Updated 3/26

Silgan Holdings is for investors focused on dependable income and long-term value, it’s a name worth paying attention to. Since the late ’80s, Silgan has built its business around something pretty simple: making the containers and closures that keep everyday products safe and shelf-ready. From food and beverages to health and personal care items, Silgan’s packaging quietly supports the brands people use every day.

It’s not glamorous, but it’s consistent. And for dividend investors, that reliability counts for a lot.

Recent Events

2024 has been a bit of a mixed bag for Silgan. Revenues have ticked up slightly—around 5.3% higher than last year—but profit margins have come under pressure. Net income has taken a step back, and quarterly earnings fell noticeably compared to the same period last year.

That might sound like a red flag, but Silgan has still been churning out serious cash. Operating cash flow came in at over $720 million, and free cash flow was just north of $400 million. Even with profit pressure, this company keeps the money moving. And management hasn’t flinched when it comes to the dividend—if anything, they’ve leaned in, giving investors another annual increase.

Key Dividend Metrics

📈 Forward Yield: 1.57%

💰 Annual Dividend: $0.80 per share

📊 Payout Ratio: 29.46%

📉 5-Year Average Yield: 1.39%

📆 Next Pay Date: March 31, 2025 (Ex-Date: March 17)

🔁 Growth Streak: 20 consecutive years

Dividend Overview

While the dividend yield isn’t eye-popping, it’s consistent. That’s the real story here. Silgan has upped its dividend every year for the past two decades, proving its commitment to income-focused shareholders. And with a payout ratio below 30%, the dividend is well protected by earnings.

There’s room for further growth, too. Silgan has made a habit of modest but steady dividend bumps, and it has the financial flexibility to keep that going. It’s not trying to impress with high-yield headlines—it’s quietly delivering results year in and year out.

Dividend Growth and Safety

Growth in the dividend has followed a steady, predictable path. Increases typically fall in the 3% to 5% range, which matches the slow-and-steady vibe of the overall business. While that won’t turn heads, it adds up nicely over time.

Debt is one area that might give some investors pause. With a debt-to-equity ratio around 219%, Silgan carries more leverage than some of its peers. But it also has a strong track record of managing that debt. Interest coverage is solid, and free cash flow comfortably supports ongoing debt repayment and dividend distributions.

Bottom line: the dividend isn’t just safe—it’s built into the company’s DNA.

Chart Analysis

Intraday Price Action

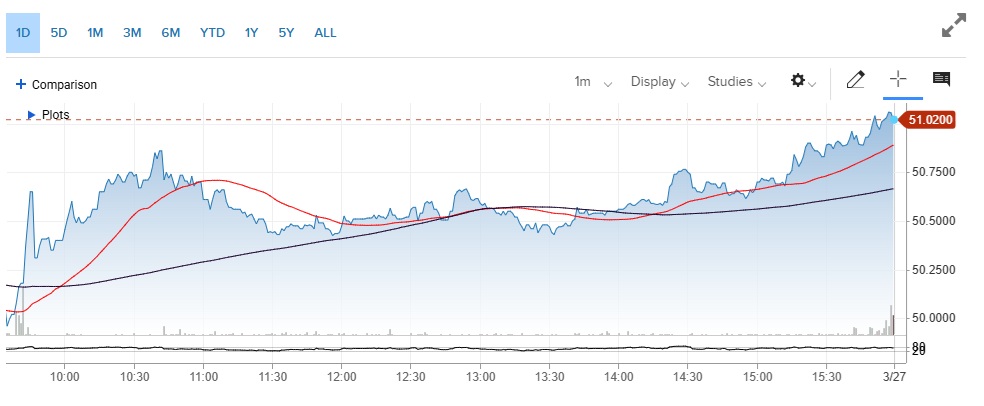

The one-day chart for Silgan Holdings (SLGN) on March 26 shows a steady upward trajectory, marked by two distinct phases of consolidation followed by renewed buying strength. The stock opened with a strong spike in volume and price, pushing quickly from just under the $50 mark to about $50.75 within the first 30 minutes of trading. This initial surge saw buyers in clear control, driving price above the short-term moving average.

Following that, the price pulled back slightly before moving into a sideways range from late morning through early afternoon. There was a visible attempt to retest the morning highs, which failed slightly, leading to some short-term profit-taking. This phase of consolidation held above the day’s earlier lows, suggesting underlying support and buyers still lingering.

Volume Profile and Buying Pressure

Volume was elevated at the open and again during the final 30 minutes of trading. In between, the volume profile remained fairly muted, indicating that most of the significant trading activity occurred during the bookends of the session. The strong late-day volume was accompanied by a solid price ramp into the close, which is typically a bullish sign, particularly when it’s not met by immediate resistance.

There’s a clear uptick in accumulation into the closing bell. Buyers pushed the stock from around $50.60 to $51.02 in the final hour, breaking above the earlier intraday high with conviction. This move was not only sharp but supported by rising volume, which often signals institutions participating in the rally.

Moving Averages Interaction

The red line, representing the shorter-term moving average, crossed above the longer-term one early in the session, confirming bullish momentum. There was a brief dip below this short-term average just before noon, but the price found support near the long-term trend line and rebounded cleanly. From 1:30 PM onward, the price consistently held above both moving averages, showing strength and trend confirmation.

The distance between the two moving averages widened into the close, which reflects increasing momentum. This expanding gap also confirms that the late-day strength wasn’t just noise—it was the result of sustained buying pressure.

Candlestick and Wick Activity

Looking at the final five candles, the action was decisively bullish. Each of the last five candles had strong bodies and minimal upper wicks, indicating very little pushback from sellers. The final candle closed at the high of the day, showing that buyers were willing to take the stock at the highest levels offered going into the close. That kind of finish often points to confidence and demand carrying over into the next session.

There’s a pattern of higher lows and higher highs throughout the latter part of the chart, and no major bearish reversal signs appear in the candle structure. The lack of long upper wicks especially stands out—sellers didn’t gain any traction even as price climbed to intraday highs.

Analyst Ratings

In recent months, Silgan Holdings Inc. (SLGN) has caught the attention of several analysts, leading to a mix of upgrades and downgrades based on evolving views of the company’s prospects and valuation.

Upgrades:

🔼 JPMorgan Chase: On August 1, 2024, JPMorgan raised its rating on Silgan from “Underweight” to “Neutral” with a new price target of $53. The upgrade reflected a shift in sentiment toward a more balanced outlook, likely driven by improving fundamentals and stability in the company’s key segments.

✅ Truist Securities: On January 5, 2024, Truist Securities upgraded Silgan from “Hold” to “Buy.” The move signaled renewed confidence in the stock’s trajectory, particularly as the company continues to generate healthy free cash flow and maintain strong customer relationships in its core packaging business.

Downgrades:

🔽 Citigroup: On January 3, 2024, Citigroup downgraded the stock from “Buy” to “Neutral,” though interestingly raised its price target from $44 to $47. This suggests the firm still sees some upside, but less conviction in outperformance. The downgrade may reflect concerns over margin compression or limited near-term catalysts.

Price Targets:

🎯 The current consensus 12-month price target for Silgan Holdings is approximately $63.24, with the range spanning from a low estimate of $58.58 to a high of $73.50. This target range indicates that most analysts expect moderate appreciation from current levels, assuming continued execution and stable end-market demand.

These changes in analyst sentiment highlight a company that remains in focus, with investors and analysts alike weighing steady fundamentals against broader economic uncertainties and sector dynamics.

Earning Report Summary

Silgan Holdings wrapped up 2024 with a mixed but overall encouraging set of numbers. While some areas saw pressure, particularly in metal packaging, the company managed to post strong results in key growth segments like dispensing closures and custom containers. The year also marked progress on integrating acquisitions and continuing cost-saving initiatives.

Fourth Quarter Snapshot

In the last three months of the year, Silgan pulled in about $1.4 billion in revenue, which was up roughly 5% from the same quarter the year before. That growth was largely fueled by the acquisition of Weener Packaging, which added meaningful scale to their dispensing and specialty closures business.

Now, earnings on a net basis were down. The company earned $45.1 million, or $0.42 per share, compared to $64.4 million, or $0.60 per share, a year earlier. A big reason for that dip was related to restructuring costs—Silgan has been reorganizing certain operations to become leaner.

That said, when you strip out one-time charges and non-cash items, adjusted earnings per share came in at $0.85, a noticeable jump from $0.63 the year before. That’s a record adjusted number for them in the fourth quarter.

Segment Breakdown

The Dispensing and Specialty Closures division led the way, posting sales of $639 million—a 22% boost year-over-year. That included about a 5% organic volume increase, especially strong in their dispensing products. Operating profit here was up as well, hitting nearly $100 million.

On the flip side, metal containers had a rougher time. Sales dropped by 8% to just over $610 million. Pet food packaging held steady, but weather-related issues and customers adjusting their inventories took a toll in other food categories. Even so, profitability in the segment held up fairly well.

Their custom containers business did better, with revenue rising 6% to around $162 million. This was helped by new customer wins and a better mix of higher-margin products. Operating income here climbed to $18 million, up from $13 million the previous year.

Full-Year Picture

For all of 2024, Silgan booked close to $5.9 billion in sales, slightly below 2023’s total. The dip was mostly tied to the pass-through of lower raw material costs in the metal can business.

Full-year net income was $276 million, or $2.58 per share, compared to $326 million, or $2.98, in the prior year. However, adjusted earnings rose to $3.62 per share, up from $3.40.

Overall, 2024 reflected a year of strategic transition—strength in higher-growth areas, solid cash generation, and continued focus on efficiency, even as traditional segments faced some headwinds.

Financial Health and Stability

Silgan runs a capital-intensive operation, and its balance sheet reflects that. Total debt is a hefty $4.36 billion, though that’s offset in part by over $800 million in cash. The current ratio is just above 1.0, suggesting the company can handle its short-term obligations, even if it’s not flush with excess liquidity.

Profitability metrics paint a picture of a mature, well-run business. Return on equity sits at 14.25%, and return on assets is 4.65%. These numbers aren’t flashy, but they’re respectable for a packaging firm operating in a low-margin environment. Operating margin is over 10%, and the company continues to grind out positive results even when conditions get tougher.

The bottom line is that Silgan doesn’t need perfect conditions to perform—it just needs to keep doing what it does best.

Valuation and Stock Performance

From a valuation standpoint, Silgan looks reasonable. It’s trading at a forward P/E of around 12.6, which feels fair for a business like this. The PEG ratio of 1.10 suggests growth is more or less in line with the price. Price-to-sales sits under 1.0, and price-to-book is about 2.74—nothing extreme, especially given the company’s consistency.

Performance-wise, the stock has inched up a little over 5% over the past year. That’s below the broader market, but not surprising given Silgan’s lower beta of 0.70. This isn’t a stock that’ll soar in bull markets, but it also tends to hold its ground better when things get rocky.

Technically, the stock is trading just below its 50-day moving average. That could indicate a bit of consolidation or a short-term breather. Long term, the trend remains quietly positive.

Risks and Considerations

The biggest thing to keep an eye on is the company’s debt. While manageable today, that level of leverage could become more of an issue if interest rates rise or cash flow slows. So far, Silgan has handled it well, but it’s definitely a point to monitor.

Commodity costs also pose a risk. Materials like aluminum and plastic can be volatile, and while Silgan can often pass some of those costs through to customers, margin pressure is always lurking.

There’s also some customer concentration. A few large consumer goods companies represent a significant share of Silgan’s revenue, so any changes in those relationships could have an impact.

And then there’s the recent earnings decline. A 30% year-over-year drop in quarterly earnings isn’t ideal, even if it hasn’t stopped cash from flowing in. That type of hit is worth keeping in the back of your mind, especially if economic conditions start to wobble.

Final Thoughts

Silgan isn’t the kind of stock people get excited about—but maybe that’s the point. For dividend-focused investors, excitement often brings risk. Silgan offers something different: a predictable, durable business that knows how to generate cash and reward shareholders without taking big swings.

The dividend is secure, the business is built for endurance, and the stock still trades at a reasonable valuation. It’s not perfect, and it’s not going to deliver triple-digit returns. But for those building a dividend portfolio around consistency and staying power, Silgan could be a quiet but powerful piece of the puzzle.