Updated 6/13/25

Motorola Solutions, Inc. is a global leader in communications technology, providing mission-critical solutions for public safety and enterprises. With a strong focus on software, services, and cloud-based solutions, the company has positioned itself for continued growth in key sectors, including law enforcement, government, and enterprise communications.

Under the leadership of CEO Greg Brown, Motorola has demonstrated consistent revenue growth, supported by its innovative approach to integrating artificial intelligence and data analytics into its products. The company’s impressive cash flow generation, strategic acquisitions, and commitment to R\&D have made it a stable choice for long-term investors.

Recent Events

Motorola Solutions, Inc. (MSI) has been navigating a period of relative stability, though its stock price recently dipped by about 0.43%. Despite this slight pullback, the company remains in a strong financial position, continuing to show solid year-over-year revenue growth of 5.8%. This is a testament to its ongoing ability to adapt to industry demands, particularly in its key focus areas such as public safety and mission-critical communications.

With a market capitalization of nearly $69 billion, MSI is certainly a significant player in the tech space. While its valuation is higher than some would like, as reflected in the trailing P/E ratio of 34.45, the forward P/E ratio of 27.93 suggests that investors may expect a more balanced growth trajectory over the coming months. Even with these fluctuations, Motorola Solutions is holding its ground, thanks to its diverse revenue streams and commitment to long-term value creation.

Key Dividend Metrics

📈 Dividend Yield: 1.06%

💰 Payout Ratio: 34.53%

💵 Annual Dividend Rate: $4.36

📊 5-Year Average Dividend Yield: 1.22%

📅 Ex-Dividend Date: June 13, 2025

📅 Dividend Date: July 15, 2025

Motorola Solutions has built a strong reputation for rewarding its shareholders with consistent dividends, though its yield tends to be on the lower end compared to other dividend-paying stocks. However, the company’s low payout ratio of 34.53% shows it’s maintaining a balance between paying out dividends and reinvesting in future growth. It’s a good sign for dividend investors, indicating sustainability and room for future dividend increases without overburdening the company’s financial structure.

Dividend Overview

MSI’s dividend strategy reflects a disciplined approach. The company offers a steady annual payout of $4.36 per share, with a dividend yield that hovers around 1.06%. Although this isn’t the highest yield in the market, it’s important to keep in mind that the company’s dividend payments are highly secure, supported by its strong financials and cash flow generation.

The payout ratio is relatively conservative, signaling that Motorola Solutions isn’t stretching its resources to maintain the dividend. Instead, the company has room to manage both its dividend obligations and its growth initiatives without compromising financial health. Investors can expect regular dividends from MSI, even as the company continues to reinvest in its technology and services.

Dividend Growth and Safety

Motorola Solutions is a good example of a company that understands the importance of steady, sustainable growth over time. While its dividend yield isn’t as high as some other stocks, MSI has maintained consistent payouts, reflecting a solid track record of financial discipline. The payout ratio of 34.53% is particularly attractive for investors who prioritize safety, as it ensures the company is not overleveraged in terms of dividend payouts.

One of the standout features of MSI’s dividend policy is its capacity to grow dividends over time. With operating cash flow of $2.52 billion and a consistent track record of revenue increases, the company is well-positioned to continue supporting and even increasing its dividends as long as it maintains these strong fundamentals. This makes MSI a particularly compelling choice for dividend investors looking for both stability and gradual growth in their income.

While the company does carry some debt (its debt-to-equity ratio stands at 393.31%), the significant cash flow it generates is more than enough to cover any obligations. As a result, investors don’t need to worry about the safety of their dividend payments, even in challenging market conditions. Motorola Solutions has demonstrated a consistent ability to manage its debt while maintaining a steady dividend, making it an attractive option for those seeking reliable income.

Cash Flow Statement

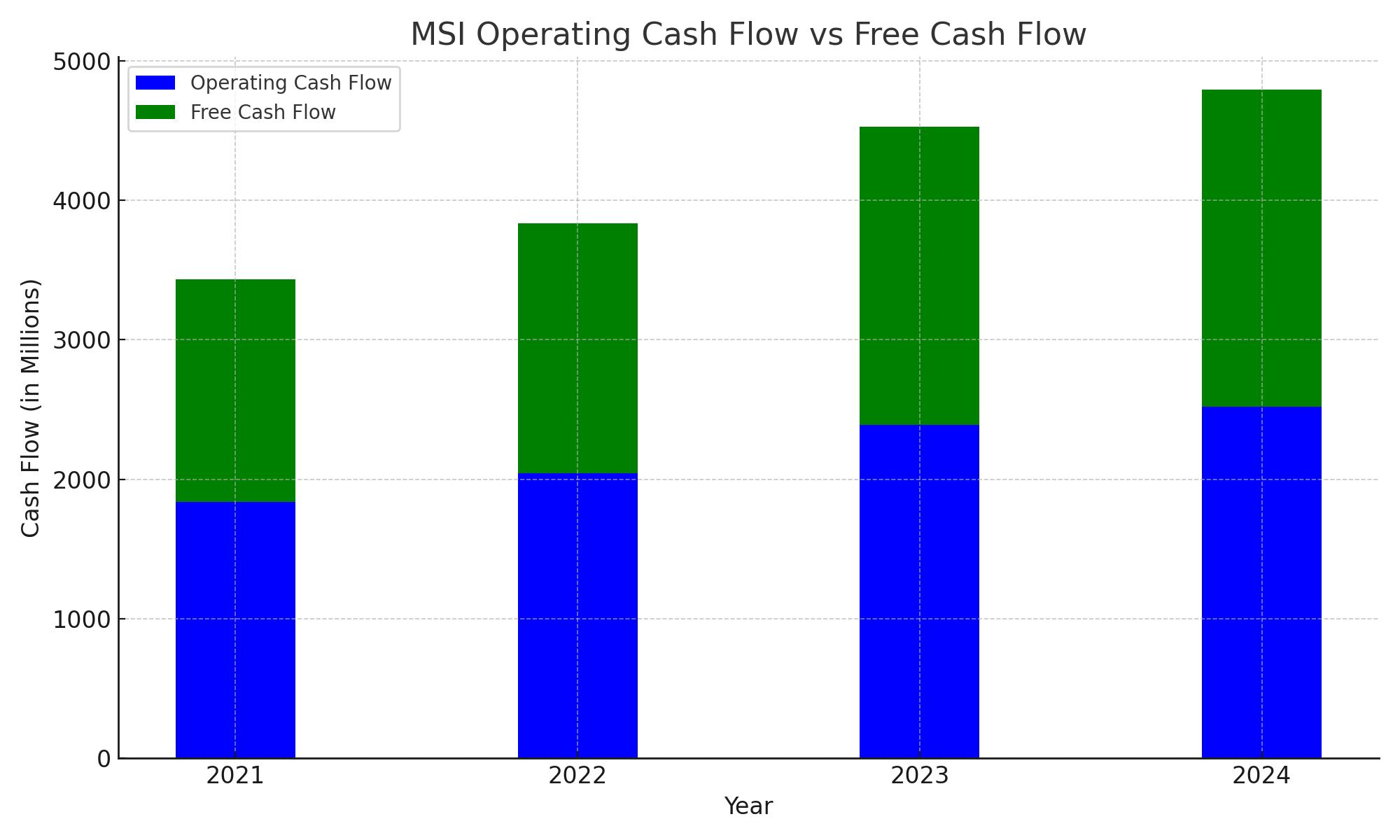

Motorola Solutions, Inc. (MSI) has demonstrated consistent operating cash flow growth over the past few years, with the trailing 12-month (TTM) figure reaching $2.52 billion. This reflects the company’s ability to generate healthy cash from its core operations, allowing it to fund investments, manage debt, and support shareholder returns. Operating cash flow has steadily increased, marking a strong performance compared to previous periods. Free cash flow, which also shows positive growth at $2.27 billion in the TTM, highlights MSI’s solid ability to maintain flexibility for reinvestment and dividend payouts.

In terms of investing and financing activities, MSI has been active in both areas, though its investing cash flow has been negative, with a TTM figure of -$937 million. This suggests the company has been investing in growth initiatives, likely in new technologies and business expansions. Financing cash flows have also been negative, reflecting debt repayments and stock repurchases, which indicates MSI’s focus on managing its capital structure. Despite these outflows, the company maintains a healthy ending cash position of $1.56 billion, ensuring liquidity and operational flexibility for future periods.

Analyst Ratings

Recently, Motorola Solutions has seen a range of analyst updates, with a mix of upgrades and downgrades based on its performance and market positioning. 📈 Analysts have generally been positive on the stock due to the company’s strong financial performance, particularly in terms of cash flow generation and revenue growth. Motorola’s consistent ability to produce healthy operating and free cash flow has been a key driver for analysts who upgraded their ratings. The company’s solid margins, even amid increasing competition, have helped reinforce its strong outlook, leading to higher price targets from some analysts.

However, not all analysts share the same enthusiasm. 📉 A few have downgraded the stock due to concerns about its high valuation relative to its growth prospects. The stock’s elevated price-to-earnings ratios have raised some eyebrows, with analysts pointing out that much of its potential has already been factored into the current price. Another factor contributing to the downgrades has been Motorola’s relatively high debt levels. While the company’s cash flow generation helps mitigate some of the risks, analysts remain cautious about the long-term impact of its debt load on the stock.

📊 The consensus price target from analysts currently sits around $480, reflecting a balanced outlook. While there’s optimism about Motorola Solutions’ long-term growth, analysts are tempered by the stock’s high valuation and potential risks associated with its debt.

Earnings Report Summary

Motorola Solutions just released its most recent earnings, and the numbers tell a strong story of growth and stability. Revenue for the quarter increased by 5.8% year-over-year, coming in at $2.7 billion. A big chunk of this growth came from the increasing demand for Motorola’s software and services, particularly in the public safety space. Their advanced video security solutions and command center software are being adopted at a rapid pace, especially by government agencies and law enforcement, which bodes well for the future.

Operating Income and Cash Flow

On the profitability side, Motorola Solutions saw a nice jump in operating income, with operating margins improving thanks to operational efficiencies and the scalability of their software platforms. Gross profit for the quarter hit $1.4 billion, and the gross margin was around 52%, which is a solid indicator of the company’s ability to maintain profitability while expanding its services.

Cash flow was another strong point in the report. The company reported operating cash flow of $2.5 billion for the trailing twelve months (TTM) and free cash flow of $2.27 billion. That’s a sign of a business that’s able to generate plenty of cash to fund future growth, return value to shareholders, and pay down debt. Leadership highlighted that this robust cash flow allows them to continue reinvesting in key technologies and infrastructure, setting the stage for sustained growth.

Leadership’s Outlook

The company’s leadership, led by CEO Greg Brown, remains confident in Motorola’s growth trajectory. They emphasized that digital transformation, especially in public safety and enterprise communication, will continue to drive Motorola’s success. Motorola is doubling down on its software solutions, artificial intelligence, and data analytics, believing these areas will play a critical role in future growth.

There’s a clear push to integrate AI and machine learning into their products, particularly in their video surveillance and analytics platforms. By staying ahead of the curve with these technologies, Motorola aims to keep its edge over competitors, providing customers with more powerful and efficient tools for real-time decision-making.

Debt Management and Future Guidance

While Motorola’s debt load is something the company continues to manage, leadership remains confident in their ability to handle it. The company’s strong cash flow helps alleviate concerns around their debt, and they plan to continue using their cash generation to pay it down over time, which will improve their capital structure and financial flexibility in the long run.

Looking ahead, Motorola Solutions raised its full-year guidance, citing a solid pipeline of opportunities in both domestic and international markets. They are especially optimistic about the second half of the year, with strong growth expected in both their government and commercial sectors. The company is focusing heavily on expanding its software and services, which they expect to drive the majority of their future growth.

Management Team

Motorola Solutions is led by a strong and experienced management team that has steered the company through multiple phases of growth and transformation. CEO Greg Brown, who has been with the company for over a decade, is known for his strategic vision and his ability to lead Motorola through its evolution into a leading provider of communications and security solutions. Under his leadership, Motorola has refocused its efforts on high-margin software and services, positioning itself to benefit from the growing demand for mission-critical technology solutions.

The leadership team also includes key executives with deep expertise in technology, finance, and operations. These individuals have successfully navigated the challenges of an increasingly complex global market, focusing on enhancing Motorola’s product offerings and expanding its footprint in key markets such as public safety and enterprise communications. The management’s emphasis on innovation, along with their disciplined financial approach, has played a significant role in driving consistent growth for the company.

One of the key factors behind Motorola’s success is the company’s focus on long-term sustainability. The management team has made significant investments in R&D, with a particular focus on cloud-based software solutions, artificial intelligence, and data analytics. This forward-looking approach is evident in their continued push to integrate AI and machine learning into their products. Leadership remains committed to staying ahead of industry trends, ensuring Motorola remains competitive in the fast-paced world of technology.

Motorola’s commitment to growth is also reflected in its M&A strategy. The company has made several strategic acquisitions in recent years, enhancing its capabilities in areas such as video surveillance, public safety software, and communications infrastructure. The management team has shown a keen ability to identify and integrate complementary technologies that not only expand the company’s product portfolio but also offer synergies that drive long-term value creation.

Valuation and Stock Performance

Motorola Solutions’ stock performance has generally been positive, although it has faced some fluctuations along the way. The stock’s current price of around $410 represents a healthy valuation relative to its performance, especially when considering its consistent revenue and profit growth. However, there are concerns about the stock being relatively expensive when compared to some of its peers, which is reflected in the company’s price-to-earnings (P/E) ratio of 34.45. This is relatively high, suggesting that the market has high expectations for Motorola’s future growth.

The forward P/E ratio of 27.93 offers some hope for a more reasonable valuation in the near term, though this still indicates that the market is anticipating continued growth from Motorola Solutions. The company’s price-to-sales (P/S) ratio of 6.47 also reflects a premium valuation, indicating that investors are willing to pay more for every dollar of sales the company generates. This is not uncommon for companies with strong growth potential and a dominant position in their respective markets.

In terms of stock performance, Motorola Solutions has managed to deliver steady returns over the past year, with a 10.03% increase in its 52-week change, though it has slightly underperformed compared to the broader S&P 500 index, which posted a 11.30% increase in the same period. The company’s price movements have been somewhat volatile, but the general trend has been upward, reflecting confidence in the company’s long-term prospects.

Motorola’s dividend yield of 1.06% is relatively modest but appealing to dividend investors who are seeking a steady, sustainable income stream. The company’s payout ratio of 34.53% suggests that the dividend is well-covered by earnings, and there’s potential for the company to increase its dividend in the future as cash flow continues to improve. The stock’s relatively low yield is indicative of its focus on reinvesting profits to fuel growth rather than paying out large dividends, a strategy that may appeal to growth-oriented investors.

Looking ahead, the stock’s valuation is likely to be influenced by a combination of factors, including the company’s ability to maintain its growth trajectory, its innovation in AI and cloud software, and the overall economic environment. While Motorola’s financial performance and strong leadership provide a solid foundation, investors should remain cautious about the stock’s high valuation relative to its peers.

Risks and Considerations

While Motorola Solutions has performed well in recent years, it is not without risks and challenges. One of the primary concerns for investors is the company’s relatively high debt load, which could become a burden if economic conditions worsen or if the company’s cash flow decreases. Motorola’s debt-to-equity ratio of 393.31% is quite high, and while the company has been managing its debt efficiently, there are always risks associated with high leverage. If interest rates rise or if the company faces challenges in its core markets, it could affect its ability to service debt and reinvest in growth.

Another risk factor is the competitive landscape in the technology and communications sectors. Motorola Solutions operates in a highly competitive environment, where technological advancements and customer preferences are constantly evolving. While Motorola has a strong position in the public safety and enterprise communications markets, it faces competition from other large players such as Cisco Systems, Nokia, and smaller, specialized firms. Maintaining its market share and continuing to innovate will be crucial to staying ahead of the competition.

Additionally, as a company with significant international exposure, Motorola is subject to risks related to global economic conditions, geopolitical tensions, and regulatory changes. Trade policies, tariffs, and changing regulations in key markets could impact the company’s ability to operate efficiently, especially in emerging markets where demand for its products is growing. The company’s global supply chain may also face disruptions due to unforeseen events like pandemics or natural disasters, which could affect its ability to deliver products on time or at the expected cost.

Another consideration is the company’s reliance on government contracts, particularly in the public safety sector. While these contracts provide a stable revenue stream, they can also be subject to changes in government spending priorities or policy shifts. If government budgets for public safety or related sectors are cut, it could negatively impact Motorola’s sales in these areas.

Lastly, there’s the challenge of maintaining growth in an increasingly mature market. While Motorola continues to innovate, much of its core business in public safety and enterprise communications is already established, and it may face challenges in finding new growth opportunities. The company’s future performance will depend on its ability to successfully scale its software solutions, integrate new technologies like AI and machine learning, and expand into new markets.

Final Thoughts

Motorola Solutions continues to be a strong player in the communications and security technology space. With a solid financial track record, impressive cash flow generation, and an experienced management team, the company is well-positioned for continued growth. However, investors should be mindful of the risks associated with its high valuation, significant debt load, and competitive pressures. The company’s strategy of focusing on high-margin software and services, along with its emphasis on innovation, should help drive future growth and maintain its position in the market.

While the stock’s current valuation may seem high relative to some peers, the growth potential in Motorola’s key markets, combined with its strong leadership and ability to adapt to changing technological trends, makes it a compelling option for long-term investors. Nevertheless, the risks surrounding global economic conditions, competitive forces, and the company’s reliance on government contracts should be carefully considered before making an investment decision.

Looking ahead, Motorola Solutions appears well-equipped to navigate the challenges of an ever-evolving market. With a strong focus on innovation and expansion into new technologies, the company is poised for continued success, although investors should remain cautious of the risks that come with high debt and competitive pressures. For those willing to accept these risks, Motorola Solutions offers an attractive growth story, but it’s important to balance optimism with a clear understanding of the factors that could affect the company’s performance in the future.