Updated 4/13/25

Abbott Laboratories (ABT) stands as a global leader in healthcare, offering a well-balanced mix of diagnostics, medical devices, nutritionals, and branded generic pharmaceuticals. With a market cap over $220 billion and a track record of strong cash generation, Abbott has quietly delivered consistent performance, including a 7.2% jump in quarterly sales and double-digit earnings growth. The company boasts over 50 consecutive years of dividend increases and maintains a payout ratio under 30%, signaling both strength and sustainability. Its medical device segment, led by the FreeStyle Libre system, continues to power revenue growth, while its diversified portfolio helps smooth volatility across economic cycles. Backed by a seasoned management team and solid financial discipline, Abbott is positioned to keep delivering long-term value.

Recent Events

Abbott Laboratories has had a steady hand at the wheel, and recent quarters are showing just how well this health care veteran is adapting in a shifting landscape. The company’s fourth-quarter results from 2024 came in with some welcomed momentum—revenue climbed 7.2% compared to the same time last year, while earnings saw a massive leap, up nearly 479%. That kind of earnings growth isn’t typical for a company of this size, and it speaks to how Abbott is navigating its post-pandemic footing.

A big piece of that growth story remains the FreeStyle Libre system, Abbott’s flagship glucose monitoring technology. It continues to grow in global adoption and is fueling double-digit expansion in the diabetes care segment. Meanwhile, COVID testing—once a massive driver—has cooled down, and diagnostics are returning to a more balanced level. Still, the business mix looks healthy, with medical devices, nutrition, and branded generics all pulling their weight.

At a forward P/E around 24.6, investors are valuing the company as a solid growth and income play, without the frothy expectations we see elsewhere. Margins also continue to impress. A profit margin nearing 32% and return on equity of over 30% both reflect the strong efficiency Abbott is squeezing from its operations. This is a company generating healthy cash flows and putting them to work without taking wild swings.

Key Dividend Metrics

🟢 Forward Yield: 1.86%

💰 Annual Payout: $2.36 per share

📈 5-Year Average Yield: 1.66%

📊 Payout Ratio: 28.8%

📅 Next Dividend Date: May 15, 2025

⚠️ Ex-Dividend Date: April 15, 2025

Dividend Overview

Abbott doesn’t offer a headline-grabbing yield, but what it does offer is consistency—and a lot of it. At just under 2%, the yield might not turn heads in a vacuum, but for investors who care about safety and steady growth, it tells the right story. This is a company that’s been paying dividends for over a century. More notably, it’s part of a very small group known as Dividend Kings—firms that have increased their dividend every single year for at least 50 straight years.

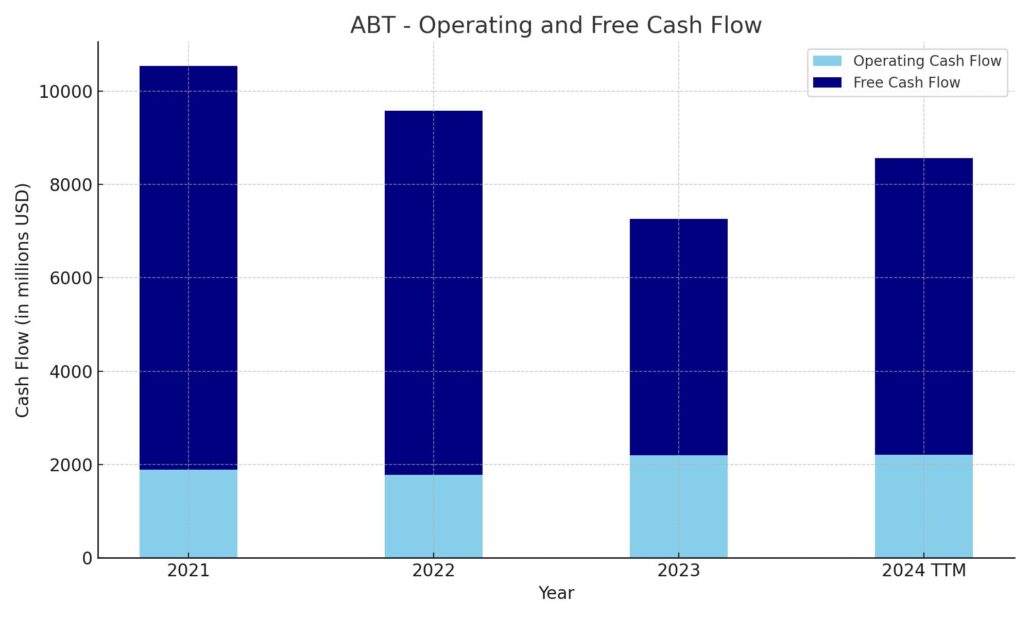

The reliability here is no accident. Abbott’s payout ratio sits comfortably below 30%, signaling there’s plenty of room for continued increases. And with over $8.5 billion in operating cash flow and $5.6 billion in free cash flow, the dividend is backed by real financial firepower. Simply put, this is not a case of borrowing to keep up appearances. Abbott can afford this dividend in its sleep.

What stands out about Abbott’s dividend approach is how intentional it is. The company knows its shareholders. It’s not chasing hype or cutting corners to juice the numbers. Instead, it steadily returns cash to investors while reinvesting in innovation, acquisitions, and its product pipeline. It’s a balanced strategy—and it’s worked for decades.

Dividend Growth and Safety

When it comes to growing the dividend, Abbott’s track record is one of slow, steady progress that holds up through thick and thin. In late 2023, they bumped the payout up another 7%—not flashy, but enough to keep pace with inflation and deliver real returns. That kind of reliability compounds beautifully over time. For investors in it for the long haul, dividend growth often outweighs starting yield, and Abbott checks that box nicely.

Over the past five years, dividend growth has been consistent, and it’s been funded from a strong foundation. With annual dividends totaling around $4.1 billion, Abbott still has billions in leftover free cash to fund R&D, pay down debt, or hold dry powder for strategic acquisitions.

Its financial structure also supports long-term income. Debt is manageable, with a debt-to-equity ratio sitting under 32%. The current ratio of 1.67 indicates solid liquidity, giving Abbott the flexibility to continue increasing the dividend even in choppier market waters.

It’s also worth noting Abbott’s beta—at 0.80, the stock tends to move less than the broader market. For income-focused investors, that lower volatility is a hidden strength. You’re not just getting paid; you’re getting paid with fewer sleepless nights.

Abbott doesn’t chase trends, and that’s part of its charm for dividend investors. It builds, it grows, it pays. Year after year. For those looking to hold quality companies that reward shareholders without drama, Abbott delivers the kind of stability that’s increasingly hard to come by.

Cash Flow Statement

Abbott Laboratories generated $8.56 billion in operating cash flow over the trailing twelve months, reflecting solid underlying business strength and efficient management of working capital. That’s a noticeable improvement from the $7.26 billion posted the prior year and brings the company closer to the high levels seen in 2021. Capital expenditures held relatively steady at $2.21 billion, resulting in free cash flow of $6.35 billion—plenty of breathing room to cover dividends and fund ongoing investment.

On the financing side, Abbott used cash strategically. The company reduced its debt by $660 million and returned $1.3 billion to shareholders through stock repurchases. Total financing outflows reached $5.4 billion, consistent with the company’s disciplined capital return philosophy. Its cash position ended at $7.62 billion, up from $6.9 billion a year ago, providing ample liquidity for future flexibility.

Analyst Ratings

📈 Analysts have recently reaffirmed their positive outlook on Abbott Laboratories, maintaining their ratings and adjusting price targets to reflect the company’s performance and prospects. 🧪 Citigroup kept its buy rating and raised the price target from $135 to $160, pointing to solid momentum in Abbott’s medical devices segment and strong free cash flow generation. 💹 Goldman Sachs also increased its target, moving it from $138 to $154, emphasizing the company’s steady earnings growth and cost discipline. 💼 Bank of America echoed a similar stance, keeping a buy rating and lifting its target from $133 to $150, citing Abbott’s diversified revenue streams and continued investment in innovation.

🧭 The overall consensus remains a moderate buy, with the average 12-month price target landing around $137.90. This reflects a modest but healthy upside from current levels, signaling confidence in Abbott’s ability to execute across its business lines. Analysts appear to be leaning into the company’s proven track record, durable cash flows, and consistent shareholder returns as reasons for optimism heading into the next few quarters.

Earning Report Summary

Strong Finish to the Year

Abbott wrapped up 2024 with a solid performance, showing investors it still has plenty of momentum. The company pulled in $11 billion in fourth-quarter sales, up more than 7% from the same quarter last year. If you strip out COVID testing—which has naturally tapered off—the core business posted over 10% organic sales growth, which is impressive for a company of this size and maturity.

For the full year, total sales reached $42 billion, up around 4.6%. And it wasn’t just one part of the business doing the heavy lifting. Medical devices led the way, particularly Abbott’s diabetes care unit, which saw sales jump nearly 23%, thanks largely to continued strong demand for the FreeStyle Libre glucose monitor. Nutrition products also saw solid traction, especially the adult nutrition lines like Ensure and Glucerna, which helped drive overall growth in that segment.

A Look at Profitability

Earnings were healthy as well. Adjusted earnings per share came in at $1.34 for the quarter, up 12.6% from the year before. On a full-year basis, adjusted EPS landed at $4.67, while the GAAP figure was significantly higher due to one-time items, reaching $7.64. That’s a strong showing and indicates Abbott is managing its costs effectively while continuing to invest in innovation.

What the CEO Had to Say

Abbott’s leadership sounded confident. CEO Robert Ford mentioned that the company finished the year with strong momentum and that Q4 was their best quarter in terms of both sales and earnings growth. He emphasized how Abbott hit the upper end of its 2024 financial targets and expressed optimism for 2025, expecting another year of solid gains.

Looking Ahead

As for the outlook, Abbott expects organic sales growth of 7.5% to 8.5% in 2025, with adjusted earnings per share projected to land between $5.05 and $5.25. Those numbers reflect confidence in continued strength across the portfolio. The company also anticipates margin improvement as efficiencies kick in, aiming for operating margins in the range of 23.5% to 24%.

There’s also a lot happening on the innovation front. In 2024 alone, Abbott rolled out over 15 new products or regulatory milestones. These include advancements like the TriClip device for heart valve repair and a new brain injury assessment tool. It’s clear the company isn’t standing still—it’s continuing to build out a pipeline that can support long-term growth.

Overall, Abbott seems to be striking the right balance: investing for the future while delivering reliable financial results quarter after quarter.

Chart Analysis

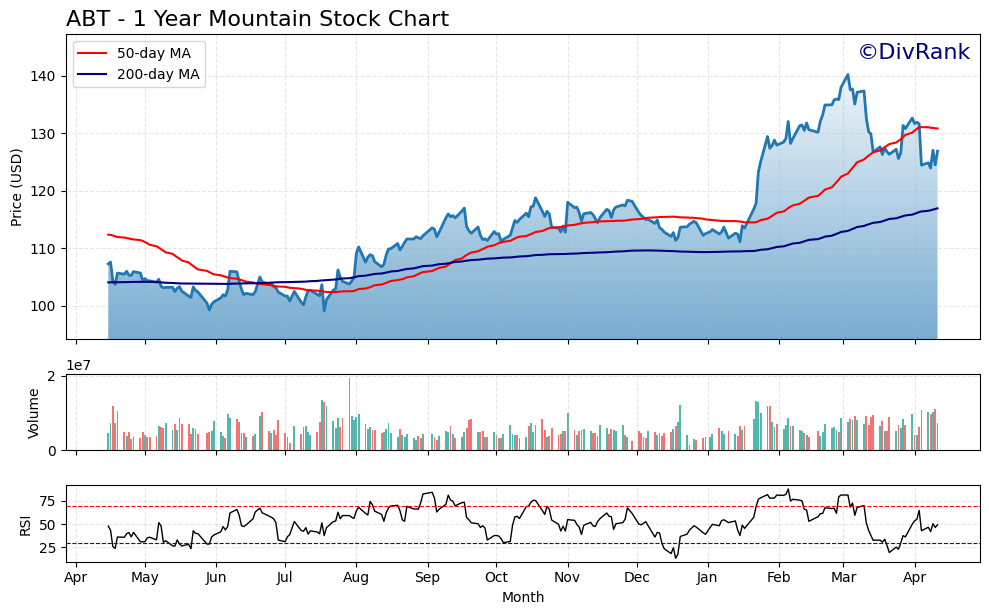

Trend Overview

ABT has been on a gradual climb over the past year, showing a clear upward trajectory that began gaining strength around October. Prior to that, the stock traded relatively sideways with a slight downward tilt through the summer. Things changed in the fall, with the price breaking out above the 50-day moving average and then continuing to push through the 200-day moving average in early November. That marked a noticeable shift in sentiment.

Momentum really accelerated from January through mid-March, with a strong run peaking just above 140. After reaching those highs, the stock experienced a pullback, retracing to the 125 range before bouncing modestly. It’s still trading above the 200-day moving average, which continues to slope higher, but the 50-day moving average is starting to flatten and roll over a bit—signaling some near-term cooling after the big run.

Volume and RSI

Volume over the year has been steady, with a few notable spikes during periods of upward movement—especially during the January rally. Recent volume levels suggest some indecision, with no major accumulation or distribution visible in the past few weeks.

The RSI tells a clear story of recent cooling off. After reaching overbought conditions in February and March, the indicator dipped below 30 in early April before climbing back above 50. This rebound from oversold territory could hint at a short-term stabilization, though the broader picture still shows the stock coming off a heated rally.

Key Levels and What Stands Out

Price action above the 200-day moving average tends to support the idea that the overall trend remains intact, even with the recent pullback. That said, the 50-day moving average is now acting as a resistance level, and the price hasn’t convincingly pushed back above it just yet. Holding support near 122–125 would be important for this setup to remain constructive.

There’s no clear panic selling, and the dip was met with some responsive buying. This suggests that while the stock may be cooling after a strong rally, it hasn’t broken its long-term structure. As long as that 200-day moving average keeps trending higher and the stock stays above it, the longer-term picture remains encouraging.

Management Team

Abbott Laboratories is guided by Chairman and CEO Robert B. Ford, who stepped into the role in March 2020. His leadership has been central to the company’s ability to navigate complex market conditions and healthcare challenges, especially during the height of the pandemic. Ford has pushed the company forward with a focus on innovation and a willingness to act quickly in an industry that often moves slowly. His leadership style blends strategic discipline with a deep understanding of the company’s global reach and mission.

Supporting Ford is a leadership team with deep experience across finance, operations, R&D, and global markets. Chief Financial Officer Brian Yoor has played a key role in maintaining the company’s financial strength, helping to prioritize long-term investment in research and development while managing shareholder returns. This executive team has proven to be a steady hand during unpredictable times, positioning Abbott to not just survive disruptions but find opportunities within them.

Valuation and Stock Performance

As of mid-April 2025, Abbott stock trades at $126.88, still below its recent peak of $141.23 from earlier in the year. The share price reflects a pullback from recent highs but still shows resilience compared to broader market volatility. The company’s market cap now sits comfortably above $220 billion, a signal that investors continue to view Abbott as a key player in healthcare with long-term relevance.

The stock’s trailing price-to-earnings ratio is 16.6, placing it at a reasonable valuation for a business with durable earnings, consistent margins, and a global footprint. Analyst sentiment has been generally positive, with an average 12-month price target around $136. That implies modest upside but also reflects the market’s view that Abbott offers a solid balance of stability and growth potential.

The FreeStyle Libre system continues to be a standout within the medical devices segment, driving meaningful revenue and expanding Abbott’s influence in the diabetes care market. Meanwhile, nutritionals like Ensure and Glucerna continue to hold strong brand recognition, contributing consistent revenue even in slower economic environments. This diversification across product lines and geographies gives Abbott a smoother ride through economic cycles than more concentrated businesses.

Risks and Considerations

While Abbott’s fundamentals are sound, it operates in a space that’s not without its pressures. Regulation remains a constant consideration. Any changes in global health policy or drug and device approvals could directly impact how and when products come to market. Given Abbott’s international exposure, currency fluctuations are another variable that can influence reported revenue and margins.

Competition is intense, especially in diagnostics and medical technology. New entrants or disruptive innovation from competitors could challenge Abbott’s market share in key categories. That keeps pressure on the company to maintain its pace of product development and innovation.

Operational risks also exist. Global supply chains remain fragile in some sectors, and medical products are not immune. A disruption in component sourcing or manufacturing could temporarily impact product availability. Inflationary pressures, rising input costs, or broader macroeconomic shifts may also weigh on margins if not carefully managed.

Final Thoughts

Abbott has shown time and again that it can adapt, evolve, and thrive across changing cycles. From diagnostics to nutrition, its wide-ranging portfolio offers a level of stability that few healthcare firms can match. Its leadership team continues to drive growth through focused investment in innovation, while keeping the balance sheet healthy and the dividend growing.

Although risks are present, as they are with any global business, Abbott’s track record, operational discipline, and commitment to long-term strategy give it staying power. For those looking at companies with both reliable fundamentals and forward-looking momentum, Abbott remains a name that consistently delivers on what it sets out to do.