Updated 6/3/25

Microsoft has come a long way from being just the company behind Windows. Today, it dominates cloud computing, artificial intelligence, enterprise software, and gaming. With a market cap well over $2.8 trillion, it stands as one of the most powerful technology companies in the world.

While Microsoft is often thought of as a growth stock, it has also quietly built a strong reputation as a dividend payer. It might not be a high-yield stock, but the combination of dividend growth, financial strength, and long-term stability makes it an interesting choice for income investors.

Recent Events

Microsoft just wrapped up its most recent quarter in March 2025 with numbers that once again showed why it’s in a league of its own. Revenue came in at $270 billion, up 13.3% from the same time last year. What’s even more impressive? Net income rose nearly 18%, hitting $96.6 billion.

These aren’t just growth numbers—they’re growth numbers from a company that’s already massive. That kind of performance this late in its business cycle suggests Microsoft isn’t coasting. Instead, it’s finding new engines of momentum through its Azure cloud offerings and AI integration across its platforms like Microsoft 365 and LinkedIn.

Financially, it continues to operate from a position of strength. With $79.6 billion in cash and a debt-to-equity ratio under 33%, Microsoft isn’t just surviving—it’s thriving. These fundamentals are the backbone that supports its dividend track record, giving it the room to grow payouts even in less favorable markets.

Key Dividend Metrics

📈 Forward Dividend Yield: 0.72%

💰 Forward Annual Dividend: $3.32 per share

🧱 Payout Ratio: 24.42%

📊 5-Year Average Dividend Yield: 0.83%

📅 Next Dividend Date: June 12, 2025

🔁 Last Stock Split: 2-for-1 on February 18, 2003

🏦 Operating Cash Flow: $130.7 billion

Microsoft might not offer a jaw-dropping dividend yield, but when you see it lined up with its financial position and growth trajectory, it becomes clear why many long-term investors include it in their portfolios. The payout is steady, covered many times over by cash flow, and backed by earnings that show no signs of slowing down.

Dividend Overview

Microsoft’s yield sits at 0.72%. That’s not going to light up a dividend screener if you’re only sorting by yield. But that number only tells part of the story. What it doesn’t show is how comfortably the company covers that payout or how consistently it increases it.

The current payout ratio is just under 25%, meaning Microsoft is using only a fraction of its profits to fund the dividend. The rest? It’s reinvested back into the business, used for buybacks, or held as cash reserves. This isn’t a company that’s forcing dividends out to satisfy shareholders—it’s doing it because it can afford to, with plenty left over.

You also won’t find erratic dividend behavior here. Microsoft tends to announce increases annually, usually around the same time, and those increases are measured, thoughtful, and supported by underlying growth. That kind of pattern is gold for income-focused investors who rely on predictable cash flow.

Dividend Growth and Safety

Here’s where Microsoft truly shines for dividend investors. Over the last ten years, the dividend has more than doubled. In the past five, it’s grown at an annual rate just over 9%. That kind of compound growth, especially from a tech giant, is rare—and it reflects both the company’s earnings power and management’s confidence in future cash flows.

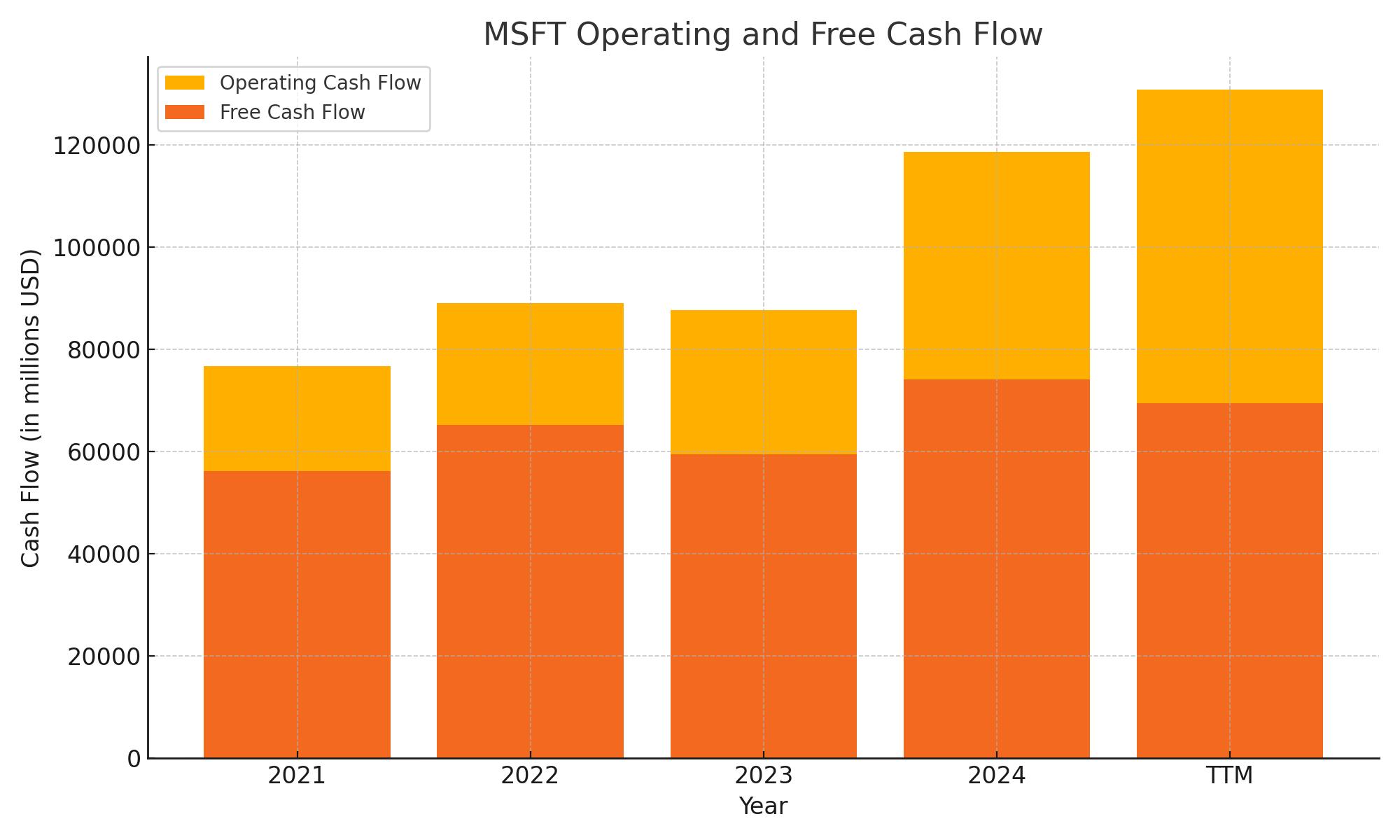

As for safety, there’s almost no red flag in sight. Microsoft generated $130.7 billion in operating cash flow over the last twelve months, and $54.8 billion of that was free cash flow. That’s after it reinvested in its own growth. With that kind of cushion, it could afford to increase the dividend significantly, though it chooses to stay conservative, which is probably the smarter move for long-term sustainability.

Debt levels are very manageable. Total debt stands at around $105 billion, which might seem high in isolation, but it’s nothing when weighed against cash reserves and the consistent stream of free cash flow. The current ratio of 1.37 means Microsoft can comfortably cover its short-term obligations, another sign of operational strength.

You also get a sense of reliability from the regularity of Microsoft’s dividend schedule. The next payment is set for June 12, with the ex-dividend date already behind us on May 15. That kind of structure is a breath of fresh air for anyone building a portfolio around predictable income.

All in, Microsoft’s dividend doesn’t just offer income—it offers peace of mind. It’s not trying to dazzle with a high yield, but it’s doing everything right to make sure the dividend keeps coming, growing, and strengthening alongside the business.

Cash Flow Statement

Microsoft’s trailing twelve-month cash flow shows the kind of financial engine you’d expect from a business of its caliber. Operating cash flow came in at $130.7 billion, a solid increase from $118.5 billion the year prior, driven by strong revenue growth and efficient cost management. Even with a noticeable rise in capital expenditures to $61.3 billion—reflecting heavy investment in cloud infrastructure and AI development—Microsoft still generated $69.4 billion in free cash flow.

Investing activities show a cash outflow of nearly $57 billion, largely due to those infrastructure and technology investments. On the financing side, Microsoft returned significant capital to shareholders, including $18.1 billion in share repurchases and $16.3 billion in debt repayments. These moves, while reducing cash, align with the company’s disciplined capital return strategy. By the end of the period, Microsoft had a healthy $29.1 billion in cash on hand, giving it ample flexibility for future growth, dividends, or opportunistic acquisitions.

Analyst Ratings

📈 Microsoft has recently seen a flurry of analyst updates, with several major firms lifting their price targets. Goldman Sachs raised its target to $550, pointing to accelerating momentum in the company’s cloud and AI divisions. Jefferies echoed that sentiment, also bumping its target to $550 and highlighting consistent growth in Microsoft’s enterprise offerings.

🔮 Evercore ISI moved its target to $515, citing optimism around Azure’s performance and strong demand for generative AI integration across Microsoft’s software suite. Citigroup followed closely with a $540 price target, noting improved efficiency and revenue growth in its productivity and business processes segment. RBC Capital maintained its “Outperform” rating and set a target at $525, reflecting confidence in Microsoft’s solid balance sheet and recurring revenue streams.

⚠️ Not all views were entirely bullish, though. Citi Research trimmed its target to $480, reflecting caution around broader economic headwinds and the potential for some moderation in IT spending.

💡 Even with a slightly cautious outlier, the average consensus price target now hovers around $513. That reflects a generally optimistic view of Microsoft’s path forward, especially as it continues to scale its AI infrastructure and maintain leadership in enterprise cloud services.

Earning Report Summary

Microsoft’s latest quarterly results delivered strong numbers across the board, keeping pace with its growth story while doubling down on AI and cloud investments. The company reported $70.1 billion in revenue for the fiscal third quarter of 2025, up 13% compared to last year. Profits came in strong too, with net income hitting $25.8 billion, or $3.46 per share—beating what Wall Street was expecting.

Cloud Takes the Lead

The real engine behind this performance was Microsoft’s Intelligent Cloud business. That segment, which includes Azure, brought in $26.8 billion in revenue, growing 21% year over year. Azure alone saw 33% growth, with a good mix of traditional cloud services and newer AI-driven offerings pulling their weight. Demand is clearly high, and leadership made it clear they’re pushing hard to expand capacity as fast as possible.

Office, LinkedIn, and Engagement

Productivity and Business Processes, which houses Microsoft 365 and LinkedIn, also had a strong quarter. This group pulled in $29.9 billion, up 10%. Commercial cloud revenue from Microsoft 365 rose 12%, and the user base keeps growing—over 430 million paid seats now. LinkedIn saw 7% revenue growth, with user engagement and premium subscriptions both contributing to the climb.

Gaming and Devices

On the personal computing side, things were more modest but still positive. This segment brought in $13.4 billion, a 6% increase. Xbox content and services had a solid quarter, growing 8%, while advertising in search and news jumped 21%. Windows OEM and devices showed only a small bump, partly because inventory levels were still adjusting after earlier supply chain pressures.

Leadership Perspective and What’s Next

CEO Satya Nadella spoke confidently about Microsoft’s direction, especially around AI and the cloud. He sees these areas not just as growth engines but as tools that help businesses work smarter and faster. CFO Amy Hood pointed out that capital spending came in slightly lower than planned this quarter—about $21.4 billion—mainly due to timing issues around new data center leases. But she was quick to note that Microsoft is on track to invest about $80 billion in infrastructure over the full year to keep up with AI demand.

The company also returned $9.7 billion to shareholders during the quarter through dividends and stock buybacks. That’s a 15% jump from the same quarter a year ago. Looking ahead, Microsoft is guiding for around $73.7 billion in revenue next quarter, showing they’re still optimistic about their momentum.

Management Team

Microsoft’s leadership is anchored by CEO Satya Nadella, who has been instrumental in steering the company toward a cloud-first, AI-driven future. Since taking the helm in 2014, Nadella has overseen significant transformations, including the expansion of Azure and strategic acquisitions like LinkedIn and GitHub. His focus on innovation and adaptability has been pivotal in maintaining Microsoft’s competitive edge.

Supporting Nadella is CFO Amy Hood, who has been with Microsoft since 2002 and assumed her current role in 2013. Hood is known for her strategic financial management, overseeing major investments in AI and cloud infrastructure. Her leadership has been crucial in balancing growth initiatives with fiscal responsibility, ensuring Microsoft’s financial health remains robust.

The executive team also includes Brad Smith, President and Vice Chair, who manages legal and corporate affairs, and Kevin Scott, CTO, who leads technological advancements. Together, this leadership ensemble drives Microsoft’s mission to empower individuals and organizations globally.

Valuation and Stock Performance

As of early June 2025, Microsoft’s stock is trading around $463, reflecting a market capitalization of approximately $2.79 trillion. The company has experienced a 16% stock surge in May, marking its best monthly performance in over three years and bringing its share price within 1.5% of the all-time high set in July 2024. This uptick is largely attributed to a broader recovery in U.S. equity markets and renewed investor confidence in Microsoft’s Azure cloud-computing division.

Analyst sentiment remains positive, with a consensus price target of approximately $513, suggesting potential for further growth. The company’s strong financials, including a PE ratio of 28.88 and EPS of $12.93, support this optimistic outlook.

Risks and Considerations

While Microsoft’s prospects are strong, several risks warrant attention. The company faces ongoing antitrust scrutiny, particularly concerning its bundling practices and market dominance in cloud services. Regulatory challenges in the U.S. and Europe could impact operations and growth strategies.

Economic uncertainties, such as fluctuating interest rates and global trade tensions, may also affect Microsoft’s performance. The tech sector’s sensitivity to macroeconomic factors means that broader market downturns could influence investor sentiment and stock valuation.

Additionally, Microsoft’s significant investments in AI and cloud infrastructure, while positioning the company for future growth, involve substantial capital expenditures. The success of these investments depends on sustained demand and effective integration into existing services.

Final Thoughts

Microsoft’s strategic focus on cloud computing and AI, under the guidance of a seasoned leadership team, positions the company well for continued success. The recent stock performance and positive analyst outlook reflect confidence in Microsoft’s direction. However, investors should remain cognizant of regulatory and economic risks that could impact future performance.