Updated 5/30/25

Matson, Inc. (NYSE: MATX) is a leading U.S. shipping and logistics company, operating across the Pacific with routes linking the mainland to Hawaii, Alaska, Guam, and Asia. With over a century of experience, Matson combines a legacy of reliability with a disciplined, forward-looking strategy centered on operational efficiency and steady capital returns.

Backed by a seasoned management team and a strong balance sheet, the company has delivered consistent earnings, robust free cash flow, and a growing dividend. Its focus on fleet modernization and integrated logistics continues to support long-term shareholder value even as the global trade environment evolves.

Recent Events

The post-pandemic cooling in global shipping rates has been a reality check for many in the industry, but Matson is weathering the shift surprisingly well. In its most recent quarter ending March 2025, revenue climbed 8.3% year-over-year, and earnings saw an eye-popping 100% growth. That kind of performance, especially after the highs of the last few years, signals a company that’s still operating with efficiency and focus.

Matson reported a diluted earnings per share of $15.07 and a trailing twelve-month net income of $512.6 million. These aren’t just good numbers for a shipping company—they’re strong by any standard. The company’s profit margin sits at nearly 15%, and the operating margin is close to 10%, which shows it’s not just moving cargo—it’s doing so with meaningful profitability.

Even more telling is how Matson is managing its capital. It holds a manageable debt load at $706 million and is clearly favoring financial discipline. Despite a tightening freight market, it continues to generate strong free cash flow, positioning itself for both stability and growth.

Key Dividend Metrics

📈 Dividend Yield: 1.21%

💰 Annual Dividend: $1.36 per share

🔁 5-Year Average Yield: 1.45%

🧱 Payout Ratio: 8.89%

🧮 Free Cash Flow Coverage: $511 million

🗓️ Next Dividend Date: June 5, 2025

📉 Dividend Growth Streak: 12 consecutive years

Dividend Overview

At first glance, Matson’s dividend yield might not jump off the page. At just over 1.2%, it’s not going to turn heads in a high-yield screen. But sometimes, the best dividend plays are hiding in plain sight.

The most striking part of Matson’s dividend story isn’t the yield—it’s the coverage. With a payout ratio under 9%, the dividend is barely a dent in the company’s cash generation. That kind of cushion provides immense flexibility. Matson can continue rewarding shareholders even if the shipping cycle turns choppier, and still have room left to pay down debt, invest in operations, or buy back stock.

That’s exactly what a disciplined dividend investor should want—reliable income with a large margin of safety. This isn’t a yield trap. It’s a measured approach to capital return from a business that knows its limitations and strengths.

There’s also something to be said for Matson’s shareholder culture. It isn’t a flashy operator that splashes cash when times are good. Instead, it steadily increases its payout and returns capital when it makes sense. The dividend is like clockwork, and that predictability is what long-term investors can appreciate.

Dividend Growth and Safety

One of Matson’s most underappreciated strengths is its dividend consistency. For more than a decade, it has increased the payout each year—never dramatically, but always intentionally. That consistency has become part of its identity.

The dividend compound growth rate over the last several years has hovered in the mid-to-high single digits. Not explosive, but very respectable. And crucially, it hasn’t missed a beat. Through trade cycles, global slowdowns, and changing market conditions, the dividend has kept rising.

This speaks volumes about management’s confidence and discipline. The dividend isn’t just a check—it’s a signal of financial strength. With a return on equity over 20%, Matson clearly knows how to make every dollar work. Add in a relatively light debt load and strong cash flow, and you’ve got a payout that looks built to last.

The company is sitting on over $820 million in operating cash flow and more than $511 million in free cash flow. That kind of firepower gives it room to maneuver—whether that means boosting dividends, retiring debt, or seizing opportunities when competitors are pulling back.

While other names might offer flashier yields or bigger quarterly increases, Matson delivers something arguably more valuable: a quiet, consistent compounding engine. It’s not here for drama. It’s here to deliver.

Cash Flow Statement

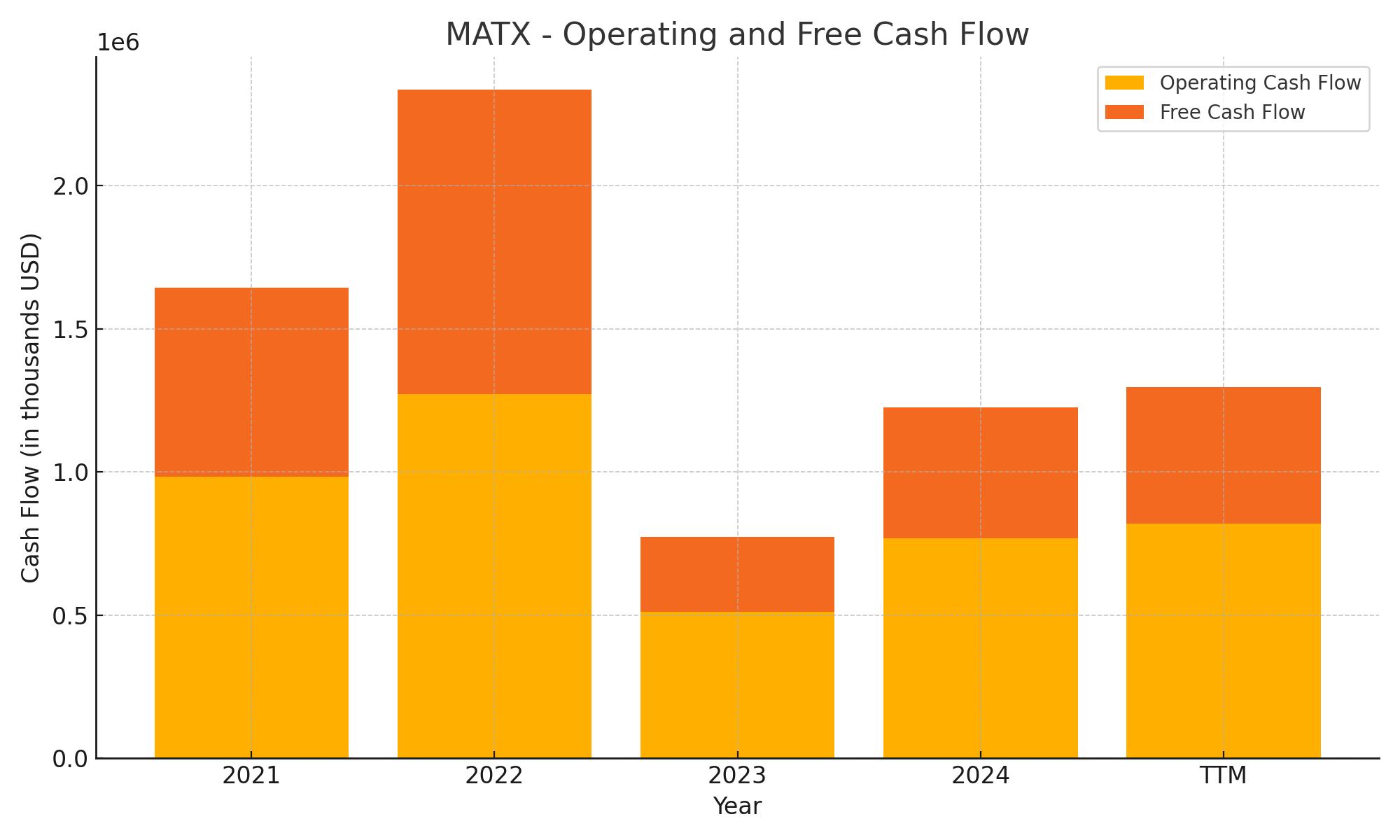

Matson’s cash flow profile continues to reflect disciplined financial management and strong operating efficiency. Over the trailing twelve months (TTM), the company generated $820.2 million in operating cash flow, showing a healthy increase from $767.8 million in 2024 and well above the $510.5 million posted in 2023. This uptick reflects improved earnings quality and working capital control, supporting its dividend and capital allocation priorities. Free cash flow stood at $476.2 million over the same period, a comfortable margin that underscores Matson’s ability to invest, reduce debt, and return capital to shareholders.

On the financing side, cash outflows remain steady, with the company using approximately $319.9 million, largely allocated to dividends, share repurchases, and debt service. There’s been no recent issuance of capital stock or new debt, and the company continues to pay down existing obligations, with $39.7 million in repayments over the past year. Matson’s end-of-period cash position sits at $122 million—lower than prior years—but this reflects its proactive use of excess cash rather than any liquidity strain. Overall, the cash flow picture illustrates a company in control of its capital, balancing operational growth with prudent financial stewardship.

Analyst Ratings

📈 In recent weeks, Matson Inc. (NYSE: MATX) has seen a shift in analyst sentiment. 🧭 Jefferies Financial Group reaffirmed its buy rating and bumped up its price target from $125 to $135. The firm pointed to Matson’s continued operational efficiency and strong capital management as key drivers behind the upgrade. Analysts there believe the company’s disciplined financial strategy and consistent cash flow performance give it room to outperform in a moderating freight environment.

🔻 On the other hand, Stifel Nicolaus took a more cautious stance. The firm downgraded MATX from buy to hold, trimming its price target from $160 to $130. Their concern centers around potential earnings softness as global shipping rates normalize from their pandemic highs. While they acknowledged Matson’s balance sheet strength, the downgrade reflects uncertainty around volume growth and pricing power over the next few quarters.

📊 The overall analyst consensus puts Matson’s 12-month price target around $138.33, with most estimates landing between $130 and $150. That implies a potential upside of about 23% from current levels. The range in projections reflects a tension between Matson’s solid fundamentals and the macro headwinds facing the shipping industry. Still, the company’s strong execution continues to earn it a good deal of respect from Wall Street.

Earning Report Summary

Strong Start to the Year

Matson kicked off 2025 with a stronger-than-expected performance that shows it still has plenty of steam, even as the broader shipping sector continues to normalize. For the first quarter, the company reported net income of $72.3 million, up from $36.1 million a year ago. That’s a solid jump in profitability, and it translated into earnings per share of $2.18—more than double the $1.04 posted in the same quarter last year.

Revenue came in at $782 million for the quarter, climbing about 8% year-over-year. A lot of that lift came from higher freight rates and relatively steady volume across Matson’s core trade routes. While China volumes were notably weaker, down around 30%, the company held its ground by managing costs tightly and leaning into its pricing power where possible.

Leadership’s View and What’s Ahead

Executives didn’t shy away from the fact that there are still some headwinds. The ongoing volatility in transpacific trade, tariff noise, and softer demand from China are all factors they’re watching closely. Still, management sounded confident on the call. They believe Matson’s long-term strategy—focused on disciplined operations, fleet investments, and customer relationships—is what will carry it through the ups and downs.

The company is also sticking with its commitment to shareholders. Matson is keeping the quarterly dividend at $0.34 per share, set to be paid out on June 5. That steady payout reflects confidence in the business even in a more tempered freight environment.

Looking forward, they’re not sugarcoating things—there’s caution around short-term volumes out of China and broader macro uncertainties. But Matson seems ready to navigate what’s ahead. With a solid balance sheet and consistent free cash flow, leadership is focused on the long game, balancing investment in the business with responsible returns to shareholders.

Management Team

Matson’s leadership is a steady-handed group with a strong track record of navigating change and executing long-term strategy. Chairman and CEO Matthew J. Cox has led the company since 2012, bringing a clear focus on fleet upgrades, cost control, and capital efficiency. Under his leadership, Matson has managed to grow responsibly while staying financially disciplined.

Joel Wine, the company’s Executive Vice President and CFO, has played a central role in capital allocation and maintaining the company’s conservative financial profile. He works closely with other long-standing executives like Peter Heilmann, who serves as Chief Administrative Officer, and Rusty Rolfe, President of Matson Logistics. Together, the team reflects a depth of industry knowledge and a shared philosophy rooted in operational excellence and sustainable growth. This kind of leadership stability is not something you can measure on a spreadsheet, but it’s often what makes a company like Matson a steady performer over the years.

Valuation and Stock Performance

As of late May 2025, Matson shares are trading around $113, which puts the stock at a trailing P/E ratio of roughly 7.6. That’s a level that may catch the eye of investors who like solid cash-flowing businesses at reasonable valuations. With a forward dividend yield just above 1.2% and a payout ratio under 9%, the valuation still leaves plenty of room for reinvestment, future dividend increases, or buybacks.

Looking back over the past year, Matson’s stock has seen some volatility. After peaking near $169, it pulled back on concerns over softening freight rates and China exposure. Still, it has held a decent floor in the low $90s and has recovered to current levels thanks to stronger-than-expected earnings and consistent execution. The average analyst price target sits at about $138, which implies a meaningful upside if the company continues to deliver on both the top and bottom lines. It’s not a stock that trades on hype, but on performance—and that’s just how long-term investors often prefer it.

Risks and Considerations

Despite its strengths, Matson isn’t without risks. Shipping is a cyclical business, and earnings can swing based on freight demand, pricing, and macroeconomic forces. Fuel price volatility remains a constant factor, and while Matson does manage it well, it’s an unavoidable part of the business.

Then there’s exposure to trade policy. As a major player in the transpacific routes, Matson is vulnerable to geopolitical developments, especially those involving China. Tariffs, trade disputes, or diplomatic tensions can ripple through shipping volumes quickly. Regulatory shifts affecting the Jones Act or environmental standards could also require costly compliance measures or impact the competitive landscape.

And like many capital-intensive companies, Matson needs to continuously invest in its fleet and infrastructure. These projects are vital, but they come with execution risk, especially if shipping volumes weaken at the wrong time. Investors should be aware of these dynamics and consider how they align with their own risk tolerance and time horizon.

Final Thoughts

Matson isn’t the kind of company that makes headlines daily, and it doesn’t need to be. It’s a stable, well-managed business operating in a niche where experience, relationships, and reliability matter. The leadership team is focused, the financials are strong, and the company continues to reward shareholders while making smart investments for the future.

There are real risks—every business has them—but Matson has shown it knows how to navigate choppy waters without losing direction. For investors seeking a dependable name with a history of doing things right, this is a company that earns attention the old-fashioned way: by delivering.