Updated 6/13/25

Murphy USA has steadily built a strong position in the fuel and convenience retail space, operating a network of locations—many adjacent to Walmart—that benefit from consistent customer traffic. The company emphasizes operational efficiency, disciplined capital allocation, and steady shareholder returns, backed by healthy cash flow and a thoughtful approach to debt and growth.

With a low payout ratio, a forward dividend of $2.00 per share, and continued share repurchases, Murphy USA’s capital return strategy is clear and deliberate. Leadership’s focus remains on optimizing performance, selectively expanding high-return locations, and managing through fuel margin pressures while maintaining financial flexibility.

Recent Events

The latest numbers from Murphy USA show some cooling off from previous highs. Revenue for the trailing twelve months came in at $17.6 billion, down 7.3% year-over-year. Net income also slipped, falling 19.4% to just under $490 million. That kind of dip might worry some folks at first glance, but for long-term investors, it’s part of the natural ebb and flow in a fuel-based business.

What stands out is how solid the company remains despite those drops. EBITDA was just shy of $1 billion, and operating cash flow topped $840 million. Even with some softening on the earnings front, Murphy USA is still bringing in more than enough to cover its financial obligations and shareholder returns. Free cash flow after debt payments clocked in at over $257 million, giving the company breathing room to manage its dividend and buyback programs.

Debt is worth keeping an eye on—Murphy USA carries $2.51 billion in total debt, with a debt-to-equity ratio of over 348%. That’s on the high side, but it’s been a strategic move more than a sign of stress. The return on equity sits at a staggering 65.24%, a number that only makes sense if leverage is being used wisely—and in this case, it seems to be.

Key Dividend Metrics

💸 Forward Dividend Yield: 0.48%

📈 Dividend Growth Rate: Steady and gradual

🛡 Payout Ratio: 7.87%

📅 Next Dividend Date: June 2, 2025

💵 Forward Annual Dividend: $2.00 per share

Dividend Overview

Murphy USA isn’t offering a high-yield payout, but it’s doing something arguably more important—keeping its dividend stable and sustainable. With a forward dividend yield under 0.5%, this isn’t the stock for investors chasing yield. But that number doesn’t tell the full story.

One reason the yield looks low is that the share price has run up significantly over the past few years. Even so, the dividend has kept pace, and the payout has been growing in a quiet, measured way. The low payout ratio—just under 8%—shows how much room the company has to grow the dividend if it chooses to. It’s not stretching itself thin to make payments. That flexibility is a strength.

Also, this is a company that prefers buybacks over big dividend hikes. That might not be as appealing for income-seekers, but it works in tandem with the dividend policy. By reducing the number of shares outstanding, each remaining share gets a slightly bigger piece of the pie—dividends included.

Murphy USA also operates with a relatively small float, around 19.76 million shares, with nearly 90% held by institutions. That tight share structure, paired with disciplined financial management, makes its dividend feel more like a calculated decision than an obligation.

Dividend Growth and Safety

There’s no guesswork when it comes to whether Murphy USA can afford its dividend. With a payout ratio this low and consistently strong free cash flow, the dividend is about as safe as they come. Even in tougher years—like the one they’re working through now—the company has plenty of cushion.

The dividend hasn’t been growing at breakneck speed, but it has been inching upward with intent. Management has taken the stance that slow and steady wins the race. And for shareholders looking for reliable income that doesn’t come with drama, that kind of approach builds trust.

The balance sheet does carry weight in the form of leverage, and a 348% debt-to-equity ratio is no small figure. But so far, it’s being managed smartly. Cash flow is healthy, interest payments are covered, and the company seems more focused on using that debt as a tool for shareholder value rather than a burden.

The other plus for dividend investors? Murphy USA isn’t a volatile stock. With a beta of just 0.50, it tends to move less than the broader market—making it a relatively calm place to park capital, collect modest dividends, and ride out market swings.

All told, Murphy USA may not wow with yield, but it does impress with consistency. The dividend is small, but it’s backed by solid fundamentals and supported by a management team that understands capital discipline. For long-term investors who care about predictability and preservation of income, that’s more than enough.

Cash Flow Statement

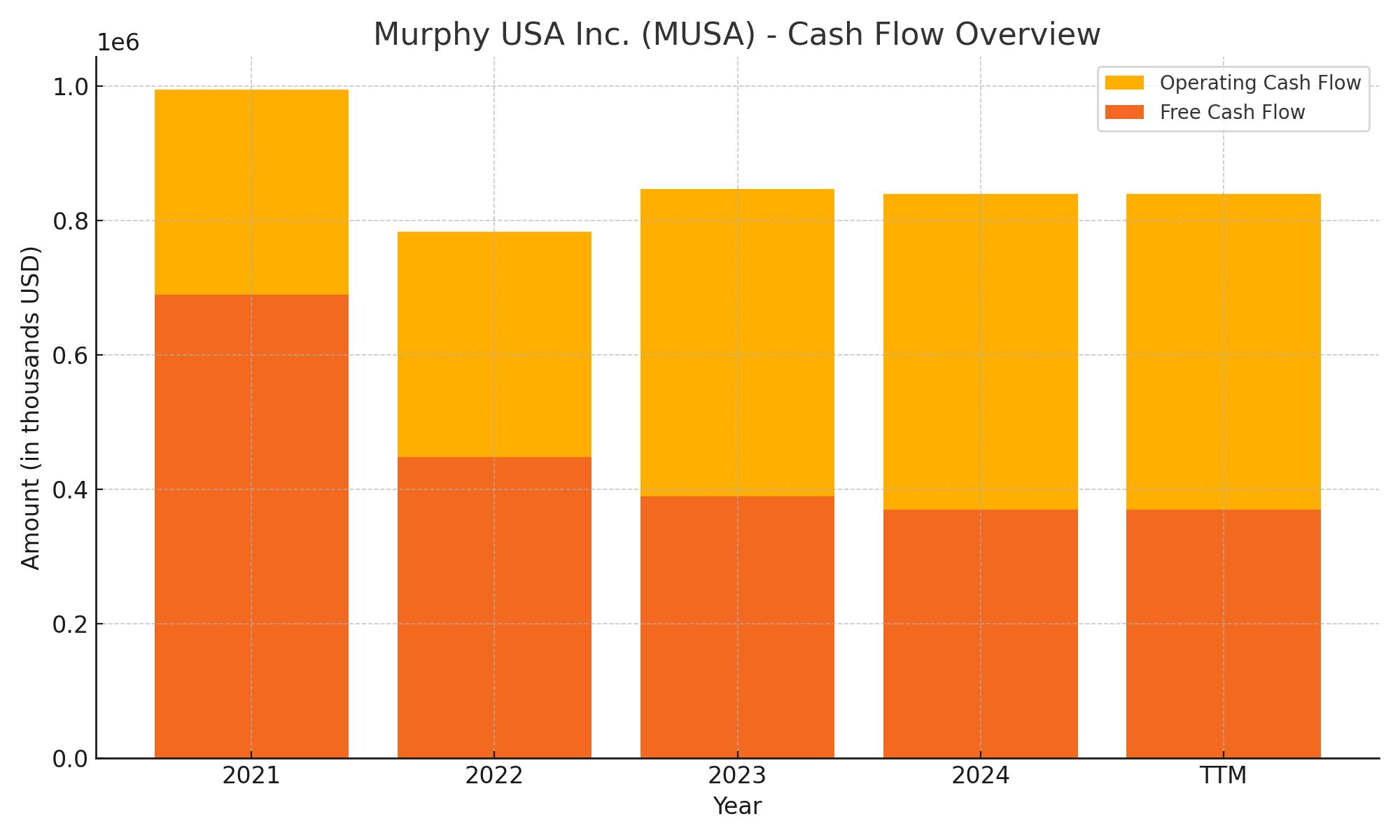

Murphy USA generated $840.1 million in operating cash flow over the trailing twelve months, showing a slight dip from the previous year but still maintaining a strong core of cash generation. Capital expenditures rose to $469.7 million, reflecting continued reinvestment into infrastructure and store expansion. Despite that uptick in spending, free cash flow remained healthy at $370.4 million, giving the company ample flexibility for dividends and share repurchases.

On the financing side, Murphy USA continued its shareholder-first approach, spending over $509 million to repurchase shares. The company issued $1.38 billion in debt and repaid $1.19 billion, a sign of active debt management rather than accumulation. The net result was a modest rise in the cash balance to $49.4 million. Even with lower year-end cash than in past years, liquidity appears sufficient, and the business continues to fund both its growth and capital returns from internal cash flow.

Analyst Ratings

In recent weeks, Murphy USA has experienced a mix of sentiment changes from analysts. 🛠️ KeyCorp adjusted its price target from $550 down to $525 while still maintaining an overweight rating. Their revised outlook reflects some concern over weaker earnings momentum and softer revenue performance. Similarly, Stephens & Co. brought their target from $530 to $475 but kept an overweight stance, pointing to tighter fuel margins and cash-back pressure in convenience retailing as reasons for the adjustment. Around the same time, Raymond James shifted its rating from outperform to market perform, signaling reduced expectations for near-term upside. This came as analysts took a more conservative view on consumer spending trends and industry margins.

That said, not every move has been cautious. In March, Melius came in strong with a fresh buy rating and a high target of $600, citing Murphy USA’s consistent free cash flow and efficient capital deployment as key strengths. 📈 Despite the mixed adjustments, analyst sentiment remains broadly favorable. The average consensus price target sits around $526.29, suggesting about a 28% upside from current levels. 💵 Other estimates are slightly below, with targets near $511 to $515, indicating steady confidence in the company’s long-term value despite short-term pressures.

Earning Report Summary

A Mixed Quarter with Solid Cash Flow

Murphy USA’s most recent quarter didn’t blow the doors off, but it showed they’re keeping things steady where it counts. Revenue was a bit lighter than the same time last year. Fuel volumes dipped and convenience store sales weren’t quite as strong as expected. Still, the company managed to generate healthy levels of cash, which speaks to how well they run the business even when the environment gets a little choppy.

On the earnings call, leadership acknowledged the margin pressure in the fuel segment, calling it a product of broader refining conditions. But they made a point to say their core business model is holding up. Sites near Walmart continue to draw consistent traffic, and they’re working on improving store operations—things like better product selection and promotions—to give customers more reasons to stop in.

Focus on Efficiency and Customer Loyalty

Management leaned into the idea that efficiency is more important than ever right now. They’re not slashing costs recklessly, but rather tightening operations where it makes sense—store labor, supply chains, that sort of thing. There’s also a push to improve digital engagement. Loyalty programs and in-store tech upgrades are on the table to help drive repeat business and push margins a little higher.

They didn’t offer anything flashy on dividend hikes, but they did reaffirm the current dividend policy. What’s more important is how they’re using the rest of the cash. The company continues to buy back shares when conditions are right and keeps a tight grip on spending. That combo—modest dividends and smart repurchases—fits with their low-key, high-discipline approach to capital return.

Playing the Long Game with Growth and Debt

Debt came up too, and they’re taking a measured approach there as well. They’ve been refinancing where they can to lock in better rates and are slowly chipping away at older, more expensive obligations. They aren’t in a rush to pay it all off, but they’re watching it closely to make sure they have the flexibility to invest where needed.

Store growth was another bright spot. New locations are performing above expectations, and they aren’t expanding just for the sake of it. Leadership emphasized that they’re picking their spots carefully, only opening stores that meet a high return threshold. That kind of selective growth helps keep overall performance steady.

Even though there are headwinds in the fuel market, the tone from Murphy USA’s leadership was clear—they’re not overreacting. They’ve got a business model that works across different cycles, and they’re sticking to it. By keeping a sharp eye on costs, investing in areas that matter, and staying committed to returning capital to shareholders, they’re navigating the current landscape with a steady hand.

Management Team

Murphy USA’s leadership brings a calm and steady hand to the table, staying true to a strategy grounded in operational efficiency and disciplined capital allocation. The CEO is known for a straightforward approach—focused more on execution than publicity. Under this leadership, the company has maintained a strong commitment to shareholder value, prioritizing cash generation, store performance, and consistent returns over aggressive expansion or headline-grabbing moves. The CFO supports this mindset, emphasizing debt control and a return-on-investment-driven culture that filters through every decision. This is a team that isn’t trying to time the market or chase the latest trends. Instead, they stick to a well-defined playbook: grow when it adds value, trim what doesn’t, and always protect the company’s ability to return capital.

Valuation and Stock Performance

Murphy USA’s stock has taken a bit of a breather over the past year. With revenue softness and tighter margins weighing on recent results, the share price has slipped off its highs. Yet when you look beneath the surface, the valuation starts to tell a more interesting story. The price-to-earnings ratio is moderate, and the market seems to be valuing the stock on the reliability of its cash flow rather than on fast growth. That could work in its favor for income-focused investors looking for stability rather than volatility. The company’s ongoing share buyback program quietly supports earnings per share, which may become more visible over time if revenue trends stabilize. While it doesn’t have the explosive upside of a growth tech stock, Murphy USA offers something more dependable—an efficient, cash-generating business with a long runway of small but meaningful improvements.

Risks and Considerations

There are a few areas where investors need to stay sharp. Fuel margins remain the biggest variable in the business. Global refining trends, pricing competition, and shifting consumer patterns can all impact profitability. While Murphy USA’s volume advantage through Walmart partnerships is a strength, any disruption in traffic or broader economic slowdown could hit sales. The company’s debt load also deserves attention. While the leadership team has shown they can manage leverage effectively, the current debt-to-equity ratio leaves less room for error if interest rates stay high or cash flow dips unexpectedly. Competitive threats are always part of the landscape too. Whether it’s from national fuel chains or new digital-first competitors, the convenience and fuel retailing space remains crowded. Keeping customer loyalty strong through promotions, pricing, and in-store experiences is essential. Finally, store expansion—if not carefully executed—could add pressure rather than create value, so disciplined rollout remains key.

Final Thoughts

Murphy USA offers a different kind of investment story—one that’s more about consistency and control than rapid growth or big swings. The leadership team is focused, efficient, and deliberate. Their financial discipline shows up in the numbers, from free cash flow to share repurchases to debt strategy. The dividend, while modest in yield, is backed by a wide earnings cushion and signals the company’s intent to return capital steadily.

The current valuation looks reasonable given the cash-generating nature of the business. The share price may not reflect excitement right now, but that can be a good thing for long-term investors who prefer under-the-radar strength to speculative hype. There are risks tied to fuel margins and debt, but the business model has shown resilience. Investments in loyalty, store upgrades, and targeted expansion could begin to unlock more upside if executed carefully.

For investors who value patience and prefer well-managed companies that prioritize durability over drama, Murphy USA continues to hold its place as a quiet but capable performer. It may not demand attention, but it consistently earns it.