Updated 6/3/25

For investors looking to blend growth with a reliable stream of income, Monolithic Power Systems (MPWR) may not be the first name that comes to mind. It’s a company steeped in advanced power solutions—semiconductors that drive everything from data centers and automotive systems to industrial and telecom applications. At a glance, it seems geared toward growth chasers. But a closer look reveals a dividend story quietly gaining momentum behind the scenes.

This isn’t your typical high-yield stock. Instead, MPWR fits into that special niche of tech companies that have built up enough financial muscle to return capital to shareholders while continuing to reinvest in their business. It’s the kind of stock that can quietly build wealth over time for the income-minded investor who’s willing to look beyond the surface.

Recent Events

MPWR’s most recent quarter ended March 2025, and the results were, quite frankly, impressive. Revenue rose by nearly 40% year-over-year, bringing in $2.39 billion over the trailing twelve months. Net income was a strong $1.83 billion, and that translated into an almost unbelievable 76.6% profit margin. That level of profitability is rare, especially in a sector known for heavy competition and cyclical swings.

What stands out even more is the consistency. Earnings per share hit $37.51 over the past year, marking a 44.6% jump from the year prior. That’s not just growth—it’s explosive, and it’s being supported by underlying demand, pricing strength, and smart execution.

Cash generation remains a bright spot. Operating cash flow came in at $796.75 million, with free cash flow of $443.83 million after accounting for investments. Those numbers tell you the dividend isn’t just sustainable—it’s backed by real, recurring cash, not accounting tricks or financial engineering.

Key Dividend Metrics

📈 Forward Dividend Yield: 0.93%

💰 Annual Dividend Rate: $6.24

📅 Most Recent Dividend Date: April 15, 2025

🚫 Payout Ratio: 14.16%

📊 5-Year Average Dividend Yield: 0.64%

🔁 Dividend Growth (5-Year Average): Up steadily each year

🛡️ Dividend Safety: Strong, thanks to fortress-like financials and high return on equity

Dividend Overview

At just under 1%, MPWR’s dividend yield might not raise eyebrows at first glance. But that small number is only part of the story. What really matters here is sustainability and growth potential.

The company pays out just 14.16% of its earnings in dividends, which is incredibly conservative. That gives it a wide runway to keep raising payouts year after year, even if earnings were to slow temporarily. There’s also no conflict between rewarding shareholders and funding innovation—MPWR’s cash flows are healthy enough to do both.

More importantly, this isn’t a new trend. The company has been building up its dividend profile with purpose. Over the past five years, the average yield has ticked up from 0.64% while the payout itself has grown significantly. It’s not a stock you buy for instant income—it’s one you hold to watch your income grow steadily over time.

Dividend Growth and Safety

When it comes to dividend safety, MPWR checks all the boxes. The balance sheet is rock solid. With just $17.75 million in total debt against over $1 billion in cash, there’s no question the company can weather downturns. The current ratio stands at 4.92, another sign of financial strength.

And with return on equity approaching 68%, the company is clearly putting its capital to work effectively. That kind of number is almost unheard of, and it speaks volumes about the quality of the business model.

The recent dividend hike—from $5.31 to $6.24 annually—is a signal of confidence. That’s nearly an 18% increase in one shot, and it aligns with the kind of cash generation MPWR is delivering. The company doesn’t need to stretch or dip into reserves to fund this payout. It’s coming straight from organic earnings.

There’s also no indication that the pace of growth is slowing. With EPS over $37 and consistent revenue expansion, management has the flexibility to continue boosting the dividend in tandem with profitability. The structure is in place for MPWR to evolve into a serious dividend growth stock in the coming years.

For income-focused investors who aren’t just chasing the highest yield but are instead looking for growth, reliability, and long-term compounding, MPWR offers a compelling story. It may not fit the mold of a classic dividend stock, but that might just be what makes it worth a closer look.

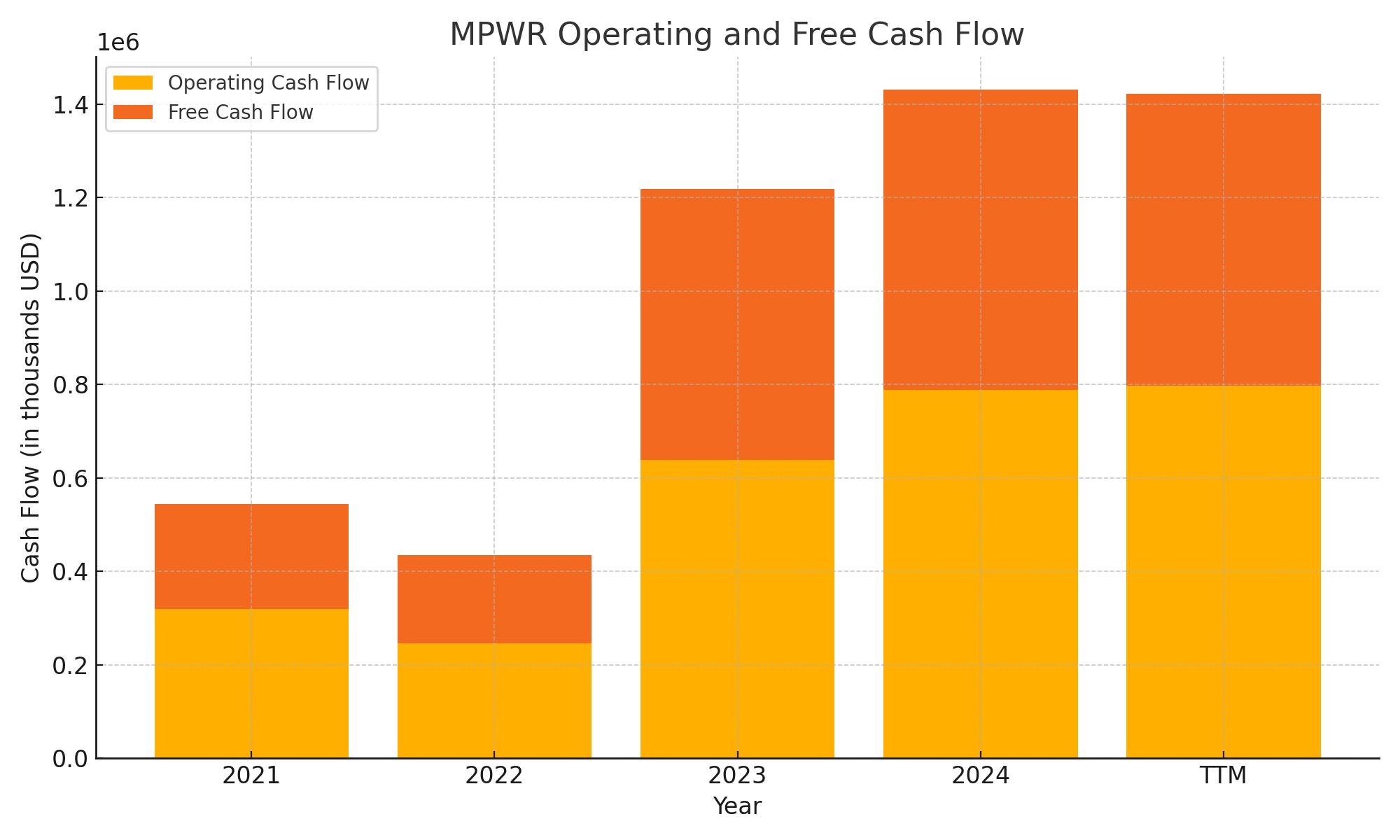

Cash Flow Statement

Monolithic Power Systems has shown strong consistency in its ability to generate cash from operations, with trailing 12-month (TTM) operating cash flow reaching $796.7 million. This marks a slight uptick from the prior year and continues a multi-year trend of growth, reflecting a healthy, scalable business model. Capital expenditures also rose to $170.5 million in the TTM period, a sign that the company continues to invest back into its operations. Even so, free cash flow remained strong at $626.3 million, giving the company substantial room to support dividends, buybacks, or future investments.

On the financing side, MPWR returned significant capital to shareholders, with $632.2 million spent on share repurchases alone. Financing cash flow totaled a negative $878.1 million in the TTM period, underscoring its shareholder-friendly capital strategy. The company did not issue or repay debt, maintaining a clean balance sheet. Meanwhile, investing cash flow was positive at $231.6 million, signaling some asset sales or returns on earlier investments. Overall, cash on hand ended at $638.6 million, slightly lower than the previous year, but still very healthy given the scale of returns to shareholders.

Analyst Ratings

📈 Monolithic Power Systems (MPWR) has seen a wave of analyst updates lately, and the tone remains largely optimistic. The consensus rating currently leans toward a “Moderate Buy,” a reflection of ongoing confidence in the company’s financial performance and long-term outlook.

💹 Citigroup maintained its Buy stance while lifting its price target from $615 to $700, encouraged by MPWR’s solid earnings beat and momentum in the AI hardware and automotive segments. Meanwhile, Raymond James took a more cautious approach, keeping an Outperform rating but trimming the target from $925 to $720 to factor in broader market volatility and sector valuation resets.

🔍 KeyBanc also reaffirmed its Overweight rating, adjusting the price target slightly downward from $850 to $820. Their outlook remains positive on the strength of recurring revenues and strong margins. In contrast, Rosenblatt maintained a Neutral stance, resetting its target to $644, pointing to valuation pressures despite the company’s operational excellence.

🎯 The average analyst price target now sits around $768.71, with a range that stretches from a low of $644 to a high of $943.95. That gives the stock room for about 13% upside from recent levels.

💼 These updates highlight MPWR’s consistent execution and the broader confidence in its positioning within key growth markets like data centers and EVs, even as analysts fine-tune their numbers in response to the latest earnings results.

Earnings Report Summary

Strong Start to the Year

Monolithic Power Systems kicked off 2025 with a solid performance that exceeded many expectations. Revenue came in at $637.6 million for the first quarter, up 39.2% compared to the same period last year. Much of that growth was powered by strength in the company’s Storage and Computing business, which jumped 38% from the previous quarter. Automotive also contributed nicely, up 13% quarter-over-quarter. These gains reflect the company’s ability to execute across a wide range of sectors and adapt to shifting customer demands.

Michael Hsing, the company’s CEO, spoke about MPWR’s shift from being strictly a chipmaker to offering full-service silicon-based solutions. It’s a broader vision that ties together the company’s innovation pipeline with the practical needs of customers in industries like robotics, electric vehicles, building automation, and data centers. Hsing emphasized that continuing to deliver innovation while staying close to what customers actually need is at the heart of their strategy.

Earnings and Margins Hold Steady

On the profitability front, MPWR posted GAAP net income of $133.8 million, translating to $2.79 per diluted share. On a non-GAAP basis, net income reached $193.8 million, or $4.04 per share. Gross margins stayed healthy too—GAAP gross margin was 55.4%, and non-GAAP edged slightly higher at 55.7%. These margins are a good reflection of pricing discipline and a well-managed cost structure.

Cash flow was another bright spot. Operating cash flow hit $256.4 million, showing how efficiently the company is converting its earnings into cash. That kind of strength provides flexibility—not just to return value to shareholders but also to invest in the business where it counts.

What’s Ahead

Looking to the next quarter, MPWR expects revenue between $640 million and $660 million. Gross margins are expected to stay in a similar range, with GAAP margins between 54.9% and 55.5%, and non-GAAP between 55.2% and 55.8%. Operating expenses are projected to land between $189 million and $195 million on a GAAP basis, or slightly lower if you strip out stock-based comp and other adjustments.

Leadership sounded optimistic about where the business is headed. They’re leaning into innovation and keeping the customer at the center of everything. There’s also been a steady focus on expanding into new applications and strengthening the supply chain, which should help navigate any bumps that may come later in the year. All in all, the tone was confident, and the numbers backed it up.

Management Team

Monolithic Power Systems (MPWR) is guided by founder and CEO Michael Hsing, who launched the company in 1997 with the goal of transforming how power systems are integrated onto chips. His approach has shaped MPWR into a leader in analog and mixed-signal semiconductors, emphasizing simplicity, performance, and reliability.

Supporting Hsing is a group of long-tenured executives. Theodore Blegen serves as Executive Vice President and CFO, bringing nearly a decade of financial leadership to MPWR. Deming Xiao, Executive Vice President of Global Operations, oversees the company’s worldwide manufacturing and logistics strategy. Saria Tseng leads strategic corporate development and has played a key role in long-term planning for more than 20 years. Maurice Sciammas, in charge of worldwide sales and marketing, has helped expand MPWR’s global customer base over the past 18 years.

This team has steered the company through market cycles with a focus on innovation, customer satisfaction, and operational discipline. Their continuity and shared vision are a strong part of the company’s consistent execution.

Valuation and Stock Performance

As of early June 2025, MPWR trades around $685 per share. That puts the stock roughly 28 percent below its 52-week high of $959 but well above its 52-week low near $439. Like much of the tech sector, it has seen its share of price swings over the past year, reflecting both changing investor sentiment and sector-wide valuation resets.

With a current market cap close to $27.8 billion and a trailing P/E ratio of 15.19, MPWR’s valuation looks more reasonable than it did during the sector’s peak. Analysts tracking the name have landed on a consensus 12-month price target of about $768. That leaves some room for upside from current levels, though the range of estimates remains broad, reflecting differing views on growth durability and broader market direction.

Earnings have been strong, with net income over the trailing twelve months reaching $1.83 billion and earnings per share climbing to $37.49. The company also maintains a clean balance sheet, minimal debt, and strong free cash flow, all of which provide room for reinvestment and shareholder returns.

Risks and Considerations

No investment is without its risks, and MPWR is no exception. As a semiconductor company, it operates in a highly cyclical industry. Demand can shift quickly, especially when broader economic or tech spending trends change.

Valuation is another consideration. While the current multiples look better than they did a year ago, some investors may still feel hesitant given the competitive landscape and potential for short-term earnings volatility. The high level of innovation in this space also means MPWR must constantly stay ahead of shifting technology standards.

Supply chain constraints, while improving, remain an operational risk, especially for a company that relies on a global manufacturing and logistics footprint. Regulatory developments, particularly in international trade or technology exports, could also introduce uncertainty.

For long-term investors, understanding these risks is essential. It’s a business built for growth, but not without exposure to factors beyond its control.

Final Thoughts

Monolithic Power Systems has built a strong track record as a dependable and innovative player in the power management chip space. The leadership team’s long tenure and focused execution give the company a sense of stability that’s not always common in the tech sector.

The recent financial performance speaks for itself—strong revenue growth, expanding earnings, and solid free cash flow. The company also returns capital to shareholders, all while continuing to invest in its long-term growth path.

While the stock may not be cheap on some traditional metrics, it offers investors exposure to a business with high margins, scalable technology, and a clear vision. As with any stock, it’s important to weigh the potential rewards against the risks. But for those looking for a combination of operational strength and dividend growth potential in the tech space, MPWR stands out as one worth keeping on the radar.