Key Takeaways

📈 McDonald’s has increased its dividend for 47 consecutive years, with a current forward yield of 2.26% and a payout ratio around 61%, reflecting both growth and sustainability.

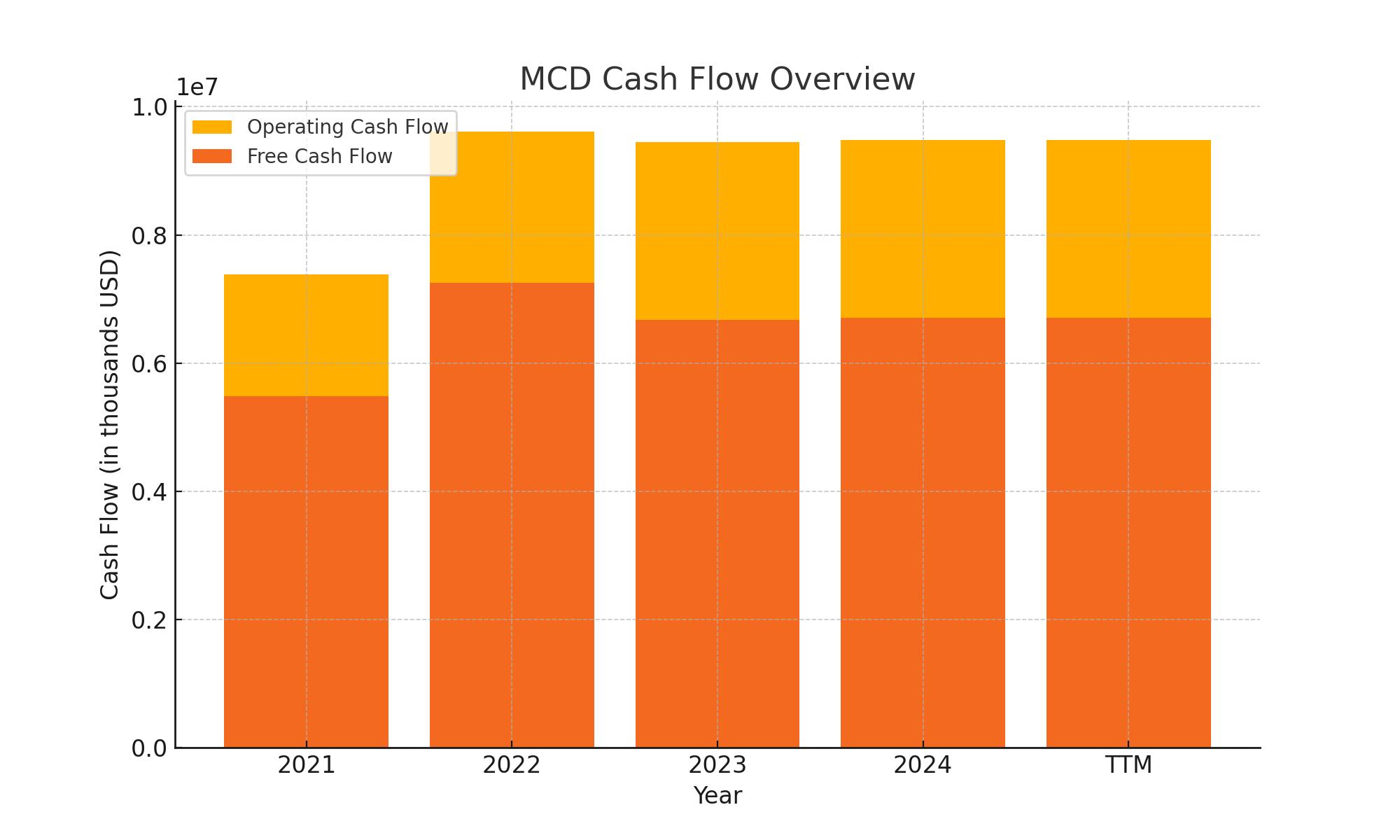

💵 The company reported $9.5 billion in operating cash flow and $6.7 billion in free cash flow over the trailing 12 months, providing strong coverage for dividends and capital allocation.

🧐 Analysts maintain a positive outlook with a consensus price target of $325.91, though recent downgrades reflect cautious views on near-term sales momentum and valuation.

Updated 6/2/25

McDonald’s continues to stand out as a steady performer in an unpredictable market. With over 40,000 restaurants worldwide and a history of 47 consecutive years of dividend increases, it remains a core holding for many income-focused investors. The company’s first quarter of 2025 reflected softer sales, especially in the U.S., yet its strong operating margins and nearly \$9.5 billion in operating cash flow highlight the strength of its business model.

Leadership has remained proactive, responding to inflationary pressures and shifting consumer behavior with value-driven menu options and increased digital engagement. Supported by a solid management team and a forward-looking strategy, McDonald’s is maintaining its footing through disciplined execution and a continued focus on long-term shareholder returns.

Recent Events

As of the end of May, McDonald’s stock was trading around $313.85—right up near its 52-week high of $326.32. That kind of strength isn’t just market noise. It’s coming off the back of continued operational discipline, even as the broader consumer space has faced some bumps. Most recent earnings showed a slight dip in both revenue and profit—down 3.5% and 3.2%, respectively, year-over-year. Not exactly the kind of slide that sets off alarms, but it does show the weight of higher input costs across the industry.

What hasn’t dipped is the company’s ability to generate serious cash. In the last twelve months, McDonald’s pulled in $9.48 billion in operating cash flow and delivered over $5.3 billion in free cash after everything else. That’s more than enough to keep funding its dividend comfortably.

Margins continue to impress. A 44.58% operating margin in this space is something most of its competitors can only dream about. And despite macro pressures, McDonald’s continues to reward shareholders both through regular payouts and solid share performance—posting a 20.83% gain over the past year, well above the S&P 500’s climb.

Key Dividend Metrics

📈 Forward Annual Dividend Yield: 2.26%

💰 Forward Annual Dividend Rate: $7.08 per share

🧮 Payout Ratio: 60.72%

📆 Next Dividend Date: June 16, 2025

🔻 Ex-Dividend Date: June 2, 2025

📊 5-Year Average Dividend Yield: 2.22%

🌱 Dividend Growth Streak: 47 years and counting

Dividend Overview

McDonald’s isn’t trying to be the highest-yielding stock out there. And that’s okay. What it brings to the table is far more valuable for long-term investors: consistency and growth.

With a forward yield of 2.26%, it’s right in line with its historical average. That kind of steady return works especially well in portfolios where the goal is to preserve capital and grow income slowly but surely. You’re not taking wild swings here—you’re investing in predictability.

More importantly, McDonald’s has now raised its dividend for 47 consecutive years. That’s nearly half a century of increasing payouts, through every kind of market condition imaginable. That kind of record doesn’t happen by accident. It happens because the company knows how to generate cash and isn’t afraid to share it with shareholders.

It’s also worth noting how balanced the payout ratio is. At around 61%, McDonald’s still keeps plenty of cash for reinvestment, debt servicing, and other shareholder returns. The dividend isn’t a burden. It’s part of the business model.

Dividend Growth and Safety

This is where McDonald’s truly stands out. The company’s dividend isn’t just about getting a check every quarter—it’s about knowing that check is likely to get bigger every year.

The last dividend increase was a clear signal. Management bumped the quarterly dividend from $1.52 to $1.77 per share—a 16.4% hike. That kind of move doesn’t just show confidence; it shows commitment.

Looking under the hood, the numbers support that confidence. With $5.31 billion in levered free cash flow and roughly $5 billion in annual dividend payments, there’s still cushion. The business has the breathing room to keep raising that payout even if growth slows.

Debt levels are high—over $52 billion—but that’s not out of character for a franchise-heavy business model like this one. What matters is whether the company can service that debt, and with EBITDA at $13.9 billion, there’s no indication of strain. Credit markets remain open to McDonald’s, and it continues to maintain a strong financial footing.

There’s also the built-in defense that comes with being a value-oriented quick service restaurant. When wallets tighten, people don’t stop eating out entirely—they just trade down. That trend has always worked in McDonald’s favor, and it’s one of the reasons the business remains relatively resilient even in downturns.

Pricing power plays a part too. Menu prices can creep up without losing too much foot traffic. Customers might notice a few extra cents on a combo meal, but it rarely changes buying behavior in a meaningful way. That ability to pass along costs helps protect margins and, by extension, the dividend.

Over the last decade, McDonald’s has more than doubled its annual dividend from $3.24 in 2014 to over $7 today. That’s a pace that outstrips inflation and outperforms many of its dividend-paying peers.

With the next dividend date approaching on June 16 and the ex-dividend cutoff landing on June 2, income investors will once again be reminded that some companies make paying you back a habit. For McDonald’s, it’s a habit that’s been refined for generations—and one that shows no signs of slowing.

Cash Flow Statement

McDonald’s continues to demonstrate strong cash generation, reporting $9.5 billion in operating cash flow over the trailing 12 months. This number is consistent with its historical trend and underscores the company’s ability to produce stable internal cash, even with minor year-over-year variations. Capital expenditures came in at roughly $2.8 billion, keeping investment levels steady while allowing the company to retain a sizable free cash flow position of $6.7 billion. That’s more than sufficient to cover dividend obligations and fund strategic initiatives without stretching the balance sheet.

On the financing side, cash outflows remain significant, totaling $5.4 billion over the same period. This includes continued debt repayments, share buybacks, and dividend payments—each a reflection of McDonald’s shareholder return strategy. Despite these outflows, the end cash position actually ticked higher to $1.3 billion, up from $1.1 billion the previous year. While investing cash flows were negative at $3.6 billion, most of this was tied to routine capital allocation rather than one-time items. All told, McDonald’s cash flow picture reflects a mature, disciplined company that knows how to balance reinvestment with rewarding shareholders.

Analyst Ratings

McDonald’s has recently experienced a mix of analyst sentiment, with some firms adjusting their outlooks based on evolving market dynamics. 🟡 Erste Group downgraded the stock from “Strong Buy” to “Hold,” citing concerns over limited sales growth momentum for the year and a valuation that appears slightly elevated compared to sector averages.

🔼 On the other hand, several analysts have maintained or increased their price targets, reflecting confidence in the company’s strategic initiatives. 🟢 Citigroup reaffirmed its “Buy” rating and raised the price target from $353 to $364, signaling optimism about McDonald’s ability to navigate current challenges. 🟢 Barclays also maintained an “Overweight” rating, adjusting its target from $347 to $355, suggesting that the company’s scale and marketing efforts could drive continued growth.

📊 The consensus among analysts points to a moderate upside, with an average price target of $325.91, implying a potential increase of approximately 3.9% from current levels. This reflects a balanced view, acknowledging both the company’s strong operational foundation and the headwinds it faces in the current economic environment.

Earning Report Summary

Slower Quarter Amid Economic Pressure

McDonald’s kicked off 2025 with a softer-than-usual first quarter. Global same-store sales dipped by 1%, and the U.S. market in particular saw a notable 3.6% decline—the largest drop in four years. Part of this dip came down to timing, as the previous year benefited from an extra sales day thanks to Leap Year. Still, it was clear that consumer behavior is shifting, especially in the U.S., where wallet-conscious diners are pulling back.

Chris Kempczinski, McDonald’s CEO, acknowledged the slowdown and pointed out that many customers are feeling financial pressure. He mentioned that people are being more thoughtful about how often they eat out and what they spend when they do. That trend is showing up not just in the numbers, but in how McDonald’s is responding.

Refocusing on Value and Familiar Favorites

To meet customers where they are, McDonald’s is doubling down on value. The return of the $5 value meal has been one of the more anticipated moves, aimed directly at budget-conscious diners. These types of value bundles have been effective in the past, and leadership seems confident they’ll drive traffic again.

They’re also leaning into nostalgia and comfort food with items like Snack Wraps and a broader rollout of McCrispy chicken options. These additions aren’t just about novelty—they’re about bringing back proven winners that customers already know and love. The strategy is clear: create menu excitement without requiring a big change in spending habits.

Investing in Operations and Digital Reach

Beyond menu changes, the company is making tweaks to how it operates. Longer store hours are being tested and gradually rolled out, which could help capture more late-night or early-morning traffic. At the same time, the digital side of the business continues to grow. App ordering, delivery, and loyalty programs are now major contributors, and McDonald’s is investing to make those channels even more seamless.

All in all, while the quarter wasn’t without its challenges, leadership remains focused on adjusting quickly and staying ahead of changing customer habits. The business is still solidly profitable, and the tools are in place to navigate through what looks like a more cautious consumer environment in the near term.

Management Team

McDonald’s leadership is anchored by Chairman and CEO Chris Kempczinski, who has been at the helm since 2019 and took on the chairman role in 2024. Under his guidance, the company has embraced the “Accelerating the Arches” strategy, focusing on digital innovation, menu development, and enhancing the customer experience. Kempczinski’s vision emphasizes agility and responsiveness to market changes, ensuring McDonald’s remains a leader in the fast-food industry.

Supporting this vision, Jill McDonald was appointed as the Chief Restaurant Experience Officer in May 2025. Her role encompasses overseeing operations, supply chain, franchising, and development, aiming to streamline processes and accelerate the introduction of new menu items. This restructuring is part of a broader initiative to enhance coordination across departments and respond more swiftly to consumer demands.

Additionally, Manuel JM Steijaert has been named Executive Vice President and President of International Operated Markets (IOM), bringing a wealth of experience to oversee McDonald’s operations outside the U.S. These leadership changes reflect McDonald’s commitment to strengthening its global presence and operational efficiency.

Valuation and Stock Performance

As of early June 2025, McDonald’s stock is trading at approximately $313.85, reflecting a steady performance amid broader market fluctuations. Analysts have set a consensus price target of around $325.91, indicating a modest upside potential. This valuation considers McDonald’s robust free cash flow, consistent dividend payouts, and strategic initiatives aimed at long-term growth.

The company’s forward price-to-earnings (P/E) ratio stands at 25.51, suggesting investor confidence in its earnings stability. Despite challenges such as a 3.6 percent decline in U.S. comparable sales in Q1 2025, McDonald’s has demonstrated resilience through its global footprint and adaptability. The stock’s performance is bolstered by ongoing investments in technology, menu innovation, and expansion into new markets.

Risks and Considerations

While McDonald’s maintains a strong market position, it faces several risks that could impact its performance. Economic pressures, particularly inflation and reduced consumer spending, have led to decreased foot traffic in some markets. The company has responded with value offerings, but sustaining profitability amid rising costs remains a challenge.

Operational risks include supply chain disruptions and labor shortages, which can affect service quality and customer satisfaction. Additionally, McDonald’s faces reputational risks, such as recent scrutiny over labor practices in the UK, which could impact investor sentiment and brand perception.

The competitive landscape also presents challenges, with rivals introducing innovative menu items and leveraging digital platforms to capture market share. McDonald’s must continue to innovate and adapt to changing consumer preferences to maintain its leadership position.

Final Thoughts

McDonald’s continues to navigate a complex operating environment with strategic initiatives aimed at sustaining growth and enhancing customer experience. The company’s leadership is focused on innovation, operational efficiency, and global expansion, positioning it well for long-term success. While challenges persist, McDonald’s proactive approach and strong brand equity provide a solid foundation for future performance.