Updated 6/13/25

Mueller Water Products plays a critical role in the infrastructure that supports clean, reliable water access across North America. With a business built around hydrants, valves, metering systems, and related services, it serves municipalities and utilities that rely on durable, long-life-cycle products. The company has consistently delivered solid operating results, improved margins, and growing free cash flow backed by disciplined capital management.

Its leadership emphasizes cost control, efficient execution, and long-term value creation. With a growing focus on aftermarket services and new metering technologies, Mueller is positioning itself for steady expansion. The dividend remains well-supported by cash flows, while valuation and stock performance reflect investor confidence in its long-term fundamentals.

Recent Events

Over the past year, Mueller’s stock has gained over 38%, far outpacing the broader market. While it hasn’t made headlines doing so, the numbers quietly reflect a business that’s been steadily improving. Revenue grew 3.1% year-over-year in the most recent quarter, while earnings jumped almost 16%. Again, not earth-shaking, but definitely a sign of strength.

The company’s profitability metrics are heading in the right direction. Operating margin has moved north of 20%, and return on equity sits at a solid 17.68%. Those kinds of numbers are healthy for a mid-cap industrial name and show that management is doing a good job of turning sales into actual earnings.

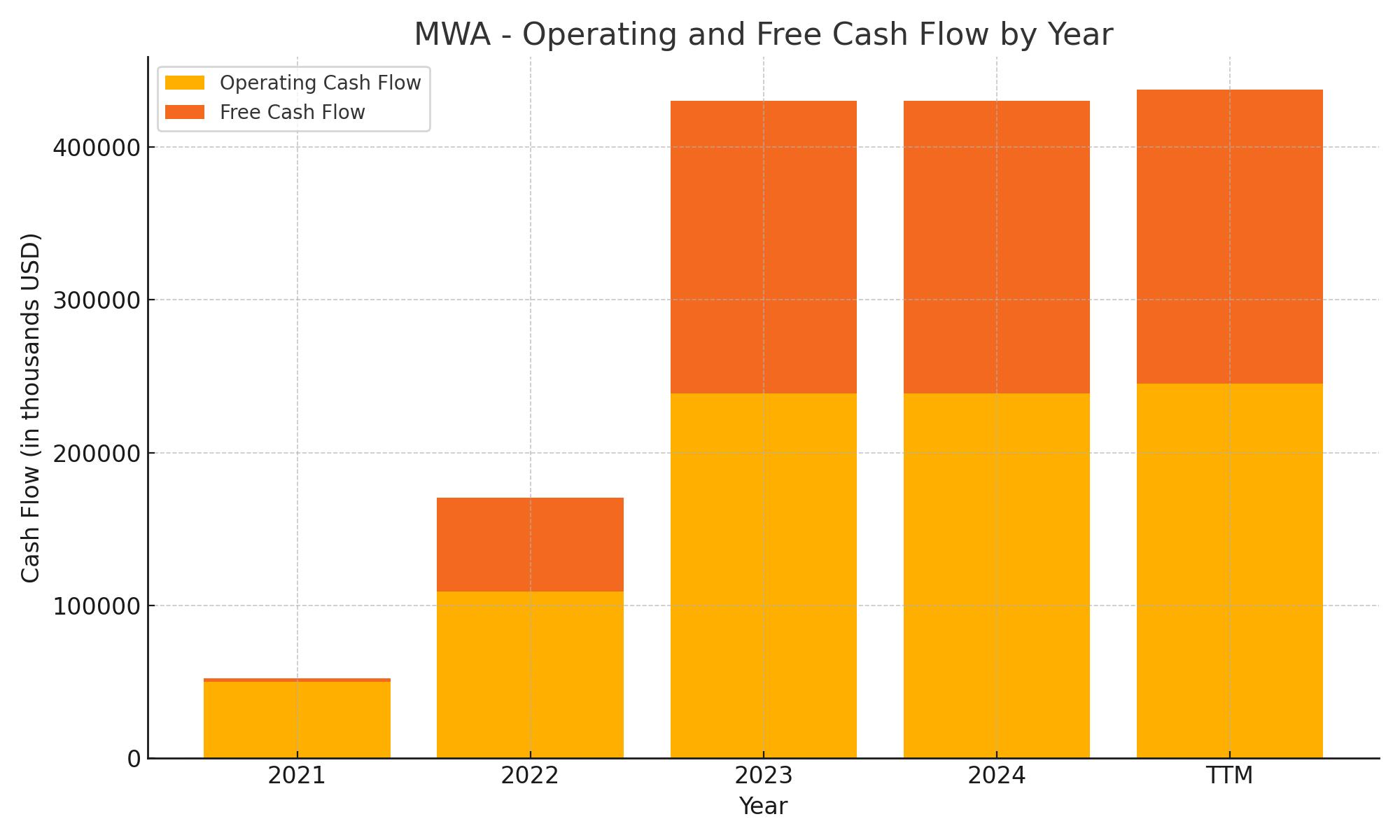

Cash flow is another highlight here. Mueller generated $245 million in operating cash flow and nearly $186 million in free cash flow over the past 12 months. Those are strong numbers when you compare them to the company’s annual dividend obligation. Simply put, they’re not stretching to make those payments, which is something dividend investors should always be watching.

Valuation has also become more attractive. The forward P/E ratio is down to 17.4 from well above 30 earlier in the year, meaning investors are getting more earnings for every dollar they invest now. That makes the case for sticking with Mueller stronger, particularly for those in it for the long haul.

Key Dividend Metrics

📅 Dividend Yield: 1.12% (forward)

💸 Dividend Rate: $0.27 per share annually

🧮 Payout Ratio: 28.79%

📈 5-Year Avg. Yield: 1.63%

🔄 Dividend Growth: Slow but consistent

🧾 Next Dividend Date: May 21, 2025

🔻 Ex-Dividend Date: May 12, 2025

Dividend Overview

At first glance, a yield just north of 1% might not turn many heads, especially when compared to higher-yielding sectors like utilities or REITs. But that’s not the full picture. Mueller’s dividend is intentionally conservative, backed by solid free cash flow and a disciplined payout ratio. It’s not meant to dazzle. It’s meant to last.

With a payout ratio of just under 29%, the dividend isn’t anywhere close to stressing the balance sheet. There’s plenty of room for management to continue raising it over time, even if earnings growth slows. What’s more, this approach gives Mueller the flexibility to invest back into the business or keep cash on hand for opportunities.

Over the past five years, the average dividend yield has been about 1.63%, which tells us the recent stock price appreciation has compressed the yield. That’s not a bad thing—it’s just a signal that the company has been executing well and the market has taken notice.

Dividend Growth and Safety

One of the more compelling reasons to consider Mueller as a dividend stock is its built-in safety. It’s not a high-yield income machine, but it doesn’t need to be. What it does offer is consistent, reliable cash generation from a critical infrastructure niche. That’s a steady foundation for any income-focused portfolio.

Mueller’s dividend policy seems clearly designed to be sustainable through cycles. The company only uses a fraction of its free cash flow to fund dividends, which leaves a buffer if things get tight. Right now, they’re using about $42 million a year for dividends out of nearly $186 million in free cash flow. That’s not just manageable—it’s conservative.

Debt levels are also in check. The company carries around $480 million in debt, offset by $330 million in cash, and the current ratio is a very comfortable 3.79. That’s plenty of liquidity. Add in a relatively low beta of 1.20, and you’ve got a stock that doesn’t bounce wildly with market swings.

Institutional investors hold a significant chunk of the float—over 100% when accounting for overlapping funds—and short interest is modest at just over 4%. That level of institutional backing typically supports price stability and signals confidence in the company’s longer-term prospects.

Mueller Water Products might not be a flashy dividend play, but for investors seeking durable income with the potential for slow, steady growth, it fits the mold. You’re not buying it for the yield today. You’re buying it for what that yield might look like in five years—backed by a company that plays a critical role in keeping the country’s water infrastructure up and running.

Cash Flow Statement

Mueller Water Products has significantly strengthened its cash flow profile over the trailing twelve months. Operating cash flow surged to $245 million, reflecting both improved earnings quality and strong working capital management. That’s more than double the figure from fiscal 2022 and nearly five times what the company reported just three years ago. Free cash flow followed suit, reaching $192.3 million—almost triple what it was two years ago. These numbers suggest a solid cash-generating engine, comfortably covering dividends, capex, and modest buybacks.

On the investing side, capital expenditures held steady at around $52.7 million, in line with prior years and signaling disciplined reinvestment. Financing cash flow remains negative at $41.5 million, mostly due to stock repurchases and debt service. The company repurchased $5 million in shares while maintaining minimal debt repayment obligations. Cash on hand climbed to $330.2 million, more than double the position at the end of fiscal 2022. Mueller hasn’t issued any new debt in recent periods, reinforcing its conservative capital structure. This cash flow consistency underlines the company’s ability to support its dividend and still retain flexibility for growth or shareholder returns.

Analyst Ratings

📈 Goldman Sachs and RBC both lifted their price targets for Mueller Water Products earlier this year. On February 6, Goldman bumped its target from $26 to $29, crediting stronger-than-expected quarterly results and improving demand trends in Mueller’s core markets. RBC followed suit, raising its own target from $25 to $29, highlighting margin expansion and solid operating momentum as key drivers.

✅ Oppenheimer also expressed continued confidence, reiterating its buy rating while inching its target up from $26 to $27. The rationale was centered on Mueller’s ability to maintain pricing strength and consistent free cash flow—an encouraging signal for income-focused investors.

⚠️ Not all the updates were upgrades. TD Cowen made a more cautious move back in August, downgrading the stock from strong buy to hold and slightly lifting the target from $19 to $20. The firm suggested that while the fundamentals remain intact, the near-term upside had become more limited given how far the stock had run.

📊 At the moment, the consensus price target among analysts sits around $26.25. That implies a modest upside from where the stock is currently trading. Most analysts seem to view Mueller as a stable performer with dependable cash flows, though they appear to be waiting on further growth signals before adjusting their stance more aggressively.

Earning Report Summary

Mueller Water Products just delivered a quarter that didn’t try to wow anyone, but it definitely showed up with solid, dependable numbers. The kind of report that doesn’t make headlines but quietly keeps the long-term story intact. Revenue saw a small but healthy bump from the same quarter last year, helped along by stronger-than-expected performance in both municipal and commercial markets. Supply chain friction has eased a bit, and they’ve been able to keep projects moving on time, which helped soften some of the typical delays that used to weigh things down.

Margins and Profitability

One of the more encouraging parts of the report was the margin expansion. Operating margin improved, thanks to a combination of smart cost controls and smoother execution in manufacturing. Leadership was clear that this wasn’t just about raising prices—it was about getting the basics right. Better planning, tighter cost discipline, and running operations with fewer surprises. Earnings per share came in ahead of last year’s numbers, and if you strip out some of the one-off items, the underlying trend looks even stronger. This gave them confidence to stick with their full-year guidance.

Free Cash Flow and Capital Allocation

Free cash flow continues to be one of Mueller’s strengths. They turned in another solid number here, which comfortably supported their ongoing capital spending and share buybacks. The CFO made it clear they’re going to stay balanced when it comes to how they use that cash. Dividends come first, buybacks where it makes sense, and they’re keeping the door open to smart acquisitions—nothing dramatic, but small strategic adds where it fits.

What Leadership Had to Say

The tone on the earnings call was pretty grounded. Management wasn’t overly bullish, but they came across confident and focused. The CEO acknowledged that municipal budgets remain tight, but stressed that the team is staying focused on controlling costs, moving through backlog efficiently, and continuing to roll out new products. One of those products is a new line of updated water meters, set to launch later this year, which they believe could become a meaningful growth driver over time.

Looking Ahead

Looking into the second half of the year, leadership expects to see a seasonal lift, especially in warmer regions where infrastructure activity picks up. They also talked about focusing on aftermarket demand and replacement cycles, areas that tend to stay steady even when new projects are slower to start. There’s still work to do, and they didn’t sugarcoat that. But the sense you get is that they’re playing the long game—building out a more efficient business while staying responsive to market shifts.

Overall, this quarter wasn’t about big surprises. It was about consistent execution, a clear strategy, and staying financially disciplined. For investors who value predictable growth and reliable income, Mueller is continuing to move in the right direction.

Management Team

Mueller’s leadership team brings a steady and measured approach that fits the nature of its business. At the helm, the CEO brings years of experience in the industrial and infrastructure space, and his communication consistently emphasizes operational execution and margin control over big, splashy moves. He’s not interested in making noise—he’s focused on getting projects done on time, keeping costs in line, and delivering long-term value. His updates tend to stick to clear priorities: keep operations running efficiently, stay disciplined with pricing, and focus on products that fill real needs in the water infrastructure world.

The CFO has been a consistent voice on financial discipline. Her comments in earnings calls and updates always circle back to cash flow—specifically how it supports dividends, share buybacks, and selective reinvestment. She reinforces the idea that Mueller isn’t chasing growth at all costs. Instead, the company is prioritizing a healthy balance sheet and reliable shareholder returns. Together, the management team stays aligned in its messaging, whether it’s from operations, finance, or sales. There’s a growing focus on aftermarket parts and service—areas that offer margin potential and consistent demand—highlighting how the company is thinking about more sustainable and recurring revenue streams.

Valuation and Stock Performance

Mueller’s stock has quietly outpaced the broader market over the past year, rising more than 38 percent. Despite the run, shares don’t look overheated. The forward price-to-earnings ratio sits around 17, which places it in a reasonable spot given the company’s earnings growth and stability. It’s not being priced for perfection, but it’s also not stuck in the bargain bin. The valuation seems to reflect where the company is today—dependable, generating cash, and rewarding shareholders steadily without big surprises.

The market’s view seems to match this steady profile. The consensus analyst price target is around $26.25, suggesting some modest upside from recent trading levels. It’s not a stock that investors chase for high-risk, high-reward potential. Instead, it has become something of a safe haven for those who want predictable returns and measured capital deployment.

On the technical side, the stock found support near its 200-day moving average earlier this year and has slowly crept higher since. There hasn’t been heavy trading volume or speculative activity—just a gradual accumulation by long-term investors. That kind of performance doesn’t turn heads, but for those focused on dividends and low-volatility names, it’s often the kind of pattern they prefer.

Risks and Considerations

Even with its strengths, Mueller carries a few risks investors should watch. One of the more obvious ones is tied to its municipal customer base. A large part of Mueller’s revenue comes from city and local government projects, which can slow down if budget pressures rise. When public budgets tighten, infrastructure upgrades tend to get delayed or scaled back, which could affect both order volumes and backlog movement.

Commodity costs are another consideration. While the company has done a good job maintaining margins through smart pricing, it still has exposure to raw materials like steel. If input costs climb quickly and Mueller can’t adjust pricing fast enough, margins could get squeezed. This is a manageable risk, but it’s worth keeping in mind.

There’s also some execution risk when it comes to Mueller’s longer-term growth plans. Management has talked about expanding into smarter water metering systems and building up its aftermarket service presence. These are logical extensions of the core business, but they require tight coordination, good product development, and careful rollout. Any hiccups in those areas could delay revenue contributions or lead to higher short-term costs.

Debt is under control, and the company holds a comfortable cash cushion, but as with any industrial company, maintaining that balance will depend on continued operational performance. If earnings dip or a planned acquisition stretches their capital too far, it could shift the outlook quickly.

Final Thoughts

Mueller Water Products may not make daily headlines, but it’s a solid, cash-generating business that does the basics right. For investors looking for dependable dividend income and a company that manages itself with restraint, it checks a lot of boxes. The leadership team sticks to a clear plan, doesn’t overextend, and prioritizes shareholder returns in a methodical way.

Valuation seems fair, performance has been quietly strong, and the risks are visible but not overwhelming. There’s a clear sense that Mueller isn’t trying to reinvent itself—it’s trying to do what it already does, just a little better each quarter. That kind of consistent, steady strategy often pays off over time, especially for those focused on long-term income and capital preservation.