Updated 6/3/25

Mondelez International might not be the most talked-about stock at the moment, but it quietly holds a strong position in the portfolios of income-focused investors. With a lineup that includes Oreos, Cadbury chocolate, and Ritz crackers, Mondelez has crafted a resilient, globally recognized snack empire. This is a company built on everyday indulgences—small-ticket items that don’t get cut even when budgets tighten.

The firm operates in over 150 countries and leans heavily on emerging markets for long-term growth potential. Meanwhile, its presence in more mature markets gives it pricing power and some nice efficiencies. In short, Mondelez knows its niche and sticks to what it does best.

For those looking for consistency in their dividend payers, Mondelez is worth a deeper dive. Let’s get into what’s been happening recently and how its dividend story stacks up.

Recent Events

Mondelez’s recent performance has been somewhat uneven. Revenue barely nudged upward in the latest quarter, with only 0.2% year-over-year growth. The more striking headline came from earnings, which took a sharp drop—down over 70% compared to the previous year. That’s not the trend anyone likes to see, but context matters.

A combination of inflationary pressures, currency headwinds, and supply chain costs have put a squeeze on margins. Despite those challenges, Mondelez has continued to deliver strong free cash flow—$3.6 billion in levered FCF over the last twelve months, to be specific. That cash is what underpins the dividend, and it’s still flowing.

The company is also carrying a decent amount of debt—over $20 billion—which raises an eyebrow. Its debt-to-equity ratio sits at 78%, and the current ratio of just 0.61 doesn’t leave a lot of wiggle room in the short term. However, for a company of this size and stability, it’s not a red flag. It’s something to watch, but not panic over.

Key Dividend Metrics

📈 Forward Dividend Yield: 2.78%

💰 Annual Dividend: $1.88 per share

📊 Payout Ratio: 68.22%

📆 Next Dividend Date: July 14, 2025

⏳ Ex-Dividend Date: June 30, 2025

📉 5-Year Average Yield: 2.26%

🔒 Dividend Growth Streak: 11 years

💼 Free Cash Flow Coverage: $3.6 billion

🛡 Debt Load: $20.16 billion

⚖️ Beta: 0.50

Dividend Overview

Mondelez doesn’t make a lot of noise with its dividend, but that quiet consistency is exactly what makes it appealing for income investors. The current yield of 2.78% is modest but still comfortably ahead of its five-year average. That alone makes the stock look relatively attractive at current prices.

Its payout ratio, sitting at just over 68%, might seem a bit high on the surface. But for Mondelez, that’s still within a manageable range, especially when supported by strong and stable cash flows. The dividend isn’t being paid out of hope—it’s covered by real, recurring income.

And the company isn’t just handing out dividends. It’s also been buying back shares, adding another layer of shareholder return. It’s a model that’s worked well over the years: maintain a steady dividend, reinvest in growth, and return excess cash when it makes sense.

Dividend Growth and Safety

Where Mondelez really earns its spot in a dividend portfolio is in the way it treats its shareholders over time. It’s been raising its dividend consistently for over a decade, showing a commitment to steady, reliable income rather than flash-in-the-pan jumps.

In terms of growth, the pace has been reasonable—not aggressive, but consistent. That fits the company’s personality. Mondelez isn’t trying to wow the market; it’s here to deliver dependable, repeatable results. For long-term income investors, that’s exactly the type of play you want as a foundation.

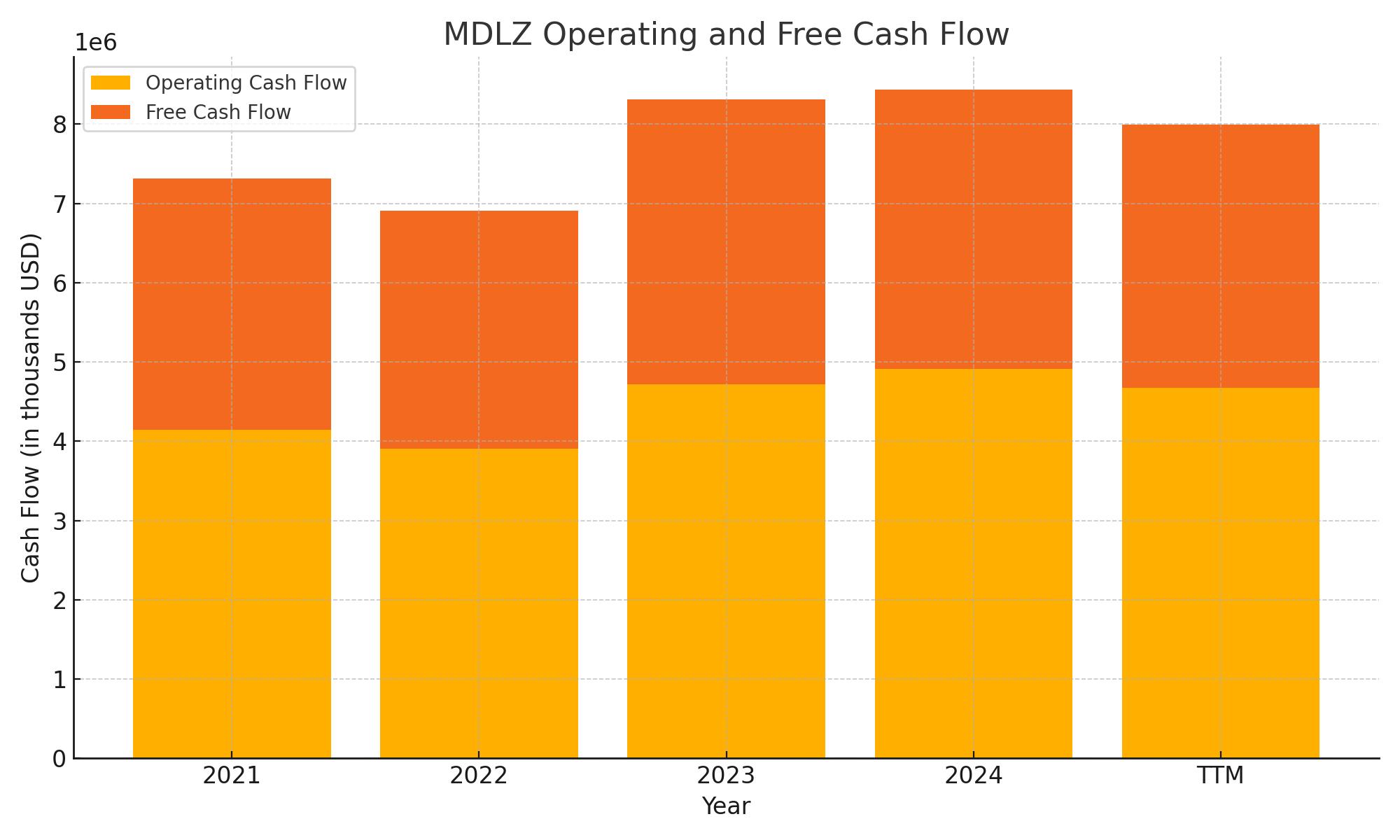

Cash flow tells the real story. With $4.68 billion in operating cash flow last year, there’s plenty of cushion to cover dividends and buybacks. It’s a sign that even when earnings take a hit, the company still has the firepower to support its dividend.

Now, there are things to keep an eye on. The debt level is notable, especially in a higher interest rate environment. If borrowing costs rise further, the company might eventually need to rethink capital allocation. That could mean pulling back on buybacks or slowing the pace of dividend growth. But so far, there’s no sign that the dividend itself is at risk.

With a low beta of 0.50, the stock doesn’t swing around much. That kind of stability makes it especially appealing for those looking to protect capital while earning steady income. In a volatile world, Mondelez feels like a steady hand—and sometimes, that’s the most valuable thing in a portfolio built around dividends.

Cash Flow Statement

Mondelez International has demonstrated consistent strength in its operating cash flow, pulling in $4.68 billion over the trailing twelve months. This is in line with previous years, reflecting the company’s stable core operations despite recent earnings volatility. Capital expenditures came in at $1.37 billion, resulting in a solid free cash flow of $3.31 billion, which comfortably supports dividends and share buybacks. That level of free cash flow is not only healthy but suggests Mondelez can continue rewarding shareholders without straining its financial flexibility.

On the financing side, Mondelez saw a cash outflow of $5.26 billion, largely due to debt repayments and aggressive share repurchases. The company paid down $2.82 billion in debt while issuing just $1.12 billion, tightening its leverage modestly. Share buybacks were a significant factor, with $3.29 billion used to repurchase stock. On the investing front, the company actually recorded a cash inflow of $721 million, which is a reversal from prior years that saw large outflows, particularly in 2021. The ending cash position rose slightly to $1.6 billion, showing Mondelez is maintaining liquidity while managing capital return and investment needs with discipline.

Analyst Ratings

📉 Mondelez International (MDLZ) has recently seen a mix of analyst actions, reflecting both confidence in its long-term prospects and caution regarding near-term challenges.

🔁 On April 24, 2025, DA Davidson downgraded MDLZ from “Buy” to “Neutral,” adjusting the price target from $66 to $68. This shift was driven by concerns over slowing revenue growth and potential pressure on profit margins, suggesting a more measured outlook on short-term performance.

📈 On the other side of the aisle, optimism hasn’t disappeared. Barclays reaffirmed its “Overweight” rating on May 1, 2025, and nudged its price target up from $71 to $74. The firm cited steady progress in strategic initiatives and confidence in the company’s category leadership as reasons for its continued support. Stifel and RBC Capital also reiterated positive outlooks—Stifel lifted its target to $73, while RBC pushed its to $71. Both noted Mondelez’s consistent cash flow and global scale as strengths that should play well over time.

📊 The general tone from Wall Street remains cautiously constructive. The average 12-month price target across analysts now sits at approximately $70.55, with a wide range spanning from $52 to $88. With shares hovering around $67, there’s still a modest upside priced in by the Street.

Earning Report Summary

A Mixed Start to the Year

Mondelez International kicked off 2025 with a quarter that left room for both encouragement and concern. Revenue came in at $9.31 billion, barely above where it was a year ago. The real story, though, was in the underlying numbers. Adjusted for currency shifts and other one-offs, organic revenue was up 3.1%. That growth didn’t come from selling more snacks—volume and mix actually fell by 3.5%. Instead, Mondelez leaned into pricing, which jumped 6.6% and helped hold the top line steady.

Performance varied by geography. Europe and AMEA turned in decent numbers, while North America and Latin America came in a bit softer. On the product side, chocolate was the standout performer. Even with lower volume, revenue in that category climbed 10.1%, thanks to new launches like the Cadbury Dairy Milk Biscoff bar that found strong early traction.

Pressures on Margins

That said, the profit side of the equation took a hit. Gross profit and operating income both saw meaningful declines. Higher ingredient and shipping costs, combined with an unfavorable product mix, pushed gross margin down sharply to 26.1%. Operating margin dropped as well, landing at 7.3%. These numbers reflect a challenging cost environment that isn’t letting up just yet.

Earnings per share told the same story. GAAP EPS was down more than 70% to just $0.31, with adjusted EPS at $0.74, also showing a noticeable decline. Despite this, Mondelez still managed to generate over a billion dollars in operating cash flow. Free cash flow came in at $800 million, and the company returned a healthy $2.1 billion to shareholders between dividends and buybacks.

Keeping the Full-Year View Steady

Even with all the noise in the quarter, Mondelez leadership didn’t change its view for the full year. They’re still aiming for around 5% organic revenue growth and expect adjusted EPS to be down about 10% on a constant currency basis. Free cash flow should top $3 billion.

CEO Dirk Van de Put pointed to strong share performance and pricing execution as signs that the business model is holding up. Despite the margin squeeze, the company is staying the course on its strategy. With brand strength across multiple regions and categories, Mondelez seems focused on playing the long game rather than reacting too quickly to short-term cost headwinds.

Management Team

Mondelez International is under the leadership of Chairman and CEO Dirk Van de Put, who took the reins in 2017. Since then, he’s helped steer the company through global expansion and a refined focus on snacking as its core. He’s known for championing brand strength while also pushing innovation and operational efficiency.

Supporting him is CFO Luca Zaramella, who plays a central role in managing the company’s balance sheet and capital allocation. He’s been part of the Mondelez ecosystem for over two decades and brings deep institutional knowledge. The broader executive team includes leaders across business transformation, digital strategy, and global category management, all working in tandem to keep Mondelez agile and focused in a competitive landscape. Their collective experience positions the company to balance short-term performance with long-term strategic growth.

Valuation and Stock Performance

Mondelez shares are trading at around $67, giving the company a market cap close to $87 billion. Its enterprise value sits at roughly $106 billion, reflecting the broader footprint of its debt and cash flow picture. The current price-to-earnings ratio is just over 25, while the forward P/E of 22 suggests a slightly more favorable valuation based on projected earnings.

Over the past year, the stock has traded between $54 and $76, showing some sensitivity to macroeconomic shifts and earnings volatility. The average analyst price target is about $70.50, with a range stretching from $52 on the low end to $88 on the high side. While not explosive, this implies a steady path higher, especially if the company can deliver on operational efficiency and brand growth.

Risks and Considerations

One of the most consistent challenges Mondelez faces is input cost inflation. Ingredients like cocoa and wheat have seen price volatility, and while Mondelez has pricing power, there’s only so much that can be passed on to consumers before volume takes a hit. That dynamic is especially relevant in developed markets where snack competition is fierce and brand loyalty is tested by affordability.

The company also operates globally, which brings exposure to regulatory and geopolitical risk. Currency fluctuations, trade policy changes, and regional instability all have the potential to affect earnings. There’s also reputational risk from ongoing legal actions, such as recent claims of packaging design infringement. While these may not be material individually, they can add up over time.

Finally, debt is something to monitor. While Mondelez generates healthy free cash flow, it also carries over $20 billion in debt. The interest environment matters here, particularly if rates remain elevated and refinancing becomes more expensive.

Final Thoughts

Mondelez is not a fast-moving growth story, but it doesn’t need to be. It’s a company built on brands that people reach for every day. The stability of its products, combined with a clear dividend policy and a disciplined capital allocation strategy, makes it an appealing option for income-focused investors.

Leadership is experienced, strategy is consistent, and despite some near-term margin pressure, the long-term picture remains intact. Mondelez has weathered supply chain disruptions, inflation, and shifting consumer preferences, and it continues to deliver. In a world where consistency can be hard to find, that steadiness can be worth quite a bit.