Updated 6/2/25

McKesson Corporation stands as one of the largest pharmaceutical distributors in the U.S., playing a critical role in the healthcare supply chain. With roots dating back to 1833, the company handles one-third of all medications delivered across North America. Its recent earnings and financial strength reflect solid execution, with revenue reaching \$359 billion and adjusted EPS climbing to \$33.05 for the fiscal year.

The stock has gained over 25% in the past year, supported by consistent free cash flow and a shareholder-friendly capital return program. McKesson’s leadership continues to invest in high-growth areas like oncology and biopharma while navigating risks tied to regulation and litigation.

Recent Events

In the most recent quarter ending March 31, McKesson posted some impressive numbers. Revenue came in at a staggering $359 billion over the past twelve months, marking nearly 19% growth compared to the year before. Earnings were even stronger, with a 59% jump in quarterly profits. This isn’t just a case of sales volume going up—it’s about management finding ways to pull more margin out of every dollar.

Margins are tight, as is typical in distribution-heavy businesses. Operating margin landed around 1.5%, which is par for the course. But McKesson continues to drive that revenue into solid bottom-line results, with diluted earnings per share at $25.69 and net income of $3.3 billion.

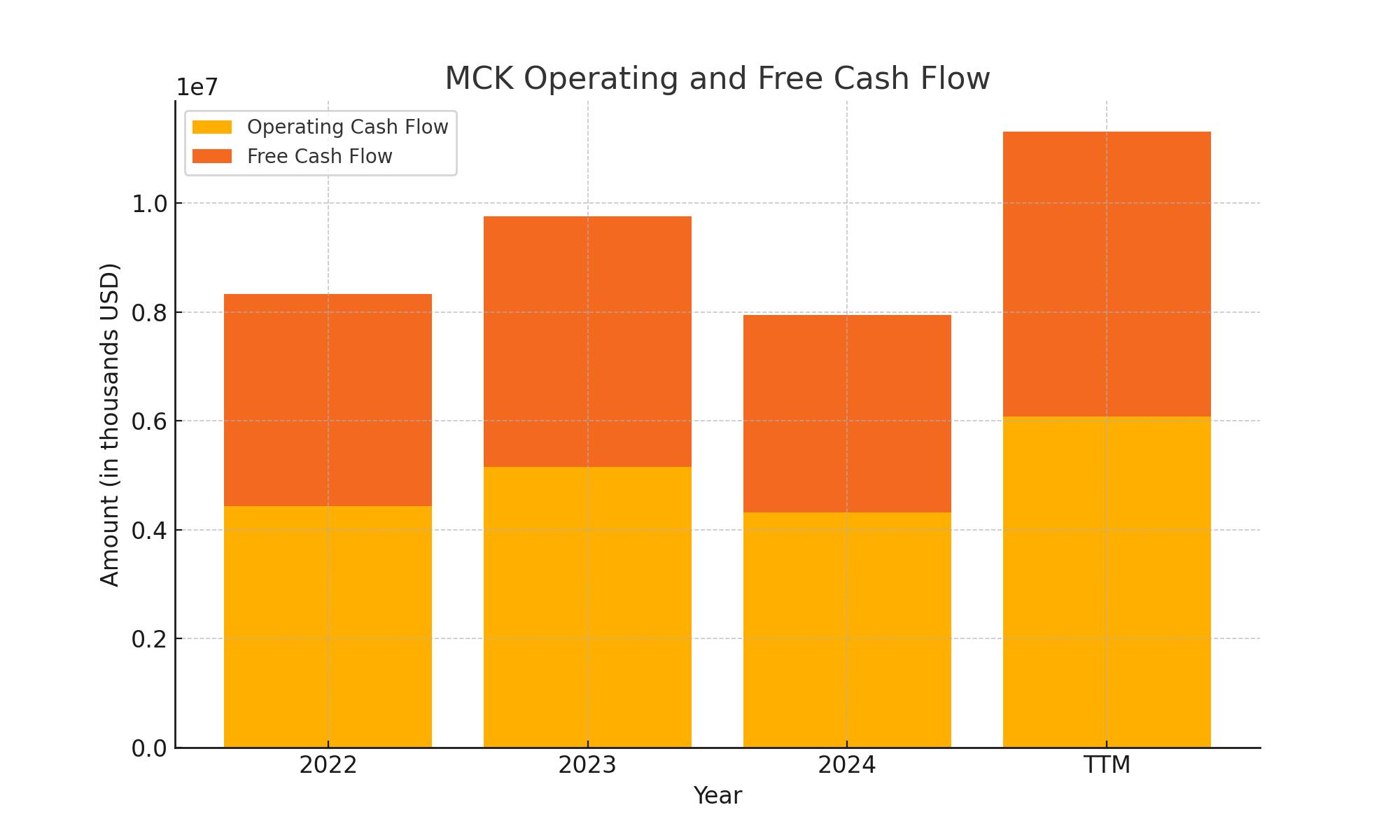

Cash flow is another bright spot. Operating cash flow over the last year was just over $6 billion, and levered free cash flow hit $4.73 billion. The company’s financial footing is sturdy, supported by $5.7 billion in cash on hand versus $7.4 billion in debt. The current ratio is under 1, sitting at 0.90, but that’s not a red flag given McKesson’s steady cash engine.

Shares have also performed well. MCK stock is up over 25% in the past year, clearly outpacing the broader market. That kind of move, along with 90% institutional ownership, shows strong confidence from long-term investors.

Key Dividend Metrics

📈 Forward Dividend Yield: 0.39%

💰 Forward Dividend Rate: $2.84

🧮 Payout Ratio: 10.69%

📊 5-Year Average Dividend Yield: 0.64%

🗓️ Next Ex-Dividend Date: June 2, 2025

📅 Next Dividend Pay Date: July 1, 2025

📉 Trailing Dividend Yield: 0.39%

🔁 Last Dividend Increase: Continued annual raises

🧱 Dividend Stability: High and uninterrupted since the 1990s

Dividend Overview

McKesson’s dividend isn’t going to catch your eye if you’re scanning for high yields. At just under 0.4%, it’s modest—but that doesn’t mean it’s not worth your attention. The yield might look small, but that’s more a reflection of the stock’s recent price appreciation than a lack of payout power.

Where McKesson shines is in the consistency and strength of its dividend policy. The current payout ratio is just a hair above 10%, meaning the company is using only a small fraction of its earnings to reward shareholders. That leaves plenty of room for raises down the line, even if earnings were to slow or the business hits a rough patch.

Dividends are covered several times over by cash flow, and with such a lean payout structure, the risk of a cut is virtually nonexistent. This isn’t a company trying to impress income hunters with flashy yields—it’s a disciplined operator offering reliable growth.

Dividend Growth and Safety

McKesson has quietly built a strong track record of dividend growth. While it doesn’t carry the “Aristocrat” label, the company has managed steady increases year after year, always in line with rising earnings. It’s not just keeping pace—it’s showing commitment.

With such a low payout ratio and consistent cash generation, McKesson’s dividend is among the safest in the healthcare sector. Even in economic downturns, demand for medication stays resilient, and McKesson’s role in that supply chain means its revenue engine rarely misses a beat.

Add in the company’s massive share buyback program and the math becomes even more compelling. Fewer shares each year mean more earnings to go around, and dividend payments become more concentrated. The effect? Per-share income that grows even if the overall dividend pool rises slowly.

The company also benefits from a remarkably low beta of 0.49, making it a haven for stability. In a volatile market, this stock tends to keep a cool head, which only adds to its appeal for income investors who prefer a smoother ride.

For those who don’t mind a lower initial yield and are more focused on long-term dividend reliability, McKesson presents a clear-cut case. This isn’t a stock for someone chasing fast returns—it’s a holding built for patience and confidence.

Cash Flow Statement

McKesson’s cash flow profile continues to demonstrate strength and consistency, particularly in its operating activities. Over the trailing twelve months, the company generated $6.1 billion in operating cash flow, a solid increase from $4.3 billion in the prior year. This growth reflects improved profitability and working capital efficiency. Free cash flow followed a similar path, rising to $5.2 billion TTM, suggesting McKesson remains disciplined in its capital spending, even as it continues investing in infrastructure and technology.

On the financing side, McKesson returned significant capital to shareholders. The company repurchased over $3.1 billion in stock while also managing its debt obligations with near-perfect balance—$15.6 billion issued and nearly the same amount repaid. This disciplined approach helped boost the cash position to $5.7 billion at the end of the period, the highest level in the past four years. Though financing outflows remain sizable, they’re clearly part of a deliberate capital allocation strategy that supports shareholder returns while preserving flexibility.

Analyst Ratings

📈 McKesson has recently attracted positive attention from analysts, with several firms raising their price targets. 🏦 Bank of America increased its target from $755 to $800, citing strong earnings and robust cash flow. 🧮 UBS followed suit, adjusting its target from $708 to $805, reflecting confidence in McKesson’s operational strength and market position. 💼 Morgan Stanley also raised its target from $642 to $745, highlighting the company’s consistent performance and ability to navigate the healthcare landscape with precision.

⚖️ However, not all analysts are uniformly bullish. 🧐 Mizuho maintained a more neutral stance, adjusting its target from $630 to $690, indicating a cautious outlook despite solid fundamentals. While the tone of their update wasn’t negative, it leaned more conservative in contrast to the enthusiasm shown by others.

🎯 The overall consensus remains optimistic, with an average price target of approximately $736.62. This implies room for further upside from current levels. Analyst targets range widely—from a conservative $567.31 to a bullish high of $845.25—underscoring a mix of valuation views but a shared respect for McKesson’s resilience and financial discipline.

Earning Report Summary

Strong Finish to the Fiscal Year

McKesson closed out its fiscal 2025 on a high note, reporting a fourth-quarter revenue of $90.8 billion. That’s a solid 19% jump compared to the same period last year. Adjusted earnings per share came in at $10.12, which is up a whopping 64% year-over-year. Over the full year, the company pulled in $359.1 billion in revenue, reflecting a healthy 16% increase, and adjusted EPS climbed 20% to $33.05.

These numbers weren’t just a result of riding market trends. McKesson’s leadership pointed to strong execution in its pharmaceutical distribution business, steady expansion in oncology, and a growing role in biopharma services. Cash flow also stayed robust, with $5.2 billion in free cash flow helping the company return $3.5 billion to shareholders through a mix of buybacks and dividends.

Strategic Moves and Looking Forward

CEO Brian Tyler was clear about where the company is heading. He emphasized that the performance wasn’t just about beating expectations—it was about laying groundwork for future growth. McKesson made a couple of key acquisitions, including PRISM Vision and Core Ventures, both aimed at deepening its reach in specialty care and oncology.

There was also big news about restructuring. McKesson plans to spin off its Medical-Surgical Solutions segment into a separate company. The move is part of a shift to focus more sharply on higher-growth businesses like oncology and biopharma. It’s a significant change, but it fits the broader direction they’ve been signaling for a while.

Looking into fiscal 2026, the company is guiding for adjusted earnings per share between $36.75 and $37.55. That’s a confident outlook, and one that suggests McKesson expects the momentum to continue as it leans further into its strengths and positions itself in key areas of the healthcare landscape.

Management Team

McKesson’s leadership team is composed of seasoned professionals with deep expertise in healthcare, technology, and corporate strategy. At the helm is CEO Brian Tyler, who has been with the company for over two decades, bringing a wealth of experience from various leadership roles within McKesson. Under his guidance, the company has focused on strategic growth and operational excellence, while maintaining a clear commitment to innovation and shareholder value.

Supporting Tyler is a strong executive bench. Britt Vitalone serves as Chief Financial Officer, guiding McKesson’s financial strategy and capital allocation. Nancy Flores holds dual roles as Chief Information Officer and Chief Technology Officer, steering the company’s digital transformation and IT infrastructure. Tracy Faber, as Chief Human Resources Officer, plays a key role in talent development and maintaining a strong corporate culture. Other notable leaders include Lori Schechter as Chief Legal Officer and Tom Rodgers as Chief Strategy and Business Development Officer, each bringing unique perspectives that help shape the company’s direction and competitive edge.

Valuation and Stock Performance

McKesson’s stock has shown solid momentum, reflecting the market’s confidence in its operational performance and future growth potential. As of late May 2025, shares are trading around $719, not far off from the 52-week high of $731. Over the past year, the stock has delivered strong gains, outpacing the broader market and solidifying its place as a reliable name in the healthcare sector.

On the valuation side, McKesson’s forward P/E ratio is about 19.3, suggesting it’s reasonably priced given its earnings growth and consistent cash generation. Compared to industry peers, this valuation appears well-aligned with its size, market presence, and track record. The average analyst price target hovers around $736.62, indicating there could still be modest upside. The stock may not appear deeply undervalued on a surface level, but the company’s consistent performance and low payout ratio leave room for longer-term capital appreciation.

Risks and Considerations

While McKesson is positioned in a resilient industry, it’s not immune to risks. One of the most significant concerns continues to be legal exposure related to the opioid crisis. The company has faced a series of lawsuits alleging its involvement in improper distribution practices, which have led to multi-state settlements and financial penalties. Though some of this legal overhang has been addressed, there’s still potential for further liabilities or reputational impact.

Regulatory risk is another area worth watching. McKesson operates in a tightly controlled environment, and shifts in federal or state-level healthcare policy, drug pricing laws, or pharmaceutical reimbursement models could influence profitability. In addition, the company’s distribution segment runs on thin margins, which leaves it exposed to cost fluctuations, competitive pricing pressure, and supplier dynamics. As digital transformation accelerates across industries, cybersecurity and data protection also remain critical areas of focus, requiring ongoing investment and attention.

Final Thoughts

McKesson plays a foundational role in the healthcare ecosystem, reliably delivering medications and medical products across the country. It’s a business built on operational precision and scale, with a leadership team that understands how to balance growth and risk. The company’s strategic focus on specialty pharma, oncology, and biopharma services is helping it adapt to where healthcare is headed, not just where it’s been.

While legal and regulatory concerns are important to monitor, McKesson’s strong balance sheet, predictable cash flow, and ability to reinvest intelligently in the business make it a compelling example of a mature, adaptable healthcare company. For investors looking for dependable exposure to the healthcare distribution space with the potential for steady capital appreciation, McKesson offers a blend of reliability and smart strategic positioning.