.9 million in operating cash flow over the trailing twelve months, a decline from the previous year’s $717.9 million. While it’s a step down, the figure still reflects healthy core operations. The business continues to convert earnings into cash effectively, and with capital expenditures at $213.8 million, free cash flow came in at $344.1 million—more than enough to support dividends, debt service, and modest share repurchases.

On the investing side, cash outflows widened to $442.7 million, a reflection of continued investments in growth and infrastructure. Financing activities consumed $183.9 million, driven by share repurchases and debt repayments. Despite this, the company ended the period with $497.8 million in cash, virtually unchanged from the prior year. That stability in liquidity, even after meaningful capital deployment, underscores the strength of WMS’s financial position.

Analyst Ratings

🟢 Advanced Drainage Systems (NYSE: WMS) has recently attracted fresh attention from analysts, with a number of firms showing continued confidence in the company’s long-term potential. Deutsche Bank initiated coverage with a buy rating and set a price target of $134, pointing to the company’s leading position in stormwater management and expectations for strong demand across infrastructure and residential sectors.

🔄 Loop Capital also maintained its buy rating but adjusted its price target downward from $170 to $160. The revision reflects a more tempered view on near-term earnings momentum, although the firm remains positive on WMS’s operational efficiency and strategic market exposure.

🔵 Barclays kept its overweight rating in place but lowered the target from $160 to $149. Analysts noted that while near-term valuation may look stretched relative to historical averages, the underlying business remains fundamentally strong.

🟢 UBS upgraded WMS from neutral to buy and set a price target of $155, highlighting the company’s consistent cash flow, efficient capital allocation, and potential for margin expansion as key drivers.

🟡 On the other hand, Stephens & Co. downgraded the stock from overweight to equal-weight with a maintained price target of $135. The downgrade came amid concerns around current valuation levels and increasing competitive pressures in the construction and infrastructure space.

📊 As it stands, the analyst consensus leans toward a moderate buy, with an average price target of $146.67. That implies a meaningful upside from the current trading level and reflects continued belief in the company’s earnings power and market leadership.

Earnings Report Summary

Revenue Still Growing, But Margins Feeling the Pressure

Advanced Drainage Systems turned in its fiscal third-quarter results for the period ending December 31, 2024, and while top-line numbers showed some strength, there were clear signs of pressure further down the income statement. Revenue came in at $690.5 million, a 4.3% increase compared to the same period a year ago. A big part of that lift came from Infiltrator sales, which jumped over 30%, boosted by both strong underlying demand and the recent acquisition of Orenco Systems.

On the flip side, domestic pipe sales dipped slightly, down about 1.6%, and international revenue also slipped by nearly 5%. The company saw a mixed bag—growth in newer areas, while some of the legacy parts of the business showed signs of softness.

Earnings Slipped, But Strategic Moves Are Taking Shape

Despite growing sales, the bottom line didn’t keep pace. Net income fell 23% to $82.3 million, and earnings per share dropped to $1.04 from $1.34 a year ago. Adjusted EBITDA was down 6.2% to $191.5 million. It wasn’t unexpected, though—higher input costs and pricing adjustments were already in play, and the Orenco acquisition, while strategic, temporarily weighed on margins.

Still, leadership is looking ahead. CEO Scott Barbour described the quarter as largely in line with internal expectations. He pointed to strong performance in the Infiltrator business as a bright spot, and reiterated the company’s focus on long-term growth areas—especially as demand for stormwater solutions keeps climbing.

Focus Remains on Infrastructure, Recycling, and Future Growth

Barbour also highlighted ongoing investments, particularly in recycling capabilities and manufacturing expansion. One standout is the Cordele, Georgia recycling facility, which is being scaled up to support rising demand. These moves are part of a broader effort to stay ahead in the evolving water infrastructure market, where climate shifts and aging systems are creating more opportunities.

Looking toward the end of the fiscal year, the company maintained its guidance. It expects full-year sales between $2.9 billion and $2.975 billion, and adjusted EBITDA in the $880 to $920 million range. Capital expenditures are set to come in around $225 million, as Advanced Drainage continues investing in production, technology, and operational improvements.

All in all, while the earnings report had a few softer spots, the company’s direction remains consistent. Leadership continues to steer toward long-term structural growth, even if the short-term numbers are a bit lumpy.

Chart Analysis

Trend and Moving Averages

WMS has been under consistent pressure for most of the past year. After peaking in mid-2023, the stock began a steady decline, and both the 50-day and 200-day moving averages confirm that weakness. The 50-day average crossed below the 200-day back in November, a technical signal often interpreted as the start of a bearish phase. Since then, both moving averages have been sloping downward, with price action hugging the lower end of the range and staying beneath both trend lines.

This long-term downtrend reflects more than just a momentary dip—it’s a sustained move lower, possibly due to macro softness in construction-related markets and a cooling off after a strong multi-year run. What’s important to note here is that the stock hasn’t made any meaningful attempt to reclaim either moving average since late last year. It suggests there’s no strong reversal underway yet.

Volume and Buying Behavior

Volume has been mixed throughout the period, with no standout spikes that signal capitulation or accumulation. That said, there have been a few pockets of elevated trading in February and late March, hinting at interest coming in at the lower end of the price range. But there hasn’t been sustained buying pressure to confirm a shift in trend.

This is typical behavior during extended markdown phases—buyers show up in short bursts, but confidence hasn’t returned in a meaningful or widespread way. Until volume consistently picks up on green days and not just on rebounds, the price is likely to remain in a cautious range.

RSI Momentum

The Relative Strength Index (RSI) has hovered in the lower-middle range for most of the year, rarely approaching overbought territory. It dipped below 30 a few times—most notably in December and late March—signaling that the stock had become oversold. Each time, the RSI bounced, but the stock price didn’t break trend, which shows weak momentum behind those technical rallies.

Most recently, the RSI is ticking upward but remains below 50, reinforcing the idea that while the selling pressure has eased a bit, the stock hasn’t yet found a solid floor. The RSI pattern lines up with a market still figuring out where real support lies.

Final Takeaway

WMS appears to be deep in a markdown phase, with lower highs, declining volume support, and momentum indicators all suggesting continued caution. There are signs that the pace of selling is slowing, and occasional upticks in volume show some traders stepping in at key levels. But the broader chart points to a stock that hasn’t yet built a base. A shift in trend would likely need confirmation via stronger volume, RSI climbing above 50, and a reclaiming of at least the 50-day average. Until then, it’s a name to watch for signs of stabilization.

Management Team

Advanced Drainage Systems is led by CEO Scott Barbour, who has been steering the company since 2017. Barbour brings deep experience in engineering and operations, having previously held leadership roles in global industrial companies. His style blends a technical mindset with a practical, execution-focused approach, and under his leadership, ADS has expanded both its product reach and its footprint in sustainable infrastructure.

Supporting him is CFO Scott Cottrill, a steady hand on the company’s financial direction. Cottrill’s background in corporate finance and operational oversight has helped ADS maintain a disciplined balance sheet while funding expansion and investment. On the operations side, the company is supported by co-COOs Ronald Vitarelli and Thomas Fussner, who manage day-to-day logistics, supply chain efficiency, and manufacturing initiatives.

The leadership team is focused on driving innovation through both product development and internal efficiency. Their investments in recycling technology, advanced manufacturing, and engineering R&D reflect a long-term strategy built around environmental stewardship and infrastructure modernization. The tone from management has been consistently focused on steady growth, responsible capital use, and navigating short-term cycles without losing sight of long-term positioning.

Valuation and Stock Performance

Shares of WMS have pulled back significantly from their highs, now trading around $105 compared to a 52-week peak of $184. While that drawdown looks steep, it mirrors broader weakness across industrial and housing-adjacent stocks over the past year. The company’s trailing price-to-earnings ratio sits at 17.67, with a forward P/E of 16.00, suggesting the stock isn’t stretched on valuation. Compared to its historical range, WMS looks more attractively priced for those with a longer horizon.

Analyst sentiment remains cautiously positive. Some firms have revised price targets lower to reflect softer short-term earnings, but the average still hovers in the mid-$140s, well above current levels. The PEG ratio, sitting at 0.94, hints that growth is being undervalued relative to price—something that often attracts attention from value-oriented investors.

From a balance sheet standpoint, the company continues to look stable. A current ratio of 3.21 and a debt-to-equity ratio just under 96% show that while the company uses leverage, it’s not in over its head. The beta is on the higher side at 1.48, meaning it tends to move more dramatically with the market, so investors should be comfortable with a bit of volatility.

Risks and Considerations

While ADS has a lot going for it, no stock is without its risks. The company is tightly linked to construction cycles and infrastructure spending, both of which can be sensitive to interest rates, government budgets, and broader economic conditions. If new housing starts or infrastructure projects slow, ADS could feel the impact on sales.

There’s also competitive pressure. The company has carved out a strong niche in water management, but maintaining leadership requires constant investment in product innovation and customer service. Rising input costs or supply chain issues—especially related to the recycled materials that ADS depends on—can eat into margins and affect delivery schedules.

Environmental regulations are another consideration. ADS is well aligned with the sustainability movement, especially through its recycled product lines, but keeping pace with changing standards can be costly. There’s also always the risk that evolving legislation or environmental mandates could introduce unforeseen challenges.

Final Thoughts

Advanced Drainage Systems is a company that combines industrial reliability with long-term relevance. Water management isn’t going away—it’s becoming more critical with each passing year—and ADS has positioned itself as a major player in that space. Management has a clear strategy, the company generates solid cash flow, and the balance sheet leaves room to maneuver.

While recent stock performance has been weak, it’s more a reflection of the current cycle than the company’s core health. For investors who are comfortable looking past short-term volatility and focusing on fundamentals, the setup offers potential. As always, it’s important to weigh the risks against the opportunity and make decisions based on personal investment goals and timelines.