Updated 6/13/25

MSA Safety (NYSE: MSA) is a century-old leader in safety equipment, serving industrial clients, firefighters, utilities, and first responders around the world. With a strong operating margin of over 21%, consistent cash flow, and a growing backlog of orders, MSA continues to show it can deliver solid financial results while supporting long-term innovation. The stock currently trades around \$164 with a dividend yield of 1.29%, backed by a payout ratio under 30% and over five decades of uninterrupted dividends.

Analyst sentiment remains constructive with a consensus price target near \$192, reflecting steady performance and earnings growth. Management’s focus has remained on expanding core offerings with smart technology and service contracts while keeping the balance sheet strong. With dependable execution, measured growth strategies, and a shareholder-focused approach, MSA stands as a durable income option in the industrial sector.

Recent Events

The past year hasn’t been a high-flyer for MSA stock. Shares have slipped just over 7% over the last 12 months, while the S&P 500 has pushed ahead with double-digit gains. The underperformance might seem discouraging at first glance, but dig a little deeper and the picture looks more measured than negative.

In the first quarter of 2025, MSA posted 2.5% earnings growth from a year ago. Net income reached $286 million, with earnings per share sitting at $7.25. Revenue was up a modest 1.9%. This isn’t a company chasing rapid expansion. Instead, it focuses on margin stability and operational strength—something it does well, as shown by a 21.5% operating margin.

One number that stands out is the return on equity, which came in at a solid 26.2%. That kind of return tells you management is allocating shareholder capital with care. While the stock has pulled back from its 52-week high of just over $200, it’s now hovering around the $164 range, near its 200-day moving average. In short, it’s taking a breather after a strong run in prior years.

Key Dividend Metrics 🧮

📈 Dividend Yield: 1.29% (Forward)

💰 Annual Dividend: $2.12 per share

🔁 5-Year Average Yield: 1.22%

📊 Payout Ratio: 28.1%

🛡️ Free Cash Flow Coverage: $220.5M in FCF vs. ~$83M in dividends

🧱 Balance Sheet Strength: 2.93 current ratio, 46% debt-to-equity

📅 Most Recent Dividend Date: June 10, 2025

🔔 Ex-Dividend Date: May 15, 2025

🏁 Dividend Streak: Over 50 years uninterrupted

Dividend Overview

MSA doesn’t offer the kind of juicy dividend yield that turns heads at first glance. At 1.29%, it’s modest, but in line with what it’s offered over the past several years. That consistency is a hallmark of MSA’s approach. It’s not chasing yield; it’s building something durable.

What gives the dividend real strength is how comfortably it’s funded. The company is only paying out about 28% of its earnings in dividends. That’s well below the danger zone and leaves plenty of room for future increases, even if earnings hit a soft patch.

Free cash flow came in at $220 million over the last year, with around $83 million going to dividends. That kind of coverage isn’t just healthy—it’s conservative. And for dividend investors, that’s a good thing. It means MSA can keep its payout steady even in rougher economic waters, without having to dip into reserves or take on extra debt.

On the balance sheet side, the company looks just as solid. A current ratio close to 3 suggests plenty of liquidity, while a manageable debt load gives it flexibility. This isn’t a company that’s boxed in by financial constraints.

Dividend Growth and Safety

One of MSA’s strongest qualities is its track record. This company has paid out dividends for more than 50 years without interruption. That kind of history tells you a lot about management’s priorities and the durability of the business.

Dividend growth hasn’t been explosive, but it has been reliable. Over the past five years, annual increases have typically landed between 4% and 7%. That’s enough to outpace inflation and keep income growing over time, without putting pressure on the balance sheet.

What really reinforces the safety of the dividend is how well the business performs in terms of profitability and capital management. With a return on equity over 26% and operating margins north of 20%, MSA isn’t just coasting. It’s executing well and has the financial strength to maintain its shareholder commitments without sacrificing internal investment.

The underlying business model helps here too. MSA serves industries where safety is non-negotiable. These aren’t nice-to-have products—they’re regulatory requirements. That gives the company a reliable customer base, and in turn, a steady revenue stream to support ongoing dividend payments.

All in all, MSA Safety offers the kind of dividend story that doesn’t grab headlines but delivers the goods for those paying attention. Reliable growth, conservative payout practices, and a long history of shareholder-friendly behavior make it a name worth keeping on the radar for any income-oriented portfolio.

Cash Flow Statement

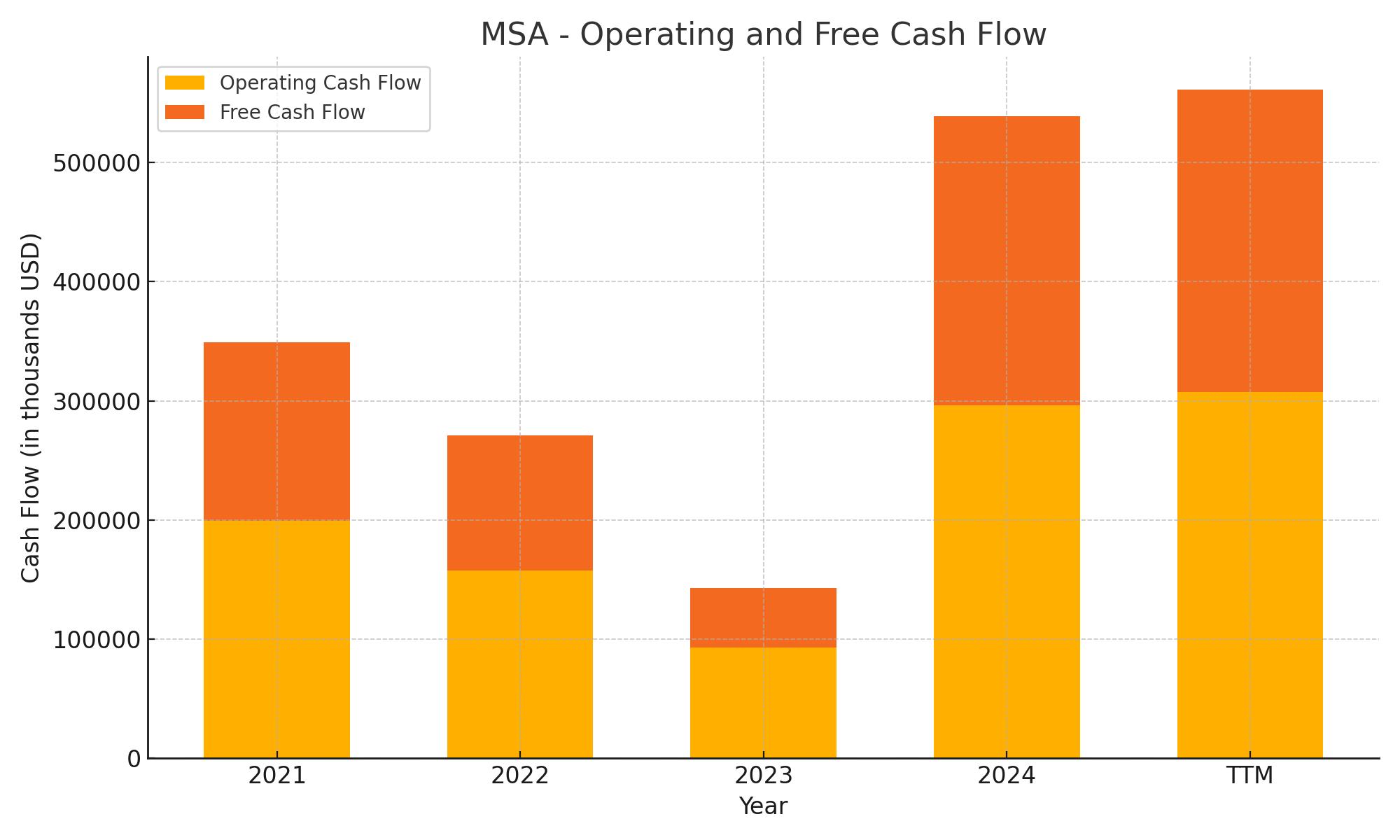

MSA Safety’s cash flow profile over the trailing twelve months shows a company operating with strong internal efficiency. Operating cash flow came in at $307 million, continuing its upward trend from the prior year’s $296 million and sharply ahead of the $92 million logged in 2022. Free cash flow also surged to $253 million, reflecting not just higher operating income but also disciplined capital expenditures, which totaled roughly $54 million. This signals a business generating meaningful excess cash after covering its reinvestment needs.

On the financing side, outflows remain substantial, hitting $225 million. The bulk of this stemmed from aggressive debt repayments that exceeded new borrowings, alongside increased share repurchases. Investing activities remained modest, with just over $53 million in net outflows, indicating restrained acquisition or expansion spending. Altogether, the company ended the period with $179 million in cash—up from the previous year and a strong indicator of financial stability. These trends show that MSA isn’t just generating solid cash—it’s putting it to work conservatively, while still rewarding shareholders.

Analyst Ratings

📈 In recent weeks, analysts have made some adjustments to their stance on MSA, reflecting a more measured optimism. DA Davidson maintained its strong buy rating but slightly lowered its price target from $188 to $183. They cited steady earnings and firm margins as positives, though they believe the stock was approaching its upper valuation band at the previous target.

📉 B. Riley followed a similar path—keeping its buy rating intact while trimming the price target from $200 to $195. Their view echoed the sentiment that MSA’s fundamentals are sound, but upside potential has tightened a bit given the current price level.

🔼 More notably, one upgrade came through from Wall Street Zen, who shifted their recommendation from hold to buy. The reason behind the move? They pointed to a growing backlog of safety equipment orders and consistent demand in end markets like utilities and public safety, which are expected to support near-term growth.

🎯 The consensus price target among analysts now stands around $191.80. This suggests potential upside from current levels, with individual price estimates ranging from the mid-$160s up to about $215. The general tone remains constructive, grounded in confidence about MSA’s operational efficiency and its steady, defensive business model.

Earning Report Summary

A Solid, Steady Quarter

MSA Safety turned in a solid performance in its most recent quarter, showing once again that consistency is one of its core strengths. Revenue ticked up slightly—about 1.9% compared to last year—not a blowout, but enough to keep the needle moving in the right direction. The company isn’t chasing rapid growth, and it shows. They’re more focused on delivering reliable results and maintaining their strong operating margins, which landed at a healthy 21.5%.

Earnings per share came in at $7.25, with net income around $286 million. These numbers reflect a company that’s staying disciplined, even as economic conditions remain a bit uneven. What’s more encouraging is the tone from leadership. They pointed out that while growth wasn’t explosive, demand remained firm across their core segments. Utilities, public safety, and industrial sectors are holding up well. The team noted that their backlog is growing steadily, suggesting there’s confidence among their customers, and orders are continuing to flow.

Leadership’s Outlook and Priorities

From the top down, MSA’s management struck a confident tone. They called out strong free cash flow—around $220 million—which gives them the room to balance shareholder returns with smart reinvestment in the business. Dividends are being paid regularly, share repurchases continue, and they’re not shy about putting money into R&D or improving their product line. The CFO emphasized that they’re not cutting corners on innovation to return cash. Both are priorities.

Capex came in close to $54 million for the quarter, and that’s part of a long-term view—one where MSA is quietly expanding its edge in digital safety solutions and service-oriented offerings. There’s no pivot happening, just a methodical widening of what they already do well. On the financial side, they’re keeping the balance sheet in good shape. Debt levels are under control, and their current ratio sits comfortably near 3, which gives them flexibility if opportunities come up.

Slow and Steady Wins the Race

One of the things that stood out was how intentionally MSA is moving. They’re not throwing money at growth for the sake of appearances. Instead, they’re focusing on adjacent spaces they know well—adding connected tech to safety equipment, for instance, or building out recurring revenue from service agreements. It’s a strategy rooted in understanding their customers, many of whom are dealing with strict regulations and can’t afford to take chances.

Leadership doesn’t seem worried about flashy competition. Their value comes from being a trusted partner in industries where reliability and safety are mission-critical. They’ve built that trust over decades, and now they’re simply layering on more value in a way that fits naturally with what they already offer.

Management Team

When you take a closer look at MSA Safety’s leadership, what stands out is a sense of quiet capability. CEO Matthew Loeb brings years of experience in engineering-driven firms, and that expertise shows in how the company approaches product development and market expansion. He’s not out chasing trends but instead making thoughtful moves to modernize MSA’s already reliable lineup. The CFO, Andrea Sabatini, keeps things tight on the financial side, maintaining a balanced approach to dividend payments, share repurchases, and reinvestment in future growth.

The broader team is made up of individuals who understand the environments where MSA’s products are actually used. There’s a practical mindset running through leadership decisions, built on field knowledge and long-term relationships with customers. That perspective has led to steady, deliberate expansion. They’ve been enhancing their safety technology, adding connected features to traditional gear, and exploring service contracts that deepen customer relationships. None of it is flashy, but it’s been effective. The strategy has stayed grounded in what they know best—safety—and how to do it better with each iteration.

Valuation and Stock Performance

MSA’s stock is currently trading around $164, down from its 52-week high north of $200. The valuation sits at roughly 22 to 23 times trailing earnings, a slight retreat from higher levels in late 2023. This drop doesn’t necessarily signal trouble. More likely, it’s a reflection of broader market shifts, especially as investor interest tilts toward high-growth sectors. MSA’s underlying fundamentals haven’t changed all that much, and the business continues to show consistent performance.

With book value per share around $30, the stock trades at a price-to-book ratio above 5. That premium is supported by strong returns on equity, sitting near 26 percent. It’s clear the market still values the company’s intangible strengths, including its brand reputation, regulatory expertise, and strong customer ties. From a dividend perspective, the yield is modest—just over 1 percent—but that’s paired with a very manageable payout ratio under 30 percent.

The stock isn’t cheap, but it’s not overextended either. If anything, the recent pullback brings the price into a more reasonable range for those seeking long-term consistency rather than short-term gains. For investors who prize steady cash flow and a history of reliable execution, MSA still looks like a name worth holding onto.

Risks and Considerations

While MSA has a lot going for it, there are risks to keep in mind. The company’s performance is partly tied to broader industrial and energy cycles. If spending slows in those sectors, it could put pressure on sales, especially for larger equipment orders. The services and tech side of the business may soften the blow, but they’re not yet large enough to fully cushion a downturn.

There’s also exposure to global supply chains, which means shifts in trade policies or tariffs could pose challenges. MSA has managed well through previous disruptions, but global operations always carry some risk. Currency movements, particularly a stronger dollar, can also have a quiet but persistent impact on financial results when international earnings are translated back to U.S. dollars.

The competitive landscape is also evolving. Startups and tech firms are moving into the safety space with lower costs or new digital models. MSA has responded by upgrading its product features and investing in connected technologies, but new players could still capture niche market segments if they move quickly. Lastly, although MSA’s dividend is well covered today, unexpected hits to free cash flow—whether from capex needs or a drop in orders—could narrow the margin of safety.

Final Thoughts

MSA Safety continues to stand out as a disciplined, consistent operator in a vital niche. Its leadership team stays focused on doing a few things well, rather than overreaching. That’s reflected in the steady performance of its core business and the company’s thoughtful approach to growth—measured, calculated, and well-aligned with the needs of its customers.

Valuation may not be a bargain by typical industrial standards, but it’s supported by reliable earnings, strong cash generation, and decades of shareholder-friendly policies. Risks exist, as they do with any global business, but the company’s track record suggests it’s capable of navigating the challenges.

For income-focused investors looking for a stock that won’t demand constant attention, MSA offers a reassuring profile. It’s not about explosive gains, but rather the kind of durable performance that rewards patience and consistency. Whether the market is calm or chaotic, this is a business that tends to stay on course.