Updated 6/13/25

Morningstar, Inc. (MORN) has built a strong reputation in the investment research and financial data space, supported by durable subscription-based revenue and steady cash generation. The company reported 7% revenue growth and a 22% increase in adjusted operating income in the most recent quarter, with standout performance in its PitchBook and credit research segments. Management continues to prioritize disciplined growth, reinvesting cash flow into strategic acquisitions while maintaining shareholder returns through dividends and share repurchases.

The leadership team, led by CEO Kunal Kapoor, has emphasized a balanced approach—expanding into private credit and structured finance while keeping a close eye on cost management. With a forward P/E around 31, analysts maintain a consensus price target near $361, reflecting confidence in Morningstar’s consistency and market position. For long-term investors focused on quality and sustainable returns, the company offers a blend of operational strength, modest dividend growth, and thoughtful capital allocation.

Recent Events

In the most recent quarter, Morningstar reported some healthy progress. Revenue was up 7.2% year-over-year, while net income jumped 22.3%. That’s not just solid—it’s the kind of operational execution that tells you this business knows how to manage itself through different environments.

Operating margin came in at 19.6%, and profit margin stood at 16.6%. These numbers reflect strong efficiency and a lean cost structure. The company is spending wisely, growing where it matters, and keeping the bottom line intact.

It’s also worth noting that Morningstar generated $478 million in levered free cash flow over the last twelve months. That’s meaningful in the context of its $12.9 billion market cap. The balance sheet remains strong with over $559 million in cash and $1 billion in debt. A current ratio of 1.11 suggests they’re comfortably managing their liabilities.

The stock has traveled a broad range over the past year—from $250 up to $365—and currently sits around $301. Volatility has been pretty tame, with a beta of 1.03. This is the kind of name that tends to move with the broader market, rather than overreacting to it.

Key Dividend Metrics

📈 Forward Dividend Yield: 0.60%

💵 Forward Annual Dividend Rate: $1.82

🧮 Payout Ratio: 19.3%

📅 Next Ex-Dividend Date: July 11, 2025

📆 Next Payment Date: October 31, 2025

📊 5-Year Average Dividend Yield: 0.56%

For those who focus on dividend income, Morningstar may not immediately stand out. The yield is on the lower end, but it comes with the comfort of consistency and a strong financial foundation behind it.

Dividend Overview

The current yield of 0.60% won’t have yield-chasers lining up, but that’s not really what Morningstar is about. What it offers is a dividend that’s quietly dependable, backed by a company that produces solid earnings and strong cash flow year after year.

A key detail here is the payout ratio—just 19.3%. That’s very conservative, leaving plenty of room for reinvestment or future dividend growth. The most recent quarterly payout was $0.455 per share, part of a stable pattern that hasn’t wavered.

And don’t overlook management’s skin in the game. With insiders holding nearly 45% of the stock, there’s a clear alignment between leadership and shareholders. That kind of ownership tends to promote prudent decision-making, especially when it comes to capital returns like dividends.

Dividend Growth and Safety

Morningstar’s dividend growth profile is slow but steady. The company isn’t going to double its payout overnight, but it’s consistently nudged higher over time, in line with earnings growth. The 5-year average dividend yield of 0.56% is close to where it stands today, which tells you the growth has kept pace with the stock price appreciation.

Earnings per share currently sits at $8.92, and the forward price-to-earnings ratio is just under 31. The market clearly expects Morningstar to keep performing, and that supports the idea of continued dividend increases in the future.

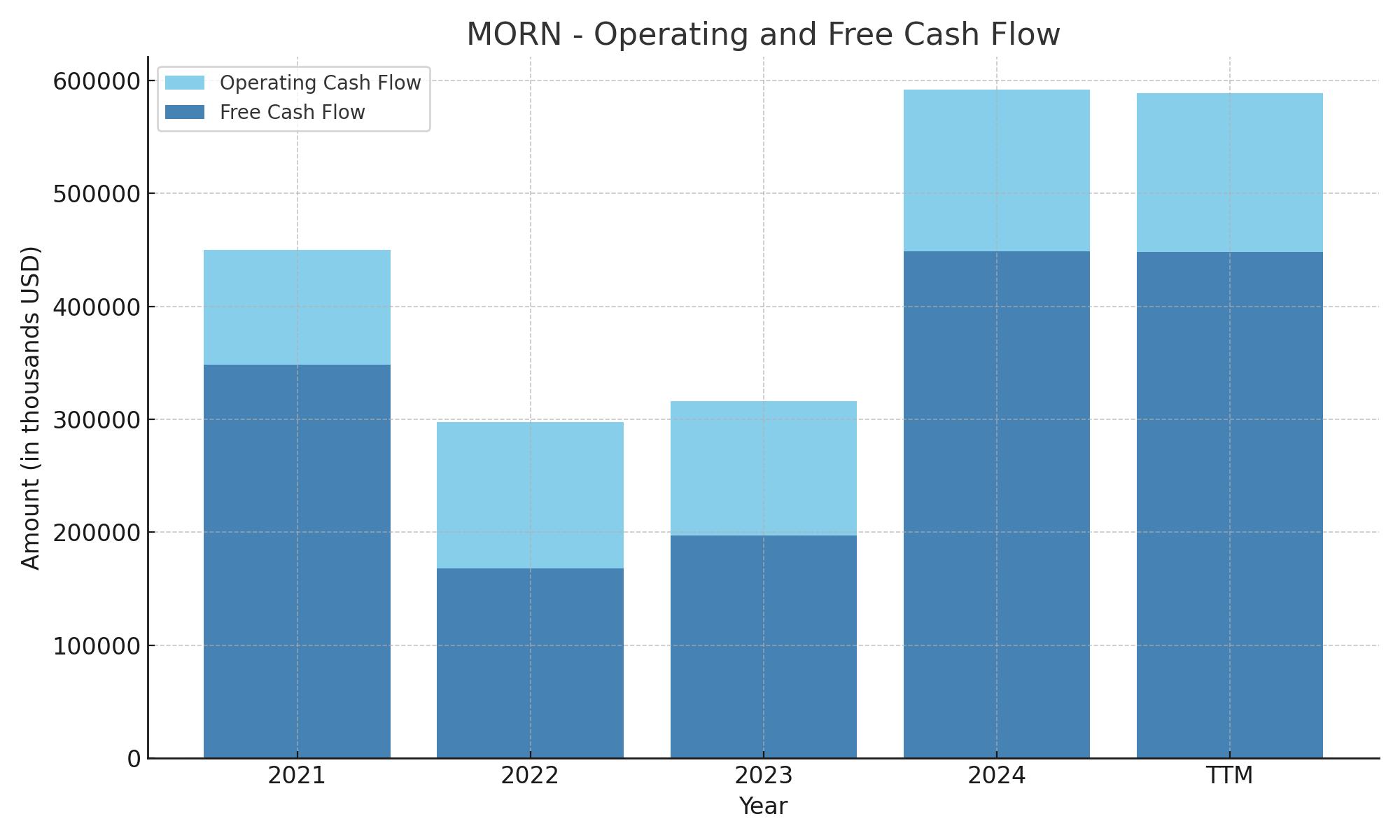

But the real underpinning here is cash flow. With $478 million in free cash flow and only a fraction of that going to dividends, there’s a wide safety margin. Operating cash flow over the past year was $589 million, more than enough to cover all payout obligations with room to spare.

Morningstar doesn’t require heavy capital expenditures to sustain growth, which gives it more flexibility. That, combined with a solid balance sheet and sticky revenue model, means the dividend isn’t just safe—it’s got room to breathe and grow.

For income-focused investors who appreciate consistency and a long-term view, Morningstar delivers. The yield might not be high, but the reliability and headroom for growth are certainly there.

Cash Flow Statement

Morningstar has maintained a strong operating cash flow position, with $589 million generated over the trailing twelve months. That marks a steady hold from the $591.6 million recorded in 2024, and a significant improvement over prior years, reflecting both increased revenues and effective cost management. Free cash flow for the same period stood at $448.2 million—evidence that the business not only generates strong earnings but converts those earnings into real, usable cash after capital expenditures.

On the investing side, cash outflows were relatively modest at $65.3 million, mostly attributed to capital spending, which remains consistent around $140–$150 million annually. Financing cash flow was more aggressive, with $365 million flowing out, primarily due to debt repayments and share repurchases. Notably, debt reduction outpaced new borrowings, signaling a clear effort to de-lever the balance sheet. The company ended the period with $512.4 million in cash, up slightly from the previous year, providing solid liquidity and flexibility for both operations and capital returns.

Analyst Ratings

📈 BMO Capital Markets recently raised their price target on Morningstar to $355, up from $339. The move reflects confidence in the company’s core business lines, particularly its subscription and research segments. Analysts pointed to strong client retention and a resilient fee-based model that continues to generate stable cash flow. These fundamentals supported their more optimistic view on where the stock could head next.

🔍 On the other hand, Redburn Atlantic shifted its stance from Buy to Neutral, lowering its target to $340. Their downgrade was driven more by valuation than fundamentals. The firm noted that while Morningstar’s business remains solid, the current stock price already reflects much of that strength. In their view, the premium valuation may limit upside potential in the short term, even as the company’s long-term prospects remain intact.

📊 Looking at the broader analyst landscape, the consensus price target sits around $361. That suggests a potential upside of roughly 19–20% from where the stock is currently trading. The range of targets spans from $338 to $362, reflecting cautious optimism. Morningstar’s consistent earnings performance, dependable free cash flow, and recurring revenue streams are keeping sentiment in positive territory—even as analysts stay mindful of price-to-earnings multiples.

Earning Report Summary

Solid Start to the Year

Morningstar opened 2025 on a confident note. Revenue came in at $581.9 million for the quarter, up about 7% from the same time last year. A big chunk of that growth—roughly 9%—was organic, showing that the core business is still expanding without needing a bunch of outside help. Operating income was also strong, jumping 23%, with adjusted operating income up just over 22%. When you see those kinds of gains in both top-line and bottom-line numbers, it’s usually a good sign that operations are running efficiently.

Net income landed at $78.5 million, which breaks down to $1.82 per diluted share. That’s a healthy 22% improvement over the prior year. Adjusted earnings per share did even better, rising nearly 29% to $2.23. So not only is the company growing, but it’s also getting more profitable as it goes.

A Look at Cash Flow and Capital Moves

Cash generation was solid this quarter. Operating cash flow hit $91 million, and while free cash flow dipped slightly to $58.8 million, it was still strong enough to fund the company’s share buybacks. Morningstar repurchased about 368,000 shares, spending just under $110 million. That’s a pretty big show of confidence from leadership.

To help finance a few new acquisitions—namely Lumonic and DealX—Morningstar added $105 million in borrowings. These moves are part of a strategy to build out more tools in private credit and structured finance, areas the company believes will be increasingly important to clients.

What Leadership Had to Say

CEO Kunal Kapoor called out the strong performance of PitchBook and Morningstar Credit as key drivers for the quarter. He described the company’s recent acquisitions as thoughtful expansions that align with their long-term strategy. Kapoor emphasized that even in a tricky market, they’re staying focused on steady, sustainable growth.

He also made it clear that Morningstar isn’t just chasing top-line numbers. The team is being selective about where to grow and how to allocate resources. They’re watching the broader economy carefully but not letting uncertainty get in the way of long-term planning.

Efficiency and Execution

Operating expenses rose just 4%, which is low compared to the revenue gains. That tells you management is keeping a tight grip on costs, even as they invest in talent and technology. Expenses related to employee compensation and infrastructure were planned and well-controlled, helping to preserve margin strength.

Overall, it was a quarter that checked all the right boxes—growth, profitability, and discipline. Morningstar continues to balance strategic ambition with financial stability, giving shareholders reasons to stay patient and optimistic.

Management Team

Morningstar’s leadership team blends long-term vision with a steady operational hand. At the center is Kunal Kapoor, who has served as CEO since 2021. His approach to growth emphasizes steady expansion, particularly in areas like private credit and structured finance. Under his direction, the company has pursued targeted acquisitions, aiming to broaden its analytics and data capabilities while maintaining a disciplined financial stance.

Chief Financial Officer Andrew Zaffiro supports that effort with careful capital management. In the latest quarter, he oversaw both debt issuance and repayment while directing share buybacks that returned value to shareholders. His role in maintaining Morningstar’s financial flexibility has allowed the company to invest in new areas without compromising its balance sheet.

The rest of the management team includes experienced leaders in product development, technology, and client services. They’ve helped ensure that while Morningstar evolves, it does so in a way that maintains consistency for its customer base. There’s a noticeable emphasis on operational efficiency and product integrity, which reflects in everything from cost control to platform reliability. This group doesn’t chase headlines, but they execute with clarity and care, which has been key to Morningstar’s reputation.

Valuation and Stock Performance

Morningstar’s stock trades at a forward price-to-earnings ratio around 31, a level that suggests investors are willing to pay a premium for steady revenue and dependable earnings. That premium is rooted in the company’s reliable performance—earnings per share over the past year reached nearly $8.92, and operating cash flow continues to hold steady.

The stock has moved within a wide but stable range between $250 and $365 over the past 12 months. Currently priced near $300, it’s positioned slightly below its long-term average, though not dramatically. With a beta close to 1.03, Morningstar tends to move with the broader market, rather than in exaggerated swings. That sort of behavior reflects its identity as a quality-driven, relatively low-volatility name.

Analyst price targets hover in the mid to upper $350s, reflecting moderate expected upside. The market seems to be assigning fair value for consistent growth and durable cash flow, rather than pricing in explosive potential. That works well for investors looking for long-term return stability rather than rapid appreciation. In that context, Morningstar offers a valuation that matches its personality—measured, methodical, and built to last.

Risks and Considerations

There are some clear risks investors should keep in mind. The first is valuation pressure. While Morningstar’s premium is justified by its fundamentals, market shifts or economic slowdowns could pull that multiple lower, even if the business continues to perform well. Any broader downturn in sentiment could hurt stocks with relatively high P/E ratios.

Acquisition-related risk is another area to watch. Integrating new platforms like Lumonic and DealX may take time, and success isn’t guaranteed. Issues like overlapping systems, client transitions, or unexpected costs could weigh on results if they’re not carefully managed.

Another factor is the subscription nature of Morningstar’s business. It provides consistent revenue, but also depends heavily on client retention. In a tight economy, some clients may delay renewals or reduce service levels. While Morningstar’s customer loyalty has traditionally been strong, the model still carries risk if client priorities change.

There’s also industry competition. Fintech startups and larger data providers continue to push into analytics and research. Morningstar will need to keep innovating to stay ahead. This means continued investment in tools and infrastructure, which could weigh on margins if not tightly managed.

Final Thoughts

Morningstar represents a type of company that doesn’t seek the spotlight but continues to perform. Its value lies in its stability. The leadership team manages the business with care, balancing innovation with financial discipline. Cash flow remains strong, the dividend is comfortably supported by earnings, and the business model—anchored in subscription services—offers visibility that many investors appreciate.

The company doesn’t chase growth for its own sake. Instead, it focuses on what it does best: delivering high-quality financial research and analytics with a steady hand. Whether it’s through targeted acquisitions or measured product expansion, Morningstar continues to build strength quietly.

For those looking for predictable cash flow, a sustainable dividend, and management that makes thoughtful capital decisions, Morningstar delivers. It may not offer rapid-fire gains, but its long-term consistency offers its own kind of reward. This is the kind of stock that fits comfortably into a portfolio built for durability and discipline.